|

Great Moderation

The Great Moderation is a period of macroeconomic stability in the United States of America coinciding with the rise of central bank independence beginning with the Volcker shock in 1980 and continuing to the present day. It is characterized by generally milder business cycle fluctuations in developed nations, compared with decades before. Throughout this period, major economic variables such as real GDP growth, industrial production, unemployment, and price levels have become less volatile, while average inflation has fallen and recessions have become less common. The Great Moderation is typically attributed to the adoption of standards for macroeconomic targeting such as the Taylor rule and inflation targeting. However, some economists argue technological shifts also played a role.Ćorić, Bruno. "The Sources Of The Great Moderation: A Survey." Challenges Of Europe: Growth & Competitiveness – Reversing Trends: Ninth International Conference Proceedings: 2011 (2011): ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ben Bernanke

Ben Shalom Bernanke ( ; born December 13, 1953) is an American economist who served as the 14th chairman of the Federal Reserve from 2006 to 2014. After leaving the Federal Reserve, he was appointed a distinguished fellow at the Brookings Institution. During his tenure as chairman, Bernanke oversaw the Federal Reserve's response to the 2008 financial crisis, for which he was named the 2009 Time Person of the Year, ''Time'' Person of the Year. Before becoming Federal Reserve chairman, Bernanke was a tenured professor at Princeton University and chaired the Princeton University Department of Economics, Department of Economics there from 1996 to September 2002, when he went on public service leave. Bernanke was awarded the 2022 Nobel Memorial Prize in Economic Sciences, jointly with Douglas Diamond and Philip H. Dybvig, "for research on banks and financial crises", more specifically for his analysis of the Great Depression. From August 5, 2002, until June 21, 2005, he was a member ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

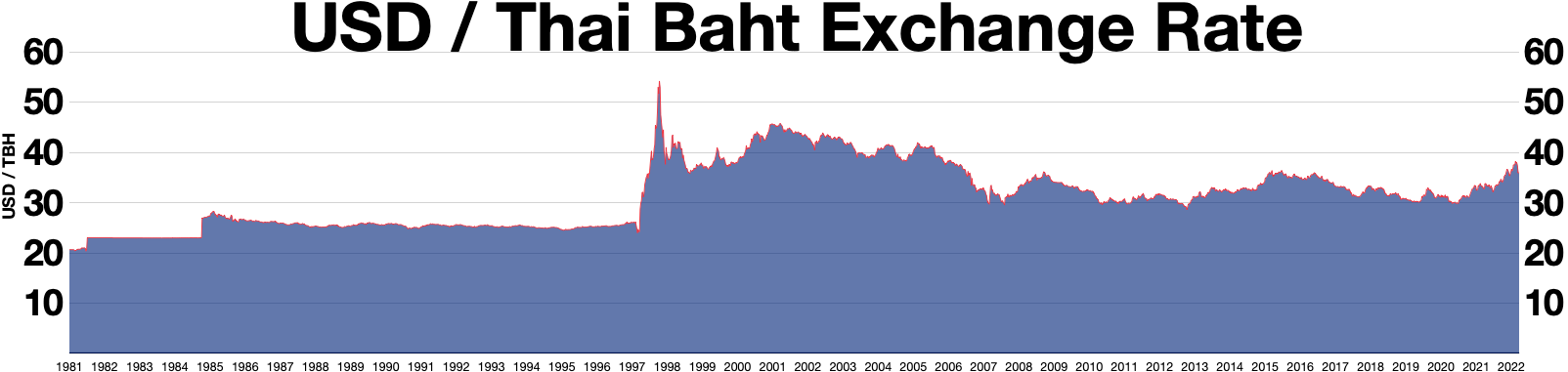

1997 Asian Financial Crisis

The 1997 Asian financial crisis gripped much of East Asia, East and Southeast Asia during the late 1990s. The crisis began in Thailand in July 1997 before spreading to several other countries with a ripple effect, raising fears of a worldwide economic meltdown due to financial contagion. However, the recovery in 1998–1999 was rapid, and worries of a meltdown quickly subsided. Originating in Thailand, where it was known as the ''Tom yum, Tom Yum Kung crisis'' () on 2 July, it followed the financial collapse of the Thai baht after the Thai government was forced to floating currency, float the baht due to lack of list of circulating currencies, foreign currency to support its currency fixed exchange rate, peg to the U.S. dollar. Capital flight ensued almost immediately, beginning an international chain reaction. At the time, Thailand had acquired a burden of foreign debt. As the crisis spread, other Southeast Asian countries and later Japan and South Korea saw slumping currencies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Monday (1987)

Black Monday (also known as Black Tuesday in some parts of the world due to time zone differences) was a global, severe and largely unexpected stock market crash on Monday, October 19, 1987. Worldwide losses were estimated at US$1.71 trillion. The severity sparked fears of extended economic instability or a reprise of the Great Depression. Possible explanations for the initial fall in stock prices include a fear that stocks were significantly overvalued and were certain to undergo a correction, persistent US trade and budget deficits, and rising interest rates. Another explanation for Black Monday comes from the decline of the dollar, followed by a lack of faith in governmental attempts to stop that decline. In February 1987, leading industrial countries had signed the Louvre Accord, hoping that monetary policy coordination would stabilize international money markets, but doubts about the viability of the accord created a crisis of confidence. The fall may have been acceler ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

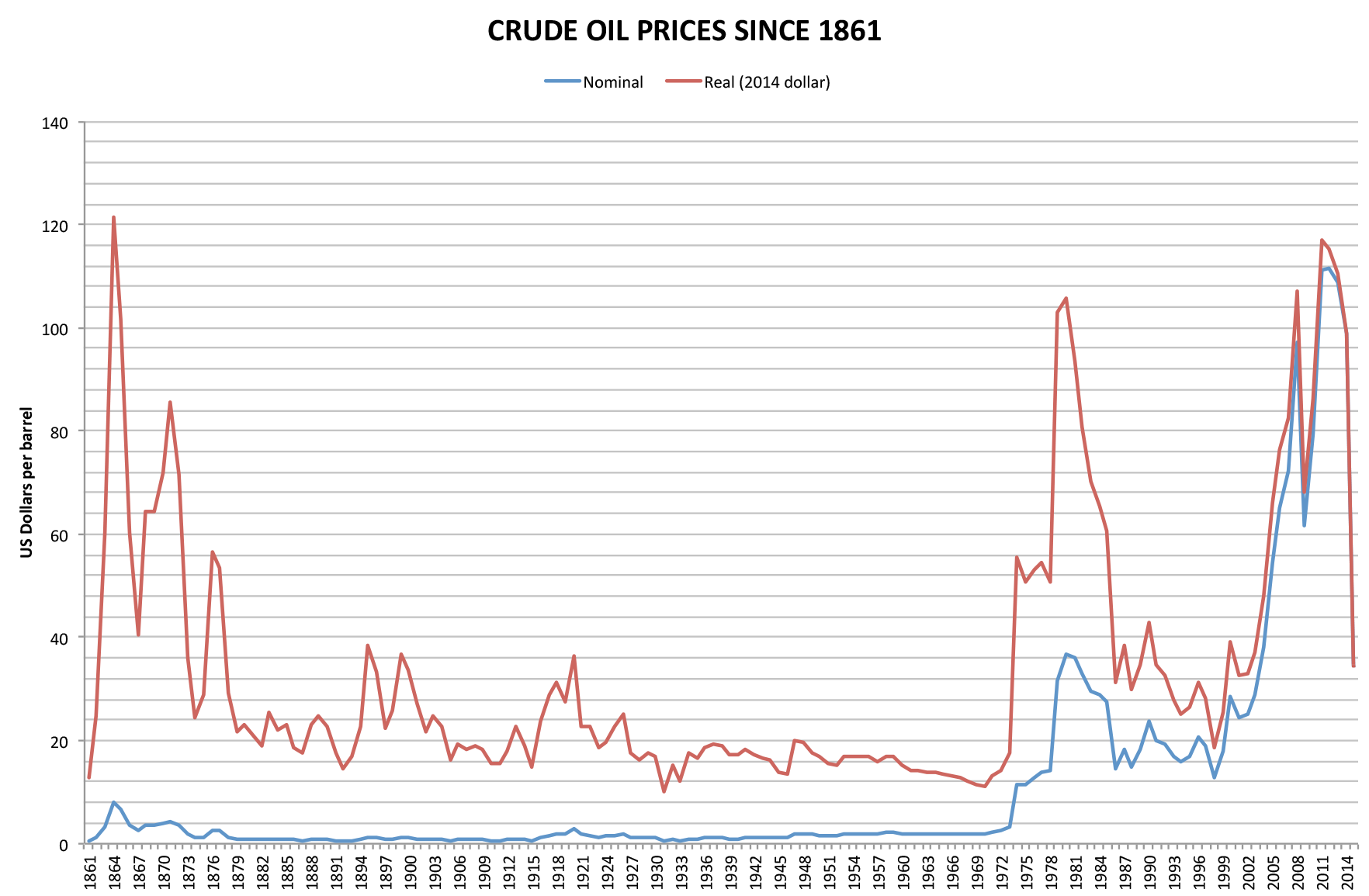

Continental Illinois

The Continental Illinois National Bank and Trust Company was an American bank established in 1910, which was at its peak the seventh-largest commercial bank in the United States as measured by deposits, with approximately $40 billion in assets. In 1984, Continental Illinois faced what was then the largest bank failure in U.S. history, when a run on the bank led to its seizure by the Federal Deposit Insurance Corporation (FDIC). The bank nearly collapsed under the weight of bad debt associated with oil industry financing associated with the energy price boom of the late 1970s. Regulators in the 1980s determined the bank was " too big to fail", and instead arranged a rescue under new management. Continental Illinois was eventually bought out and its former assets are now part of Bank of America. The later failure of Washington Mutual in 2008 during the 2008 financial crisis dwarfed the failure of Continental Illinois. History Early history Continental Illinois can be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Latin American Debt Crisis

The Latin American debt crisis (; ) was a financial crisis that originated in the early 1980s (and for some countries starting in the 1970s), often known as '' La Década Perdida'' (The Lost Decade), when Latin American countries reached a point where their foreign debt exceeded their earning power, and they could not repay it. The IMF's response to the crisis has been criticized for prolonging unsustainable borrowing and transferring private banking losses onto taxpayers, which deepened the region’s debt overhang and delayed necessary market corrections. Origins In the 1960s and 1970s, many Latin American countries, notably Brazil, Argentina, and Mexico, borrowed huge sums of money from international creditors for industrialization, especially infrastructure programs. These countries had soaring economies at the time, so the creditors were happy to provide loans. Initially, developing countries typically garnered loans through public routes like the World Bank. After 1973, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Central Bank

The European Central Bank (ECB) is the central component of the Eurosystem and the European System of Central Banks (ESCB) as well as one of seven institutions of the European Union. It is one of the world's Big Four (banking)#International use, most important central banks with a balance sheet total of around 7 trillion. The Governing Council of the European Central Bank, ECB Governing Council makes monetary policy for the Eurozone and the European Union, administers the foreign exchange reserves of EU member states, engages in foreign exchange operations, and defines the intermediate monetary objectives and key interest rate of the EU. The Executive Board of the European Central Bank, ECB Executive Board enforces the policies and decisions of the Governing Council, and may direct the national central banks when doing so. The ECB has the exclusive right to authorise the issuance of euro banknotes. Member states can issue euro coins, but the volume must be approved by the EC ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Developed Country

A developed country, or advanced country, is a sovereign state that has a high quality of life, developed economy, and advanced technological infrastructure relative to other less industrialized nations. Most commonly, the criteria for evaluating the degree of economic development are the gross domestic product (GDP), gross national product (GNP), the per capita income, level of industrialization, amount of widespread infrastructure and general standard of living. Which criteria are to be used and which countries can be classified as being developed are subjects of debate. Different definitions of developed countries are provided by the International Monetary Fund and the World Bank; moreover, HDI ranking is used to reflect the composite index of life expectancy, education, and income per capita. In 2025, 40 countries fit all three criteria, while an additional 21 countries fit two out of three. Developed countries have generally more advanced post-industrial economies, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Real Income

Real income is the income of individuals or nations after adjusting for inflation. It is calculated by dividing nominal income by the price level. Real variables such as real income and real GDP are variables that are measured in physical units, while nominal variables such as nominal income and nominal GDP are measured in monetary units. Therefore, real income is a more useful indicator of well-being since it measures the amount of goods and services that can be purchased with the income. Growth of real income is related to real gross national income per capita growth. According to the classical dichotomy theory, real variables and nominal variables are separate in the long run, so they are not influenced by each other. In other words, if the nominal starting income was 100 and there was 10% inflation (general rise in prices, for example, what cost 10 now costs 11), then with nominal income of still 100, one can buy roughly 9% less; so if nominal income was not a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Level

The general price level is a hypothetical measure of overall prices for some set of goods and services (the consumer basket), in an economy or monetary union during a given interval (generally one day), normalized relative to some base set. Typically, the general price level is approximated with a daily price ''index'', normally the Daily CPI. The general price level can change more than once per day during hyperinflation. Theoretical foundation The classical dichotomy is the assumption that there is a relatively clean distinction between overall increases or decreases in prices and underlying, “nominal” economic variables. Thus, if prices ''overall'' increase or decrease, it is assumed that this change can be decomposed as follows: Given a set C of goods and services, the total value of transactions in C at time t is :\sum_ (p_\cdot q_)=\sum_ P_t\cdot p'_)\cdot q_P_t\cdot \sum_ (p'_\cdot q_) where :q_\, represents the quantity of c at time t :p_\, represents the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Funds Rate

In the United States, the federal funds rate is the interest rate at which depository institutions (banks and credit unions) lend reserve balances to other depository institutions overnight on an collateral (finance), uncollateralized basis. Bank reserves, Reserve balances are amounts held at the Federal Reserve. Institutions with surplus balances in their accounts lend those balances to institutions in need of larger balances. The federal funds rate is an important benchmark in financial markets and central to the conduct of Monetary policy of the United States, monetary policy in the United States as it influences a wide range of market interest rates. The effective federal funds rate (EFFR) is calculated as the effective median interest rate of overnight federal funds transactions during the previous business day. It is published daily by the Federal Reserve Bank of New York. The federal funds target range is determined by a meeting of the members of the Federal Open Mar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Rate

Bank rate, also known as discount rate in American English, and (familiarly) the base rate in British English, is the rate of interest which a central bank charges on its loans and advances to a commercial bank. The bank rate is known by a number of different terms depending on the country, and has changed over time in some countries as the mechanisms used to manage the rate have changed. Whenever a bank has a shortage of funds, they can typically borrow from the central bank based on the monetary policy of the country. The borrowing is commonly done via repos: the repo rate is the rate at which the central bank lends short-term money to the banks against securities. It is more applicable when there is a liquidity crunch in the market. In contrast, the reverse repo rate is the rate at which banks can park surplus funds with the reserve bank, which is mostly done when there is surplus liquidity. Determining the rate The interest rate that is charged by a country's central or fe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |