|

Google Tax Avoidance

Criticism of Google includes concern for tax avoidance, misuse and manipulation of search results, its use of others' intellectual property, concerns that its compilation of data may violate people's privacy and collaboration with the US military on Google Earth to spy on users, censorship of search results and content, and the energy consumption of its servers as well as concerns over traditional business issues such as monopoly, restraint of trade, antitrust, patent infringement, indexing and presenting false information and propaganda in search results, and being an "Ideological Echo Chamber". Google's parent company, Alphabet Inc., is an American multinational public corporation invested in Internet search, cloud computing, and advertising technologies. Google hosts and develops a number of Internet-based services and products, and generates profit primarily from advertising through its Google Ads (formerly AdWords) program. Google's stated mission is "to organize the wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded so ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Washington Post

''The Washington Post'' (also known as the ''Post'' and, informally, ''WaPo'') is an American daily newspaper published in Washington, D.C. It is the most widely circulated newspaper within the Washington metropolitan area and has a large national audience. Daily broadsheet editions are printed for D.C., Maryland, and Virginia. The ''Post'' was founded in 1877. In its early years, it went through several owners and struggled both financially and editorially. Financier Eugene Meyer purchased it out of bankruptcy in 1933 and revived its health and reputation, work continued by his successors Katharine and Phil Graham (Meyer's daughter and son-in-law), who bought out several rival publications. The ''Post'' 1971 printing of the Pentagon Papers helped spur opposition to the Vietnam War. Subsequently, in the best-known episode in the newspaper's history, reporters Bob Woodward and Carl Bernstein led the American press's investigation into what became known as the Waterga ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

PvdA (NL)

The Labour Party ( nl, Partij van de Arbeid, , abbreviated as ''PvdA'', or ''P van de A'', ) is a social-democratic political party in the Netherlands. The party was founded in 1946 as a merger of the Social Democratic Workers' Party, the Free-thinking Democratic League and the Christian Democratic Union. Prime Ministers from the Labour Party have been Willem Drees (1948–1958), Joop den Uyl (1973–1977) and Wim Kok (1994–2002). From 2012 to 2017, the PvdA formed the second-largest party in parliament and was the junior partner in the Second Rutte cabinet with the People's Party for Freedom and Democracy. The Leader of the Labour Party is Attje Kuiken. The party fell to nine seats in the House of Representatives at the 2017 general election, making it the seventh-largest faction in the chamber—its worst showing ever. However, the party rebounded with a first-place finish in the 2019 European Parliament election in the Netherlands, winning 6 of 26 seats, with 19% of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Register

''The Register'' is a British technology news website co-founded in 1994 by Mike Magee, John Lettice and Ross Alderson. The online newspaper's masthead sublogo is "''Biting the hand that feeds IT''." Their primary focus is information technology news and opinions. Situation Publishing Ltd is listed as the site's publisher. Drew Cullen is an owner and Linus Birtles is the managing director. Andrew Orlowski was the executive editor before leaving the website in May 2019. History ''The Register'' was founded in London as an email newsletter called ''Chip Connection''. In 1998 ''The Register'' became a daily online news source. Magee left in 2001 to start competing publications '' The Inquirer'', and later the '' IT Examiner'' and '' TechEye''.Walsh, Bob (2007). ''Clear Blogging: How People Blogging Are Changing the World and How You Can Join Them.'' Apress, In 2002, ''The Register'' expanded to have a presence in London and San Francisco, creating ''The Register USA'' at t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

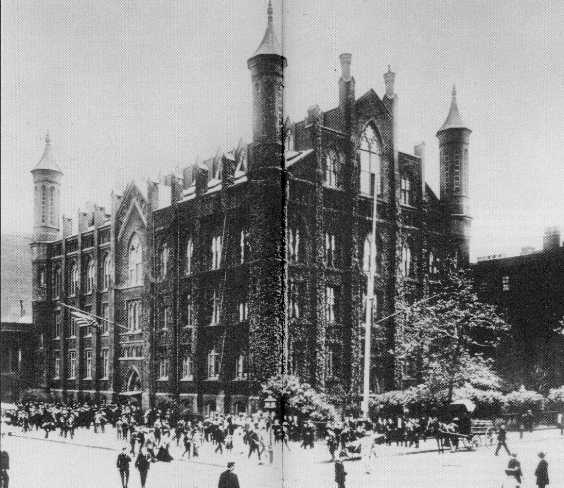

Baruch College

Baruch College (officially the Bernard M. Baruch College) is a public college in New York City. It is a constituent college of the City University of New York system. Named for financier and statesman Bernard M. Baruch, the college operates undergraduate and postgraduate programs through the Zicklin School of Business, the Weissman School of Arts and Sciences, and the Marxe School of Public and International Affairs. History Baruch College is one of the senior colleges in the CUNY system. It traces its roots back to the 1847 founding of the Free Academy, the first institution of free public higher education in the United States. The New York State Literature Fund was created to serve students who could not afford to enroll in New York City's private colleges. The Fund led to the creation of the Committee of the Board of Education of the City of New York, led by Townsend Harris, J.S. Bosworth, and John L. Mason, which brought about the establishment of what would become the F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Abraham J

Abraham, ; ar, , , name=, group= (originally Abram) is the common Hebrew patriarch of the Abrahamic religions, including Judaism, Christianity, and Islam. In Judaism, he is the founding father of the special relationship between the Jews and God; in Christianity, he is the spiritual progenitor of all believers, whether Jewish or non-Jewish; and in Islam, he is a link in the chain of Islamic prophets that begins with Adam (see Adam in Islam) and culminates in Muhammad. His life, told in the narrative of the Book of Genesis, revolves around the themes of posterity and land. Abraham is called by God to leave the house of his father Terah and settle in the land of Canaan, which God now promises to Abraham and his progeny. This promise is subsequently inherited by Isaac, Abraham's son by his wife Sarah, while Isaac's half-brother Ishmael is also promised that he will be the founder of a great nation. Abraham purchases a tomb (the Cave of the Patriarchs) at Hebron to be Sarah ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dutch Sandwich (tax Avoidance)

Dutch Sandwich is a base erosion and profit shifting (BEPS) corporate tax tool, used mostly by U.S. multinationals to avoid incurring EU withholding taxes on untaxed profits as they were being moved to non-EU tax havens (such as the Bermuda black hole). These untaxed profits could have originated from within the EU, or from outside the EU, but in most cases were routed to major EU corporate-focused tax havens, such as Ireland and Luxembourg, by the use of other BEPS tools. The Dutch Sandwich was often used with Irish BEPS tools such as the Double Irish, the Single Malt and the Capital Allowances for Intangible Assets ("CAIA") tools. In 2010, Ireland changed its tax-code to enable Irish BEPS tools to avoid such withholding taxes without needing a Dutch Sandwich. Explanation The structure relies on the tax loophole that most EU countries will allow royalty payments be made to other EU countries without incurring withholding taxes. However, the Dutch tax code allows royalty ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double Irish Arrangement

The Double Irish arrangement was a base erosion and profit shifting (BEPS) corporate tax avoidance tool used mostly by United States multinationals since the late 1980s to avoid corporate taxation on non-U.S. profits. It was the largest tax avoidance tool in history and by 2010 was shielding US$100 billion annually in US multinational foreign profits from taxation, and was the main tool by which US multinationals built up untaxed offshore reserves of US$1 trillion from 2004 to 2018. Traditionally, it was also used with the Dutch Sandwich BEPS tool; however, 2010 changes to tax laws in Ireland dispensed with this requirement. Despite US knowledge of the Double Irish for a decade, it was the European Commission that in October 2014 forced Ireland to close the scheme, starting in January 2015. However, users of existing schemes, such as Apple, Google, Facebook and Pfizer, were given until January 2020 to close them. At the announcement of the closure it was known that multi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bermuda

) , anthem = " God Save the King" , song_type = National song , song = "Hail to Bermuda" , image_map = , map_caption = , image_map2 = , mapsize2 = , map_caption2 = , subdivision_type = Sovereign state , subdivision_name = , established_title2 = English settlement , established_date2 = 1609 (officially becoming part of the Colony of Virginia in 1612) , official_languages = English , demonym = Bermudian , capital = Hamilton , coordinates = , largest_city = Hamilton , ethnic_groups = , ethnic_groups_year = 2016 , government_type = Parliamentary dependency under a constitutional monarchy , leader_title1 = Monarch , leader_name1 = Charles III , leader_title2 = Governor , leader_name2 = Rena Lalgie , leader_title3 = Premier , leader_name3 = Edward David Burt , legislature = Parliament , upper_house = Senate , lower_house = House of Assembly , area_km2 = 53.2 , area_sq_mi = 20.54 , area_rank = , percent_water = 27 , elevation_max ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Netherlands

) , anthem = ( en, "William of Nassau") , image_map = , map_caption = , subdivision_type = Sovereign state , subdivision_name = Kingdom of the Netherlands , established_title = Before independence , established_date = Spanish Netherlands , established_title2 = Act of Abjuration , established_date2 = 26 July 1581 , established_title3 = Peace of Münster , established_date3 = 30 January 1648 , established_title4 = Kingdom established , established_date4 = 16 March 1815 , established_title5 = Liberation Day (Netherlands), Liberation Day , established_date5 = 5 May 1945 , established_title6 = Charter for the Kingdom of the Netherlands, Kingdom Charter , established_date6 = 15 December 1954 , established_title7 = Dissolution of the Netherlands Antilles, Caribbean reorganisation , established_date7 = 10 October 2010 , official_languages = Dutch language, Dutch , languages_type = Regional languages , languages_sub = yes , languages = , languages2_type = Reco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ireland

Ireland ( ; ga, Éire ; Ulster Scots dialect, Ulster-Scots: ) is an island in the Atlantic Ocean, North Atlantic Ocean, in Northwestern Europe, north-western Europe. It is separated from Great Britain to its east by the North Channel (Great Britain and Ireland), North Channel, the Irish Sea, and St George's Channel. Ireland is the List of islands of the British Isles, second-largest island of the British Isles, the List of European islands by area, third-largest in Europe, and the List of islands by area, twentieth-largest on Earth. Geopolitically, Ireland is divided between the Republic of Ireland (officially Names of the Irish state, named Ireland), which covers five-sixths of the island, and Northern Ireland, which is part of the United Kingdom. As of 2022, the Irish population analysis, population of the entire island is just over 7 million, with 5.1 million living in the Republic of Ireland and 1.9 million in Northern Ireland, ranking it the List of European islan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Resistance Movement

A resistance movement is an organized effort by some portion of the civil population of a country to withstand the legally established government or an occupying power and to disrupt civil order and stability. It may seek to achieve its objectives through either the use of nonviolent resistance (sometimes called civil resistance), or the use of force, whether armed or unarmed. In many cases, as for example in the United States during the American Revolution, or in Norway in the Second World War, a resistance movement may employ both violent and non-violent methods, usually operating under different organizations and acting in different phases or geographical areas within a country. Etymology The Oxford English Dictionary records use of the word "resistance" in the sense of organised opposition to an invader from 1862. The modern usage of the term "Resistance" became widespread from the self-designation of many movements during World War II, especially the French Resistance. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)