|

Goldman Roll

The Goldman roll is the monthly sale and purchase of commodities for the Goldman Sachs Commodity Index (S&P-GSCI). While a stock market index is a purely mathematical construct, a commodity index requires entering a long position or ownership of a physical product through a futures exchange. These contracts must be released and renewed, typically monthly. This roll yield both creates and requires arbitrage opportunities which are statistically significant, measuring a Sharpe ratio as high as 4.4 between 2000 and 2010. As the S&P-GSCI was the first commodity index and remains popular, the rollover of its futures was analyzed and described as the Goldman roll. Yiqun Mou's analysis of the Goldman roll indicates up to $26 billion was made through arbitrage of the Goldman roll between 2000 and 2009. Matt Taibbi Matthew Colin Taibbi (; born March 2, 1970) is an American author, journalist, and podcaster. He has reported on finance, media, politics, and sports. A former contributing ed ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Goldman Sachs Commodity Index

The S&P GSCI (formerly the Goldman Sachs Commodity Index) serves as a benchmark for investment in the commodity markets and as a measure of commodity performance over time. It is a tradable index that is readily available to market participants of the Chicago Mercantile Exchange. The index was originally developed in 1991, by Goldman Sachs. In 2007, ownership transferred to Standard & Poor's, who currently own and publish it. Futures of the S&P GSCI use a multiple of 250. The index contains a much higher exposure to energy than other commodity price indices such as the Dow Jones-UBS Commodity Index. Index composition The S&P GSCI contains as many commodities as possible, with rules excluding certain commodities to maintain liquidity and investability in the underlying futures markets. The index currently comprises 24 commodities from all commodity sectors - energy products, industrial metals, agricultural products, livestock products and precious metals. The wide range of constit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Index

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors can invest in a stock market index by buying an index fund, which are structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called '' tracking error''. For a list of major stock market indices, see List of stock market indices. Types of indices by weighting method Stock market indices could be segmented by their index weight methodology, or the rules on how stocks are allocated in the index, independent of its stock coverage. For example, the S&P 500 and the S&P 500 Equal Weight both covers the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Index

A commodity price index is a fixed-weight index or (weighted) average of selected commodity prices, which may be based on spot or futures prices. It is designed to be representative of the broad commodity asset class or a specific subset of commodities, such as energy or metals. It is an index that tracks a basket of commodities to measure their performance. These indexes are often traded on exchanges, allowing investors to gain easier access to commodities without having to enter the futures market. The value of these indexes fluctuates based on their underlying commodities, and this value can be traded on an exchange in much the same way as stock index futures. Investors can choose to obtain a passive exposure to these commodity price indices through a total return swap or a commodity index fund. The advantages of a passive commodity index exposure include negative correlation with other asset classes such as equities and bonds, as well as protection against inflation. The disadv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Exchange

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Roll Yield

The roll yield is the difference between the profit or loss of a futures contract and the change in the spot price of the underlying asset of that futures contract. Unlike fixed income or dividend yields, a roll yield does not provide a cash payment, and may not be counted as a profit in certain cases if it accounts for the underlying asset's cost-of-carry. Nonetheless, the roll yield is often characterized as a return that a futures investor capture in addition to the price change of the underlying asset of a futures contract. Source of roll yield The Theory of storage explains roll yield as a combination of storage costs, convenience yield, and asset yield, or a cost-of-carry in aggregate. In a theoretical efficient market equilibrium with no barriers to arbitrage, an investment strategy of investing in a futures contract should be no more or less profitable than an investment strategy of holding the underlying asset and paying its cost-of-carry. If one of these strategies is rel ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arbitrage

In economics and finance, arbitrage (, ) is the practice of taking advantage of a difference in prices in two or more markets; striking a combination of matching deals to capitalise on the difference, the profit being the difference between the market prices at which the unit is traded. When used by academics, an arbitrage is a transaction that involves no negative cash flow at any probabilistic or temporal state and a positive cash flow in at least one state; in simple terms, it is the possibility of a risk-free profit after transaction costs. For example, an arbitrage opportunity is present when there is the possibility to instantaneously buy something for a low price and sell it for a higher price. In principle and in academic use, an arbitrage is risk-free; in common use, as in statistical arbitrage, it may refer to ''expected'' profit, though losses may occur, and in practice, there are always risks in arbitrage, some minor (such as fluctuation of prices decreasing prof ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

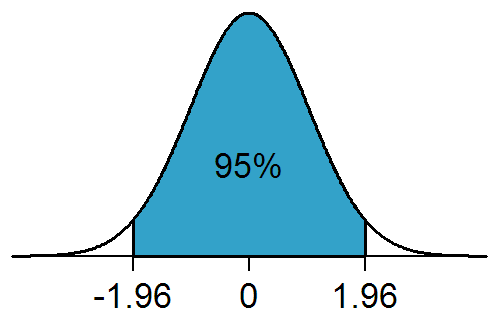

Statistical Significance

In statistical hypothesis testing, a result has statistical significance when it is very unlikely to have occurred given the null hypothesis (simply by chance alone). More precisely, a study's defined significance level, denoted by \alpha, is the probability of the study rejecting the null hypothesis, given that the null hypothesis is true; and the ''p''-value of a result, ''p'', is the probability of obtaining a result at least as extreme, given that the null hypothesis is true. The result is statistically significant, by the standards of the study, when p \le \alpha. The significance level for a study is chosen before data collection, and is typically set to 5% or much lower—depending on the field of study. In any experiment or observation that involves drawing a sample from a population, there is always the possibility that an observed effect would have occurred due to sampling error alone. But if the ''p''-value of an observed effect is less than (or equal to) the significan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sharpe Ratio

In finance, the Sharpe ratio (also known as the Sharpe index, the Sharpe measure, and the reward-to-variability ratio) measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk. It is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment returns. It represents the additional amount of return that an investor receives per unit of increase in risk. It was named after William F. Sharpe, who developed it in 1966. Definition Since its revision by the original author, William Sharpe, in 1994, the ''ex-ante'' Sharpe ratio is defined as: : S_a = \frac = \frac, where R_a is the asset return, R_b is the risk-free return (such as a U.S. Treasury security). E_a-R_b/math> is the expected value of the excess of the asset return over the benchmark return, and is the standard deviation of the asset excess return. The ''ex-p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Columbia University

Columbia University (also known as Columbia, and officially as Columbia University in the City of New York) is a private research university in New York City. Established in 1754 as King's College on the grounds of Trinity Church in Manhattan, Columbia is the oldest institution of higher education in New York and the fifth-oldest institution of higher learning in the United States. It is one of nine colonial colleges founded prior to the Declaration of Independence. It is a member of the Ivy League. Columbia is ranked among the top universities in the world. Columbia was established by royal charter under George II of Great Britain. It was renamed Columbia College in 1784 following the American Revolution, and in 1787 was placed under a private board of trustees headed by former students Alexander Hamilton and John Jay. In 1896, the campus was moved to its current location in Morningside Heights and renamed Columbia University. Columbia scientists and scholars hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Straits Times

''The Straits Times'' is an English-language daily broadsheet newspaper based in Singapore and currently owned by SPH Media Trust (previously Singapore Press Holdings). ''The Sunday Times'' is its Sunday edition. The newspaper was established on 15 July 1845 as ''The Straits Times and Singapore Journal of Commerce''. ''The Straits Times'' is considered a newspaper of record for Singapore. The print and digital editions of ''The Straits Times'' and ''The Sunday Times'' have a daily average circulation of 364,134 and 364,849 respectively in 2017, as audited by Audit Bureau of Circulations Singapore. Myanmar and Brunei editions are published, with newsprint circulations of 5,000 and 2,500 respectively. History The original conception for ''The Straits Times'' has been debated by historians of Singapore. Prior to 1845, the only English-language newspaper in Singapore was ''The'' ''Singapore Free Press'', founded by William Napier in 1835. Marterus Thaddeus Apcar, an Armenian m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Matt Taibbi

Matthew Colin Taibbi (; born March 2, 1970) is an American author, journalist, and podcaster. He has reported on finance, media, politics, and sports. A former contributing editor for ''Rolling Stone'', he is an author of several books, co-host of ''Useful Idiots'', and publisher of the newsletter ''TK News'' on Substack. Taibbi began as a freelance reporter working in the former Soviet Union, including a period in Uzbekistan, from where he was deported for criticizing President Islam Karimov. Taibbi later worked as a sports journalist for the English-language newspaper '' The Moscow Times''. He also played professional baseball in Uzbekistan and Russia as well as professional basketball in Mongolia. In 1997, he moved back to Russia to edit the tabloid ''Living Here'', but eventually left to co-edit rival tabloid '' The eXile''. Taibbi returned to the United States in 2002 and founded the Buffalo-based newspaper '' The Beast''. He left a year later to work as a columnist for th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bubble Machines, Vampire Squids, And The Long Con That Is Breaking America

Bubble, Bubbles or The Bubble may refer to: Common uses * Bubble (physics), a globule of one substance in another, usually gas in a liquid ** Soap bubble * Economic bubble, a situation where asset prices are much higher than underlying fundamentals Arts, entertainment and media Fictional characters * Bubble, a character in ''Absolutely Fabulous'' * Bubbles, an oriole from the ''Angry Birds'' franchise * Bubble, in the video game ''Clu Clu Land'' * Bubbles (''The Wire'') * Bubbles (''Trailer Park Boys'') * Bubbles, a yellow tang fish in the ''Finding Nemo'' franchise * Bubbles, in ''Jabberjaw'' * Bubbles Utonium, in ''The Powerpuff Girls'' ** Bubbles (Miyako Gotokuji), in ''Powerpuff Girls Z'' * Bubbles (''The Adventures of Little Carp'') * Bubbles, in '' The Adventures of Timmy the Tooth'' * Bubbles the Clown, a doll used in the BBC's Test Card F * Cobra Bubbles, in ''Lilo & Stitch'' * Bubbles DeVere, in ''Little Britain'' * Bubbles Yablonsky, the protagonist in a series ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |