|

Fugit

In mathematical finance, fugit is the expected (or optimal) date to exercise an American- or Bermudan option. It is useful for hedging purposes here; see Greeks (finance) and . The term was first introduced by Mark Garman in an article "Semper tempus fugit" published in 1989.Mark Garman in an article "Semper tempus fugit" published in 1989 by Risk Publications, and included in the book "From Black Scholes to Black Holes" pages 89-91 The Latin term "tempus fugit" means "time flies" and Garman suggested the name because "time flies especially when you're having fun managing your book of American options". Details Fugit provides an estimate of when an option would be exercised, which is then a useful indication for the maturity to use when hedging American or Bermudan products with European options.Eric BenhamouFugit (options)/ref> Fugit is thus used for the hedging of convertible bonds, equity linked convertible notes, and any putable or callable exotic coupon notes. Although ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

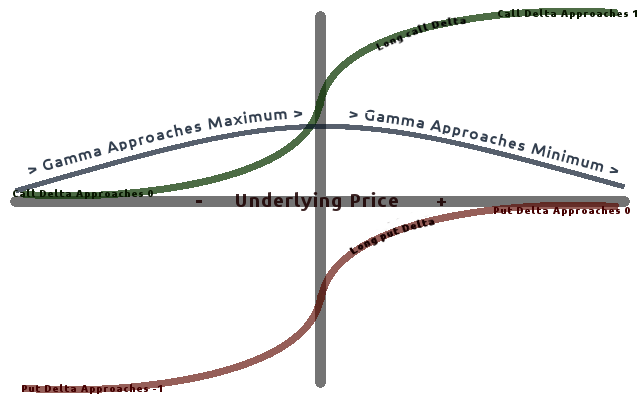

Greeks (finance)

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters (as are some other finance measures). Collectively these have also been called the risk sensitivities, risk measures or hedge parameters. Use of the Greeks The Greeks are vital tools in risk management. Each Greek measures the sensitivity of the value of a portfolio to a small change in a given underlying parameter, so that component risks may be treated in isolation, and the portfolio rebalanced accordingly to achieve a desired exposure; see for example delta hedging. The Greeks in the Black–Scholes model are relatively easy to calculate, a desirable property of financial models, and are very useful for derivatives traders, especi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Employee Stock Option

Employee stock options (ESO) is a label that refers to compensation contracts between an employer and an employee that carries some characteristics of financial options. Employee stock options are commonly viewed as an internal agreement providing the possibility to participate in the share capital of a company, granted by the company to an employee as part of the employee's remuneration package. Regulators and economists have since specified that ESOs are compensation contracts. These nonstandard contracts exist between employee and employer, whereby the employer has the liability of delivering a certain number of shares of the employer stock, when and if the employee stock options are exercised by the employee. The contract length varies, and often carries terms that may change depending on the employer and the current employment status of the employee. In the United States, the terms are detailed within an employer's "Stock Option Agreement for Incentive Equity Plan". Es ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical fina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Derivatives

A journal, from the Old French ''journal'' (meaning "daily"), may refer to: *Bullet journal, a method of personal organization *Diary, a record of what happened over the course of a day or other period *Daybook, also known as a general journal, a daily record of financial transactions *Logbook, a record of events important to the operation of a vehicle, facility, or otherwise *Record (other) *Transaction log, a chronological record of data processing *Travel journal In publishing, ''journal'' can refer to various periodicals or serials: *Academic journal, an academic or scholarly periodical **Scientific journal, an academic journal focusing on science **Medical journal, an academic journal focusing on medicine **Law review, a professional journal focusing on legal interpretation *Magazine, non-academic or scholarly periodicals in general **Trade magazine, a magazine of interest to those of a particular profession or trade **Literary magazine, a magazine devoted to literat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Wiley & Sons

John Wiley & Sons, Inc., commonly known as Wiley (), is an American multinational publishing company founded in 1807 that focuses on academic publishing and instructional materials. The company produces books, journals, and encyclopedias, in print and electronically, as well as online products and services, training materials, and educational materials for undergraduate, graduate, and continuing education students. History The company was established in 1807 when Charles Wiley opened a print shop in Manhattan. The company was the publisher of 19th century American literary figures like James Fenimore Cooper, Washington Irving, Herman Melville, and Edgar Allan Poe, as well as of legal, religious, and other non-fiction titles. The firm took its current name in 1865. Wiley later shifted its focus to scientific, technical, and engineering subject areas, abandoning its literary interests. Wiley's son John (born in Flatbush, New York, October 4, 1808; died in East Orange, New Je ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

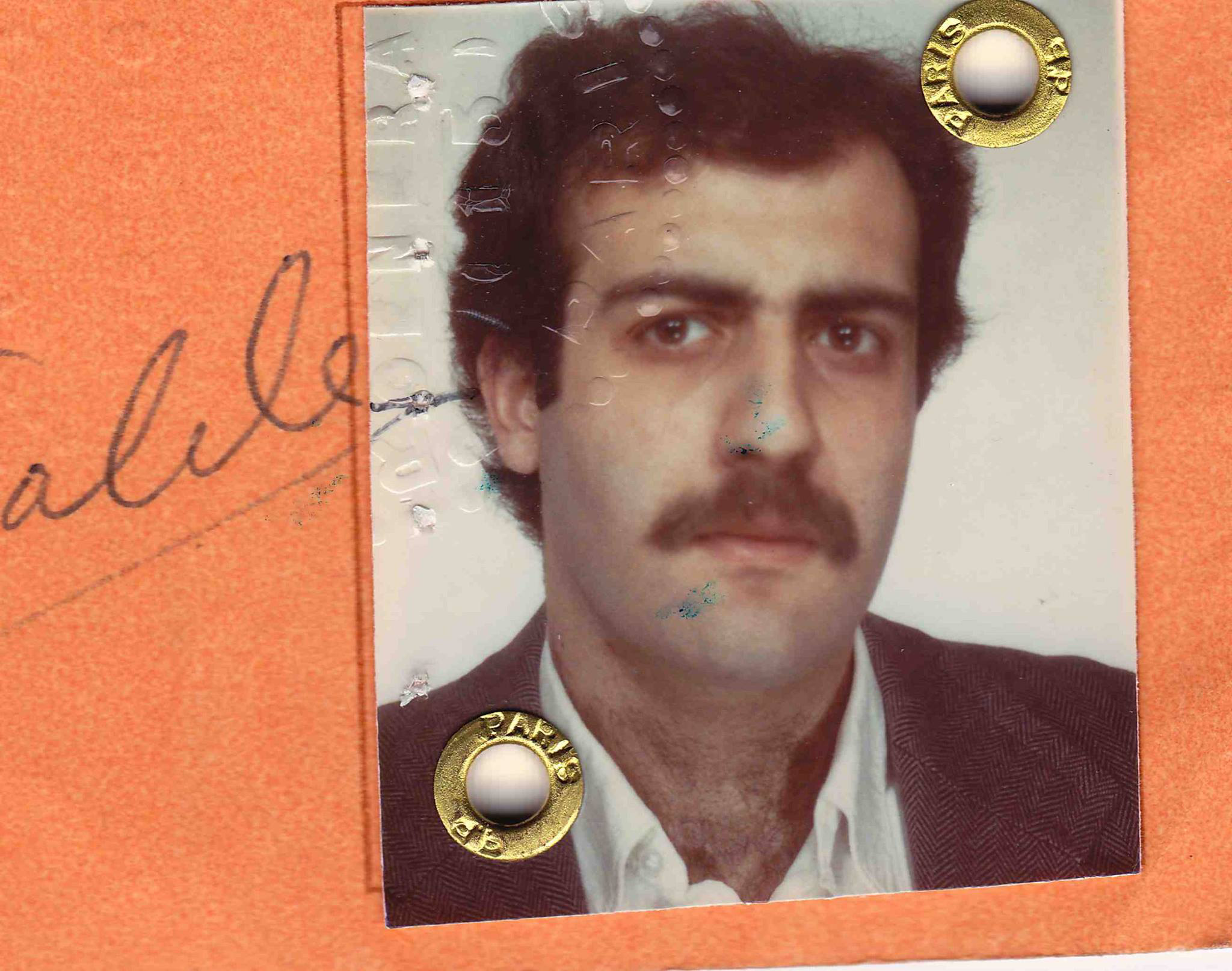

Nassim Taleb

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. ''The Sunday Times'' called his 2007 book '' The Black Swan'' one of the 12 most influential books since World War II. Taleb is the author of the ''Incerto'', a five-volume philosophical essay on uncertainty published between 2001 and 2018 (of which the best-known books are ''The Black Swan'' and ''Antifragile''). He has been a professor at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has been co-editor-in-chief of the academic journal ''Risk and Decision Analysis'' since September 2014. He has also been a practitioner of mathematical finance, a hedge fund manager, and a derivatives trader, and i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finite Difference Methods For Option Pricing

Finite difference methods for option pricing are numerical methods used in mathematical finance for the valuation of options. Finite difference methods were first applied to option pricing by Eduardo Schwartz in 1977. In general, finite difference methods are used to price options by approximating the (continuous-time) differential equation that describes how an option price evolves over time by a set of (discrete-time) difference equations. The discrete difference equations may then be solved iteratively to calculate a price for the option. Phil Goddard (N.D.).''Option Pricing – Finite Difference Methods''/ref> The approach arises since the evolution of the option value can be modelled via a partial differential equation (PDE), as a function of (at least) time and price of underlying; see for example the Black–Scholes PDE. Once in this form, a finite difference model can be derived, and the valuation obtained. The approach can be used to solve derivative pricing problems ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Binomial Options Pricing Model

In finance, the binomial options pricing model (BOPM) provides a generalizable numerical method for the valuation of options. Essentially, the model uses a "discrete-time" ( lattice based) model of the varying price over time of the underlying financial instrument, addressing cases where the closed-form Black–Scholes formula is wanting. The binomial model was first proposed by William Sharpe in the 1978 edition of ''Investments'' (), and formalized by Cox, Ross and Rubinstein in 1979 and by Rendleman and Bartter in that same year. For binomial trees as applied to fixed income and interest rate derivatives see . Use of the model The Binomial options pricing model approach has been widely used since it is able to handle a variety of conditions for which other models cannot easily be applied. This is largely because the BOPM is based on the description of an underlying instrument over a period of time rather than a single point. As a consequence, it is used to value Am ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mark Rubinstein

Mark Edward Rubinstein (June 8, 1944 – May 9, 2019) was a leading financial economist and financial engineer. He was ''Paul Stephens Professor of Applied Investment Analysis'' at the Haas School of Business of the University of California, Berkeley. He held various other professional offices, directing the American Finance Association, amongst others, especially portfolio insurance and the binomial options pricing model (also known as the Cox-Ross-Rubinstein model), as well as his work on discrete time stochastic calculus more generally. Along with fellow Berkeley finance professor Hayne E. Leland and adjunct professor John O'Brien, Rubinstein developed the portfolio insurance financial product in 1976. (This strategy later became associated with the October 19, 1987, Stock Market Crash; see ). With Leland and O'Brien he also introduced the first exchange-traded fund (ETF) in the United States. Rubinstein popularized the term "exotic option" in 1990/92 working pape"Exotic Op ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk-neutral

In economics and finance, risk neutral preferences are preferences that are neither risk averse nor risk seeking. A risk neutral party's decisions are not affected by the degree of uncertainty in a set of outcomes, so a risk neutral party is indifferent between choices with equal expected payoffs even if one choice is riskier. For example, if offered either \$50 or a 50\% chance each of \$100 and \$0, a risk neutral person would have no preference. In contrast, a risk averse person would prefer the first offer, while a risk seeking person would prefer the second. Theory of the firm In the context of the theory of the firm, a risk neutral firm facing risk about the market price of its product, and caring only about profit, would maximize the expected value of its profit (with respect to its choices of labor input usage, output produced, etc.). But a risk averse firm in the same environment would typically take a more cautious approach. Portfolio theory In portfolio choice,Merton ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paul Wilmott

Paul Wilmott (born 8 November 1959) is an English researcher, consultant and lecturer in quantitative finance.Financial gurus He is best known as the author of various academic and practitioner texts on risk and derivatives, for ''Wilmott'' magazine and Wilmott.com, a quantitative finance portal, and for his prescient warnings about the misuse of mathematics in finance. Early life One of two sons of an accountant and an entrepreneurial mother, Wilmott attended Wirral Grammar School for Boys in , and read mathematics at |

Option Style

In finance, the style or family of an option is the class into which the option falls, usually defined by the dates on which the option may be exercised. The vast majority of options are either European or American (style) options. These options—as well as others where the payoff is calculated similarly—are referred to as "vanilla options". Options where the payoff is calculated differently are categorized as "exotic options". Exotic options can pose challenging problems in valuation and hedging. American and European options The key difference between American and European options relates to when the options can be exercised: * A European option may be exercised only at the expiration date of the option, i.e. at a single pre-defined point in time. * An American option on the other hand may be exercised at any time before the expiration date. For both, the payoff—when it occurs—is given by * \max\, for a call option * \max\, for a put option where K is the strike pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |