|

Flow-through Entity

A flow-through entity (FTE) is a legal entity where income "flows through" to investors or owners; that is, the income of the entity is treated as the income of the investors or owners. Flow-through entities are also known as pass-through entities or fiscally-transparent entities. Common types of FTEs are general partnerships, limited partnerships and limited liability partnerships. In the United States, additional types of FTE include S corporations, income trusts and limited liability companies. Most countries require an FTE (or its owners) to file an annual return reporting the shares of income allocated to owners, and to provide each owner with a statement of allocated income to enable owners to report their shares of income on their own tax returns. In the United States, the statement of allocated income is known as a K-1 (or Schedule K-1). Depending on the local tax regulations, this structure can avoid dividend tax and double taxation because only owners or investors are t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Legal Personality

Legal capacity is a quality denoting either the legal aptitude of a person to have rights and liabilities (in this sense also called transaction capacity), or altogether the personhood itself in regard to an entity other than a natural person (in this sense also called legal personality). Natural persons Capacity covers day-to-day decisions, including: what to wear and what to buy, as well as, life-changing decisions, such as: whether to move into a care home or whether to have major surgery. As an aspect of the social contract between a state and its citizens, the state adopts a role of protector to the weaker and more vulnerable members of society. In public policy terms, this is the policy of ''parens patriae''. Similarly, the state has a direct social and economic interest in promoting trade, so it will define the forms of business enterprise that may operate within its territory, and lay down rules that will allow both the businesses and those that wish to contract with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In The United States

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed (with some exceptions in the case of Federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels. In the United States, the term "payroll tax" usually refers to FICA taxes that are paid to fund Social Security and Medicare, while "income tax" re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Types Of Business Entity

A business entity is an entity that is formed and administered as per corporate law in order to engage in business activities, charitable work, or other activities allowable. Most often, business entities are formed to sell a product or a service. There are many types of business entities defined in the legal systems of various countries. These include corporations, cooperatives, partnerships, sole traders, limited liability companies and other specifically permitted and labelled types of entities. The specific rules vary by country and by state or province. Some of these types are listed below, by country. For guidance, approximate equivalents in the company law of English-speaking countries are given in most cases, for example: *private company limited by shares or Ltd. (UK, Ireland and the Commonwealth) *public limited company (UK, Ireland and the Commonwealth) *limited partnership *general partnership *chartered company *statutory corporation *state-owned enterprise *holding ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Taxation

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Finance

Corporate finance is the area of finance that deals with the sources of funding, the capital structure of corporations, the actions that managers take to increase the Value investing, value of the firm to the shareholders, and the tools and analysis used to allocate financial resources. The primary goal of corporate finance is to Shareholder value, maximize or increase valuation (finance), shareholder value. Correspondingly, corporate finance comprises two main sub-disciplines. Capital budgeting is concerned with the setting of criteria about which value-adding projects should receive investment funding, and whether to finance that investment with ownership equity, equity or debt capital. Working capital management is the management of the company's monetary funds that deal with the short-term business operations, operating balance of current assets and Current liability, current liabilities; the focus here is on managing cash, inventory, inventories, and short-term borrowing an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sole Proprietorship

A sole proprietorship, also known as a sole tradership, individual entrepreneurship or proprietorship, is a type of enterprise owned and run by one person and in which there is no legal distinction between the owner and the business entity. A sole trader does not necessarily work alone and may employ other people. The sole trader receives all profits (subject to taxation specific to the business) and has unlimited responsibility for all losses and debts. Every asset of the business is owned by the proprietor, and all debts of the business are that of the proprietor. It is a "sole" proprietorship in contrast with a partnership, which has at least two owners. Sole proprietors may use a trade name or business name other than their or its legal name. They may have to trademark their business name legally if it differs from their own legal name, with the process varying depending upon country of residence. Advantages and disadvantages Registration of a business name for a sole propri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Cuts And Jobs Act Of 2017

The Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018, , is a congressional revenue act of the United States originally introduced in Congress as the Tax Cuts and Jobs Act (TCJA), that amended the Internal Revenue Code of 1986. Major elements of the changes include reducing tax rates for businesses and individuals, increasing the standard deduction and family tax credits, eliminating personal exemptions and making it less beneficial to itemize deductions, limiting deductions for state and local income taxes and property taxes, further limiting the mortgage interest deduction, reducing the alternative minimum tax for individuals and eliminating it for corporations, doubling the estate tax exemption, and cancelling the penalty enforcing individual mandate of the Affordable Care Act (ACA). The Act is based on tax reform advocated by congressional Republicans and the Trump administration. The nonpartisan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Atlantic

''The Atlantic'' is an American magazine and multi-platform publisher. It features articles in the fields of politics, foreign affairs, business and the economy, culture and the arts, technology, and science. It was founded in 1857 in Boston, as ''The Atlantic Monthly'', a literary and cultural magazine that published leading writers' commentary on education, the abolition of slavery, and other major political issues of that time. Its founders included Francis H. Underwood and prominent writers Ralph Waldo Emerson, Oliver Wendell Holmes Sr., Henry Wadsworth Longfellow, Harriet Beecher Stowe, and John Greenleaf Whittier. James Russell Lowell was its first editor. In addition, ''The Atlantic Monthly Almanac'' was an annual almanac published for ''Atlantic Monthly'' readers during the 19th and 20th centuries. A change of name was not officially announced when the format first changed from a strict monthly (appearing 12 times a year) to a slightly lower frequency. It was a mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sam Brownback

Samuel Dale Brownback (born September 12, 1956) is an American attorney, politician, diplomat, and member of the Republican Party (United States), Republican Party who served as the United States Ambassador-at-Large for International Religious Freedom, United States Ambassador at Large for International Religious Freedom from 2018 to 2021. Brownback previously served as the Kansas Department of Agriculture, Secretary of Agriculture of Kansas (1986–93), as the United States House of Representatives, U.S. representative for Kansas's 2nd congressional district (1995–96), as a United States Senate, United States senator from Kansas (1996–2011) and the List of governors of Kansas, 46th governor of Kansas (2011–18). He also ran for the Republican Party presidential primaries, 2008, Republican nomination for President of the United States, President in 2008 United States presidential election, 2008. Born in Garnett, Kansas, Brownback grew up on the family farm in Parker, Kansas. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kansas

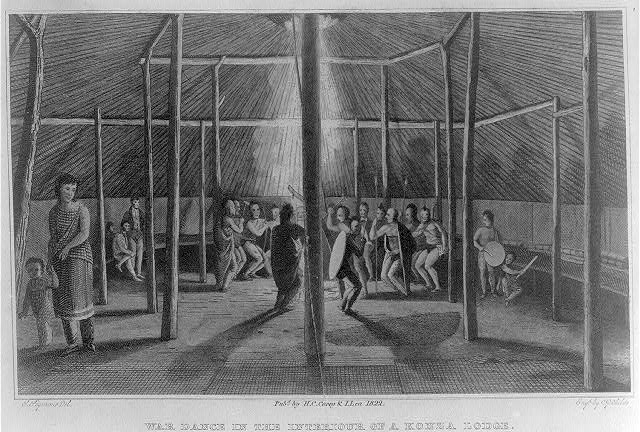

Kansas () is a state in the Midwestern United States. Its capital is Topeka, and its largest city is Wichita. Kansas is a landlocked state bordered by Nebraska to the north; Missouri to the east; Oklahoma to the south; and Colorado to the west. Kansas is named after the Kansas River, which in turn was named after the Kansa Native Americans who lived along its banks. The tribe's name (natively ') is often said to mean "people of the (south) wind" although this was probably not the term's original meaning. For thousands of years, what is now Kansas was home to numerous and diverse Native American tribes. Tribes in the eastern part of the state generally lived in villages along the river valleys. Tribes in the western part of the state were semi-nomadic and hunted large herds of bison. The first Euro-American settlement in Kansas occurred in 1827 at Fort Leavenworth. The pace of settlement accelerated in the 1850s, in the midst of political wars over the slavery debate. Wh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

General Partnerships

A general partnership, the basic form of partnership under common law, is in most countries an association of persons or an unincorporated company with the following major features: *Must be created by agreement, proof of existence and estoppel. *Formed by two or more persons *The owners are jointly and severally liable for any legal actions and debts the company may face, unless otherwise provided by law or in the agreement. It is a partnership in which partners share equally in both responsibility and liability. Characteristics Partnerships have certain default characteristics relating to both (a) the relationship between the individual partners and (b) the relationship between the partnership and the outside world. The former can generally be overridden by express agreement between the partners. Whilst the latter is in general hardly varied, a careful draft would oust certain kinds of third party liability. A clause can contain that only the negligent partners can be sued ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)