|

Financial Management

Financial management is the business function concerned with profitability, expenses, cash and credit, so that the "organization may have the means to carry out its objective as satisfactorily as possible;" the latter often defined as maximizing the value of the firm for stockholders. Financial managersFinancial Managers (FM) are specialized professionals directly reporting to , often the |

Business

Business is the practice of making one's living or making money by producing or Trade, buying and selling Product (business), products (such as goods and Service (economics), services). It is also "any activity or enterprise entered into for profit." Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for debts incurred by the business. If the business acquires debts, the creditors can go after the owner's personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business. The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company, such as a corporation or cooperative. Corporations, in contrast with Sole proprietorship, sole proprietors and partnerships, are a separate legal entity and provide limited liability for their owners/members, as well as being su ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend Policy

Dividend policy is concerned with financial policies regarding paying cash dividend in the present or paying an increased dividend at a later stage. Whether to issue dividends, and what amount, is determined mainly on the basis of the company's unappropriated profit (excess cash) and influenced by the company's long-term earning power. When cash surplus exists and is not needed by the firm, then management is expected to pay out some or all of those surplus earnings in the form of cash dividends or to repurchase the company's stock through a share buyback program. If there are no NPV positive opportunities, i.e. projects where returns exceed the hurdle rate, and excess cash surplus is not needed, then – finance theory suggests – management should return some or all of the excess cash to shareholders as dividends. This is the general case, however there are exceptions. For example, shareholders of a "growth stock", expect that the company will, almost by definition, retain most ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Structure

In corporate finance, capital structure refers to the mix of various forms of external funds, known as capital, used to finance a business. It consists of shareholders' equity, debt (borrowed funds), and preferred stock, and is detailed in the company's balance sheet. The larger the debt component is in relation to the other sources of capital, the greater financial leverage (or gearing, in the United Kingdom) the firm is said to have. Too much debt can increase the risk of the company and reduce its financial flexibility, which at some point creates concern among investors and results in a greater cost of capital. Company management is responsible for establishing a capital structure for the corporation that makes optimal use of financial leverage and holds the cost of capital as low as possible. Capital structure is an important issue in setting rates charged to customers by regulated utilities in the United States. The utility company has the right to choose any capital str ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

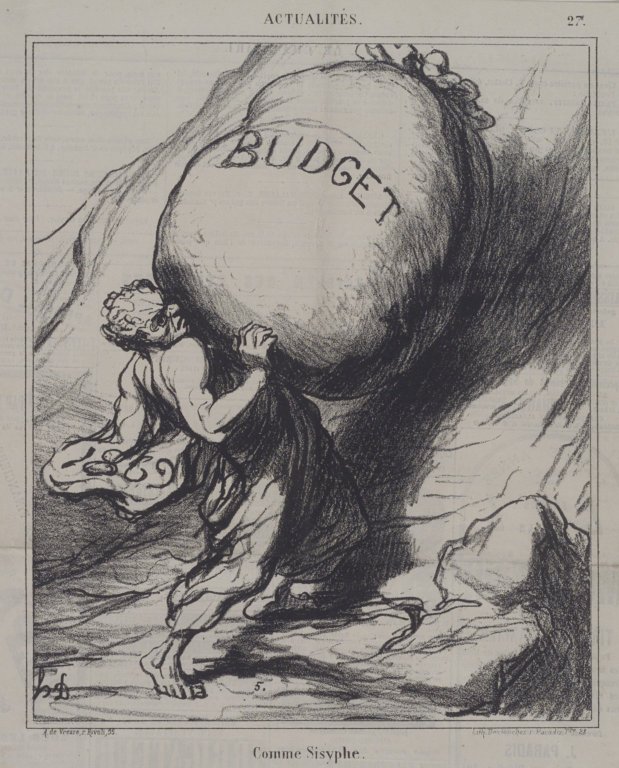

Budget Analyst

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Production Budget

Production budget is a term used specifically in film production and, more generally, in business. A "film production budget" determines how much will be spent on the entire film project. This involves identifying the elements and then estimating their cost, for each phase of filmmaking (development, pre-production, production, post-production and distribution). The budget structure normally separates " above-the-line" (creative) and " below-the-line" (technical) costs. In business, "production budget" refers to the budget set by a corporation for the number of units of a product that will be required and produced; (archived) see demand forecasting, capacity planning and ; and financial forecast more generally. See also *Film budgeting *Television crew *Budget References Sources * ''Film Budgeting'' by Ralph S. Singleton (1996) * ''Film Production Management'' by Bastian Clevé Bastian Clevé (born 1 January 1950, in Munich), is a German filmmaker and producer. He ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sales Budget

Revenue management is the application of disciplined analytics that predict consumer behaviour at the micro-market levels and optimize product availability, leveraging price elasticity to maximize revenue growth and thereby, profit. The primary aim of revenue management is selling the right product to the right customer at the right time for the right price and with the right pack. The essence of this discipline is in understanding customers' perception of product value and accurately aligning product prices, placement and availability with each customer segment.Cross, R. (1997) Revenue Management: Hard-Core Tactics for Market Domination. New York, NY: Broadway Books. Overview Businesses face important decisions regarding what to sell, when to sell, to whom to sell, and for how much. Revenue management uses data-driven tactics and strategy to answer these questions in order to increase revenue.Talluri, K., and van Ryzin, G. (1999) Revenue Management: Research Overview and Prosp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Budget

A budget is a calculation play, usually but not always financial, for a defined period, often one year or a month. A budget may include anticipated sales volumes and revenues, resource quantities including time, costs and expenses, environmental impacts such as greenhouse gas emissions, other impacts, assets, liabilities and cash flows. Companies, governments, families, and other organizations use budgets to express strategic plans of activities in measurable terms. A budget expresses intended expenditures along with proposals for how to meet them with resources. A budget may express a surplus, providing resources for use at a future time, or a deficit in which expenditures exceed income or other resources. Government The budget of a government is a summary or plan of the anticipated resources (often but not always from taxes) and expenditures of that government. There are three types of government budget: the operating or current budget, the capital or investment budget, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Funding

Funding is the act of providing resources to finance a need, program, or project. While this is usually in the form of money, it can also take the form of effort or time from an organization or company. Generally, this word is used when a firm uses its internal reserves to satisfy its necessity for cash, while the term financing is used when the firm acquires capital from external sources. Sources of funding include credit, venture capital, donations, grants, savings, subsidies, and taxes. Fundings such as donations, subsidies, and grants that have no direct requirement for return of investment are described as "soft funding" or " crowdfunding". Funding that facilitates the exchange of equity ownership in a company for capital investment via an online funding portal per the Jumpstart Our Business Startups Act (alternately, the "JOBS Act of 2012") (U.S.) is known as equity crowdfunding. Funds can be allocated for either short-term or long-term purposes. Economics In economics f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Cost

Capital costs are fixed, one-time expenses incurred on the purchase of land, buildings, construction, and equipment used in the production of goods or in the rendering of services. In other words, it is the total cost needed to bring a project to a commercially operable status. Whether a particular cost is capital or not depend on many factors such as accounting, tax laws, and materiality. Categories Capital costs include expenses for tangible goods such as the purchase of plants and machinery, as well as expenses for intangibles assets such as trademarks and software development. Capital costs are not limited to the initial construction of a factory or other business. Namely, the purchase of a new machine to increase production and last for years is a capital cost. Capital costs do not include labor costs (they do include construction labor). Unlike operating costs, capital costs are one-time expenses but payment may be spread out over many years in financial reports and tax r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cashflow Forecast

Cash flow forecasting is the process of obtaining an estimate or forecast of a company's future financial position; the cash flow forecast is typically based on anticipated payments and receivables. See Financial forecast for general discussion re methodology. Function Cash flow forecasting is an important element of financial management generally; Cash flow is the "life-blood" of all businesses — particularly start-ups and small enterprises — and if the business runs out of cash and is not able to obtain new finance, it will become insolvent. As a result, it is essential that management forecast (predict) cash levels. How often, will depend on the financial security of the business: if the business is "struggling", management may assess, if not forecast, cash flow on a daily basis; if the finances are more stable, then this process may be weekly or monthly. Key dependencies re the forecast: * Identify potential shortfalls in cash balances in advance — the cash ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cash Flow

A cash flow is a real or virtual movement of money: *a cash flow in its narrow sense is a payment (in a currency), especially from one central bank account to another; the term 'cash flow' is mostly used to describe payments that are expected to happen in the future, are thus uncertain and therefore need to be forecast with cash flows; *a cash flow is determined by its time ''t'', nominal amount ''N'', currency ''CCY'' and account ''A''; symbolically ''CF'' = ''CF''(''t,N,CCY,A''). * it is however popular to use ''cash flow'' in a less specified sense describing (symbolic) payments into or out of a business, project, or financial product. Cash flows are narrowly interconnected with the concepts of value, ''interest rate'' and liquidity. A cash flow that shall happen on a future day ''t''N can be transformed into a cash flow of the same value in ''t''0. Cash flow analysis Cash flows are often transformed into measures that give information e.g. on a company's value and situat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Revenue

Marginal revenue (or marginal benefit) is a central concept in microeconomics that describes the additional total revenue generated by increasing product sales by 1 unit.Bradley R. chiller, "Essentials of Economics", New York: McGraw-Hill, Inc., 1991.Edwin Mansfield, "Micro-Economics Theory and Applications, 3rd Edition", New York and London:W.W. Norton and Company, 1979.Roger LeRoy Miller, "Intermediate Microeconomics Theory Issues Applications, Third Edition", New York: McGraw-Hill, Inc, 1982.Tirole, Jean, "The Theory of Industrial Organization", Cambridge, Massachusetts: The MIT Press, 1988.John Black, "Oxford Dictionary of Economics", New York: Oxford University Press, 2003. To derive the value of marginal revenue, it is required to examine the difference between the aggregate benefits a firm received from the quantity of a good and service produced last period and the current period with one extra unit increase in the rate of production. Marginal revenue is a fundamental too ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |