|

Fundamental Analysis Software

Fundamental analysis software automates analysis that supports fundamental analysts in their review of a company's financial statements and valuation. Features The following are the most common features of fundamental analysis applications. Backtesting Enables traders to test fundamental analysis strategies or algorithms to see what kind of return they would have achieved if they had invested based on that strategy or algorithm in the past. Backtest results will typically display total and annualized returns compared to a benchmark such as the S&P 500. In addition to returns, backtest results will also display volatility statistics such as average beta or maximum drawdown. Scanner Stock scanning, or screening, is the most common feature of fundamental analysis software. Scanners enable users to 'scan' the market, be it stocks, options, currencies etc., to identify investment opportunities that meet a user's specific investment criteria. Using a fundamental analysis scanner, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fundamental Analysis

Fundamental analysis, in accounting and finance, is the analysis of a business's financial statements (usually to analyze the business's assets, liabilities, and earnings); health; and competitors and markets. It also considers the overall state of the economy and factors including interest rates, production, earnings, employment, GDP, housing, manufacturing and management. There are two basic approaches that can be used: bottom up analysis and top down analysis. These terms are used to distinguish such analysis from other types of investment analysis, such as quantitative and technical. Fundamental analysis is performed on historical and present data, but with the goal of making financial forecasts. There are several possible objectives: * to conduct a company stock valuation and predict its probable price evolution; * to make a projection on its business performance; * to evaluate its management and make internal business decisions and/or to calculate its credit risk; * ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

S&P 500

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. As of December 31, 2020, more than $5.4 trillion was invested in assets tied to the performance of the index. The S&P 500 index is a free-float weighted/ capitalization-weighted index. As of August 31, 2022, the nine largest companies on the list of S&P 500 companies accounted for 27.8% of the market capitalization of the index and were, in order of highest to lowest weighting: Apple, Microsoft, Alphabet (including both class A & C shares), Amazon.com, Tesla, Berkshire Hathaway, UnitedHealth Group, Johnson & Johnson and ExxonMobil. The components that have increased their dividends in 25 consecutive years are known as the S&P 500 Dividend Aristocrats. The index is one of the factors in computation of the Conference Board Leading Econom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Volatility (finance)

In finance, volatility (usually denoted by ''σ'') is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns. Historic volatility measures a time series of past market prices. Implied volatility looks forward in time, being derived from the market price of a market-traded derivative (in particular, an option). Volatility terminology Volatility as described here refers to the actual volatility, more specifically: * actual current volatility of a financial instrument for a specified period (for example 30 days or 90 days), based on historical prices over the specified period with the last observation the most recent price. * actual historical volatility which refers to the volatility of a financial instrument over a specified period but with the last observation on a date in the past **near synonymous is realized volatility, the square root of the realized variance, in turn calculated using the sum of s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

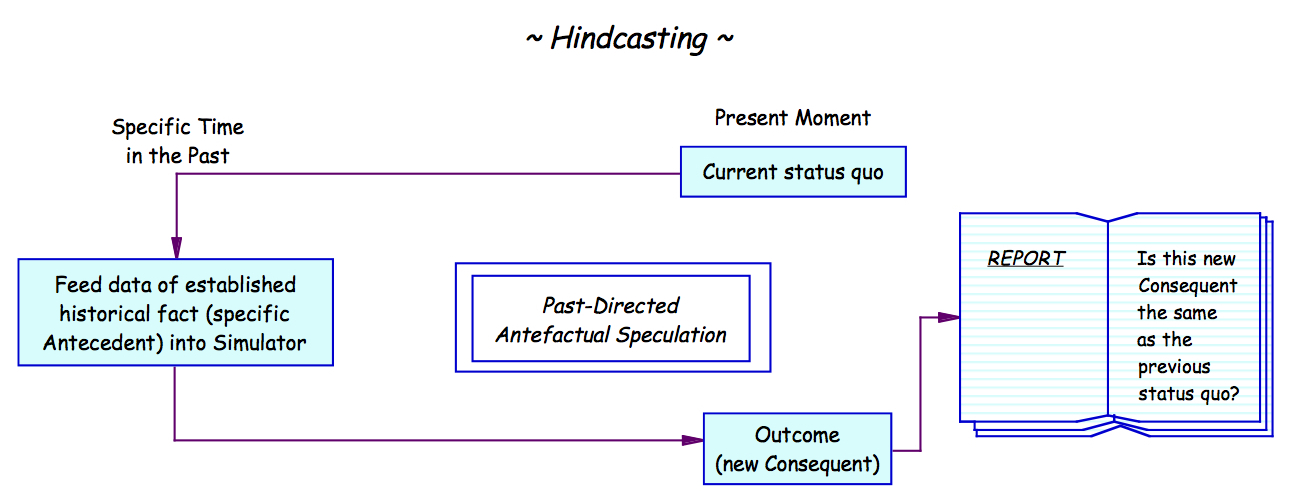

Backtesting

Backtesting is a term used in modeling to refer to testing a predictive model on historical data. Backtesting is a type of retrodiction, and a special type of cross-validation applied to previous time period(s). Financial analysis In a trading strategy, investment strategy, or risk modeling, backtesting seeks to estimate the performance of a strategy or model if it had been employed during a past period. This requires simulating past conditions with sufficient detail, making one limitation of backtesting the need for detailed historical data. A second limitation is the inability to model strategies that would affect historic prices. Finally, backtesting, like other modeling, is limited by potential overfitting. That is, it is often possible to find a strategy that would have worked well in the past, but will not work well in the future. Despite these limitations, backtesting provides information not available when models and strategies are tested on synthetic data. Backtesting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Software

Business software (or a business application) is any software or set of computer programs used by business users to perform various business functions. These business applications are used to increase productivity, measure productivity, and perform other business functions accurately. Overview Much business software is developed to meet the needs of a specific business, and therefore is not easily transferable to a different business environment, unless its nature and operation are identical. Due to the unique requirements of each business, off-the-shelf software is unlikely to completely address a company's needs. However, where an on-the-shelf solution is necessary, due to time or monetary considerations, some level of customization is likely to be required. Exceptions do exist, depending on the business in question, and thorough research is always required before committing to bespoke or off-the-shelf solutions. Some business applications are interactive, i.e., they have a g ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |