|

Fund Administration

Fund administration is the name given to the execution of back office activities including fund accounting, financial reporting, net asset value calculation, capital calls, distributions, investor communications and other functions carried out in support of an investment fund, which may take the form of a traditional mutual fund, a hedge fund, a private equity fund, a venture capital fund, a pension fund, a unit trust, or other pooled investment vehicle. Managers of funds often choose to outsource some or all of these activities to external specialist companies, such as the fund's custodian bank or transfer agent. These companies are known as fund administrators. Administration services United States These administrative activities may include the following administrative functions, which in turn may include "fund accounting" services. Some of these items may be specific to fund operations in the US, and some pertain only whether the fund is an SEC-registered fund: *Calcula ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fund Accounting

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law.Leon E. Hay (1980). ''Accounting for Governmental and Nonprofit Entities, Sixth edition'', page 5. Richard D. Irwin, Inc., Homewood, IL. It emphasizes accountability rather than profitability, and is used by nonprofit organizations and by governments. In this method, a ''fund'' consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions. The label ''fund accounting'' has also been applied to investment accounting, portfolio accounting or securities accounting – all synonyms describing the process of accounting for a portfolio of investments such as securities, commodities and/or real estate held in an investment fund such as a mutual fund or hedge fund. Investment acco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Broker

A broker is a person or entity that arranges transactions between a buyer and a seller. This may be done for a commission when the deal is executed. A broker who also acts as a seller or as a buyer becomes a principal party to the deal. Neither role should be confused with that of an agent—one who acts on behalf of a principal party in a deal. Definition A broker is an independent party whose services are used extensively in some industries. A broker's prime responsibility is to bring sellers and buyers together and thus a broker is the third-person facilitator between a buyer and a seller. An example would be a real estate broker who facilitates the sale of a property. Brokers can furnish market research and market data. Brokers may represent either the seller or the buyer but generally not both at the same time. Brokers are expected to have the tools and resources to reach the largest possible base of buyers and sellers. They then screen these potential buyers or sellers f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fund Governance

Fund governance refers to a system of checks and balances and work performed by the governing body (board) of an investment fund to ensure that the fund is operated not only in accordance with law, but also in the best interests of the fund and its investors. The objective of fund governance is to uphold the regulatory principles commonly known as the four pillars of investor protection that are typically promulgated through the investment fund regulation applicable in the jurisdiction of the fund. These principles vary by jurisdiction and in the US, the 1940 Act generally ensure that: (i) The investment fund will be managed in accordance with the fund's investment objectives, (ii) The assets of the investment fund will be kept safe, (iii) When investors redeem they will get their pro rata share of the investment fund's assets, (iv) The investment fund will be managed for the benefit of the fund's shareholders and not its service providers. Fund governance structures Offshore in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Duty Of Care

In Tort, tort law, a duty of care is a legal Law of obligations, obligation that is imposed on an individual, requiring adherence to a standard of care, standard of Reasonable person, reasonable care to avoid careless acts that could foreseeably harm others, and lead to claim in negligence. It is the first element that must be established to proceed with an action in negligence. The claimant must Cause of action, be able to show a duty of care imposed by law that the defendant has breached. In turn, breaching a duty may subject an individual to liability. The duty of care may be imposed ''by operation of law'' between individuals who have no ''current'' direct relationship (familial or contractual or otherwise) but eventually become related in some manner, as defined by common law (meaning case law). Duty of care may be considered a formalisation of the social contract, the established and implicit responsibilities held by individuals/entities towards others within society. It ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citco

Citco, also known as the Citco Group of Companies and the Curaçao International Trust Co., is a privately owned global hedge fund administrator headquartered in the British Virgin Islands, founded in 1948.Halah Touryalai (April 6, 2011)"Protection Racket,"''Forbes''. It is the world's largest hedge fund administrator, managing over $1.8 trillion in assets under administration. History Citco is a large privately owned global hedge fund administrator. It is headquartered in Tortola in the British Virgin Islands. It is the world's largest hedge fund administrator. Citco was founded in 1948. In 1965, the Sandoz Family Foundation made a substantial equity investment in Citco."Citco announces change in ownership but remains independent," ''HedgeWeek'', ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fairfield Greenwich Group

Fairfield Greenwich Group is an investment firm founded in 1983 in New York City. The firm had among the largest exposures to the Bernard Madoff fraud. History of the firm The firm was founded in 1983 by Walter M. Noel Jr. At one time, the firm operated from Noel's adopted hometown in Greenwich, Connecticut, before relocating its headquarters to New York City, New York. In 1989, Noel merged his business with a small brokerage firm whose general partner was Jeffrey Tucker, who had worked as a lawyer in the enforcement division of the Securities and Exchange Commission. Both Noel and Tucker are semi-retired. Fairfield offered feeder funds of single-strategy trading managers. Fairfield also started several fund of funds, each investing in a basket of hedge funds, though the offering of feeder funds has been the primary business of Fairfield. It described its investigation of investment options as "deeper and broader" than competitive firms, because of Tucker's regulatory expe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ponzi Scheme

A Ponzi scheme (, ) is a form of fraud that lures investors and pays Profit (accounting), profits to earlier investors with Funding, funds from more recent investors. Named after Italians, Italian confidence artist Charles Ponzi, this type of scheme misleads investors by either falsely suggesting that profits are derived from legitimate business activities (whereas the business activities are non-existent), or by exaggerating the extent and profitability of the legitimate business activities, leveraging new investments to fabricate or supplement these profits. A Ponzi scheme can maintain the illusion of a sustainable business as long as investors continue to contribute new funds, and as long as most of the investors do not demand full repayment or lose faith in the non-existent assets they are purported to own. Some of the first recorded incidents to meet the modern definition of the Ponzi scheme were carried out from 1869 to 1872 by Adele Spitzeder in German Empire, Germany and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bernard Madoff

Bernard Lawrence Madoff ( ; April 29, 1938April 14, 2021) was an American financial criminal and financier who was the admitted mastermind of the largest known Ponzi scheme in history, worth an estimated $65 billion. He was at one time chairman of the Nasdaq stock exchange. Madoff's firm had two basic units: a stock brokerage and an asset management business; the Ponzi scheme was centered in the asset management business. Madoff founded a penny stock brokerage in 1960, which eventually grew into Bernard L. Madoff Investment Securities. He served as the company's chairman until his arrest on December 11, 2008. That year, the firm was the sixth-largest market maker in S&P 500 stocks. While the stock brokerage part of the business had a public profile, Madoff tried to keep his asset management business low profile and exclusive. At the firm, he employed his brother Peter Madoff as senior managing director and chief compliance officer, Peter's daughter Shana Madoff as t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Crisis

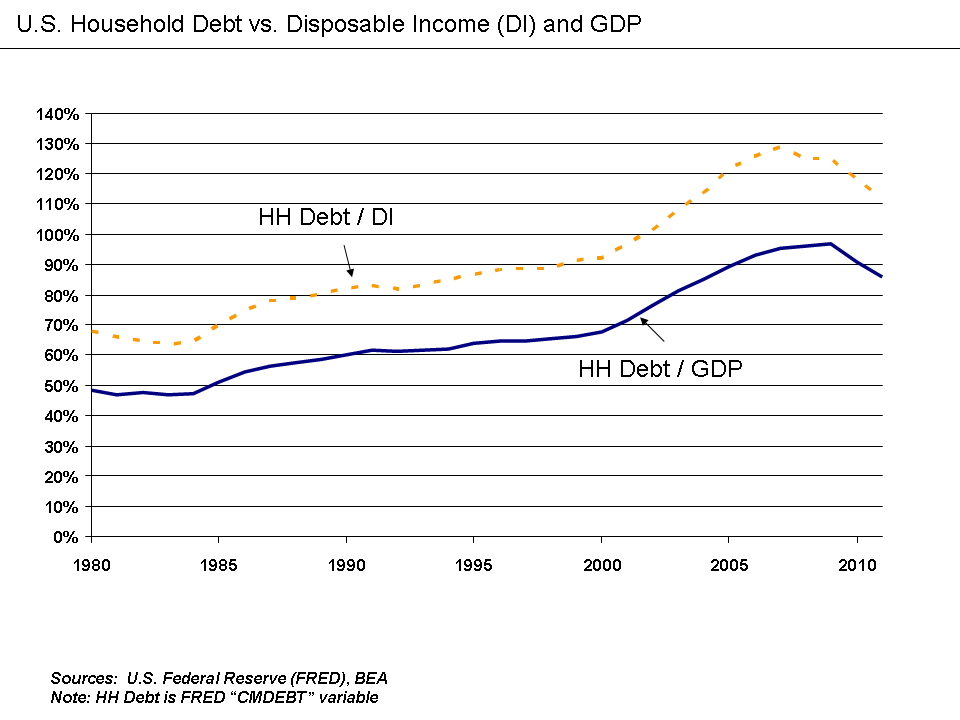

A credit crunch (a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises). Causes A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investors in debt when th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Investment Management

Investment management (sometimes referred to more generally as financial asset management) is the professional asset management of various Security (finance), securities, including shareholdings, Bond (finance), bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contract, contracts/mandates or via collective investment schemes like mutual funds, exchange-traded funds, or REIT, Real estate investment trusts. The term ''investment management'' is often used to refer to the management of investment funds, most often specializing in private equity, private and public equity, real assets, alternative assets, and/or bonds. The more generic term ''asset management'' may refer to management of assets not necessarily primarily held for investment purpos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dissolution (law)

In law, dissolution is any of several legal events that terminate a legal entity or agreement such as a marriage, adoption, corporation, or union. Dissolution is the last stage of liquidation, the process by which a company (or part of a company) is brought to an end, and the assets and property of the company are gone forever. Dissolution of a partnership is the first of two stages in the termination of a partnership. "Winding up" is the second stage. Dissolution may refer to the termination of a contract or other legal relationship. For example, in England and Wales, divorce is the end of a marriage; dissolution is the end of a civil partnership. ( A common misperception is that dissolution is only if the husband or wife does not agree: if the husband and wife agree then it is a dissolution). Dissolution is also the term for the legal process by which an adoption is reversed. While this applies to the vast majority of adoptions which are terminated, they are more commonly ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidation

Liquidation is the process in accounting by which a Company (law), company is brought to an end. The assets and property of the business are redistributed. When a firm has been liquidated, it is sometimes referred to as :wikt:wind up#Noun, wound-up or dissolved, although Dissolution (law), dissolution technically refers to the last stage of liquidation. The process of liquidation also arises when customs, an authority or Government agency, agency in a country responsible for collecting and safeguarding Duty (economics), customs duties, determines the final computation or ascertainment of the duties or drawback accruing on an entry. Liquidation may either be compulsory (sometimes referred to as a ''creditors' liquidation'' or ''receivership'' following bankruptcy, which may result in the court creating a "liquidation trust"; or sometimes a court can mandate the appointment of a liquidator e.g. ''wind-up order'' in Australia) or voluntary (sometimes referred to as a ''sharehold ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |