|

Freightos Baltic Index

The Freightos Baltic Index (FBX) (also sometimes known as the Freightos Baltic Daily Index or Freightos Baltic Global Container Index) is a daily freight container index issued by the Baltic Exchange and Freightos. The index measures global container freight rates by calculating spot rates for 40-foot containers on 12 global tradelanes. It is reported around the world as a proxy for shipping stocks, and is a general shipping market bellwether. The FBX is currently one of the most widely used freight rate indices. History The Freightos International Freight Index was first launched as a weekly freight index in early 2017. The Freightos Baltic Index has been in wide use since 2018. It is currently the only freight rate index that is issued daily, and is also the only IOSCO-compliant freight index that is currently regulated by the EU (in particular, the European Securities and Markets Authority). The index is calculated from real-time anonymized data. As of February 2020, 50 to 70 mil ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Baltic Exchange

The Baltic Exchange (incorporated as The Baltic Exchange Limited) is a membership organisation for the maritime industry, and freight market information provider for the trading and settlement of physical and derivative contracts. It was located at 24–28 St Mary Axe, London, until the building was destroyed by a bomb in 1992. The Baltic Exchange moved into a new building at 38 St Mary Axe on 15 May 1995. It is now located at 107 Leadenhall St and has further offices in Europe, across Asia, and in the United States. Overview Its international community of 650 member companies encompasses the majority of world shipping interests and commits to a code of business conduct overseen by the Baltic. Baltic Exchange members are responsible for a large proportion of all dry cargo and tanker fixtures as well as the sale and purchase of merchant vessels. The Baltic Exchange traces its roots back to 1744 and the Virginia and Baltick Coffee House in Threadneedle Street. (English coff ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Freightos

Freightos operates a booking and payments platform for international freight, using a SaaS-Enabled Marketplace model. It also provides rate management and quoting software for freight forwarders and carriers through WebCargo, a subsidiary acquired in 2016 The freightos.com online freight marketplace, which as first piloted in July 2016, enables online instant freight quoting and booking, as well as shipment management. The platform is also used by partners, like Alibaba.com. The company went public on Nasdaq with ticker symbol ''CRGO'' January 2023 by combining with the SPAC Gesher 1. History Freightos was founded in January 2012 by Zvi Schreiber. Schreiber has previously founded and managed other start-up companies including companies acquired by IBM and GE. The first beta customers of Freightos went live in October 2012 and the SaaS service was commercially launched in March 2013. Freightos raised initial funding from OurCrowd. Freightos is the trading name of Freightos L ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Freight Rate

A freight rate (historically and in ship chartering simply freight) is a price at which a certain cargo is delivered from one point to another. The price depends on the form of the cargo, the mode of transport (truck, ship, train, aircraft), the weight of the cargo, and the distance to the delivery destination. Many shipping services, especially air carriers, use dimensional weight for calculating the price, which takes into account both weight and volume of the cargo. For example, bulk coal long-distance rates in America are approximately 1 cent/ton-mile. So a 100 car train, each carrying 100 tons, over a distance of 1000 miles, would cost $100,000. On the other hand, Intermodal container shipping rates depend heavily on the route taken over the weight of the cargo, just as long as the container weight does not exceed the maximum lading capacity. Prices can vary between $300-$10,000 per Twenty foot equivalent unit (TEU) depending on the supply and demand of a given route. In sh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Spot Rate

In finance, a spot contract, spot transaction, or simply spot, is a contract of buying or selling a commodity, security or currency for immediate settlement (payment and delivery) on the spot date, which is normally two business days after the trade date. The settlement price (or rate) is called spot price (or spot rate). A spot contract is in contrast with a forward contract or futures contract where contract terms are agreed now but delivery and payment will occur at a future date. Spot prices and future price expectations Depending on the item being traded, spot prices can indicate market expectations of future price movements in different ways. For a security or non-perishable commodity (e.g. silver), the spot price reflects market expectations of future price movements. In theory, the difference in spot and forward prices should be equal to the finance charges, plus any earnings due to the holder of the security, according to the cost of carry model. For example, on a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bellwether

A bellwether is a leader or an indicator of trends.bellwether " ''Cambridge Dictionary''. Retrieved 2022-01-22. In , the term often applies in a metaphorical sense to characterize a geographic region where political tendencies match in microcosm those of a wider area, such that the result of an in the former region might predict the eventual result in the latter. In |

International Organization Of Securities Commissions

The International Organization of Securities Commissions (IOSCO) is an association of organizations that regulate the world's securities and futures markets. Members are typically primary securities and/or futures regulators in a national jurisdiction or the main financial regulator from each country. Its mandate is to: * Develop, implement, and promote high standards of regulation to enhance investor protection and reduce systemic risk * Share information with exchanges and assist them with technical and operational issues * Establish standards toward monitoring global investment transactions across borders and markets IOSCO has members from over 100 countries, who regulate more than 95% of the world's securities markets. It has a permanent secretariat in Madrid, Spain. History IOSCO was born in 1983 from the transformation of its ancestor the "Inter-American Regional Association" (created in 1974) into a truly global cooperative. This decision to expand the organization beyond t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Securities And Markets Authority

The European Securities and Markets Authority (ESMA) is an independent European Union Authority located in Paris. ESMA replaced the Committee of European Securities Regulators (CESR) on 1 January 2011. It is one of the three new European Supervisory Authorities set up within the European System of Financial Supervisors. __TOC__ Overview ESMA works in the field of securities legislation and regulation to improve the functioning of financial markets in Europe, strengthening investor protection and co-operation between national competent authorities. The idea behind ESMA is to establish an "EU-wide financial markets watchdog". One of its main tasks is to regulate credit rating agencies. In 2010 credit rating agencies were criticized for the lack of transparency in their assessments and for a possible conflict of interest. At the same time, the impact of the assigned ratings became significant for companies and banks but also states. In October 2017, ESMA organised its first ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Price Point

Price points are prices at which demand for a given product is supposed to stay relatively high. Characteristics Introductory microeconomics depicts a demand curve as downward-sloping to the right and either linear or gently convex to the origin. The downwards slope generally holds, but the model of the curve is only piecewise true, as price surveys indicate that demand for a product is not a linear function of its price and not even a smooth function. Demand curves resemble a series of waves rather than a straight line. The diagram shows price points at the points labeled A, B, and C. When a vendor increases a price beyond a price point (say to a price slightly above ''price point B''), sales volume decreases by an amount more than proportional to the price increase. This decrease in quantity-demanded more than offsets the additional revenue from the increased unit-price. As a result, total revenue (price multiplied by quantity-demanded) decreases when a firm raises its price ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

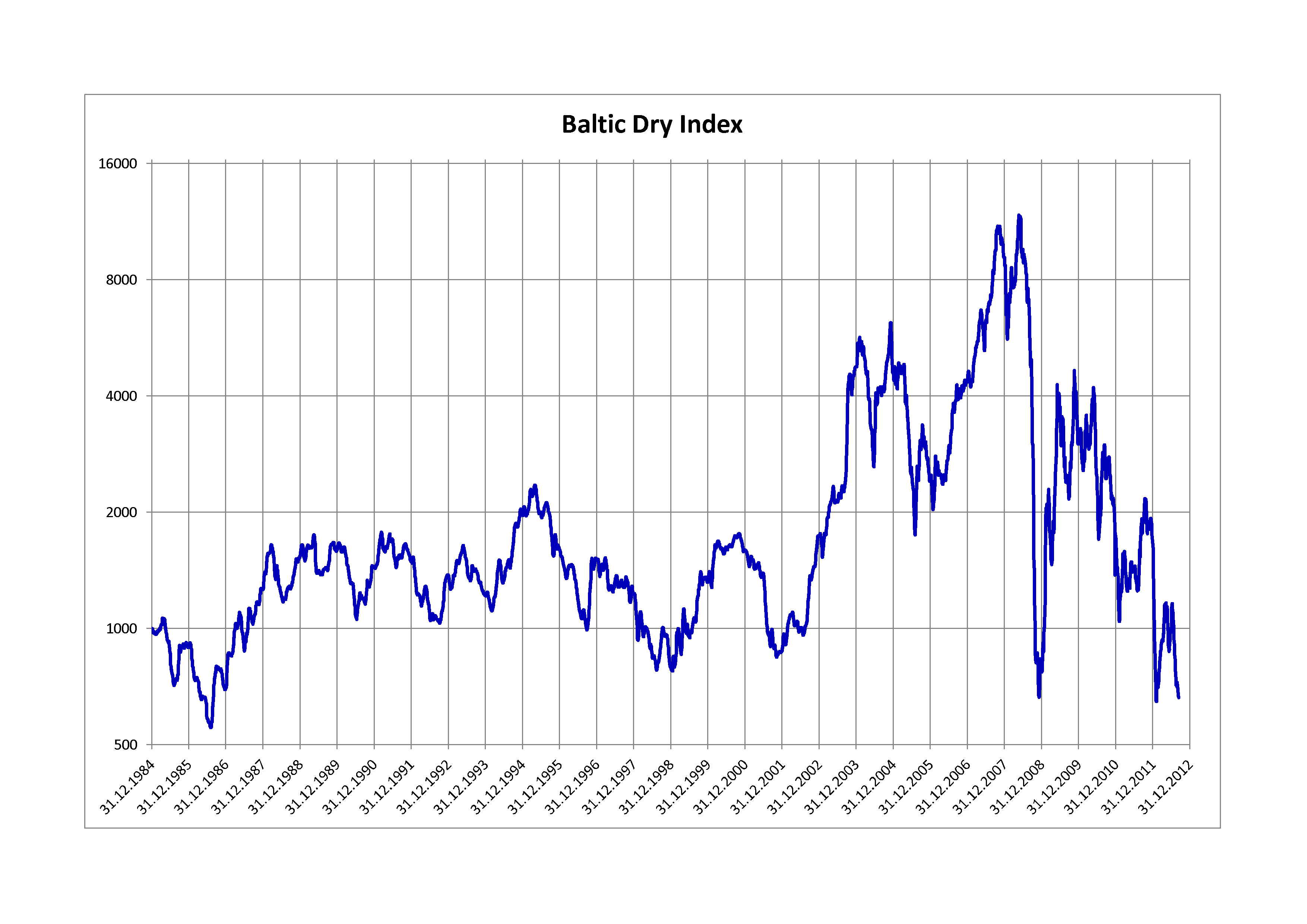

Baltic Dry Index

The Baltic Dry Index (BDI) is a shipping freight-cost index issued daily by the London, England, London-based Baltic Exchange. The BDI is a composite of the Capesize, Panamax and Supramax Timecharter Averages. It is reported around the world as a proxy for dry bulk shipping stocks as well as a general shipping market bellwether. The BDI is the successor to the Baltic Freight Index (BFI) and came into operation on 1 November 1999. The BDI continues the established time series of the BFI, however, the voyages and vessels covered by the index have changed over time so caution should be exercised in assuming long term constancy of the data. Historical origin In 1744, the ''Virginia and Maryland'' coffee house in Threadneedle Street, London, changed its name to ''Virginia and Baltick,'' to more accurately describe the business interests of the merchants who gathered there. Today's Baltic Exchange has its roots in a committee of merchants formed in 1823 to regulate trading and forma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ship Management

Ship management is the activity of managing marine vessels. The vessels under management could be owned by a sister concern of the ship management company or by independent vessel owners. A vessel owning company that generally has several vessels in its fleet, entrusts the fleet management to a single or multiple ship management companies. Ship management is often entrusted to third parties due to the various hassles that are involved in managing a ship. For instance, ships could be considered as large factories that travel across seas under various weather conditions for several days at a stretch. These vessels are equipped with several types of machinery that require appropriate maintenance and the associated spares on board. In the scenario of a vessel lacking adequate maintenance, this could lead to the breakdown of the equipment in the middle of a voyage at sea. A breakdown could be an expensive affair. A second scenario would be – a vessel is continuously on the move or u ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |