|

Form 8812

A child tax credit (CTC) is a tax credit for parents with dependent children given by various countries. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayer's income level. For example, in the United States, only families making less than $400,000 per year may claim the full CTC. Similarly, in the United Kingdom, the tax credit is only available for families making less than £42,000 per year. Germany Germany has a programme called the which, despite technically being a tax exemption and not a tax credit, functions similarly. The child allowance is an allowance in German tax law, in which a certain amount of money is tax-free in the taxation of parents. In the income tax fee paid, child benefit and tax savings through the child tax credit are compared against each other, and the parents pay whichever results in the lesser amount of tax. United Kingdom In the United Kingdom, a family with children and an income below about ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Credit

A tax credit is a tax incentive which allows certain taxpayers to subtract the amount of the credit they have accrued from the total they owe the state. It may also be a credit granted in recognition of taxes already paid or a form of state "discount" applied in certain cases. Another way to think of a tax credit is as a rebate. Refundable vs. non-refundable A refundable tax credit is one which, if the credit exceeds the taxes due, the government pays back to the taxpayer the difference. In other words, it makes possible a negative tax liability. For example, if a taxpayer has an initial tax liability of $100 and applies a $300 tax credit, then the taxpayer ends with a liability of –$200 and the government refunds to the taxpayer that $200. With a non-refundable tax credit, if the credit exceeds the taxes due then the taxpayer pays nothing but does not receive the difference. In this case, the taxpayer from the example would end with a tax liability of $0 (i.e. they could mak ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can be said to be "taxed" at a high rate, compared to other forms of personal expenditure which are formally recognized as investments. Taxes are i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UK Labour Law

United Kingdom labour law regulates the relations between workers, employers and trade unions. People at work in the UK can rely upon a minimum charter of employment rights, which are found in Acts of Parliament, Regulations, common law and equity (legal concept), equity. This includes the right to a minimum wage of £9.50 for over-23-year-olds from April 2022 under the National Minimum Wage Act 1998. The Working Time Regulations 1998 give the right to 28 days paid holidays, breaks from work, and attempt to limit long working hours. The Employment Rights Act 1996 gives the right to leave for child care, and the right to request flexible working patterns. The Pensions Act 2008 gives the right to be automatically enrolled in a basic occupational pension, whose funds must be protected according to the Pensions Act 1995. Workers must be able to vote for trustees of their occupational pensions under the Pensions Act 2004. In some enterprises, such as universities, staff can Codetermina ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United Kingdom

Taxation in the United Kingdom may involve payments to at least three different levels of government: central government (HM Revenue & Customs), devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion. History A uniform Land tax, originally was introduced in England during the late 17th century, formed the main source of government revenue throughout the 18th century and the early 19th century. Stephen Dowell, ''History of Taxation and Taxes in England'' (Rou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

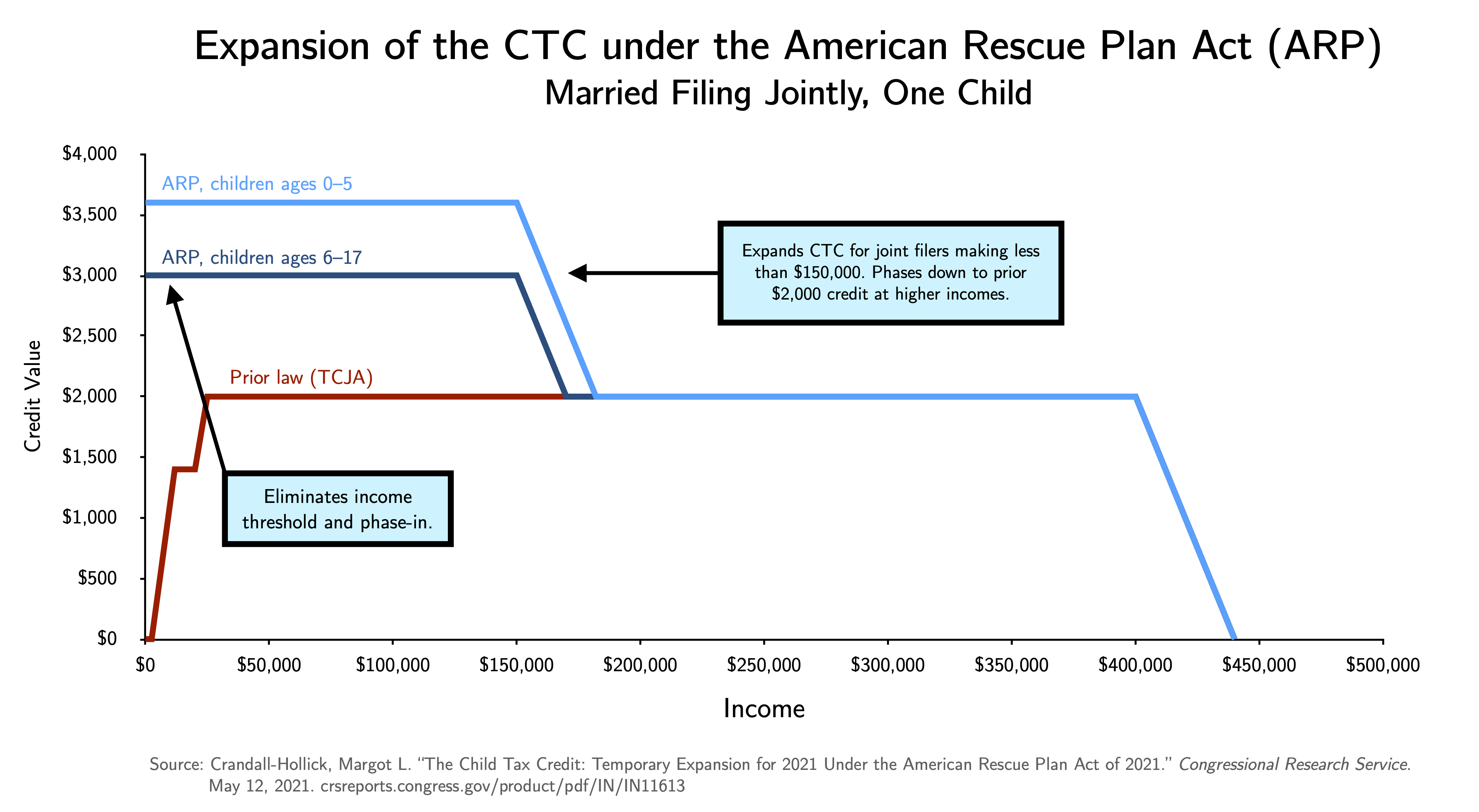

American Rescue Plan Act

The American Rescue Plan Act of 2021, also called the COVID-19 Stimulus Package or American Rescue Plan, is a economic stimulus bill passed by the 117th United States Congress and signed into law by President Joe Biden on March 11, 2021, to speed up the country's recovery from the economic and health effects of the COVID-19 pandemic and the ongoing recession. First proposed on January 14, 2021, the package builds upon many of the measures in the CARES Act from March 2020 and in the Consolidated Appropriations Act, 2021, from December. Beginning on February 2, 2021, Democrats in the United States Senate started to open debates on a budget resolution that would allow them to pass the stimulus package through the process of reconciliation which would not require support from Republicans. The House of Representatives voted 218–212 to approve its version of the budget resolution. A so-called ''vote-a-rama'' session started two days later after the resolution was approved, and the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Columbia University

Columbia University (also known as Columbia, and officially as Columbia University in the City of New York) is a private research university in New York City. Established in 1754 as King's College on the grounds of Trinity Church in Manhattan, Columbia is the oldest institution of higher education in New York and the fifth-oldest institution of higher learning in the United States. It is one of nine colonial colleges founded prior to the Declaration of Independence. It is a member of the Ivy League. Columbia is ranked among the top universities in the world. Columbia was established by royal charter under George II of Great Britain. It was renamed Columbia College in 1784 following the American Revolution, and in 1787 was placed under a private board of trustees headed by former students Alexander Hamilton and John Jay. In 1896, the campus was moved to its current location in Morningside Heights and renamed Columbia University. Columbia scientists and scholars hav ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Economist

''The Economist'' is a British weekly newspaper printed in demitab format and published digitally. It focuses on current affairs, international business, politics, technology, and culture. Based in London, the newspaper is owned by The Economist Group, with its core editorial offices in the United States, as well as across major cities in continental Europe, Asia, and the Middle East. In 2019, its average global print circulation was over 909,476; this, combined with its digital presence, runs to over 1.6 million. Across its social media platforms, it reaches an audience of 35 million, as of 2016. The newspaper has a prominent focus on data journalism and interpretive analysis over original reporting, to both criticism and acclaim. Founded in 1843, ''The Economist'' was first circulated by Scottish economist James Wilson to muster support for abolishing the British Corn Laws (1815–1846), a system of import tariffs. Over time, the newspaper's coverage expanded furthe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Poverty

Child poverty refers to the state of children living in poverty and applies to children from poor families and orphans being raised with limited or no state resources. UNICEF estimates that 356 million children live in extreme poverty. It's estimated that 1 billion children (about 1 in 2 children worldwide) lack at least one essential necessity such as housing, regular food, or clean water. Children are more than twice as likely to live in poverty as adults and the poorest children are twice as likely to die before the age of 5 compared to their wealthier peers. Definition The definition of children in most countries is "people under the age of eighteen".“Convention on the Rights of the Child” (1989) Office of the United Nations High Commissioner for Human Rights Culturally defining the end of childhood is more complex, and takes into account factors such as the commencement of work, end of schooling and marriage as well as class, gender and race. According to the United Nat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Vox (website)

''Vox'' () is an American news and opinion website owned by Vox Media. The website was founded in April 2014 by Ezra Klein, Matt Yglesias, and Melissa Bell, and is noted for its concept of explanatory journalism. Vox's media presence also includes a YouTube channel, several podcasts, and a show presented on Netflix. ''Vox'' has been described as left-of-center and progressive. History Prior to founding ''Vox'', Ezra Klein worked for ''The Washington Post'' as the head of Wonkblog, a public policy blog. When Klein attempted to launch a new site using funding from the newspaper's editors, his proposal was turned down and Klein subsequently left ''The Washington Post'' for a position with Vox Media, another communications company, in January 2014. ''The New York Times'' David Carr associated Klein's exit for ''Vox'' with other "big-name journalists" leaving newspapers for digital start-ups, such as Walter Mossberg and Kara Swisher (of '' Recode'', which was later ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Build Back Better Act

The Build Back Better Act was a bill introduced in the 117th Congress to fulfill aspects of President Joe Biden's Build Back Better Plan. It was spun off from the American Jobs Plan, alongside the Infrastructure Investment and Jobs Act, as a $3.5 trillion Democratic reconciliation package that included provisions related to climate change and social policy. Following negotiations, the price was lowered to approximately $1.7 trillion. The bill was passed 220–213 by the House of Representatives on November 19, 2021. During negotiations, Senator Joe Manchin publicly pulled his support from the bill for not matching his envisioned cost of about $1.75 trillion due to provisions that lasted for less than ten years. After renegotiating the reduction of the Build Back Better Act's size, scope, and cost with Biden and Democratic congressional leaders, Manchin ultimately rejected the bill over the procedural tactics used. Continued negotiations between Manchin and Senate Majority Lead ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Rescue Plan Act Of 2021

The American Rescue Plan Act of 2021, also called the COVID-19 Stimulus Package or American Rescue Plan, is a economic stimulus bill passed by the 117th United States Congress and signed into law by President Joe Biden on March 11, 2021, to speed up the country's recovery from the economic and health effects of the COVID-19 pandemic and the ongoing recession. First proposed on January 14, 2021, the package builds upon many of the measures in the CARES Act from March 2020 and in the Consolidated Appropriations Act, 2021, from December. Beginning on February 2, 2021, Democrats in the United States Senate started to open debates on a budget resolution that would allow them to pass the stimulus package through the process of reconciliation which would not require support from Republicans. The House of Representatives voted 218–212 to approve its version of the budget resolution. A so-called '' vote-a-rama'' session started two days later after the resolution was approved, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)