|

Foreign Exchange (musician)

The foreign exchange market (Forex, FX, or currency market) is a global decentralized or over-the-counter (OTC) market for the trading of currencies. This market determines foreign exchange rates for every currency. It includes all aspects of buying, selling and exchanging currencies at current or determined prices. In terms of trading volume, it is by far the largest market in the world, followed by the credit market. The main participants in this market are the larger international banks. Financial centers around the world function as anchors of trading between a wide range of multiple types of buyers and sellers around the clock, with the exception of weekends. Since currencies are always traded in pairs, the foreign exchange market does not set a currency's absolute value but rather determines its relative value by setting the market price of one currency if paid for with another. Ex: USD 1 is worth X CAD, or CHF, or JPY, etc. The foreign exchange market works thr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Dollar Index DXY

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Eurozone

The euro area, commonly called eurozone (EZ), is a currency union of 19 member states of the European Union (EU) that have adopted the euro (€) as their primary currency and sole legal tender, and have thus fully implemented EMU policies. The 19 eurozone members are Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. The eight non-eurozone members of the EU are Bulgaria, Czech Republic, Croatia, Denmark, Hungary, Poland, Romania, and Sweden. They continue to use their own national currencies, albeit all but Denmark are obliged to join once they meet the euro convergence criteria. Croatia will become the 20th member on 1 January 2023. Among non-EU member states, Andorra, Monaco, San Marino, and Vatican City have formal agreements with the EU to use the euro as their official currency and issue their own coins. In addition, Kosovo and Montenegro h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leverage (finance)

In finance, leverage (or gearing in the United Kingdom and Australia) is any technique involving borrowing funds to buy things, hoping that future profits will be many times more than the cost of borrowing. This technique is named after a lever in physics, which amplifies a small input force into a greater output force, because successful leverage amplifies the comparatively small amount of money needed for borrowing into large amounts of profit. However, the technique also involves the high risk of not being able to pay back a large loan. Normally, a lender will set a limit on how much risk it is prepared to take and will set a limit on how much leverage it will permit, and would require the acquired asset to be provided as collateral security for the loan. Leveraging enables gains to be multiplied.Brigham, Eugene F., ''Fundamentals of Financial Management'' (1995). On the other hand, losses are also multiplied, and there is a risk that leveraging will result in a loss if financi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro. The exchange rate is also regarded as the value of one country's currency in relation to another currency. For example, an interbank exchange rate of 114 Japanese yen to the United States dollar means that ¥114 will be exchanged for or that will be exchanged for ¥114. In this case it is said that the price of a dollar in relation to yen is ¥114, or equivalently that the price of a yen in relation to dollars is $1/114. Each country determines the exchange rate regime that will apply to its currency. For example, a currency may be floating, pegged (fixed), or a hybrid. Governments can impose certain limits and controls on exchange rates. Countries can also have a strong or weak currency. There is no agreement in the econ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sydney

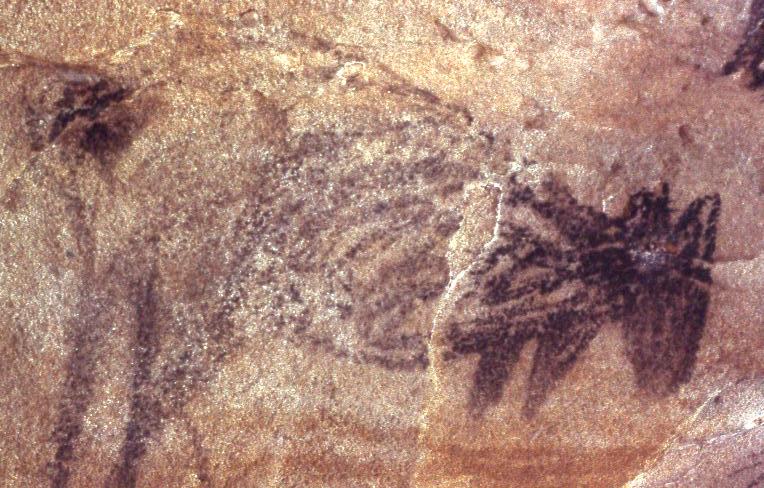

Sydney ( ) is the capital city of the state of New South Wales, and the most populous city in both Australia and Oceania. Located on Australia's east coast, the metropolis surrounds Sydney Harbour and extends about towards the Blue Mountains to the west, Hawkesbury to the north, the Royal National Park to the south and Macarthur to the south-west. Sydney is made up of 658 suburbs, spread across 33 local government areas. Residents of the city are known as "Sydneysiders". The 2021 census recorded the population of Greater Sydney as 5,231,150, meaning the city is home to approximately 66% of the state's population. Estimated resident population, 30 June 2017. Nicknames of the city include the 'Emerald City' and the 'Harbour City'. Aboriginal Australians have inhabited the Greater Sydney region for at least 30,000 years, and Aboriginal engravings and cultural sites are common throughout Greater Sydney. The traditional custodians of the land on which modern Sydney stands are ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity

{{SIA ...

Liquidity is a concept in economics involving the convertibility of assets and obligations. It can include: * Market liquidity, the ease with which an asset can be sold * Accounting liquidity, the ability to meet cash obligations when due * Liquid capital, the amount of money that a firm holds * Liquidity risk, the risk that an asset will have impaired market liquidity See also *Liquid (other) *Liquidation (other) Liquidation is the conversion of a business's assets to money in order to pay off debt. Liquidation may also refer to: * Murder * Fragmentation (music), a compositional technique * ''Liquidation'' (miniseries), a Russian television series See a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Rate Regime

An exchange rate regime is a way a monetary authority of a country or currency union manages the currency about other currencies and the foreign exchange market. It is closely related to monetary policy and the two are generally dependent on many of the same factors, such as economic scale and openness, inflation rate, the elasticity of the labor market, financial market development, capital mobility ,etc. There are two major regime types: * ''Floating (or flexible) exchange rate'' regime exist where exchange rates are determined solely by market forces and often manipulated by open-market operations. Countries do have the ability to influence their floating currency from activities such as buying/selling currency reserves, changing interest rates, and through foreign trade agreements. * ''Fixed (or pegged) exchange rate'' regimes, exist when a country sets the value of its home currency directly proportional to the value of another currency or commodity. For years many curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Floating Exchange Rate

In macroeconomics and economic policy, a floating exchange rate (also known as a fluctuating or flexible exchange rate) is a type of exchange rate regime in which a currency's value is allowed to fluctuate in response to foreign exchange market events. A currency that uses a floating exchange rate is known as a ''floating currency'', in contrast to a ''fixed currency'', the value of which is instead specified in terms of material goods, another currency, or a set of currencies (the idea of the last being to reduce currency fluctuations). In the modern world, most of the world's currencies are floating, and include the most widely traded currencies: the United States dollar, the euro, the Swiss franc, the Indian rupee, the pound sterling, the Japanese yen, and the Australian dollar. However, even with floating currencies, central banks often participate in markets to attempt to influence the value of floating exchange rates. The Canadian dollar most closely resembles a pure f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

World War II

World War II or the Second World War, often abbreviated as WWII or WW2, was a world war that lasted from 1939 to 1945. It involved the vast majority of the world's countries—including all of the great powers—forming two opposing military alliances: the Allies and the Axis powers. World War II was a total war that directly involved more than 100 million personnel from more than 30 countries. The major participants in the war threw their entire economic, industrial, and scientific capabilities behind the war effort, blurring the distinction between civilian and military resources. Aircraft played a major role in the conflict, enabling the strategic bombing of population centres and deploying the only two nuclear weapons ever used in war. World War II was by far the deadliest conflict in human history; it resulted in 70 to 85 million fatalities, mostly among civilians. Tens of millions died due to genocides (including the Holocaust), starvation, ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bretton Woods System

The Bretton Woods system of monetary management established the rules for commercial and financial relations among the United States, Canada, Western European countries, Australia, and Japan after the 1944 Bretton Woods Agreement. The Bretton Woods system was the first example of a fully negotiated monetary order intended to govern monetary relations among independent states. The Bretton Woods system required countries to guarantee convertibility of their currencies into U.S. dollars to within 1% of fixed parity rates, with the dollar convertible to gold bullion for foreign governments and central banks at US$35 per troy ounce of fine gold (or 0.88867 gram fine gold per dollar). It also envisioned greater cooperation among countries in order to prevent future competitive devaluations, and thus established the International Monetary Fund (IMF) to monitor exchange rates and lend reserve currencies to nations with balance of payments deficits. Preparing to rebuild the interna ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UNCTAD

The United Nations Conference on Trade and Development (UNCTAD) is an intergovernmental organization within the United Nations Secretariat that promotes the interests of developing countries in world trade. It was established in 1964 by the United Nations General Assembly (UNGA) and reports to that body and the United Nations Economic and Social Council (ECOSOC). UNCTAD is composed of 195 member states and works with nongovernmental organizations worldwide; its permanent secretariat is in Geneva, Switzerland. The primary objective of UNCTAD is to formulate policies relating to all aspects of development, including trade, aid, transport, finance and technology. It was created in response to concerns among developing countries that existing international institutions like GATT (now replaced by the World Trade Organization), the International Monetary Fund (IMF), and the World Bank were not properly organized to handle the particular problems of developing countries; UNCTAD wou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)