|

Financialisation

Financialization (or financialisation in British English) is a term sometimes used to describe the development of financial capitalism during the period from 1980 to present, in which debt-to-equity ratios increased and financial services accounted for an increasing share of national income relative to other sectors. Financialization describes an economic process by which exchange is facilitated through the intermediation of financial instruments. Financialization may permit real goods, services, and risks to be readily exchangeable for currency, and thus make it easier for people to rationalize their assets and income flows. Financialization is tied to the transition from an industrial economy to a service economy, as financial services belong to the tertiary sector of the economy. Specific academic approaches Various definitions, focusing on specific aspects and interpretations, have been used: * Greta Krippner of the University of Michigan writes that financializati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deregulation

Deregulation is the process of removing or reducing state regulations, typically in the economic sphere. It is the repeal of governmental regulation of the economy. It became common in advanced industrial economies in the 1970s and 1980s, as a result of new trends in economic thinking about the inefficiencies of government regulation, and the risk that regulatory agencies would be controlled by the regulated industry to its benefit, and thereby hurt consumers and the wider economy. Economic regulations were promoted during the Gilded Age, in which progressive reforms were claimed as necessary to limit externalities like corporate abuse, unsafe child labor, monopolization, pollution, and to mitigate boom and bust cycles. Around the late 1970s, such reforms were deemed burdensome on economic growth and many politicians espousing neoliberalism started promoting deregulation. The stated rationale for deregulation is often that fewer and simpler regulations will lead to raised lev ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Market

A capital market is a financial market in which long-term debt (over a year) or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties. Transactions on capital markets are generally managed by entities within the financial sector or the treasury departments of governments and corporations, but some can be accessed directly by the public. As an example, in the United States, any American citizen with an internet connection can create an account with TreasuryDirect and use it to buy bonds in the primary market, though sales to indiv ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Michael Hudson (economist)

Michael Hudson (born March 14, 1939) is an American economist, Professor of Economics at the University of Missouri–Kansas City and a researcher at the Levy Economics Institute at Bard College, former Wall Street analyst, political consultant, commentator and journalist. He is a contributor to ''The Hudson Report'', a weekly economic and financial news podcast produced by Left Out. Hudson graduated from the University of Chicago (BA, 1959) and New York University (MA, 1965, PhD, 1968) and worked as a balance of payments economist in Chase Manhattan Bank (1964–1968). He was assistant professor of economics at the New School for Social Research (1969–1972) and worked for various governmental and non-governmental organizations as an economic consultant (1980s–1990s). Hudson has devoted his career to the study of debt, both domestic debt (loans, mortgages, interest payments), and external debt. In his works, he consistently advocates the idea that loans and exponentially ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Chicago School Of Economics

The Chicago school of economics is a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago, some of whom have constructed and popularized its principles. Milton Friedman and George Stigler are considered the leading scholars of the Chicago school. Chicago macroeconomic theory rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. The freshwater–saltwater distinction is largely antiquated today, as the two traditions have heavily incorporated ideas from each other. Specifically, new Keynesian economics was developed as a response to new classical economics, electing to incorporate the insight of rational expectations without giving up the traditional Keynesian focus on imperfect competition and sticky wages. Chicago economists have also left their intellectual influence in other fields, notably in pion ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Milton Friedman

Milton Friedman (; July 31, 1912 – November 16, 2006) was an American economist and statistician who received the 1976 Nobel Memorial Prize in Economic Sciences for his research on consumption analysis, monetary history and theory and the complexity of stabilization policy. With George Stigler and others, Friedman was among the intellectual leaders of the Chicago school of economics, a neoclassical school of economic thought associated with the work of the faculty at the University of Chicago that rejected Keynesianism in favor of monetarism until the mid-1970s, when it turned to new classical macroeconomics heavily based on the concept of rational expectations. Several students, young professors and academics who were recruited or mentored by Friedman at Chicago went on to become leading economists, including Gary Becker, Robert Fogel, Thomas Sowell and Robert Lucas Jr. Friedman's challenges to what he called "naive Keynesian theory" began with his interpretatio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Neoliberalism

Neoliberalism (also neo-liberalism) is a term used to signify the late 20th century political reappearance of 19th-century ideas associated with free-market capitalism after it fell into decline following the Second World War. A prominent factor in the rise of conservative and libertarian organizations, political parties, and think tanks, and predominantly advocated by them, it is generally associated with policies of economic liberalization, including privatization, deregulation, globalization, free trade, monetarism, austerity, and reductions in government spending in order to increase the role of the private sector in the economy and society. The defining features of neoliberalism in both thought and practice have been the subject of substantial scholarly debate. As an economic philosophy, neoliberalism emerged among European liberal scholars in the 1930s as they attempted to revive and renew central ideas from classical liberalism as they saw these ideas dimin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Power

Economic power refers to the ability of countries, businesses or individuals to improve living standards. It increases their ability to make decisions on their own that benefit them. Scholars of international relations also refer to the economic power of a country as a factor influencing its power in international relations. Definition Economists use several concepts featuring the word power: * Market power is the ability of a firm to profitably raise the market price of a good or service over marginal cost. ** Monopoly power is a strong form of market power—the ability to set prices or wages unilaterally. This is the opposite of the situation in a perfectly competitive market in which supply and demand set prices. * Purchasing power, i.e. the ability of any amount of money to buy goods and services. Those with more assets, or more correctly net worth, have more power of this sort. The greater the liquidity of one's assets, the greater one's purchasing power is. Purchasin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Collapse

Economic collapse, also called economic meltdown, is any of a broad range of bad economic conditions, ranging from a severe, prolonged depression with high bankruptcy rates and high unemployment (such as the Great Depression of the 1930s), to a breakdown in normal commerce caused by hyperinflation (such as in Weimar Germany in the 1920s), or even an economically caused sharp rise in the death rate and perhaps even a decline in population (such as in countries of the former USSR in the 1990s). Often economic collapse is accompanied by social chaos, civil unrest and a breakdown of law and order. Cases There are few well documented cases of economic collapse. One of the best documented cases of collapse or near collapse is the Great Depression, the causes of which are still being debated. "To understand the Great Depression is the Holy Grail of macroeconomics." —Ben Bernanke (1995) Bernanke's comment addresses the difficulty of identifying specific causes when many factors m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

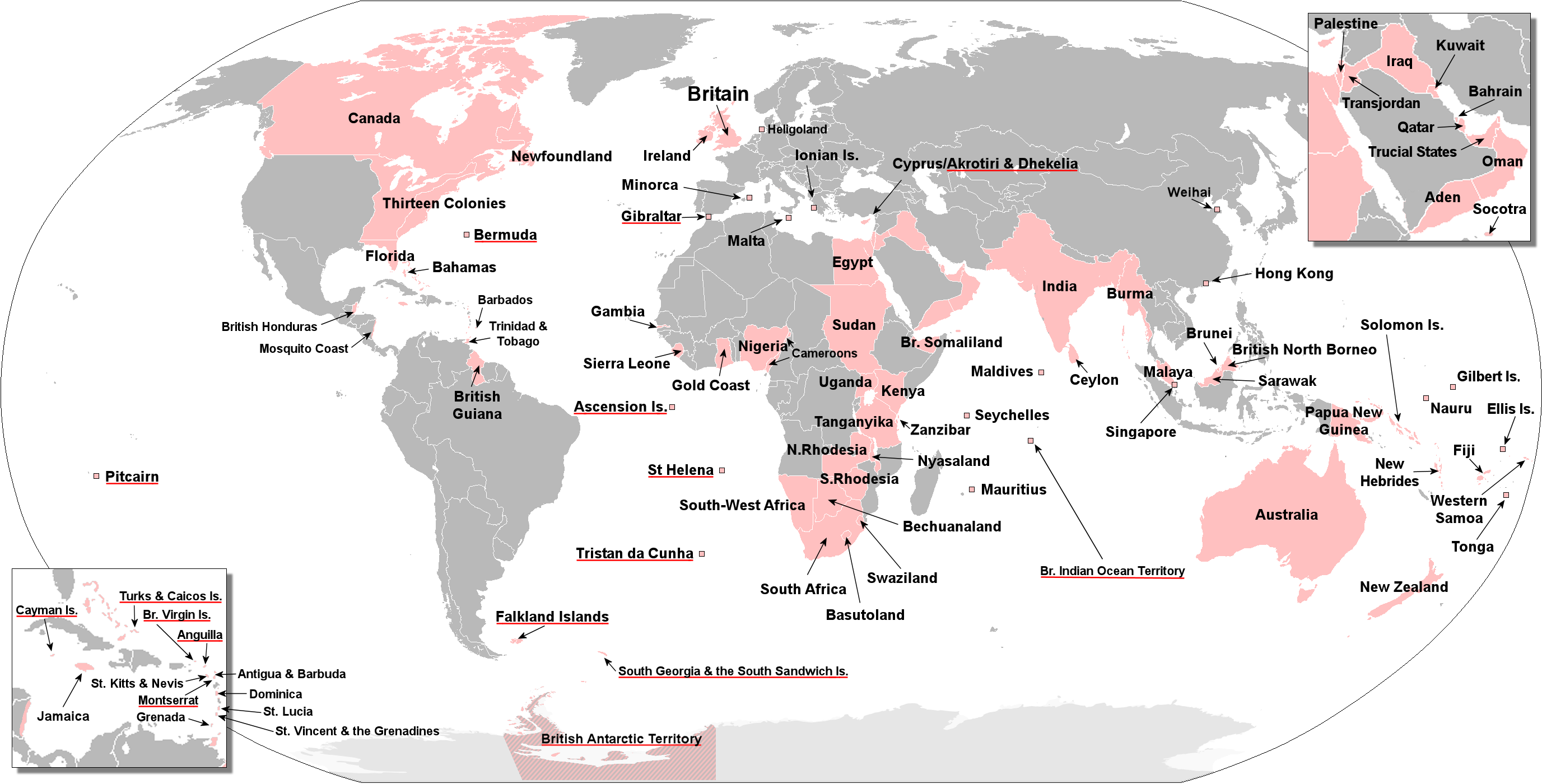

British Empire

The British Empire was composed of the dominions, colonies, protectorates, mandates, and other territories ruled or administered by the United Kingdom and its predecessor states. It began with the overseas possessions and trading posts established by England between the late 16th and early 18th centuries. At its height it was the largest empire in history and, for over a century, was the foremost global power. By 1913, the British Empire held sway over 412 million people, of the world population at the time, and by 1920, it covered , of the Earth's total land area. As a result, its constitutional, legal, linguistic, and cultural legacy is widespread. At the peak of its power, it was described as " the empire on which the sun never sets", as the Sun was always shining on at least one of its territories. During the Age of Discovery in the 15th and 16th centuries, Portugal and Spain pioneered European exploration of the globe, and in the process established ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Habsburg Spain

Habsburg Spain is a contemporary historiographical term referring to the huge extent of territories (including modern-day Spain, a piece of south-east France, eventually Portugal, and many other lands outside of the Iberian Peninsula) ruled between the 16th and 18th centuries (1516–1713) by kings from the Spanish branch of the House of Habsburg (also associated with its role in the history of Central and Eastern Europe). Habsburg Spain was a composite monarchy and a personal union. The Habsburg Hispanic Monarchs (chiefly Charles I and Philip II) reached the zenith of their influence and power ruling the Spanish Empire. They controlled territories over the five continents, including the Americas, the East Indies, the Low Countries, Belgium, Luxembourg, and territories now in Italy, France and Germany in Europe, the Portuguese Empire from 1580 to 1640, and various other territories such as small enclaves like Ceuta and Oran in North Africa. This period of Spanish h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |