|

Financial Risk Modeling

Financial risk modeling is the use of formal mathematical finance, mathematical and econometric techniques to measure, monitor and control the market risk, credit risk, and operational risk on a firm's balance sheet, on a bank's trading book, or re a fund manager's portfolio value; see Financial risk management. Risk modeling is one of many subtasks within the broader area of financial modeling. Application Risk modeling uses a variety of techniques including market risk, value at risk (VaR), Historical simulation (finance), historical simulation (HS), or extreme value theory (EVT) in order to analyze a portfolio and make forecasts of the likely losses that would be incurred for a variety of risks. As above, such risks are typically grouped into credit risk, market risk, model risk, liquidity risk, and operational risk categories. Many large financial intermediary firms use risk modeling to help portfolio managers assess the amount of Capital requirement, capital reserves to maint ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mathematical Finance

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling of financial markets. In general, there exist two separate branches of finance that require advanced quantitative techniques: derivatives pricing on the one hand, and risk and portfolio management on the other. Mathematical finance overlaps heavily with the fields of computational finance and financial engineering. The latter focuses on applications and modeling, often by help of stochastic asset models, while the former focuses, in addition to analysis, on building tools of implementation for the models. Also related is quantitative investing, which relies on statistical and numerical models (and lately machine learning) as opposed to traditional fundamental analysis when managing portfolios. French mathematician Louis Bachelier's doctoral thesis, defended in 1900, is considered the first scholarly work on mathematical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel II

Basel II is the second of the Basel Accords, which are recommendations on banking laws and regulations issued by the Basel Committee on Banking Supervision. It is now extended and partially superseded by Basel III. The Basel II Accord was published in June 2004. It was a new framework for international banking standards, superseding the Basel I framework, to determine the minimum capital that banks should hold to guard against the financial and operational risks. The regulations aimed to ensure that the more significant the risk a bank is exposed to, the greater the amount of capital the bank needs to hold to safeguard its solvency and overall economic stability. Basel II attempted to accomplish this by establishing risk and capital management requirements to ensure that a bank has adequate capital for the risk the bank exposes itself to through its lending, investment and trading activities. One focus was to maintain sufficient consistency of regulations so to limit competi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

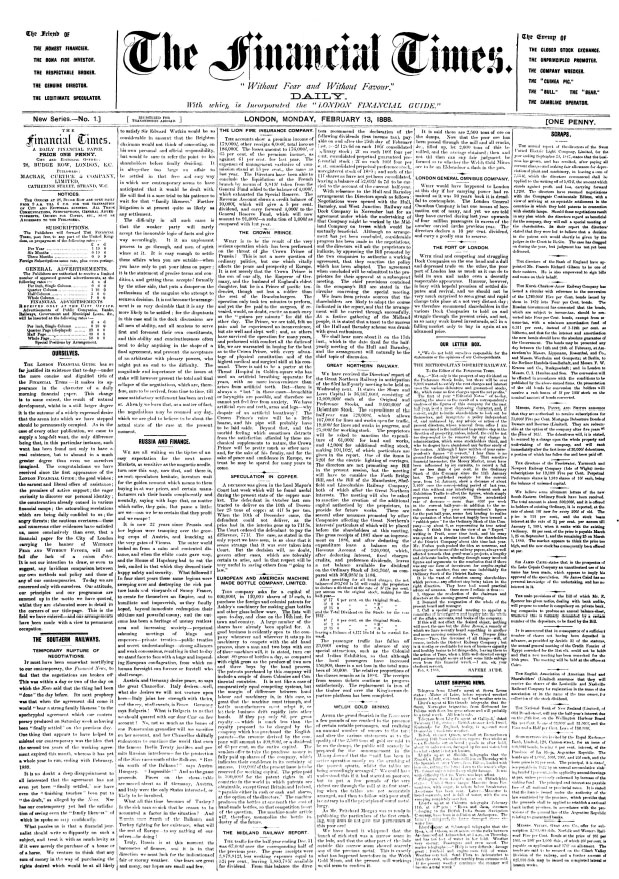

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a "Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Random House

Random House is an American book publisher and the largest general-interest paperback publisher in the world. The company has several independently managed subsidiaries around the world. It is part of Penguin Random House, which is owned by German media conglomerate Bertelsmann. History Random House was founded in 1927 by Bennett Cerf and Donald Klopfer, two years after they acquired the Modern Library imprint from publisher Horace Liveright, which reprints classic works of literature. Cerf is quoted as saying, "We just said we were going to publish a few books on the side at random," which suggested the name Random House. In 1934 they published the first authorized edition of James Joyce's novel '' Ulysses'' in the Anglophone world. ''Ulysses'' transformed Random House into a formidable publisher over the next two decades. In 1936, it absorbed the firm of Smith and Haas—Robert Haas became the third partner until retiring and selling his share back to Cerf and Klopfer in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis Of 2007–2010

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sarbanes–Oxley Act

The Sarbanes–Oxley Act of 2002 is a United States federal law that mandates certain practices in financial record keeping and reporting for corporations. The act, (), also known as the "Public Company Accounting Reform and Investor Protection Act" (in the Senate) and "Corporate and Auditing Accountability, Responsibility, and Transparency Act" (in the House) and more commonly called Sarbanes–Oxley, SOX or Sarbox, contains eleven sections that place requirements on all U.S. public company boards of directors and management and public accounting firms. A number of provisions of the Act also apply to privately held companies, such as the willful destruction of evidence to impede a federal investigation. The law was enacted as a reaction to a number of major corporate and accounting scandals, including Enron and WorldCom. The sections of the bill cover responsibilities of a public corporation's board of directors, add criminal penalties for certain misconduct, and require ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Enron

Enron Corporation was an American energy, commodities, and services company based in Houston, Texas. It was founded by Kenneth Lay in 1985 as a merger between Lay's Houston Natural Gas and InterNorth, both relatively small regional companies. Before its bankruptcy on December 2, 2001, Enron employed approximately 20,600 staff and was a major electricity, natural gas, communications, and pulp and paper company, with claimed revenues of nearly $101 billion during 2000. '' Fortune'' named Enron "America's Most Innovative Company" for six consecutive years. At the end of 2001, it was revealed that Enron's reported financial condition was sustained by an institutionalized, systematic, and creatively planned accounting fraud, known since as the Enron scandal. Enron has become synonymous with willful corporate fraud and corruption. The scandal also brought into question the accounting practices and activities of many corporations in the United States and was a factor in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Scandals

A corporate collapse typically involves the insolvency or bankruptcy of a major business enterprise. A corporate scandal involves alleged or actual unethical behavior by people acting within or on behalf of a corporation. Many recent corporate collapses and scandals have involved false or inappropriate accounting of some sort (see list at accounting scandals). List of major corporate collapses The following list of corporations involved major collapses, through the risk of job losses or size of the business, and meant entering into insolvency or bankruptcy, or being nationalised or requiring a non-market loan by a government. List of scandals without insolvency * Australia & New Zealand Banking Group scandal involving misleading file notes in the Financial Ombudsman Service (Australia) presented to the Supreme Court of Victoria. * Australia & New Zealand Banking Group allegations of racial bigotry toward billionaire businessman Pankaj Oswal and his wife. Court was presented ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Analysis (Business)

Risk analysis is a technique used to identify and assess factors that may jeopardize the success of a project or achieving a goal. This technique also helps to define preventive measures to reduce the probability of these factors from occurring and identify countermeasures to successfully deal with these constraints when they develop to avert possible negative effects on the competitiveness of the company. One of the more popular methods to perform a risk analysis in the computer field is called facilitated risk analysis process (FRAP). Facilitated risk analysis process FRAP analyzes one system, application or segment of business processes at a time. FRAP assumes that additional efforts to develop precisely quantified risks are not cost-effective because: * such estimates are time-consuming * risk documentation becomes too voluminous for practical use * specific loss estimates are generally not needed to determine if controls are needed. * without assumptions there is little ris ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard Deviation

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean (also called the expected value) of the set, while a high standard deviation indicates that the values are spread out over a wider range. Standard deviation may be abbreviated SD, and is most commonly represented in mathematical texts and equations by the lower case Greek letter σ (sigma), for the population standard deviation, or the Latin letter '' s'', for the sample standard deviation. The standard deviation of a random variable, sample, statistical population, data set, or probability distribution is the square root of its variance. It is algebraically simpler, though in practice less robust, than the average absolute deviation. A useful property of the standard deviation is that, unlike the variance, it is expressed in the same unit as the data. The standard deviation o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fat-tailed Distribution

A fat-tailed distribution is a probability distribution that exhibits a large skewness or kurtosis, relative to that of either a normal distribution or an exponential distribution. In common usage, the terms fat-tailed and heavy-tailed are sometimes synonymous; fat-tailed is sometimes also defined as a subset of heavy-tailed. Different research communities favor one or the other largely for historical reasons, and may have differences in the precise definition of either. Fat-tailed distributions have been empirically encountered in a variety of areas: physics, earth sciences, economics and political science. The class of fat-tailed distributions includes those whose tails decay like a power law, which is a common point of reference in their use in the scientific literature. However, fat-tailed distributions also include other slowly-decaying distributions, such as the log-normal. The extreme case: a power-law distribution The most extreme case of a fat tail is given by a distrib ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Power Law

In statistics, a power law is a functional relationship between two quantities, where a relative change in one quantity results in a proportional relative change in the other quantity, independent of the initial size of those quantities: one quantity varies as a power of another. For instance, considering the area of a square in terms of the length of its side, if the length is doubled, the area is multiplied by a factor of four. Empirical examples The distributions of a wide variety of physical, biological, and man-made phenomena approximately follow a power law over a wide range of magnitudes: these include the sizes of craters on the moon and of solar flares, the foraging pattern of various species, the sizes of activity patterns of neuronal populations, the frequencies of words in most languages, frequencies of family names, the species richness in clades of organisms, the sizes of power outages, volcanic eruptions, human judgments of stimulus intensity and many other quantit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |