|

Fat-tailed Distribution

A fat-tailed distribution is a probability distribution that exhibits a large skewness or kurtosis, relative to that of either a normal distribution or an exponential distribution. In common usage, the terms fat-tailed and Heavy-tailed distribution, heavy-tailed are sometimes synonymous; fat-tailed is sometimes also defined as a subset of heavy-tailed. Different research communities favor one or the other largely for historical reasons, and may have differences in the precise definition of either. Fat-tailed distributions have been empirically encountered in a variety of areas: physics, earth sciences, economics and political science. The class of fat-tailed distributions includes those whose tails decay like a power law, which is a common point of reference in their use in the scientific literature. However, fat-tailed distributions also include other slowly-decaying distributions, such as the log-normal distribution, log-normal. The extreme case: a power-law distribution The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability Distribution

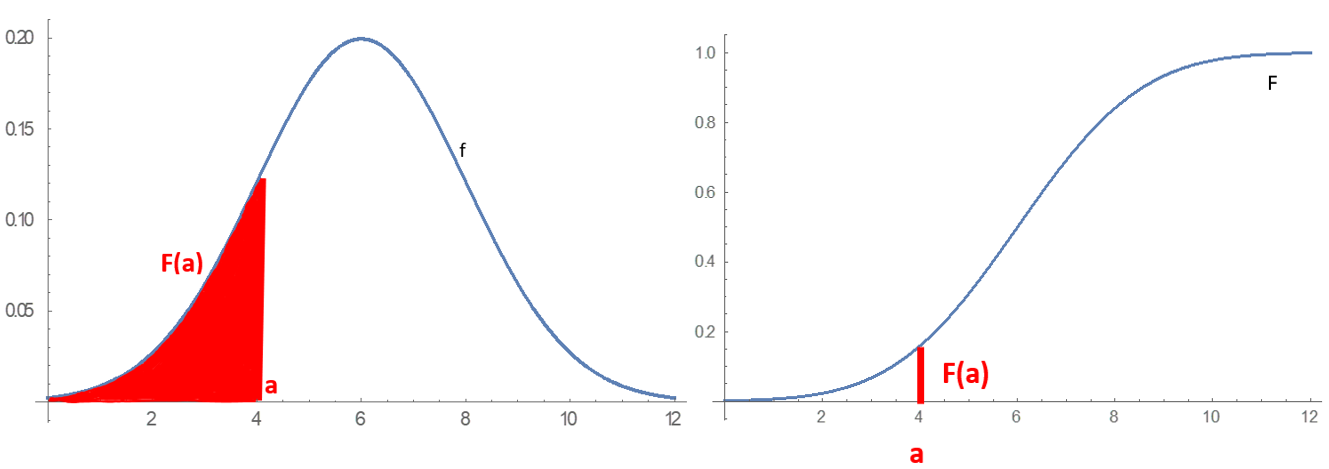

In probability theory and statistics, a probability distribution is a Function (mathematics), function that gives the probabilities of occurrence of possible events for an Experiment (probability theory), experiment. It is a mathematical description of a Randomness, random phenomenon in terms of its sample space and the Probability, probabilities of Event (probability theory), events (subsets of the sample space). For instance, if is used to denote the outcome of a coin toss ("the experiment"), then the probability distribution of would take the value 0.5 (1 in 2 or 1/2) for , and 0.5 for (assuming that fair coin, the coin is fair). More commonly, probability distributions are used to compare the relative occurrence of many different random values. Probability distributions can be defined in different ways and for discrete or for continuous variables. Distributions with special properties or for especially important applications are given specific names. Introduction A prob ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mean

A mean is a quantity representing the "center" of a collection of numbers and is intermediate to the extreme values of the set of numbers. There are several kinds of means (or "measures of central tendency") in mathematics, especially in statistics. Each attempts to summarize or typify a given group of data, illustrating the magnitude and sign of the data set. Which of these measures is most illuminating depends on what is being measured, and on context and purpose. The ''arithmetic mean'', also known as "arithmetic average", is the sum of the values divided by the number of values. The arithmetic mean of a set of numbers ''x''1, ''x''2, ..., x''n'' is typically denoted using an overhead bar, \bar. If the numbers are from observing a sample of a larger group, the arithmetic mean is termed the '' sample mean'' (\bar) to distinguish it from the group mean (or expected value) of the underlying distribution, denoted \mu or \mu_x. Outside probability and statistics, a wide rang ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk

In simple terms, risk is the possibility of something bad happening. Risk involves uncertainty about the effects/implications of an activity with respect to something that humans value (such as health, well-being, wealth, property or the environment), often focusing on negative, undesirable consequences. Many different definitions have been proposed. One ISO standard, international standard definition of risk is the "effect of uncertainty on objectives". The understanding of risk, the methods of assessment and management, the descriptions of risk and even the definitions of risk differ in different practice areas (business, economics, Environmental science, environment, finance, information technology, health, insurance, safety, security, security, privacy, etc). This article provides links to more detailed articles on these areas. The international standard for risk management, ISO 31000, provides principles and general guidelines on managing risks faced by organizations. Defi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moneyness

In finance, moneyness is the relative position of the current price (or future price) of an underlying asset (e.g., a stock) with respect to the strike price of a derivative, most commonly a call option or a put option. Moneyness is firstly a three-fold classification: * If the derivative would have positive intrinsic value if it were to expire today, it is said to be in the money (ITM); * If the derivative would be worthless if expiring with the underlying at its current price, it is said to be out of the money (OTM); * And if the current underlying price and strike price are equal, the derivative is said to be at the money (ATM). There are two slightly different definitions, according to whether one uses the current price (spot) or future price (forward), specified as "at the money spot" or "at the money forward", etc. This rough classification can be quantified by various definitions to express the moneyness as a number, measuring how far the asset is in the money or out o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option (finance)

In finance, an option is a contract which conveys to its owner, the ''holder'', the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset (or contingent liability) and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in '' over-the-counter'' (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts. Definition and application An option is a contract that allows the holder the right to buy or sell an underlying asset or financia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Option Pricing

In finance, a price (premium) is paid or received for purchasing or selling options. The calculation of this premium will require sophisticated mathematics. Premium components This price can be split into two components: intrinsic value, and time value (also called "extrinsic value"). Intrinsic value The ''intrinsic value'' is the difference between the underlying spot price and the strike price, to the extent that this is in favor of the option holder. For a call option, the option is in-the-money if the underlying spot price is higher than the strike price; then the intrinsic value is the underlying price minus the strike price. For a put option, the option is in-the-money if the ''strike'' price is higher than the underlying spot price; then the intrinsic value is the strike price minus the underlying spot price. Otherwise the intrinsic value is zero. For example, when a DJI call (bullish/long) option is 18,000 and the underlying DJI Index is priced at $18,050 then there ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance refers to monetary resources and to the study and Academic discipline, discipline of money, currency, assets and Liability (financial accounting), liabilities. As a subject of study, is a field of Business administration, Business Administration wich study the planning, organizing, leading, and controlling of an organization's resources to achieve its goals. Based on the scope of financial activities in financial systems, the discipline can be divided into Personal finance, personal, Corporate finance, corporate, and public finance. In these financial systems, assets are bought, sold, or traded as financial instruments, such as Currency, currencies, loans, Bond (finance), bonds, Share (finance), shares, stocks, Option (finance), options, Futures contract, futures, etc. Assets can also be banked, Investment, invested, and Insurance, insured to maximize value and minimize loss. In practice, Financial risk, risks are always present in any financial action and entities. Due ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stable Distribution

In probability theory, a distribution is said to be stable if a linear combination of two independent random variables with this distribution has the same distribution, up to location and scale parameters. A random variable is said to be stable if its distribution is stable. The stable distribution family is also sometimes referred to as the Lévy alpha-stable distribution, after Paul Lévy, the first mathematician to have studied it. Of the four parameters defining the family, most attention has been focused on the stability parameter, \alpha (see panel). Stable distributions have 0 < \alpha \leq 2, with the upper bound corresponding to the , and to the Cauchy distribution. The distributio ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nassim Taleb

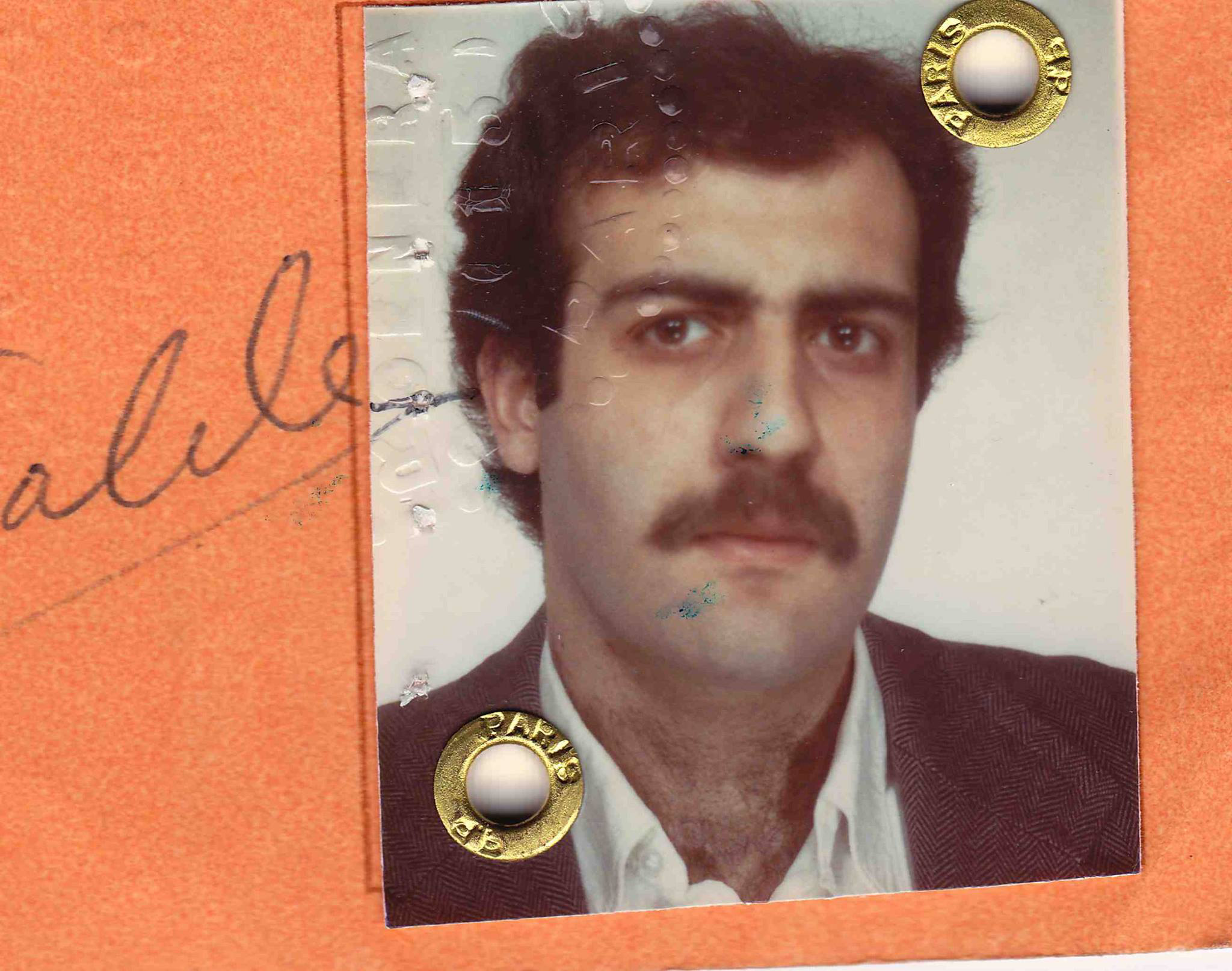

Nassim Nicholas Taleb (; alternatively ''Nessim ''or'' Nissim''; born 12 September 1960) is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist. His work concerns problems of randomness, probability, complexity, and uncertainty. Taleb is the author of the ''Incerto'', a five-volume work on the nature of uncertainty published between 2001 and 2018 (notably, '' The Black Swan'' and '' Antifragile''). He has taught at several universities, serving as a Distinguished Professor of Risk Engineering at the New York University Tandon School of Engineering since September 2008. He has also been a practitioner of mathematical finance and is currently an adviser at Universa Investments. ''The Sunday Times'' described his 2007 book '' The Black Swan'' as one of the 12 most influential books since World War II. Taleb criticized risk management methods used by the finance industry and warned about financial crises, subsequently ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Benoît Mandelbrot

Benoit B. Mandelbrot (20 November 1924 – 14 October 2010) was a Polish-born French-American mathematician and polymath with broad interests in the practical sciences, especially regarding what he labeled as "the art of #Fractals and the "theory of roughness", roughness" of physical phenomena and "the uncontrolled element in life". He referred to himself as a "fractalist" and is recognized for his contribution to the field of fractal geometry, which included coining the word "fractal", as well as developing a theory of "roughness and self-similarity" in nature. In 1936, at the age of 11, Mandelbrot and his family emigrated from Warsaw, Poland, to France. After World War II ended, Mandelbrot studied mathematics, graduating from universities in Paris and in the United States and receiving a master's degree in aeronautics from the California Institute of Technology. He spent most of his career in both the United States and France, having Multiple citizenship, dual French nati ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variance

In probability theory and statistics, variance is the expected value of the squared deviation from the mean of a random variable. The standard deviation (SD) is obtained as the square root of the variance. Variance is a measure of dispersion, meaning it is a measure of how far a set of numbers is spread out from their average value. It is the second central moment of a distribution, and the covariance of the random variable with itself, and it is often represented by \sigma^2, s^2, \operatorname(X), V(X), or \mathbb(X). An advantage of variance as a measure of dispersion is that it is more amenable to algebraic manipulation than other measures of dispersion such as the expected absolute deviation; for example, the variance of a sum of uncorrelated random variables is equal to the sum of their variances. A disadvantage of the variance for practical applications is that, unlike the standard deviation, its units differ from the random variable, which is why the standard devi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |