|

Financial Accelerator

The financial accelerator in macroeconomics is the process by which adverse shocks to the economy may be amplified by worsening financial market conditions. More broadly, adverse conditions in the real economy and in financial markets propagate the financial and macroeconomic downturn. Financial accelerator mechanism The link between the real economy and financial markets stems from firms’ need for external finance to engage in physical investment opportunities. Firms’ ability to borrow depends essentially on the market value of their net worth. The reason for this is asymmetric information between lenders and borrowers. Lenders are likely to have little information about the reliability of any given borrower. As such, they usually require borrowers to set forth their ability to repay, often in the form of collateralized assets. It follows that a fall in asset prices deteriorates the balance sheets of the firms and their net worth. The resulting deterioration of their abilit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Macroeconomics

Macroeconomics (from the Greek prefix ''makro-'' meaning "large" + ''economics'') is a branch of economics dealing with performance, structure, behavior, and decision-making of an economy as a whole. For example, using interest rates, taxes, and government spending to regulate an economy's growth and stability. This includes regional, national, and global economies. According to a 2018 assessment by economists Emi Nakamura and Jón Steinsson, economic "evidence regarding the consequences of different macroeconomic policies is still highly imperfect and open to serious criticism." Macroeconomists study topics such as Gross domestic product, GDP (Gross Domestic Product), unemployment (including Unemployment#Measurement, unemployment rates), national income, price index, price indices, output (economics), output, Consumption (economics), consumption, inflation, saving, investment (macroeconomics), investment, Energy economics, energy, international trade, and international finance. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

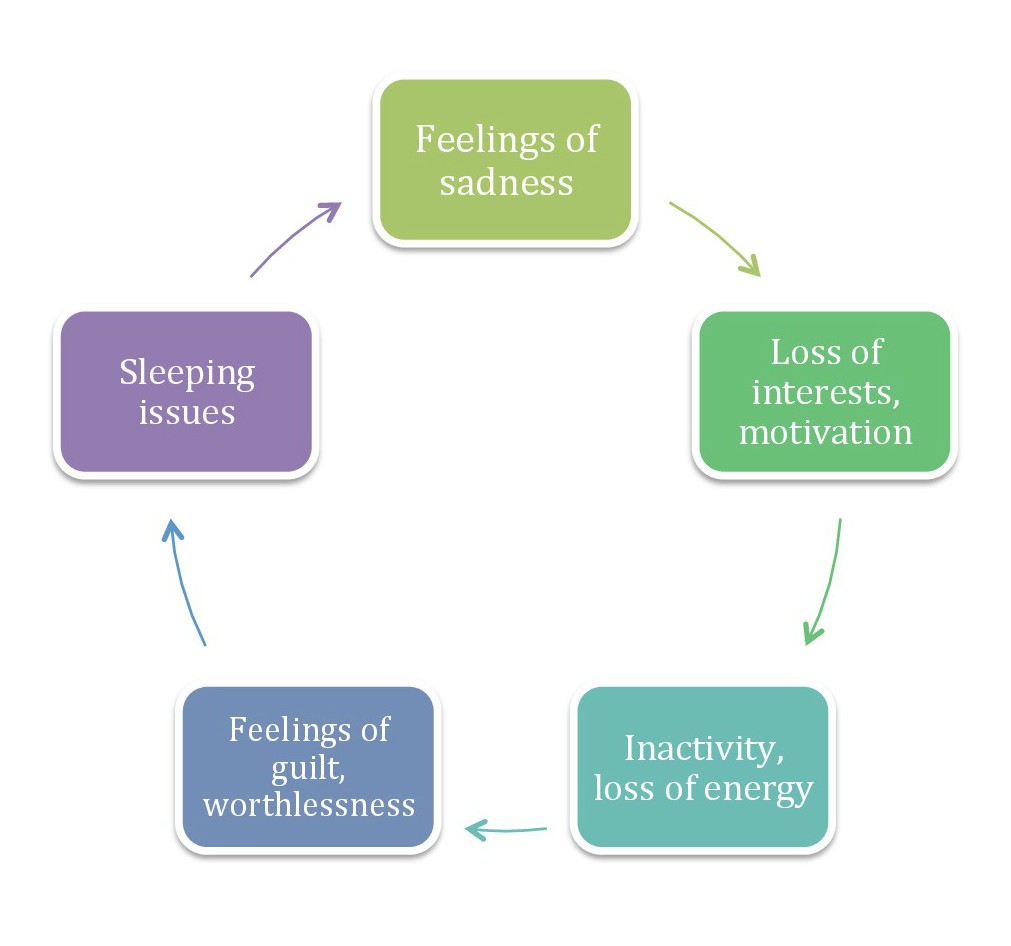

Virtuous Cycle

A vicious circle (or cycle) is a complex chain of events that reinforces itself through a feedback loop, with detrimental results. It is a system with no tendency toward equilibrium (social, economic, ecological, etc.), at least in the short run. Each iteration of the cycle reinforces the previous one, in an example of positive feedback. A vicious circle will continue in the direction of its momentum until an external factor intervenes to break the cycle. A well-known example of a vicious circle in economics is hyperinflation. A virtuous circle is an equivalent system with a favorable outcome. Examples Vicious circles in the subprime mortgage crisis The contemporary subprime mortgage crisis is a complex group of vicious circles, both in its genesis and in its manifold outcomes, most notably the late 2000s recession. A specific example is the circle related to housing. As housing prices decline, more homeowners go " underwater", when the market value of a home drops below ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Accelerator Effect

The accelerator effect in economics is a positive effect on private fixed investment of the growth of the market economy (measured e.g. by a change in Gross Domestic Product). Rising GDP (an economic boom or prosperity) implies that businesses in general see rising profits, increased sales and cash flow, and greater use of existing capacity. This usually implies that profit expectations and business confidence rise, encouraging businesses to build more factories and other buildings and to install more machinery. (This expenditure is called ''fixed investment''.) This may lead to further growth of the economy through the stimulation of consumer incomes and purchases, i.e., via the multiplier effect. Every firm has some strategies to work which usually make the progress towards achieving an optimum capital stock and not only moving smoothly from one type and size of plant and machinery to the other. This means that every firm aims to increase its profit to an optimum level rather tha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

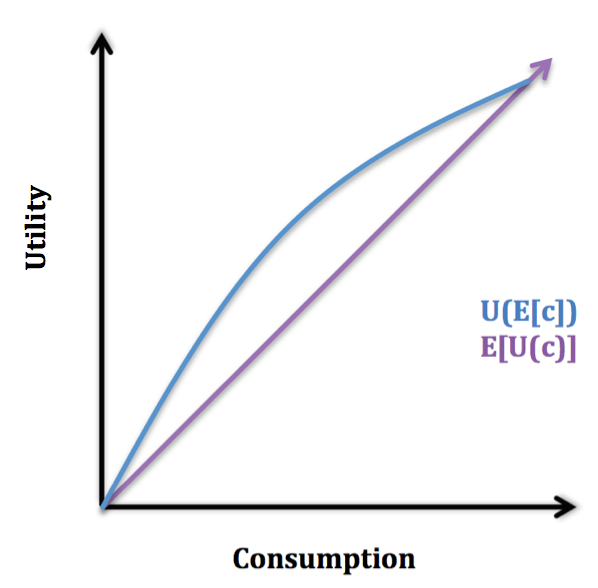

Consumption Smoothing

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life. Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate that individuals should at all stages of their life set aside money in savings, economist James Choi states that this deviates from the advice of economists. Expected utility model The graph below illustrates the expected utility model, in which U(c) is increasing in and con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Arvind Krishnamurthy

Arvind Krishnamurthy is the Short-Dooley Professor at the Paul G. Allen School of Computer Science and Engineering, University of Washington. He is currently serving as the Vice President of USENIX (since 2020), and was named an ACM Fellow in 2020. His primary areas of research are computer networks and distributed systems. Arvind Krishnamurthy received his bachelor's degree from IIT Madras (1991) and his masters (1994) and doctoral degrees (1999) from University of California, Berkeley The University of California, Berkeley (UC Berkeley, Berkeley, Cal, or California) is a public land-grant research university in Berkeley, California. Established in 1868 as the University of California, it is the state's first land-grant u .... References University of Washington Paul G. Allen School of Computer Science & Engineering faculty IIT Madras alumni UC Berkeley College of Engineering alumni Living people Year of birth missing (living people) {{compu-scien ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Agency Costs

An agency cost is an economic concept that refers to the costs associated with the relationship between a " principal" (an organization, person or group of persons), and an "agent". The agent is given powers to make decisions on behalf of the principal. However, the two parties may have different incentives and the agent generally has more information. The principal cannot directly ensure that its agent is always acting in its (the principal's) best interests.''Pay Without Performance'' by Lucian Bebchuk and Jesse Fried, Harvard University Press 2004preface and introduction This potential divergence in interests is what gives rise to agency costs. Common examples of this cost include that borne by shareholders (the principal), when corporate management (the agent) buys other companies to expand its power, or spends money on wasteful and unnecessary projects, instead of maximizing the value of the corporation's worth; or by the voters of a politician's district (the principal) whe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Political Economy

The ''Journal of Political Economy'' is a monthly peer-reviewed academic journal published by the University of Chicago Press. Established by James Laurence Laughlin in 1892, it covers both theoretical and empirical economics. In the past, the journal published quarterly from its introduction through 1905, ten issues per volume from 1906 through 1921, and bimonthly from 1922 through 2019. The editor-in-chief is Magne Mogstad (University of Chicago). It is considered one of the top five journals in economics. Abstracting and indexing The journal is abstracted and indexed in EBSCO, ProQuest, EconLit , Research Papers in Economics, Current Contents/Social & Behavioral Sciences, and the Social Sciences Citation Index. According to the ''Journal Citation Reports'', the journal has a 2020 impact factor of 9.103, ranking it 4/376 journals in the category "Economics". The journal is department-owned University of Chicago journal. Notable papers Among the most influential papers ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Nobuhiro Kiyotaki

(born June 24, 1955) is a Japanese economist and the Harold H. Helms '20 Professor of Economics and Banking at Princeton University. He is especially known for proposing several models that provide deeper microeconomic foundations for macroeconomics, some of which play a prominent role in New Keynesian macroeconomics. Career He received a B.A. from University of Tokyo in 1978. After receiving his doctorate in economics from Harvard University in 1985, Kiyotaki held faculty positions at the Univ. of Wisconsin–Madison, the Univ. of Minnesota, and the London School of Economics before moving to Princeton. He is a fellow of the Econometric Society, was awarded the 1997 Nakahara Prize of the Japan Economics Association and the 1999 Yrjö Jahnsson Award of the European Economic Association, the latter together with John Moore. In 2003, Kiyotaki was elected a Fellow of the British Academy (FBA), the United Kingdom's national academy for the humanities and social sciences. He is ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Principal–agent Problem

The principal–agent problem refers to the conflict in interests and priorities that arises when one person or entity (the "agent") takes actions on behalf of another person or entity (the " principal"). The problem worsens when there is a greater discrepancy of interests and information between the principal and agent, as well as when the principal lacks the means to punish the agent. The deviation from the principal's interest by the agent is called " agency costs".''Pay Without Performance'', Lucian Bebchuk and Jesse Fried, Harvard University Press 2004preface and introduction Common examples of this relationship include corporate management (agent) and shareholders (principal), elected officials (agent) and citizens (principal), or brokers (agent) and markets (buyers and sellers, principals). In all these cases, the principal has to be concerned with whether the agent is acting in the best interest of the principal. The concepts of moral hazard and conflict of interest re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime Mortgage Crisis

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the Financial crisis of 2007–2008, 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a 2000s United States housing bubble, housing bubble, leading to Mortgage loan, mortgage delinquencies, foreclosures, and the devaluation of Mortgage-backed security, housing-related securities. Declines in residential investment preceded the Great Recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines. The housing bubble preceding the crisis was financed with Mortgage-backed security, mortgage-backed securities (MBSes) and collateralized debt obligations (CDOs), which initially offered higher interest rates (i.e. better returns) than go ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions (t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Depression

The Great Depression (19291939) was an economic shock that impacted most countries across the world. It was a period of economic depression that became evident after a major fall in stock prices in the United States. The economic contagion began around September and led to the Wall Street stock market crash of October 24 (Black Thursday). It was the longest, deepest, and most widespread depression of the 20th century. Between 1929 and 1932, worldwide gross domestic product (GDP) fell by an estimated 15%. By comparison, worldwide GDP fell by less than 1% from 2008 to 2009 during the Great Recession. Some economies started to recover by the mid-1930s. However, in many countries, the negative effects of the Great Depression lasted until the beginning of World War II. Devastating effects were seen in both rich and poor countries with falling personal income, prices, tax revenues, and profits. International trade fell by more than 50%, unemployment in the U.S. rose to 23% and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |