|

Financial Sector Development

Financial sector development in developing countries and emerging markets is part of the private sector development strategy to stimulate economic growth and reduce poverty. The Financial sector is the set of institutions, instruments, and markets. It also includes the legal and regulatory framework that permit transactions to be made through the extension of credit. Fundamentally, financial sector development concerns overcoming “costs” incurred in the financial system. This process of reducing costs of acquiring information, enforcing contracts, and executing transactions results in the emergence of financial contracts, intermediaries, and markets. Different types and combinations of information, transaction, and enforcement costs in conjunction with different regulatory, legal and tax systems have motivated distinct forms of contracts, intermediaries and markets across countries in different times. The five key functions of a financial system in a country are: (i) informa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Emerging Markets

An emerging market (or an emerging country or an emerging economy) is a market that has some characteristics of a developed market, but does not fully meet its standards. This includes markets that may become developed markets in the future or were in the past. The term "frontier market" is used for Developing country, developing countries with smaller, riskier, or more illiquid capital markets than "emerging". As of 2006, the economies of Economy of China, China and Economy of India, India are considered to be the largest emerging markets. According to ''The Economist'', many people find the term outdated, but no new term has gained traction. Emerging market hedge fund capital reached a record new level in the first quarter of 2011 of $121 billion. Emerging market economies’ share of global PPP-adjusted GDP has risen from 27 percent in 1960 to around 53 percent by 2013. The ten largest emerging economies by List of countries by GDP (nominal), nominal GDP are 4 of the 9 BRICS cou ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Accumulation

Capital accumulation is the dynamic that motivates the pursuit of profit, involving the investment of money or any financial asset with the goal of increasing the initial monetary value of said asset as a financial return whether in the form of profit, rent, interest, royalties or capital gains. The goal of accumulation of capital is to create new fixed capital and working capital, broaden and modernize the existing ones, grow the material basis of social-cultural activities, as well as constituting the necessary resource for reserve and insurance. The process of capital accumulation forms the basis of capitalism, and is one of the defining characteristics of a capitalist economic system.''Capital'', Encyclopedia on Marxists.org: http://marxists.org/glossary/terms/c/a.htm#capital Definition In economics and accounting, capital accumulation is often equated with investment of profit income or savings, especially in real capital goods. The concentration and centralisa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Assets

In financial accounting, an asset is any resource owned or controlled by a business or an economic entity. It is anything (tangible or intangible) that can be used to produce positive economic value. Assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetaryThere are different methods of assessing the monetary value of the assets recorded on the Balance Sheet. In some cases, the ''Historical Cost'' is used; such that the value of the asset when it was bought in the past is used as the monetary value. In other instances, the present fair market value of the asset is used to determine the value shown on the balance sheet. value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business. ''Total assets'' can also be called the ''balance sheet total''. Assets can be grouped into two major classes: tangible assets and i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Shock (economics)

In economics, a shock is an unexpected or unpredictable event that affects an economy, either positively or negatively. Technically, it is an unpredictable change in exogenous factors—that is, factors unexplained by an economic model—which may influence endogenous economic variables. The response of economic variables, such as GDP and employment, at the time of the shock and at subsequent times, is measured by an impulse response function. Types of shocks A technology shock is the kind resulting from a technological development that affects productivity. If the shock is due to constrained supply, it is termed a supply shock and usually results in price increases for a particular product. Supply shocks can be produced when accidents or disasters occur. The 2008 Western Australian gas crisis resulting from a pipeline explosion at Varanus Island is one example. A demand shock is a sudden change of the pattern of private expenditure, especially of consumption spendin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Contract

A contract is an agreement that specifies certain legally enforceable rights and obligations pertaining to two or more parties. A contract typically involves consent to transfer of goods, services, money, or promise to transfer any of those at a future date. The activities and intentions of the parties entering into a contract may be referred to as contracting. In the event of a breach of contract, the injured party may seek judicial remedies such as damages or equitable remedies such as specific performance or rescission. A binding agreement between actors in international law is known as a treaty. Contract law, the field of the law of obligations concerned with contracts, is based on the principle that agreements must be honoured. Like other areas of private law, contract law varies between jurisdictions. In general, contract law is exercised and governed either under common law jurisdictions, civil law jurisdictions, or mixed-law jurisdictions that combine elem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Porfirio Díaz

José de la Cruz Porfirio Díaz Mori (; ; 15 September 1830 – 2 July 1915) was a General (Mexico), Mexican general and politician who was the dictator of Mexico from 1876 until Mexican Revolution, his overthrow in 1911 seizing power in a Plan of Tuxtepec, military coup. He served on three separate occasions as President of Mexico, a total of over 30 years, this period is known as the Porfiriato and has been called a ''de facto'' dictatorship. Díaz’s time in office is the longest of any Mexican ruler. Díaz was born to a Oaxacan family of modest means. He initially studied to become a priest but eventually switched his studies to law, and among his mentors was the future President of Mexico, Benito Juárez. Díaz increasingly became active in Liberal Party (Mexico), Liberal Party politics fighting with the Liberals to overthrow Antonio López de Santa Anna, Santa Anna in the Plan of Ayutla, and also fighting on their side against the Conservative Party (Mexico), Conservative ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Daron Acemoglu

Kamer Daron Acemoğlu (;, ; born September 3, 1967) is a Turkish Americans, Turkish-American economist of Armenians in Turkey, Armenian descent who has taught at the Massachusetts Institute of Technology since 1993, where he is currently the James Rhyne Killian, Elizabeth and James Killian Professor of Economics, and was named an List of Institute Professors at the Massachusetts Institute of Technology, Institute Professor at MIT in 2019. He received the John Bates Clark Medal in 2005, and the Nobel Memorial Prize in Economic Sciences, Nobel Prize in Economics in 2024. Acemoglu ranked third, behind Paul Krugman and Greg Mankiw, in the list of "Favorite Living Economists Under Age 60" in a 2011 survey among American economists. In 2015, he was named the most cited economist of the past 10 years per Research Papers in Economics (RePEc) data. According to the Open Syllabus Project, Acemoglu is the third most frequently cited author on college syllabus, syllabi for economics courses ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

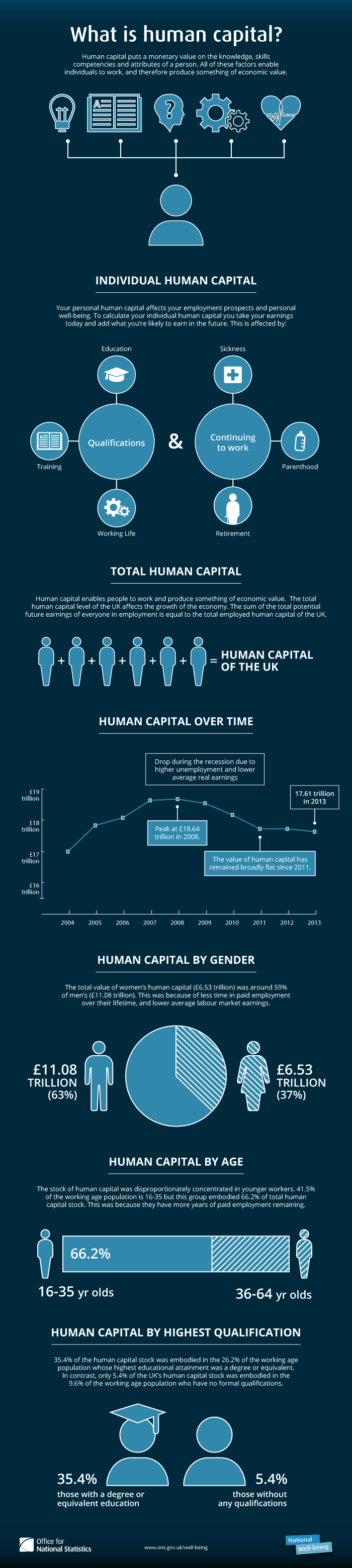

Human Capital

Human capital or human assets is a concept used by economists to designate personal attributes considered useful in the production process. It encompasses employee knowledge, skills, know-how, good health, and education. Human capital has a substantial impact on individual earnings. Research indicates that human capital investments have high economic returns throughout childhood and young adulthood. Companies can invest in human capital; for example, through education and training, improving levels of quality and production. History Adam Smith included in his definition of Capital (economics), capital "the acquired and useful abilities of all the inhabitants or members of the society". The first use of the term "human capital" may be by Irving Fisher. An early discussion with the phrase "human capital" was from Arthur Cecil Pigou: But the term only found widespread use in economics after its popularization by economists of the Chicago School of economics, Chicago School, in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Asian Institute Of Finance

The Asian Institute of Finance Berhad (AIF) is a nonprofit organisation in Malaysia. Its main purpose is to enhance human capital development and talent management across the Asian financial services industry. AIF's headquarters is located in Kuala Lumpur. The institute attracts, develops and retains talented individuals towards ensuring the development and sustainability of the industry. It advocates this principle via domestic and regional alliances with industry, multilateral organisations and academia with the sole aim of raising the profile of the human capital and talent management agenda. AIF works closely with Central Bank of Malaysia, Securities Commission Malaysia, Asian Institute of Chartered Bankers (AICB), Asian Banking School (ABS), Chartered Institute of Islamic Professionals (CIIF), Islamic Banking and Finance Institute of Malaysia (IBFIM), Securities Industry Development Corporation (SIDC) and the Malaysian Insurance Institute (MII) towards coordinating and enh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2008 Financial Crisis

The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide financial crisis centered in the United States. The causes of the 2008 crisis included excessive speculation on housing values by both homeowners and financial institutions that led to the 2000s United States housing bubble, exacerbated by predatory lending for subprime mortgages and deficiencies in regulation. Cash out refinancings had fueled an increase in consumption that could no longer be sustained when home prices declined. The first phase of the crisis was the subprime mortgage crisis, which began in early 2007, as mortgage-backed securities (MBS) tied to U.S. real estate, and a vast web of Derivative (finance), derivatives linked to those MBS, collapsed in value. A liquidity crisis spread to global institutions by mid-2007 and climaxed with the bankruptcy of Lehman Brothers in September 2008, which triggered a stock market crash and bank runs in several countries. The crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Access To Finance

Access to finance is the ability of individuals or enterprises to obtain financial services, including credit, deposit, payment, insurance, and other risk management services.Demirgüç-Kunt, A., Beck, T., & Honohan, P. (2008). ''Finance for All?: Policies and Pitfalls in Expanding Access.'' Washington, D.C.: The World Bank. Retrieved March 21, 2008, from http://siteresources.worldbank.org/INTFINFORALL/Resources/4099583-1194373512632/FFA_book.pdf Those who involuntarily have no or only limited access to financial services are referred to as the ''unbanked'' or ''underbanked,'' respectively.Richardson, B. (2008, July 15). Enhancing Customer Segmentation Processes and Optimising Adoption Techniques to Support Efforts to "Bank the Unbanked." Presentation given during the ''Mobile Banking & Financial Services Africa'' conference in Johannesburg, South Africa. Areas with inadequate banking services are referred to as banking deserts. Accumulated evidence has shown that financial access ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small And Medium Enterprise

Small and medium-sized enterprises (SMEs) or small and medium-sized businesses (SMBs) are businesses whose personnel and revenue numbers fall below certain limits. The abbreviation "SME" is used by many national agencies and international organizations such as the World Bank, the OECD, European Union, the United Nations, and the World Trade Organization (WTO). In any given national economy, SMEs outnumber large companies by a wide margin and also employ many more people. On a global scale, SMEs make up 90% of all companies and more than 50% of all employment. For example, in the EU, 99% of all businesses are SMEs. Australian SMEs makeup 98% of all Australian businesses, produce one-third of the total GDP (gross domestic product) and employ 4.7 million people. In Chile, in the commercial year 2014, 98.5% of the firms were classified as SMEs. In Tunisia, the self-employed workers alone account for about 28% of the total non-farm employment, and firms with fewer than 100 employees acc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |