|

Financial Literacy And Education Commission

The Financial Literacy and Education Commission (the Commission) was established under Title V, the Financial Literacy and Education Improvement Act which was part of the Fair and Accurate Credit Transactions Act (FACT) Act of 2003, to improve financial literacy and education of persons in the United States. The FACT Act named the Secretary of the Treasury as head of the Commission and required 20 other federal agencies and bureaus to participate in the Commission. The Commission coordinates the financial education efforts throughout the federal government, supports the promotion of financial literacy by the private sector while also encouraging the synchronization of efforts between the public and private sectors. National strategy ''Taking Ownership of the Future: The National Strategy for Financial Literacy'' is a comprehensive blueprint for improving financial literacy in America, published by the Commission. This national strategy covers 13 areas of financial education and con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fair And Accurate Credit Transactions Act

The Fair and Accurate Credit Transactions Act of 2003 (FACT Act or FACTA, ) is a United States federal law, passed by the United States Congress on November 22, 2003, and signed by President George W. Bush on December 4, 2003, as an amendment to the Fair Credit Reporting Act. The act allows consumers to request and obtain a free credit report once every 12 months from each of the three nationwide consumer credit reporting companies (Equifax, Experian, and TransUnion). In cooperation with the Federal Trade Commission, the three major credit reporting agencies set up the web site AnnualCreditReport.com to provide free access to annual credit reports. The act also contains provisions to help reduce identity theft, such as the ability for individuals to place alerts on their credit histories if identity theft is suspected, or if deploying overseas in the military, thereby making fraudulent applications for credit more difficult. Further, it requires secure disposal of consume ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Literacy

Financial literacy is the possession of the set of skills and knowledge that allows an individual to make informed and effective decisions with all of their financial resources. Raising interest in personal finance is now a focus of state-run programs in countries including Australia, Canada, Japan, the United States, and the United Kingdom. Understanding basic financial concepts allows people to know how to navigate in the financial system. People with appropriate financial literacy training make better financial decisions and manage money better than those without such training. The Organization for Economic Co-operation and Development (OECD) started an inter-governmental project in 2003 with the objective of providing ways to improve financial education and literacy standards through the development of common financial literacy principles. In March 2008, the OECD launched the International Gateway for Financial Education, which aims to serve as a clearinghouse for financial edu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

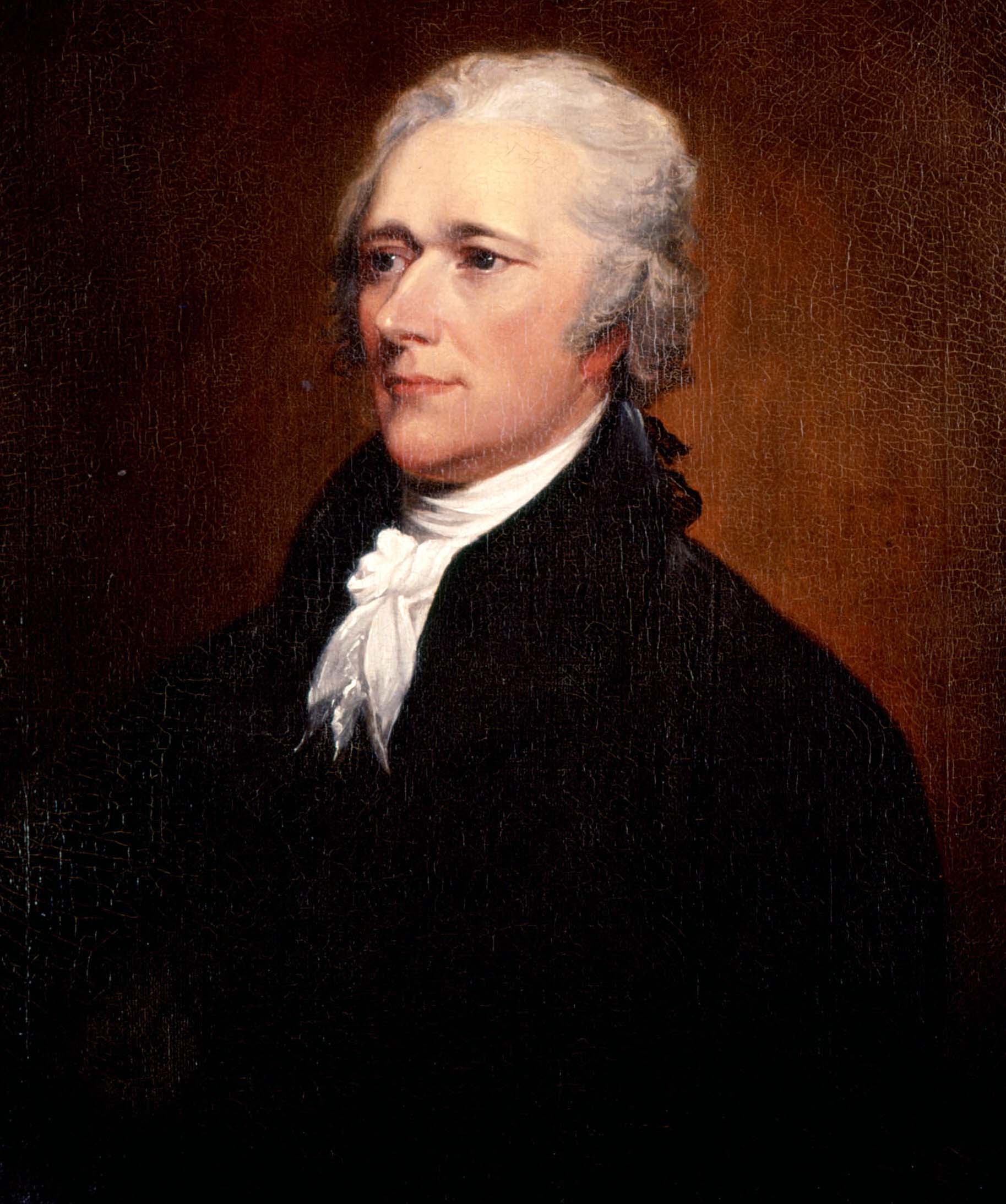

Secretary Of The Treasury

The United States secretary of the treasury is the head of the United States Department of the Treasury, and is the chief financial officer of the federal government of the United States. The secretary of the treasury serves as the principal advisor to the president of the United States on all matters pertaining to economic and fiscal policy. The secretary is a statutory member of the Cabinet of the United States, and is fifth in the presidential line of succession. Under the Appointments Clause of the United States Constitution, the officeholder is nominated by the president of the United States, and, following a confirmation hearing before the Senate Committee on Finance, is confirmed by the United States Senate. The secretary of state, the secretary of the treasury, the secretary of defense, and the attorney general are generally regarded as the four most important Cabinet officials, due to the size and importance of their respective departments. The current secretar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Governors Of The Federal Reserve System

The Board of Governors of the Federal Reserve System, commonly known as the Federal Reserve Board, is the main governing body of the Federal Reserve System. It is charged with overseeing the Federal Reserve Banks and with helping implement the monetary policy of the United States. Governors are appointed by the president of the United States and confirmed by the Senate for staggered 14-year terms.See Statutory description By law, the appointments must yield a "fair representation of the financial, agricultural, industrial, and commercial interests and geographical divisions of the country". As stipulated in the Banking Act of 1935, the Chair and Vice Chair of the Board are two of seven members of the Board of Governors who are appointed by the President from among the sitting governors of the Federal Reserve Banks. The terms of the seven members of the Board span multiple presidential and congressional terms. Once a member of the Board of Governors is appointed by the president ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commodity Futures Trading Commission

The Commodity Futures Trading Commission (CFTC) is an independent agency of the US government created in 1974 that regulates the U.S. derivatives markets, which includes futures, swaps, and certain kinds of options. The Commodity Exchange Act (CEA), ''et seq.'', prohibits fraudulent conduct in the trading of futures, swaps, and other derivatives. The stated mission of the CFTC is to promote the integrity, resilience, and vibrancy of the U.S. derivatives markets through sound regulation. After the financial crisis of 2007–08 and since 2010 with the Dodd–Frank Wall Street Reform and Consumer Protection Act, the CFTC has been transitioning to bring more transparency and sound regulation to the multitrillion dollar swaps market. History Futures contracts for agricultural commodities have been traded in the U.S. for more than 150 years and have been under federal regulation since the 1920s. The Grain Futures Act of 1922 set the basic authority and was changed by the Commo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is one of two agencies that supply deposit insurance to depositors in American depository institutions, the other being the National Credit Union Administration, which regulates and insures credit unions. The FDIC is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. The FDIC was created by the Banking Act of 1933, enacted during the Great Depression to restore trust in the American banking system. More than one-third of banks failed in the years before the FDIC's creation, and bank runs were common. The insurance limit was initially US$2,500 per ownership category, and this was increased several times over the years. Since the enactment of the Dodd–Frank Wall Street Reform and Consumer Protection Act in 2010, the FDIC insures deposits in member banks up to $250,000 per ownership category. FDIC insurance is backed by the full faith and credit of t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Trade Commission

The Federal Trade Commission (FTC) is an independent agency of the United States government whose principal mission is the enforcement of civil (non-criminal) antitrust law and the promotion of consumer protection. The FTC shares jurisdiction over federal civil antitrust enforcement with the Department of Justice Antitrust Division. The agency is headquartered in the Federal Trade Commission Building in Washington, DC. The FTC was established in 1914 with the passage of the Federal Trade Commission Act, signed in response to the 19th-century monopolistic trust crisis. Since its inception, the FTC has enforced the provisions of the Clayton Act, a key antitrust statute, as well as the provisions of the FTC Act, et seq. Over time, the FTC has been delegated with the enforcement of additional business regulation statutes and has promulgated a number of regulations (codified in Title 16 of the Code of Federal Regulations). The broad statutory authority granted to the FTC prov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Credit Union Administration

The National Credit Union Administration (NCUA) is a government-backed insurer of credit unions in the United States, one of two agencies that provide deposit insurance to depositors in U.S. depository institutions, the other being the Federal Deposit Insurance Corporation, which insures commercial banks and savings institutions. The NCUA is an independent federal agency created by the United States Congress to regulate, charter, and supervise federal credit unions. With the backing of the full faith and credit of the U.S. government, the NCUA operates and manages the National Credit Union Share Insurance Fund, insuring the deposits of more than 124 million account holders in all federal credit unions and the overwhelming majority of state-chartered credit unions. Besides the Share Insurance Fund, the NCUA operates three other funds: the NCUA Operating Fund, the Central Liquidity Facility (CLF), and the Community Development Revolving Loan Fund (CDRLF). The NCUA Operating F ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of The Comptroller Of The Currency

The Office of the Comptroller of the Currency (OCC) is an independent bureau within the United States Department of the Treasury that was established by the National Currency Act of 1863 and serves to charter, regulate, and supervise all national banks and thrift institutions and the federally licensed branches and agencies of foreign banks in the United States. The acting Comptroller of the Currency is Michael J. Hsu, who took office on May 10, 2021. Duties and functions Headquartered in Washington, D.C., it has four district offices located in New York City, Chicago, Dallas and Denver. It has an additional 92 operating locations throughout the United States. It is an independent bureau of the United States Department of the Treasury and is headed by the Comptroller of the Currency, appointed to a five-year term by the President with the consent of the Senate. The OCC pursues a number of main objectives: * to ensure the safety and soundness of the national banking system ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Office Of Thrift Supervision

The Office of Thrift Supervision (OTS) was a United States federal agency under the Department of the Treasury that chartered, supervised, and regulated all federally chartered and state-chartered savings banks and savings and loans associations. It was created in 1989 as a renamed version of the Federal Home Loan Bank Board, another federal agency (that was faulted for its role in the savings and loan crisis). Like other U.S. federal bank regulators, it was paid by the banks it regulated. The OTS was initially seen as an aggressive regulator, but was later lax. Declining revenues and staff led the OTS to market itself to companies as a lax regulator in order to get revenue. The OTS also expanded its oversight to companies that were not banks. Some of the companies that failed under OTS supervision during the financial crisis of 2007–2010 include American International Group (AIG), Washington Mutual, and IndyMac. The OTS was implicated in a backdating scandal rega ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Small Business Administration

The United States Small Business Administration (SBA) is an independent agency of the United States government that provides support to entrepreneurs and small businesses. The mission of the Small Business Administration is "to maintain and strengthen the nation's economy by enabling the establishment and viability of small businesses and by assisting in the economic recovery of communities after disasters". The agency's activities have been summarized as the "3 Cs" of capital, contracts and counseling. SBA loans are made through banks, credit unions and other lenders who partner with the SBA. The SBA provides a government-backed guarantee on part of the loan. Under the Recovery Act and the Small Business Jobs Act, SBA loans were enhanced to provide up to a 90 percent guarantee in order to strengthen access to capital for small businesses after credit froze in 2008. The agency had record lending volumes in late 2010. SBA helps lead the federal government's efforts to deliver ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Administration

The United States Social Security Administration (SSA) is an independent agency of the U.S. federal government that administers Social Security, a social insurance program consisting of retirement, disability and survivor benefits. To qualify for most of these benefits, most workers pay Social Security taxes on their earnings; the claimant's benefits are based on the wage earner's contributions. Otherwise benefits such as Supplemental Security Income (SSI) are given based on need. The Social Security Administration was established by the Social Security Act of 1935 and is codified in (). It was created in 1935 as the "Social Security Board", then assumed its present name in 1946. Its current leader is Kilolo Kijakazi, who serves on an acting basis. SSA offers its services to the public through 1,200 field offices, a website, and a national toll-free number. Field offices, which served 43 million individuals in 2019, were reopened on April 7, 2022 after being closed for two ye ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)