|

Finance Act 2010

The Finance Act 2010 is an Act of the Parliament of the United Kingdom enacting the March 2010 United Kingdom Budget. The ''Chancellor of the Exchequer'' delivers the annual budget speech outlining changes in spending, tax, duty and other financial matters. However, in 2010 there was a second budget in June. The respective year's Finance Act is the mechanism to enact the changes. Levels of Excise Duties, Value Added Tax, Income Tax, Corporation Tax and Capital Gains Tax) are often modified. The rules governing the various taxation methods are contained within the relevant taxation acts. (For instance Capital Gains Tax Legislation is contained within Taxation of Chargeable Gains Act 1992). The Finance Act details amendments to be made to each one of these Acts. Provisions Charitable tax benefits (for example Gift Aid) were extended to charities A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being (e.g. educat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Act Of Parliament

Acts of Parliament, sometimes referred to as primary legislation, are texts of law passed by the Legislature, legislative body of a jurisdiction (often a parliament or council). In most countries with a parliamentary system of government, acts of parliament begin as a Bill (law), bill, which the legislature votes on. Depending on the structure of government, this text may then be subject to assent or approval from the Executive (government), executive branch. Bills A draft act of parliament is known as a Bill (proposed law), bill. In other words, a bill is a proposed law that needs to be discussed in the parliament before it can become a law. In territories with a Westminster system, most bills that have any possibility of becoming law are introduced into parliament by the government. This will usually happen following the publication of a "white paper", setting out the issues and the way in which the proposed new law is intended to deal with them. A bill may also be introduced in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United Kingdom Acts Of Parliament 2010

United may refer to: Places * United, Pennsylvania, an unincorporated community * United, West Virginia, an unincorporated community Arts and entertainment Films * ''United'' (2003 film), a Norwegian film * ''United'' (2011 film), a BBC Two film Literature * ''United!'' (novel), a 1973 children's novel by Michael Hardcastle Music * United (band), Japanese thrash metal band formed in 1981 Albums * ''United'' (Commodores album), 1986 * ''United'' (Dream Evil album), 2006 * ''United'' (Marvin Gaye and Tammi Terrell album), 1967 * ''United'' (Marian Gold album), 1996 * ''United'' (Phoenix album), 2000 * ''United'' (Woody Shaw album), 1981 Songs * "United" (Judas Priest song), 1980 * "United" (Prince Ital Joe and Marky Mark song), 1994 * "United" (Robbie Williams song), 2000 * "United", a song by Danish duo Nik & Jay featuring Lisa Rowe Television * ''United'' (TV series), a 1990 BBC Two documentary series * ''United!'', a soap opera that aired on BBC One from 1965-19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Charity In England And Wales

, type = Non-ministerial government department , seal = , seal_caption = , logo = Charity Commission for England and Wales logo.svg , logo_caption = , formed = , preceding1 = , dissolved = , jurisdiction = England and Wales , headquarters = Petty France, London , region_code = GB , coordinates = , employees = 420 , budget = £22.9 million (2016–2017) , minister1_name = Michelle Donelan , minister1_pfo = , chief1_name Orlando Fraser QC, chief1_position = Chair , chief2_name Helen Stephenson CBE, chief2_position = Chief Executive , chief3_name = , chief3_position = , chief4_name = , chief4_position = , chief5_name = , chief5_position = , chief6_name = , chief6_position = , chief7_name = , chief7_position = , chief8_name = , chief8_position = , chief9_name = , chief9_position = , parent_department = ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gift Aid

Gift Aid is a UK tax incentive that enables tax-effective giving by individuals to charities in the United Kingdom. Gift Aid was introduced in the Finance Act 1990 for donations given after 1 October 1990, but was originally limited to cash gifts of £600 or more. This threshold was successively reduced in April 2000 when the policy was substantially revised and the minimum donation limit removed entirely. A similar policy applies to charitable donations by companies that are subject to the UK corporation tax. Gift Aid was originally intended for cash donations only. However, since 2006, HMRC compliant systems have been introduced to allow tax on the income earned by charity shops, acting as an agent for a donor, to be reclaimed. In order for the charity to operate effectively they will need HMRC-approved systems to be able to record and track the progress of each item from receipt to sale and confirm with the donor that the donation should still go ahead. In the financial year ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation Of Chargeable Gains Act 1992

The Taxation of Chargeable Gains Act 1992c 12 is an Act of Parliament which governs the levying of capital gains tax in the United Kingdom. This is a tax on the increase in the value of an asset between the date of purchase and the date of sale of that asset. The tax operates under two different regimes for a natural person and a body corporate. For a natural person, the rates of the capital gains tax are the same as those for earned income. The tax is levied at a rate determined by the highest rate of income tax which that person pays. Each year a natural person has an amount of gain, fixed by law, which is exempt from tax. By contrast, for bodies corporate, the chargeable gain is treated as additional profits for the accounting period in question. The capital gains tax is charged as additional corporation tax. Bodies corporate have no allowance for gains free from tax. Various reliefs from capital gains tax exist. These include indexation relief, where the amount of gain subje ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Capital Gains Tax

A capital gains tax (CGT) is the tax on profits realized on the sale of a non-inventory asset. The most common capital gains are realized from the sale of stocks, Bond (finance), bonds, precious metals, real estate, and property. Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. Countries that do not impose a capital gains tax include Bahrain, Barbados, Belize, Cayman Islands, Isle of Man, Jamaica, New Zealand, Sri Lanka, Singapore, and others. In some countries, such as New Zealand and Singapore, professional traders and those who trade frequently are taxed on such profits as a business income. In Sweden, the Investment Savings Account (ISK – ''Investeringssparkonto'') was introduced in 2012 in response to a decision by Parliament to stimulate saving in funds and equities. There is no tax on capital gains in ISKs; instead, the saver pays an annual standard low rate of tax. Fund savers nowadays mainly ch ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporation Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

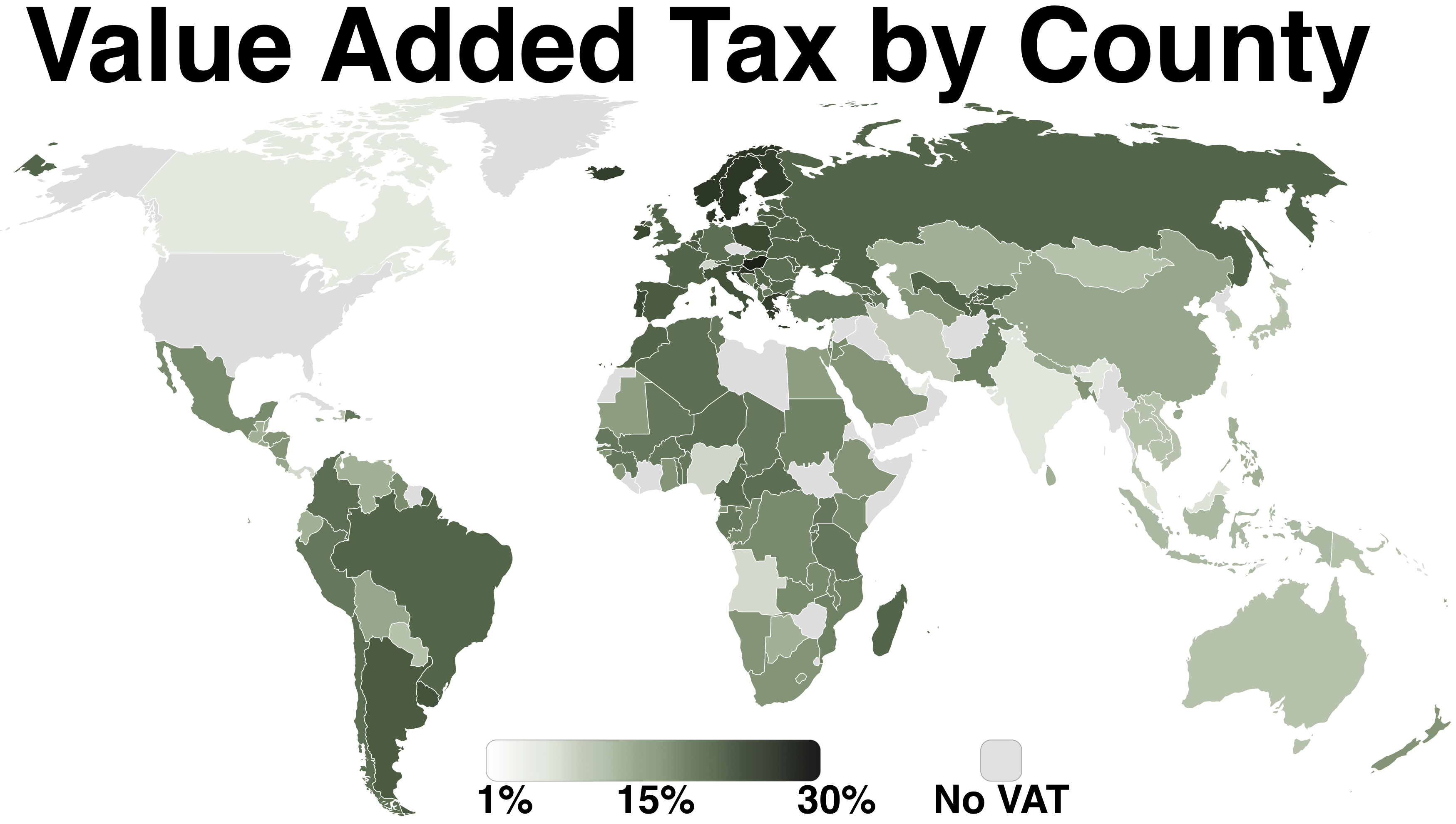

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parliament Of The United Kingdom

The Parliament of the United Kingdom is the supreme legislative body of the United Kingdom, the Crown Dependencies and the British Overseas Territories. It meets at the Palace of Westminster, London. It alone possesses legislative supremacy and thereby ultimate power over all other political bodies in the UK and the overseas territories. Parliament is bicameral but has three parts, consisting of the sovereign ( King-in-Parliament), the House of Lords, and the House of Commons (the primary chamber). In theory, power is officially vested in the King-in-Parliament. However, the Crown normally acts on the advice of the prime minister, and the powers of the House of Lords are limited to only delaying legislation; thus power is ''de facto'' vested in the House of Commons. The House of Commons is an elected chamber with elections to 650 single-member constituencies held at least every five years under the first-past-the-post system. By constitutional convention, all governme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Excise Duties

file:Lincoln Beer Stamp 1871.JPG, upright=1.2, 1871 U.S. Revenue stamp for 1/6 barrel of beer. Brewers would receive the stamp sheets, cut them into individual stamps, cancel them, and paste them over the Bunghole, bung of the beer barrel so when the barrel was tapped it would destroy the stamp. An excise, or excise tax, is any duty (economics), duty on manufactured goods (economics), goods that is levied at the moment of manufacture rather than at sale. Excises are often associated with customs duties, which are levied on pre-existing goods when they cross a designated border in a specific direction; customs are levied on goods that become taxable items at the ''border'', while excise is levied on goods that came into existence ''inland''. An excise is considered an indirect tax, meaning that the producer or seller who pays the levy to the government is expected to try to recover their loss by raising the price paid by the eventual buyer of the goods. Excises are typically impos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance Act

A Finance Act is the headline fiscal (budgetary) legislation enacted by the UK Parliament, containing multiple provisions as to taxes, duties, exemptions and reliefs at least once per year, and in particular setting out the principal tax rates for each fiscal year. Overview In the UK, the Chancellor of the Exchequer delivers a Budget speech on Budget Day, outlining changes in spending, as well as tax and duty. The changes to tax and duty are passed as law, and each year form the respective Finance Act. Additional Finance Acts are also common and are the result of a change in governing party due to a general election, a pressing loophole or defect in the law of taxation, or a backtrack with regard to government spending or taxation. However, a repeal order can also be made by statutory instrument. The rules governing the various taxation methods are contained within the relevant taxation acts. Capital Gains Tax legislation, for example, is contained within Taxation of Chargeable ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)