|

Federal National Mortgage Association Charter Act

The Federal National Mortgage Association (FNMA), commonly known as Fannie Mae, is a United States government-sponsored enterprise (GSE) and, since 1968, a publicly traded company. Founded in 1938 during the Great Depression as part of the New Deal, the corporation's purpose is to expand the secondary mortgage market by securitizing mortgage loans in the form of mortgage-backed securities (MBS), allowing lenders to reinvest their assets into more lending and in effect increasing the number of lenders in the mortgage market by reducing the reliance on locally based savings and loan associations (or "thrifts"). Its brother organization is the Federal Home Loan Mortgage Corporation (FHLMC), better known as Freddie Mac. In 2022, Fannie Mae was ranked number 33 on the ''Fortune'' 500 rankings of the largest United States corporations by total revenue. __TOC__ History Background and early decades Historically, most housing loans in the early 1900s in the United States were sh ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government-sponsored Enterprise

A government-sponsored enterprise (GSE) is a type of financial services corporation created by the United States Congress. Their intended function is to enhance the flow of credit to targeted sectors of the economy, to make those segments of the capital market more efficient and transparent, and to reduce the risk to investors and other suppliers of capital. The desired effect of the GSEs is to enhance the availability and reduce the cost of credit to the targeted borrowing sectors primarily by reducing the risk of capital losses to investors: agriculture, home finance and education. Well known GSEs are the Federal National Mortgage Association, known as Fannie Mae, and the Federal Home Loan Mortgage Corporation, or Freddie Mac. Congress created the first GSE in 1916 with the creation of the Farm Credit System. It initiated GSEs in the home finance segment of the economy with the creation of the Federal Home Loan Banks in 1932; and it targeted education when it chartered Sa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Savings And Loan Association

A savings and loan association (S&L), or thrift institution, is a financial institution that specializes in accepting savings deposits and making mortgage and other loans. The terms "S&L" or "thrift" are mainly used in the United States; similar institutions in the United Kingdom, Ireland and some Commonwealth countries include building societies and trustee savings banks. They are often mutually held (often called mutual savings banks), meaning that the depositors and borrowers are members with voting rights, and have the ability to direct the financial and managerial goals of the organization like the members of a credit union or the policyholders of a mutual insurance company. While it is possible for an S&L to be a joint-stock company, and even publicly traded, in such instances it is no longer truly a mutual association, and depositors and borrowers no longer have membership rights and managerial control. By law, thrifts can have no more than 20percent of their len ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing And Urban Development Act Of 1968

The Housing and Urban Development Act of 1968, , was passed during the Lyndon B. Johnson Administration. The act came on the heels of major riots across cities throughout the U.S. in 1967, the assassination of Civil Rights Leader Martin Luther King Jr. in April 1968, and the publication of the report of the Kerner Commission, which recommended major expansions in public funding and support of urban areas. President Lyndon B. Johnson referred to the legislation as one of the most significant laws ever passed in the U.S., due to its scale and ambition. The act's declared intention was constructing or rehabilitating 26 million housing units, 6 million of these for low- and moderate-income families, over the next 10 years. The act authorized $5.3 billion in spending over its first three years, designed to fund 1.7 million units over that time. In the longer term, the act was designed to cost $50 billion over 10 years, had it ever been fully implemented. Its policies were to be im ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

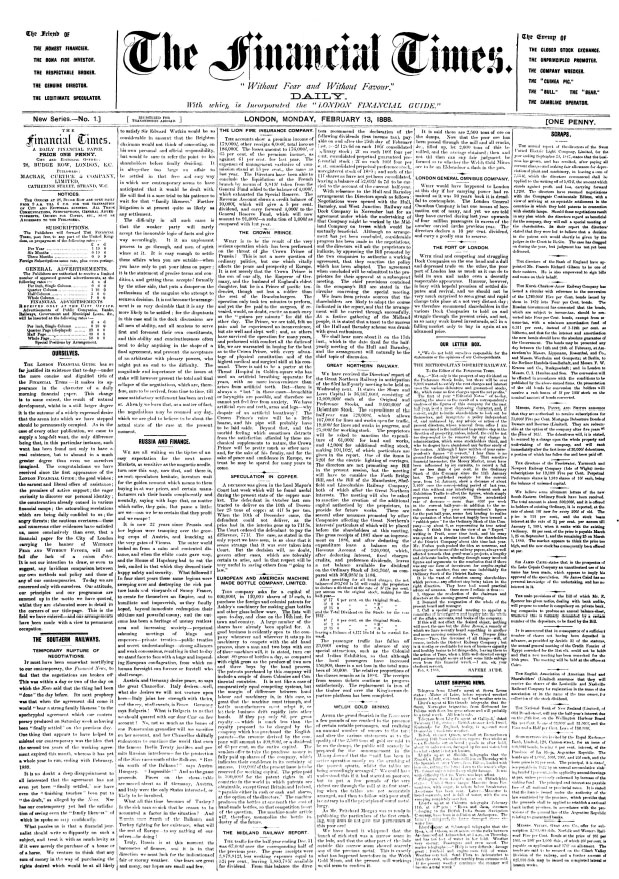

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a "Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sherid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Budget (United States)

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050. Overview The budget document often begins with the President's proposal to Congress recommending funding levels for the next fiscal year, beginning October 1 and ending on September 30 of the year following. The fiscal year refers to the year in which it ends. However, Congress is the body required by law to pass appropria ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Archives And Records Administration

The National Archives and Records Administration (NARA) is an " independent federal agency of the United States government within the executive branch", charged with the preservation and documentation of government and historical records. It is also tasked with increasing public access to those documents which make up the National Archive. NARA is officially responsible for maintaining and publishing the legally authentic and authoritative copies of acts of Congress, presidential directives, and federal regulations. NARA also transmits votes of the Electoral College to Congress. It also examines Electoral College and Constitutional amendment ratification documents for prima facie legal sufficiency and an authenticating signature. The National Archives, and its publicly exhibited Charters of Freedom, which include the original United States Declaration of Independence, United States Constitution, United States Bill of Rights, and many other historical documents, is headq ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Housing And Home Finance Agency

The Housing and Home Finance Agency (HHFA) was responsible for the principal housing programs of the United States from 1947 to 1965. It was superseded by the U.S. Department of Housing and Urban Development and preceded by the National Housing Agency. Organizational history HHFA was established as a permanent agency by Reorganization Plan No. 3 of 1947, effective July 24, 1947, replacing the National Housing Agency. Initially consisted of Federal Housing Administration, Public Housing Administration, and Federal Home Loan Bank Board, the last of which separated from HHFA in 1955. It acquired the Federal National Mortgage Association from the Federal Loan Agency as a constituent unit in 1950. The HHFA Division of Community Facilities and Operations and HHFA Division of Slum Clearance and Urban Redevelopment were redesignated the Community Facilities Administration and Urban Renewal Administration and elevated to constituent unit status in 1954. The Federal Flood Indemnit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Housing Administration

The Federal Housing Administration (FHA), also known as the Office of Housing within the Department of Housing and Urban Development (HUD), is a United States government agency founded by President Franklin Delano Roosevelt, created in part by the National Housing Act of 1934. The FHA insures mortgages made by private lenders for single-family properties, multifamily rental properties, hospitals, and residential care facilities. FHA mortgage insurance protects lenders against losses. If a property owner defaults on their mortgage, FHA pays a claim to the lender for the unpaid principal balance. Because lenders take on less risk, they are able to offer more mortgages. The goal of the organization is to facilitate access to affordable mortgage credit for low- and moderate-income and first-time homebuyers, for the construction of affordable and market rate rental properties, and for hospitals and residential care facilities in communities across the United States and its terr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Franklin Delano Roosevelt

Franklin Delano Roosevelt (; ; January 30, 1882April 12, 1945), often referred to by his initials FDR, was an American politician and attorney who served as the 32nd president of the United States from 1933 until his death in 1945. As the leader of the Democratic Party, he won a record four presidential elections and became a central figure in world events during the first half of the 20th century. Roosevelt directed the federal government during most of the Great Depression, implementing his New Deal domestic agenda in response to the worst economic crisis in U.S. history. He built the New Deal Coalition, which defined modern liberalism in the United States throughout the middle third of the 20th century. His third and fourth terms were dominated by World War II, which ended in victory shortly after he died in office. Born into the prominent Roosevelt family in Hyde Park, New York, he graduated from both Groton School and Harvard College, and attended Columbia Law S ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

National Housing Act Of 1934

The National Housing Act of 1934, , , also called the Capehart Act and the Better Housing Program, was part of the New Deal passed during the Great Depression in order to make housing and home mortgages more affordable. It created the Federal Housing Administration The Federal Housing Administration (FHA), also known as the Office of Housing within the Department of Housing and Urban Development (HUD), is a United States government agency founded by President Franklin Delano Roosevelt, created in part b ... (FHA) and the Federal Savings and Loan Insurance Corporation (FSLIC). The Act was designed to stop the tide of bank foreclosures on family homes during the Great Depression. Both the FHA and the FSLIC worked to create the backbone of the mortgage and home building industries, until the 1980s. These policies had disparate impacts on Americans along segregated lines :Author Richard Rothstein says the housing programs begun under the New Deal were tantamount to a "st ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Balloon Payment Mortgage

A balloon payment mortgage is a mortgage which does not fully amortize over the term of the note, thus leaving a balance due at maturity.Wiedemer, John P, ''Real Estate Finance, 8th Edition'', p 109-110 The final payment is called a ''balloon payment'' because of its large size. Balloon payment mortgages are more common in commercial real estate than in residential real estate.Fabozzi, Frank J. (ed), ''Handbook of Mortgage-Backed Securities, 6th Edition'', p 1125 A balloon payment mortgage may have a fixed or a floating interest rate. The most common way of describing a ''balloon loan'' uses the terminology ''X'' due in ''Y'', where ''X'' is the number of years over which the loan is amortized, and ''Y'' is the year in which the principal balance is due. An example of a balloon payment mortgage is the seven-year Fannie Mae Balloon, which features monthly payments based on a thirty-year amortization. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortgage

A mortgage loan or simply mortgage (), in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is " secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property ("foreclosure" or " repossession") to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word ''mortgage'' is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |