|

Farmer's Joint Stock Bank

The Farmer's Joint Stock Bank was a bank that operated in Upper Canada, and later in the Province of Canada, from 1834 to 1854. History Following the 1821 legalization of small notes and bills of exchange in Upper Canada, the Bank was formed in 1834 as a private bank by George Truscott and John Cleveland Green in Toronto, Upper Canada. Francis Hincks, a journalist and colonial administrator, was invited to become its first cashier. In 1835, it was taken over by a group of Reformers and constituted as a joint-stock company called the Farmers' Joint Stock Banking Company by deed of settlement. The first board of directors appointed John Elmsley, a member of the Family Compact, to be its first president, which forced Hincks and other Reform investors to leave and found the Bank of the People in December 1835. When Upper Canada moved in 1837 to restrict the ability of institutions other than incorporated banks to issue their own banknotes, the Bank was exempted. A financial crisis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Joint Stock Company

A joint-stock company is a business entity in which shares of the company's stock can be bought and sold by shareholders. Each shareholder owns company stock in proportion, evidenced by their shares (certificates of ownership). Shareholders are able to transfer their shares to others without any effects to the continued existence of the company. In modern-day corporate law, the existence of a joint-stock company is often synonymous with incorporation (possession of legal personality separate from shareholders) and limited liability (shareholders are liable for the company's debts only to the value of the money they have invested in the company). Therefore, joint-stock companies are commonly known as corporations or limited companies. Some jurisdictions still provide the possibility of registering joint-stock companies without limited liability. In the United Kingdom and in other countries that have adopted its model of company law, they are known as unlimited companies. In t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

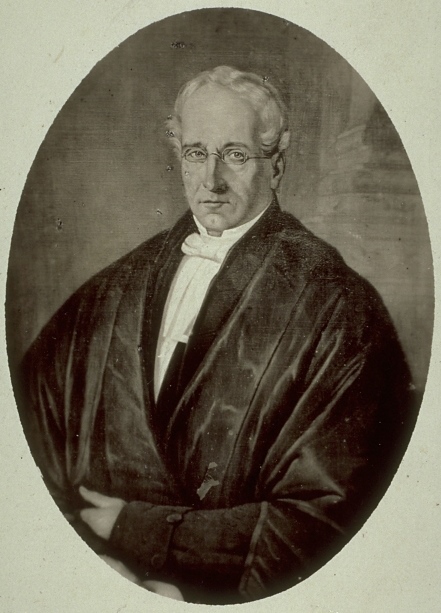

John Elmsley

John Elmsley (1762 – April 29, 1805) was Chief Justice of Upper Canada and afterwards Lower Canada. In both of the Canadas he served as President of the Executive Council and Speaker of the Legislative Council. During the Hunter administration, he was the most powerful man in Upper Canada. In Lower Canada, from 1802 until his death he was second only in rank to the Lieutenant Governor. Early life in England In 1762, he was born in England at Marylebone, London. He was the first son of Alexander and Anne (Elligood) Elmsley. He was educated at Oriel College, Oxford, graduating BA in 1786, MA in 1789, and entered the Inner Temple in 1790. At London in July, 1796, he married Mary Hallowell, daughter of Captain Benjamin Hallowell III (1723-1799) R.N., of Roxbury, Boston, by his wife Mary, daughter of Thomas Boylston. Together they had at least one son, John Jr, who later followed him into the Executive Council of Upper Canada. Mrs Elmsley's Loyalist father was His Majesty's ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Disestablished In 1854

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concepts of credit and lending that had their roots i ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banks Established In 1834

A bank is a financial institution that accepts Deposit account, deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets. Because banks play an important role in financial stability and the economy of a country, most jurisdictions exercise a Bank regulation, high degree of regulation over banks. Most countries have institutionalized a system known as fractional reserve banking, under which banks hold liquid assets equal to only a portion of their current liabilities. In addition to other regulations intended to ensure accounting liquidity, liquidity, banks are generally subject to minimum capital requirements based on an international set of capital standards, the Basel Accords. Banking in its modern sense evolved in the fourteenth century in the prosperous cities of Renaissance Italy but in many ways functioned as a continuation of ideas and concept ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

1834 Establishments In Upper Canada

Events January–March * January – The Wilmington and Raleigh Railroad is chartered in Wilmington, North Carolina. * January 1 – Zollverein (Germany): Customs charges are abolished at borders within its member states. * January 3 – The government of Mexico imprisons Stephen F. Austin in Mexico City. * February 13 – Robert Owen organizes the Grand National Consolidated Trades Union in the United Kingdom. * March 6 – York, Upper Canada, is incorporated as Toronto. * March 11 – The United States Survey of the Coast is transferred to the Department of the Navy. * March 14 – John Herschel discovers the open cluster of stars now known as NGC 3603, observing from the Cape of Good Hope. * March 28 – Andrew Jackson is censured by the United States Congress (expunged in 1837). April–June * April 10 – The LaLaurie mansion in New Orleans burns, and Madame Marie Delphine LaLaurie flees to France. * April 14 – The Whig Party is officiall ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Defunct Banks Of Canada

{{Disambiguation ...

Defunct (no longer in use or active) may refer to: * ''Defunct'' (video game), 2014 * Zombie process or defunct process, in Unix-like operating systems See also * * :Former entities * End-of-life product * Obsolescence Obsolescence is the state of being which occurs when an object, service, or practice is no longer maintained or required even though it may still be in good working order. It usually happens when something that is more efficient or less risky r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

American Economic Association

The American Economic Association (AEA) is a learned society in the field of economics. It publishes several peer-reviewed journals acknowledged in business and academia. There are some 23,000 members. History and Constitution The AEA was established in 1885 in Saratoga Springs, New York by younger progressive economists trained in the German historical school, including Richard T. Ely, Edwin Robert Anderson Seligman and Katharine Coman, the only woman co-founder; since 1900 it has been under the control of academics. The purposes of the Association are: 1) The encouragement of economic research, especially the historical and statistical study of the actual conditions of industrial life; 2) The issue of publications on economic subjects; 3) The encouragement of perfect freedom of economic discussion. The Association as such will take no partisan attitude, nor will it commit its members to any position on practical economic questions. The Association publishes one of the most pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Green Bay, Wisconsin

Green Bay is a city in the U.S. state of Wisconsin. The county seat of Brown County, it is at the head of Green Bay (known locally as "the bay of Green Bay"), a sub-basin of Lake Michigan, at the mouth of the Fox River. It is above sea level and north of Milwaukee. As of the 2020 Census, Green Bay had a population of 107,395, making it the third-largest in the state of Wisconsin, after Milwaukee and Madison, and the third-largest city on Lake Michigan, after Chicago and Milwaukee. Green Bay is the principal city of the Green Bay Metropolitan Statistical Area, which covers Brown, Kewaunee, and Oconto counties. Green Bay is well known for being the home city of the National Football League (NFL)'s Green Bay Packers. History Samuel de Champlain, the founder of New France, commissioned Jean Nicolet to form a peaceful alliance with Native Americans in the western areas, whose unrest interfered with French fur trade, and to search for a shorter trade route to China throu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Halifax Rating

The Halifax rating was a valuation of the Spanish dollar in the £sd accounting system. It set the Spanish dollar at a value of 5 shillings (60 pence) and was established c.1750 in Halifax, Nova Scotia. The rating was set 6 pence higher than the actual silver content of the coins, in an effort to keep the coins in circulation, as there was no advantage to melting the coins for their bullion content. The Halifax rating was used officially in Upper and Lower Canada until 1841 when the gold standard was adopted for the dollar; however, United Empire Loyalists brought the York rating The York rating was a valuation of the Spanish dollar in the £sd accounting system. It set the dollar equal to 8 shillings (1 real = 1 shilling). The rating was named after the colony of New York where it was adopted (see New York pound). It was a ... into Upper Canada, where it persisted well into the 19th century despite its outlawing (in favour of the Halifax rating) in 1796. Currencies of Canada ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidation

Liquidation is the process in accounting by which a company is brought to an end in Canada, United Kingdom, United States, Ireland, Australia, New Zealand, Italy, and many other countries. The assets and property of the company are redistributed. Liquidation is also sometimes referred to as winding-up or dissolution, although dissolution technically refers to the last stage of liquidation. The process of liquidation also arises when customs, an authority or agency in a country responsible for collecting and safeguarding customs duties, determines the final computation or ascertainment of the duties or drawback accruing on an entry. Liquidation may either be compulsory (sometimes referred to as a ''creditors' liquidation'' or ''receivership'' following bankruptcy, which may result in the court creating a "liquidation trust") or voluntary (sometimes referred to as a ''shareholders' liquidation'', although some voluntary liquidations are controlled by the creditors). The ter ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial bubbles, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (e.g. the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is no consensus, however, and financial crises continue to occur from time to time. Types Banking crisis When a bank suffers a sudden rush of withdrawals by depositors, this is called a ''bank run''. Si ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Of Montreal

The Bank of Montreal (BMO; french: Banque de Montréal, link=no) is a Canadian multinational investment bank and financial services company. The bank was founded in Montreal, Quebec, in 1817 as Montreal Bank; while its head office remains in Montreal, the operational headquarters and executive offices have been located in Toronto, Ontario since 1977. One of the Big Five banks in Canada, it is the fourth-largest bank in Canada by market capitalization and assets, and one of the eight largest banks in North America and the top 50 in the world. It is commonly known by its ticker symbol BMO (pronounced ), on both the Toronto Stock Exchange and the New York Stock Exchange. In October 2021, it had CA$634 billion in assets under administration (AUA). The Bank of Montreal swift code is BOFMCAM2 and the institution number is 001. On 23 June 1817, John Richardson and eight merchants signed the Articles of Association to establish the Montreal Bank in a rented house in Montreal, Quebec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |