|

Family Income Benefit Insurance

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term. After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. If the life insured dies during the term, the death benefit will be paid to the beneficiary. Term insurance is typically the least expensive way to purchase a substantial death benefit on a coverage amount per premium dollar basis over a specific period of time. Term life insurance can be contrasted to permanent life insurance such as whole life, universal life, and variable universal life, which guarantee coverage at fixed premiums for the lifetime of the covered individual unless the policy is allowed to lapse due to failure to pay premiums. Term insurance is not generally used for estate planning needs or char ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

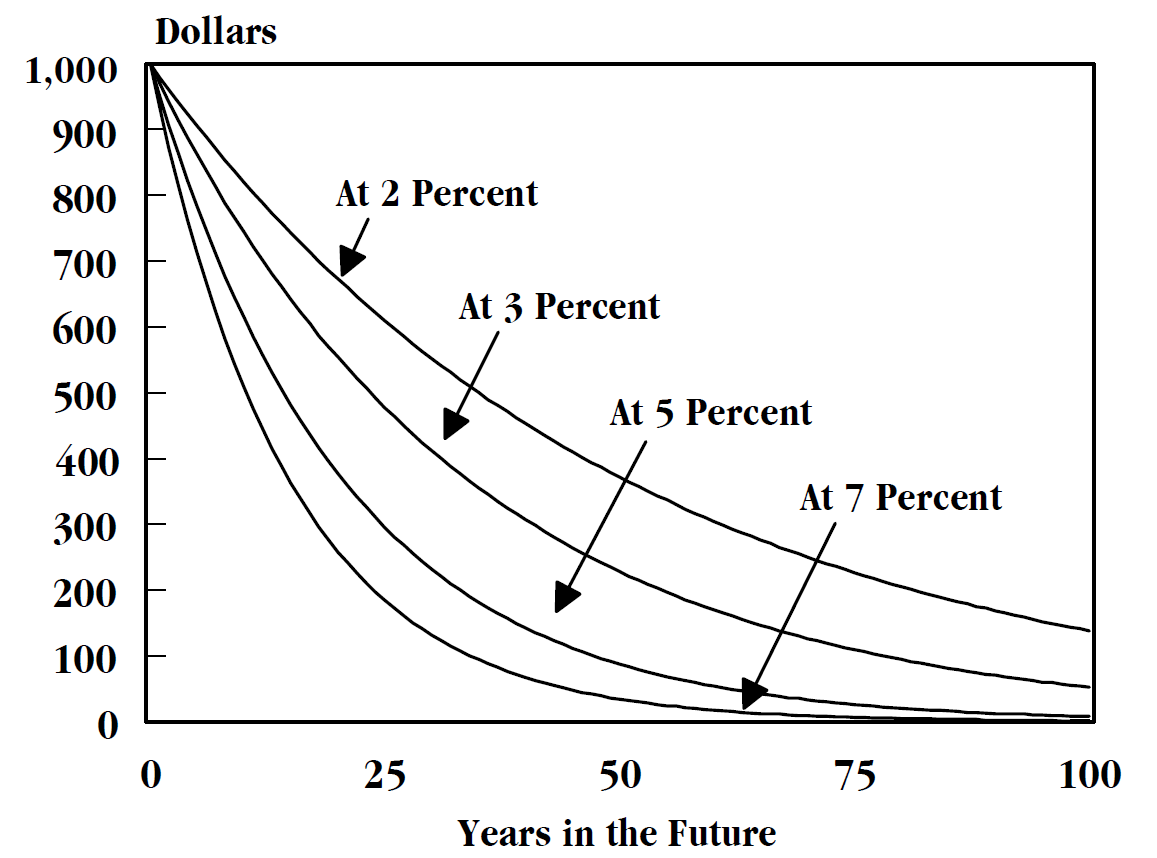

Time Value Of Money

The time value of money is the widely accepted conjecture that there is greater benefit to receiving a sum of money now rather than an identical sum later. It may be seen as an implication of the later-developed concept of time preference. The time value of money is among the factors considered when weighing the opportunity costs of spending rather than saving or investing money. As such, it is among the reasons why interest is paid or earned: interest, whether it is on a bank deposit or debt, compensates the depositor or lender for the loss of their use of their money. Investors are willing to forgo spending their money now only if they expect a favorable net return on their investment in the future, such that the increased value to be available later is sufficiently high to offset both the preference to spending money now and inflation (if present); see required rate of return. History The Talmud (~500 CE) recognizes the time value of money. In Tractate Makkos page 3a the Ta ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Whole Life Insurance

Whole life insurance, or whole of life assurance (in the Commonwealth of Nations), sometimes called "straight life" or "ordinary life", is a life insurance policy which is guaranteed to remain in force for the insured's entire lifetime, provided required premiums are paid, or to the maturity date. As a life insurance policy it represents a contract between the insured and insurer that as long as the contract terms are met, the insurer will pay the death benefit of the policy to the policy's beneficiary, beneficiaries when the insured dies. Because whole life policies are guaranteed to remain in force as long as the required premiums are paid, the premiums are typically much higher than those of term life insurance where the premium is fixed only for a limited term. Whole life premiums are fixed, based on the age of issue, and usually do not increase with age. The insured party normally pays premiums until death, except for limited pay policies which may be paid up in 10 years, 20 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Variable Universal Life Insurance

Variable universal life insurance (often shortened to VUL) is a type of life insurance that builds a cash value. In a VUL, the cash value can be invested in a wide variety of separate accounts, similar to mutual funds, and the choice of which of the available separate accounts to use is entirely up to the contract owner. The 'variable' component in the name refers to this ability to invest in separate accounts whose values vary—they vary because they are invested in stock and/or bond markets. The 'universal' component in the name refers to the flexibility the owner has in making premium payments. The premiums can vary from nothing in a given month up to maximums defined by the Internal Revenue Code for life insurance. This flexibility is in contrast to whole life insurance that has fixed premium payments that typically cannot be missed without lapsing the policy (although one may exercise an Automatic Premium Loan feature, or surrender dividends to pay a Whole Life premium). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theory Of Decreasing Responsibility

The theory of decreasing responsibility is a life insurance philosophy that holds that individual financial responsibilities rise and then decline over the course of a lifetime and that life insurance amounts should reflect those changes. These responsibilities include paying consumer debts, Mortgage loan, mortgages, funding children's education and income replacement. It is promoted by proponents of term life insurance (as opposed to Whole life insurance, cash-value insurance). Many financial responsibilities exist for a fixed time interval. Most mortgages cover a fixed number of years. Most children become independent adults. Further, most adults accumulate financial resources during their working life, whether in the form of home equity, savings, investments and/or pensions. For example, if a term insurance policy ends with retirement, the money used to pay premiums can be redirected to consumption, paying for an annuity, etc. Typically, permanent (whole life) insurance costs at ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Permanent Life Insurance

Life insurance (or life assurance, especially in the Commonwealth of Nations) is a contract between an insurance policy holder and an insurer or assurer, where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person (often the policyholder). Depending on the contract, other events such as terminal illness or critical illness can also trigger payment. The policyholder typically pays a premium, either regularly or as one lump sum. The benefits may include other expenses, such as funeral expenses. Life policies are legal contracts and the terms of each contract describe the limitations of the insured events. Often, specific exclusions written into the contract limit the liability of the insurer; common examples include claims relating to suicide, fraud, war, riot, and civil commotion. Difficulties may arise where an event is not clearly defined, for example, the insured knowingly incurred a risk by consenting to an experimental me ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Family Income Benefit Insurance

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term. After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. If the life insured dies during the term, the death benefit will be paid to the beneficiary. Term insurance is typically the least expensive way to purchase a substantial death benefit on a coverage amount per premium dollar basis over a specific period of time. Term life insurance can be contrasted to permanent life insurance such as whole life, universal life, and variable universal life, which guarantee coverage at fixed premiums for the lifetime of the covered individual unless the policy is allowed to lapse due to failure to pay premiums. Term insurance is not generally used for estate planning needs or char ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Medical Examination

In a physical examination, medical examination, or clinical examination, a medical practitioner examines a patient for any possible medical signs or symptoms of a medical condition. It generally consists of a series of questions about the patient's medical history followed by an examination based on the reported symptoms. Together, the medical history and the physical examination help to determine a diagnosis and devise the treatment plan. These data then become part of the medical record. Types Routine The ''routine physical'', also known as ''general medical examination'', ''periodic health evaluation'', ''annual physical'', ''comprehensive medical exam'', ''general health check'', ''preventive health examination'', ''medical check-up'', or simply ''medical'', is a physical examination performed on an asymptomatic patient for medical screening purposes. These are normally performed by a pediatrician, family practice physician, physician assistant, a certified nurse prac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Underwriting

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter. History The term "underwriting" derives from the Lloyd's of London insurance market. Financial backers (or risk takers), who would accept some of the risk on a given venture (historically a sea voyage with associated risks of shipwreck) in exchange for a premium, would literally write their names under the risk information that was written on a Lloyd's slip created for this purpose. Securities underwriting In the f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mortality Table

In actuarial science and demography, a life table (also called a mortality table or actuarial table) is a table which shows, for each age, what the probability is that a person of that age will die before their next birthday ("probability of death"). In other words, it represents the survivorship of people from a certain population. They can also be explained as a long-term mathematical way to measure a population's longevity. Tables have been created by demographers including Graunt, Reed and Merrell, Keyfitz, and Greville. There are two types of life tables used in actuarial science. The period life table represents mortality rates during a specific time period of a certain population. A cohort life table, often referred to as a generation life table, is used to represent the overall mortality rates of a certain population's entire lifetime. They must have had to be born during the same specific time interval. A cohort life table is more frequently used because it is able to ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |