|

Family Credit

Family Credit was a social security benefit introduced by the Social Security Act 1986 for low-paid workers with children in Great Britain that replaced Family Income Supplement. The benefit was designed for families with children if at least one person is working more than 24 hours a week on average. That represented an exclusion with entitlement to Income Support. The work was to be intended to last at least five weeks. Calculation These figures use the rates current in 1997. There was a maximum credit for each family. One adult credit, regardless of whether there was one or two adults, was £47.65, plus an amount for each child that varied by age: £12.05 under 11, £19.95 from 11 to 15, £24.80 from 16 to 17 and £34.70 at 18. A family whose net income, not including Child Benefit, Maternity Allowance or One-Parent Benefit, was £77.15 or less got the maximum. Income was calculated by using the same principles as for Housing Benefit but without a disregard for earnings. Up t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed (e.g. most pension systems), as opposed to ''social assistance'' programs which provide support on the basis of need alone (e.g. most disability benefits). The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury. More broadly, welfare may also encompass efforts to provide a basic level of well-being through free or subsidized ''social services'' such as healthcare, education, infrastructure, vocational training, and publ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Great Britain

Great Britain is an island in the North Atlantic Ocean off the northwest coast of continental Europe. With an area of , it is the largest of the British Isles, the largest European island and the ninth-largest island in the world. It is dominated by a maritime climate with narrow temperature differences between seasons. The 60% smaller island of Ireland is to the west—these islands, along with over 1,000 smaller surrounding islands and named substantial rocks, form the British Isles archipelago. Connected to mainland Europe until 9,000 years ago by a landbridge now known as Doggerland, Great Britain has been inhabited by modern humans for around 30,000 years. In 2011, it had a population of about , making it the world's third-most-populous island after Java in Indonesia and Honshu in Japan. The term "Great Britain" is often used to refer to England, Scotland and Wales, including their component adjoining islands. Great Britain and Northern Ireland now constitute the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Family Income Supplement

Family Income Supplement was a means-tested benefit for working people with children introduced in Britain in 1970 by the Conservative government of Edward Heath, effective from August 1971. It was not intended to be a permanent feature of the social security system and was abolished by the Social Security Act 1986, which replaced it with Family Credit. Half of the amount by which the claimant's income fell below £15/week was paid, plus £2 for each additional child, to a maximum of £3/week (revised to £4/week). In addition, those in receipt were given entitlement to free school meals and passported to the NHS Low Income Scheme. Claimants were required to provide payslips to prove that they were in remunerative full-time work for a minimum of 30 hours per week, or 24 hours for single parents. In 1985, differential rates for children under 11, from 11 to 15 and over 16 were introduced. There was a maximum payment to prevent abuse from claimants or employers deliberately r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Support

Income Support is an income-related benefit in the United Kingdom for some people who are on a low income, but have a reason for not actively seeking work. Claimants of Income Support may be entitled to certain other benefits, for example, Housing Benefit, Council Tax Reduction, Child Benefit, Carer's Allowance, Child Tax Credit and help with health costs. A person with capital over £16,000 cannot get Income Support, and savings over £6,000 affect how much Income Support can be received. Claimants must be between 16 and Pension Credit age, work fewer than 16 hours a week, and have a reason why they are not actively seeking work (caring for a child under 5 years old or someone who receives a specified disability benefit). Lone parents Claimants can receive income support if they are a lone parent and responsible for a child under five who is a member of their household. A claimant is considered responsible for a child in any week if receiving child benefit for the child. Howeve ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Child Benefit

Child benefit or children's allowance is a social security payment which is distributed to the parents or guardians of children, teenagers and in some cases, young adults. A number of countries operate different versions of the program. In most countries, child benefit is means-tested and the amount of child benefit paid is usually dependent on the number of children one has. Conditions for payment A number of conditional cash transfer programs in Latin America and Africa link payment to the receivers' actions, such as enrolling children into schools, and health check-ups and vaccinations. In the UK, in 2011 CentreForum proposed an additional child benefit dependent on parenting activities. Australia In Australia, Child benefit payments are currently called Family Tax Benefit. Family Tax Benefit is income tested and is linked to the Australian Income tax system. It can be claimed as fortnightly payments or as an annual lump sum. It may be payable for dependant children from ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Maternity Allowance

Maternity Allowance is a United Kingdom state benefit for women who are working but not entitled to Statutory Maternity Pay. Main conditions Women who are unable to get Statutory Maternity Pay. Entitlement starts at the 11th week before the baby is due. Amount Claimants will receive £156.66 a week or 90% of their average weekly earnings (whichever is less). It’s paid for up to 39 weeks and is not taxable or means-tested. How to Claim A certificate giving the expected date of confinement and proof of income are needed. If the employer has refused Statutory Maternity Pay they should issue form SMP1. You must claim within 3 months of being entitled. Earnings rule No benefit is payable for any day worked. Contribution test You must have worked for at least 26 weeks out of the last 66 weeks ending with the 15th week before your baby is due and been earning at least £30 a week over any 13 week period Effect on other benefits You cannot get this together with any other Co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

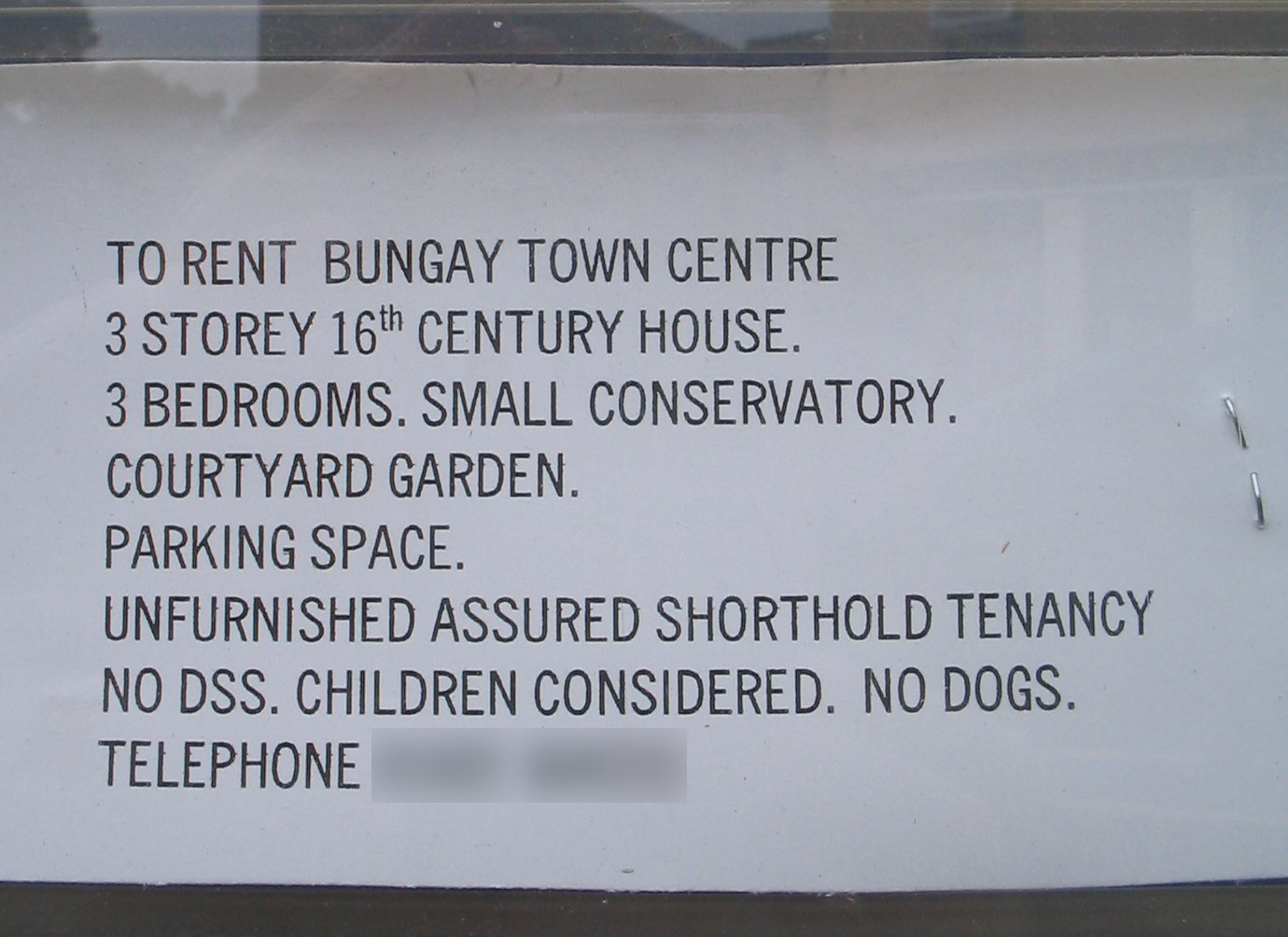

Housing Benefit

Housing Benefit is a means-tested social security benefit in the United Kingdom that is intended to help meet housing costs for rented accommodation. It is the second biggest item in the Department for Work and Pensions' budget after the state pension, totalling £23.8 billion in 2013–14. The primary legislation governing Housing Benefit is the Social Security Contributions and Benefits Act 1992. Operationally, the governing regulations are statutory instruments arising from that Act. It is governed by one of two sets of regulations. For working age claimants it is governed by the "Housing Benefit Regulations 2006", but for those who have reached the qualifying age for Pension Credit (regardless of whether it has been claimed) it is governed by the "Housing Benefit (Persons who have attained the qualifying age for state pension credit) Regulations 2006". It is normally administered by the local authority in whose area the property being rented lies. In some circumstances, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NHS Low Income Scheme

The NHS Low Income Scheme is intended to reduce the cost of NHS prescription charges, NHS dentistry, sight tests, glasses and contact lenses, necessary costs of travel to receive NHS treatment, NHS wigs and fabric supports, i.e. spinal or abdominal supports or surgical brassieres supplied through a hospital. It is administered by the NHS Business Services Authority. It is not necessary to be in receipt of any benefits in order to qualify. An online application system was under trial in 2022. It is restricted to people who do not have capital or savings of over £6,000. Tax credits People entitled to most means-tested benefits do not need to use the scheme as they are exempt from these charges. People who receive working tax credit or child tax credit are automatically assessed and, if entitled, issued with an NHS Tax Credit Exemption Certificate. Tax credit beneficiaries with an income of less than £15,276 (2013 figure), people who receive working tax credit and child tax cre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Fund (UK)

The Social Fund in the UK was a form of welfare benefit provision payable for exceptional or intermittent needs, in addition to regular payments such as Jobseeker's Allowance or Income Support. The United Kingdom coalition government has abolished the discretionary social fund with effect from April 2013, by means of legislation contained in the Welfare Reform Act 2012. Community care grants and crisis loans will be abolished from April 2013 and instead funding is being made available to local authorities in England and to the devolved administrations to provide such assistance in their areas as they see fit. Introduction There were two categories of Social Fund: # a ‘discretionary’ social fund intended to respond flexibly to meet exceptional and intermittent needs; and # a ‘regulated’ fund intended to cover maternity, funeral, winter fuel and heating expenses. The social fund schemes were implemented in 1987 to 1988, as part of an overall review of benefits (the ''Fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Poverty Trap

In economics, a cycle of poverty or poverty trap is caused by self-reinforcing mechanisms that cause poverty, once it exists, to persist unless there is outside intervention. It can persist across generations, and when applied to developing countries, is also known as a development trap. Families trapped in the cycle of poverty have few to no resources. There are many self-reinforcing disadvantages that make it virtually impossible for individuals to break the cycle. This occurs when poor people do not have the resources necessary to escape poverty, such as financial capital, education, or connections. Impoverished individuals do not have access to economic and social resources as a result of their poverty. This lack may increase their poverty. This could mean that the poor remain poor throughout their lives.Hutchinson Encycloped ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

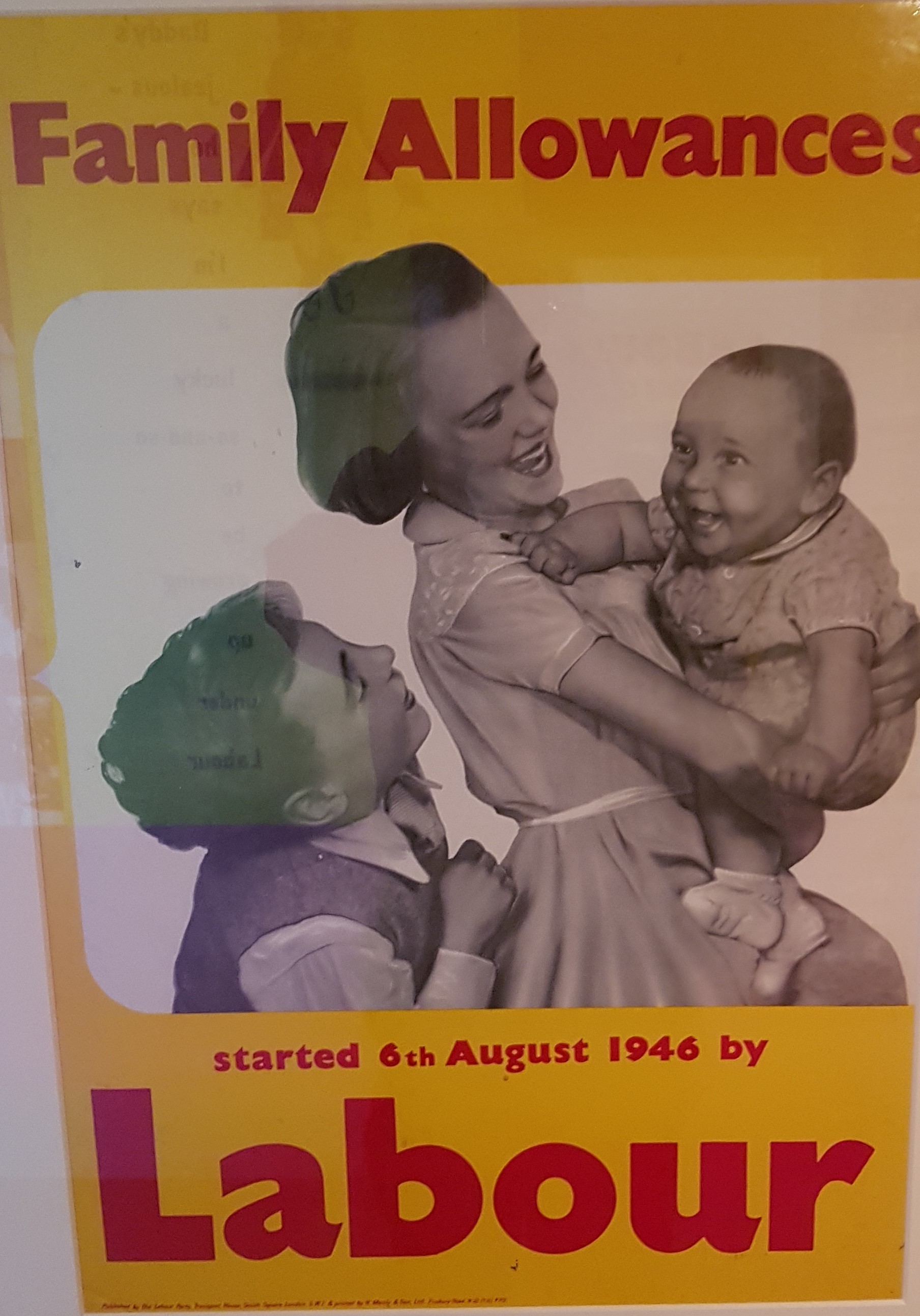

Child Benefits In The United Kingdom

Child benefits in the United Kingdom are a series of welfare payments and tax credits made to parents with children in the UK, a major part of the welfare state. The child tax allowance The first modern child tax credit was introduced in David Lloyd George's 1909 'People's Budget'. This introduced a £10 income tax allowance per child, for tax payers earning under £500 per annum. Following extensive Parliamentary debate, the Budget became law as the Finance Act (1909–1910) 1910 on 29 April 1910. Since the income tax rate was then 1 shilling and two pence in the pound (5.83%), the value of the tax credit was therefore 11 shillings and eight pence per child. Since most people did not earn enough to pay tax, this was a subsidy for middle-class parents. The nominal value of these tax credits were generally, though not always, increased in line with income tax rates. For instance, by 1916, income tax had increased to five shillings in the pound (25%), and the tax credit to £25, giving ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |