|

FTSE4Good

The FTSE4Good Index Series is a series of ethical investment stock market indices launched in 2001 by the FTSE Group which reports on the performance of companies which demonstrate "strong Environmental, Social and Governance practices". A number of stock market indices are available, for example covering UK shares, US shares, European markets and Japan, with inclusion based on a range of corporate social responsibility criteria. Research for the indices is supported by the Ethical Investment Research Services (EIRIS). The index excludes companies due to their involvement in tobacco production, nuclear weapons, conventional weapon systems, or coal power industry and rates companies for inclusion based environmental sustainability, relationships with stakeholders, attitudes to human rights, supply chain labour standards and the countering of bribery.Collison, D. J., Cobb, G., Power, D. M. and Stevenson, L. A. (2008), "The financial performance of the FTSE4Good indices". ''Corpo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ethical Investment

Socially responsible investing (SRI), social investment, sustainable socially conscious, "green" or ethical investing, is any investment strategy which seeks to consider both financial return and social/environmental good to bring about social change regarded as positive by proponents. Socially responsible investments often constitute a small percentage of total funds invested by corporations and are riddled with obstacles. Recently, it has also become known as "sustainable investing" or "responsible investing". There is also a subset of SRI known as "impact investing", devoted to the conscious creation of social impact through investment. In general, socially responsible investors encourage corporate practices that they believe promote environmental stewardship, consumer protection, human rights, and racial or gender diversity. Some SRIs avoid investing in businesses perceived to have negative social effects such as alcohol, tobacco, fast food, gambling, pornography, weapons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FTSE Group

FTSE International Limited trading as FTSE Russell ( "Footsie") is a British provider of stock market indices and associated data services, wholly owned by the London Stock Exchange (LSE) and operating from premises in Canary Wharf. It operates the well known UK FTSE 100 Index as well as a number of other indices. FTSE stands for Financial Times Stock Exchange. History The FTSE Group was created in 1995 by Pearson (former parent of the ''Financial Times'') and the London Stock Exchange Group. In 2010, the joint venture with Xinhua Finance was terminated, the index series was renamed into FTSE China Index Series; the Hong Kong incorporated company was renamed to "FTSE China Index Limited". In 2011, Pearson sold its stake to LSE. Main business FTSE Group operates 250,000 indices calculated across 80 countries and in 2015 was the number three provider of indices worldwide by revenue. FTSE Group earns around 60 per cent of revenue from annual subscription fees and 40 per cent f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Environmental, Social, And Corporate Governance

ESG (environmental, social, and corporate governance) data reflect the negative externalities (costs to others) caused by an organization with respect to the environment, to society and to corporate governance. ESG data can be used by investors to assess the material risk the organization is taking and by the organization itself as metrics for strategic and managerial purposes. Investors may also use ESG data beyond assessing material risks to the organization in their evaluation of enterprise value, specifically by designing models based on assumptions that the identification, assessment and management of sustainability-related risks and opportunities in respect to all organizational stakeholders leads to higher long-term risk-adjusted return. Organizational stakeholders include but not limited to customers, suppliers, employees, leadership, and the environment. Since 2020, there has been accelerating interest in overlaying ESG data with the Sustainable Development Goals (SDG ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Index

In finance, a stock index, or stock market index, is an index that measures a stock market, or a subset of the stock market, that helps investors compare current stock price levels with past prices to calculate market performance. Two of the primary criteria of an index are that it is ''investable'' and ''transparent'': The methods of its construction are specified. Investors can invest in a stock market index by buying an index fund, which are structured as either a mutual fund or an exchange-traded fund, and "track" an index. The difference between an index fund's performance and the index, if any, is called ''tracking error''. For a list of major stock market indices, see List of stock market indices. Types of indices by weighting method Stock market indices could be segmented by their index weight methodology, or the rules on how stocks are allocated in the index, independent of its stock coverage. For example, the S&P 500 and the S&P 500 Equal Weight both covers the sam ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Social Responsibility

Corporate social responsibility (CSR) is a form of international private business self-regulation which aims to contribute to societal goals of a philanthropic, activist, or charitable nature by engaging in or supporting volunteering or ethically oriented practices. While once it was possible to describe CSR as an internal organizational policy or a corporate ethic strategy, that time has passed as various national and international laws have been developed. Various organizations have used their authority to push it beyond individual or even industry-wide initiatives. In contrast, it has been considered a form of corporate self-regulation for some time, over the last decade or so it has moved considerably from voluntary decisions at the level of individual organizations to mandatory schemes at regional, national, and international levels. Moreover, scholars and firms are using the term "creating shared value", an extension of corporate social responsibility, to explain ways of d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FTSE Russell

FTSE Russell is a subsidiary of London Stock Exchange Group (LSEG) that produces, maintains, licenses, and markets stock market indices. The division is notable for FTSE 100 Index, Russell 2000 Index, among other indices. The brand and division FTSE Russell was introduced in 2015, while integrating the indexing services of FTSE index series and Russell index series. In the same year, LSEG sold Frank Russell Company's asset management division Russell Investments. Also in 2015, FTSE Russell acquired the corporate data company Mergent. In December 2020, FTSE Russell announced that it would strip its indexes of eight Chinese companies in response to U.S. Executive Order 13959. Indexes * FTSE 350 Index * FTSE All-Share Index * FTSE SmallCap Index * FTSE4Good Index * FTSE AIM UK 50 Index * FTSE AIM 100 Index * FTSE AIM All-Share Index * FTSE MIB *Russell Indexes *Russell 3000 Index *Russell 2500 Index *Russell 2000 Index *Russell 1000 Index *Russell Top 200 Index *Russell Top ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Calvert Social Index

The Calvert Social Index is a stock market index created by Calvert Investments as a benchmark of large companies that are considered socially responsible or ethical. It currently consists of 680 companies, weighted by market capitalization, selected from approximately 1,000 of the largest publicly traded companies in the United States using Calvert's social criteria. These criteria relate to the environment, workplace issues, product safety, community relations, weapons contracting, international operations, and human rights. This index was created following the success of the Domini 400 Social Index by KLD Research & Analytics, Inc. The Calvert index is used by many so-called socially responsible mutual funds as a benchmark for their performance. See also *FTSE4Good Index *MSCI KLD 400 Social Index The MSCI KLD 400 Social Index was launched in 1990 and is designed to help socially conscious investors weigh social and environmental factors in their investment choices. It wa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MSCI KLD 400 Social Index

The MSCI KLD 400 Social Index was launched in 1990 and is designed to help socially conscious investors weigh social and environmental factors in their investment choices. It was founded by KLD's Amy Domini as the Domini 400 Social Index. The MSCI KLD 400 Social Index is designed to provide exposure to the common stocks of companies that KLD determines have positive environmental, social and corporate governance (ESG) characteristics. The KLD400 consists of 400 companies drawn from the universe of the 3,000 largest U.S. public equities as measured by float-adjusted market capitalization. The index is composed approximately 90% of large cap companies, 9% mid cap companies chosen for sector diversification, and 1% small cap companies with exemplary social and environmental records. The eligible universe for the KLD400 is the 3,000 largest U.S. companies (by float-adjusted market capitalization) in the U.S. equity market. KLD selects the eligible universe index on April 15 (or clo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ethical Investment Research Services

Moody's Investors Service, often referred to as Moody's, is the bond credit rating business of Moody's Corporation, representing the company's traditional line of business and its historical name. Moody's Investors Service provides international financial research on bonds issued by commercial and government entities. Moody's, along with Standard & Poor's and Fitch Group, is considered one of the Big Three credit rating agencies. It is also included in the Fortune 500 list of 2021. The company ranks the creditworthiness of borrowers using a standardized ratings scale which measures expected investor loss in the event of default. Moody's Investors Service rates debt securities in several bond market segments. These include government, municipal and corporate bonds; managed investments such as money market funds and fixed-income funds; financial institutions including banks and non-bank finance companies; and asset classes in structured finance. In Moody's Investors Service' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Event Study

An event study is a statistical method to assess the impact of an event on the value of a firm. For example, the announcement of a merger between two business entities can be analyzed to see whether investors believe the merger will create or destroy value. The basic idea is to find the abnormal return attributable to the event being studied by adjusting for the return that stems from the price fluctuation of the market as a whole. The event study was invented by Ball and Brown (1968). As the event methodology can be used to elicit the effects of any type of event on the direction and magnitude of stock price changes, it is very versatile. Event studies are thus common to various research areas, such as accounting and finance, management, economics, marketing, information technology, law, political science, operations and supply chain management. One aspect often used to structure the overall body of event studies is the breadth of the studied event types. On the one hand, ther ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Share Price

A share price is the price of a single share of a number of saleable equity shares of a company. In layman's terms, the stock price is the highest amount someone is willing to pay for the stock, or the lowest amount that it can be bought for. Behaviour of share prices In economics and financial theory, analysts use random walk techniques to model behavior of asset prices, in particular share prices on stock markets. This practice has its basis in the presumption that investors act rationally and without biases, and that at any moment they estimate the value of an asset based on future expectations. Under these conditions, all existing information affects the price, which changes only when new information comes out. By definition, new information appears randomly and influences the asset price randomly. Empirical studies have demonstrated that prices do not completely follow random walks. Low serial correlations (around 0.05) exist in the short term, and slightly stronger correl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Statistical Significance

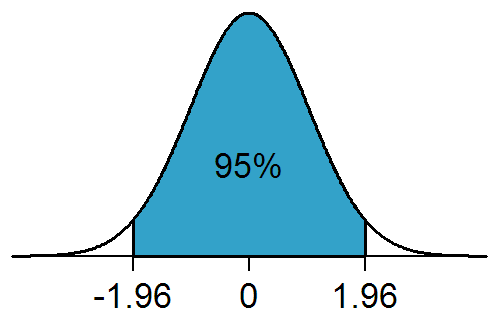

In statistical hypothesis testing, a result has statistical significance when it is very unlikely to have occurred given the null hypothesis (simply by chance alone). More precisely, a study's defined significance level, denoted by \alpha, is the probability of the study rejecting the null hypothesis, given that the null hypothesis is true; and the ''p''-value of a result, ''p'', is the probability of obtaining a result at least as extreme, given that the null hypothesis is true. The result is statistically significant, by the standards of the study, when p \le \alpha. The significance level for a study is chosen before data collection, and is typically set to 5% or much lower—depending on the field of study. In any experiment or observation that involves drawing a sample from a population, there is always the possibility that an observed effect would have occurred due to sampling error alone. But if the ''p''-value of an observed effect is less than (or equal to) the significanc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |