|

FICA

The Federal Insurance Contributions Act (FICA ) is a United States federal payroll (or employment) tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers. Calculation Overview The Federal Insurance Contributions Act is a tax mechanism codified in Title 26, Subtitle C, Chapter 21 of the United States Code. Social security benefits include old-age, survivors, and disability insurance (OASDI); Medicare provides hospital insurance benefits for the elderly. The amount that one pays in payroll taxes throughout one's working career is associated indirectly with the social security benefits annuity that one receives as a retiree. Consequently, Kevin Hassett wrote that FICA is not a tax because its collection is directly tied to benefits that one is entitled to collect later in life. However, the United States Supreme Court ruled in '' Flem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security (United States)

In the United States, Social Security is the commonly used term for the federal Old-Age, Survivors, and Disability Insurance (OASDI) program and is administered by the Social Security Administration (SSA). The Social Security Act was passed in 1935,Social Security Act of 1935 and the existing version of the Act, as amended, 2 USC 7 encompasses several social welfare and social insurance programs. The average monthly Social Security benefit for May 2025 was $1,903. This was raised from $1,783 in 2024. The total cost of the Social Security program for 2022 was $1.244 trillion or about 5.2 percent of U.S. gross domestic product (GDP). In 2025 there have been proposed budget cuts to social security. Social Security is funded primarily through payroll taxes called the Federal Insurance Contributions Act (FICA) or Self Employed Contributions Act (SECA). Wage and salary earnings from covered employment, up to an amount determined by law (see tax rate table), are subject to th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In The United States

The United States federal government and most State governments in the United States, state governments impose an income tax. They are determined by applying a tax rate, which Progressive tax, may increase as income increases, to taxable income, which is the total income less allowable tax deduction, deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnership taxation in the United States, Partnerships are not taxed (with some exceptions in the case of federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of tax credit, credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mort ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Social Security Wage Base

For the Old Age, Survivors and Disability Insurance (OASDI) tax or Social Security tax in the United States, the Social Security Wage Base (SSWB) is the maximum earned gross income or upper threshold on which a wage earner's Social Security tax may be imposed. The Social Security tax is one component of the Federal Insurance Contributions Act tax (FICA) and Self-employment tax, the other component being the Medicare tax. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated to determine a worker's Social Security benefit. In 2020, the Social Security Wage Base was $137,700, and in 2021, it was $142,800; the Social Security tax rate was 6.20% paid by the employee and 6.20% paid by the employer.Publication 15, ''Employer's Tax Guide (Circular E)'' (April. 2018), p. 23, Internal Revenue Service, U.S. Dep't of the Treasury. A person with $10,000 of gross income had $620.00 withheld as Social Security tax from his check and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-employment

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed. In the real world, the critical issue for tax authorities is not whether a person is engaged in business activity (called ''trading'' even when referring to the provision of a service) but whether the activity is profitable and therefore potentially taxable. In other words, the trading is likely to be ignored if there is no profit, so occasional and hobby- or enthusiast-based economic activity is generally ignored by tax authorities. Self-employed people are usually classified as a sole proprietor (or sole trader), independent contractor, or as a member of a partnership. Self-employed people generally find their own work rather than being provided with work by an employer and instead earn income from a profession, a tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Medicare (United States)

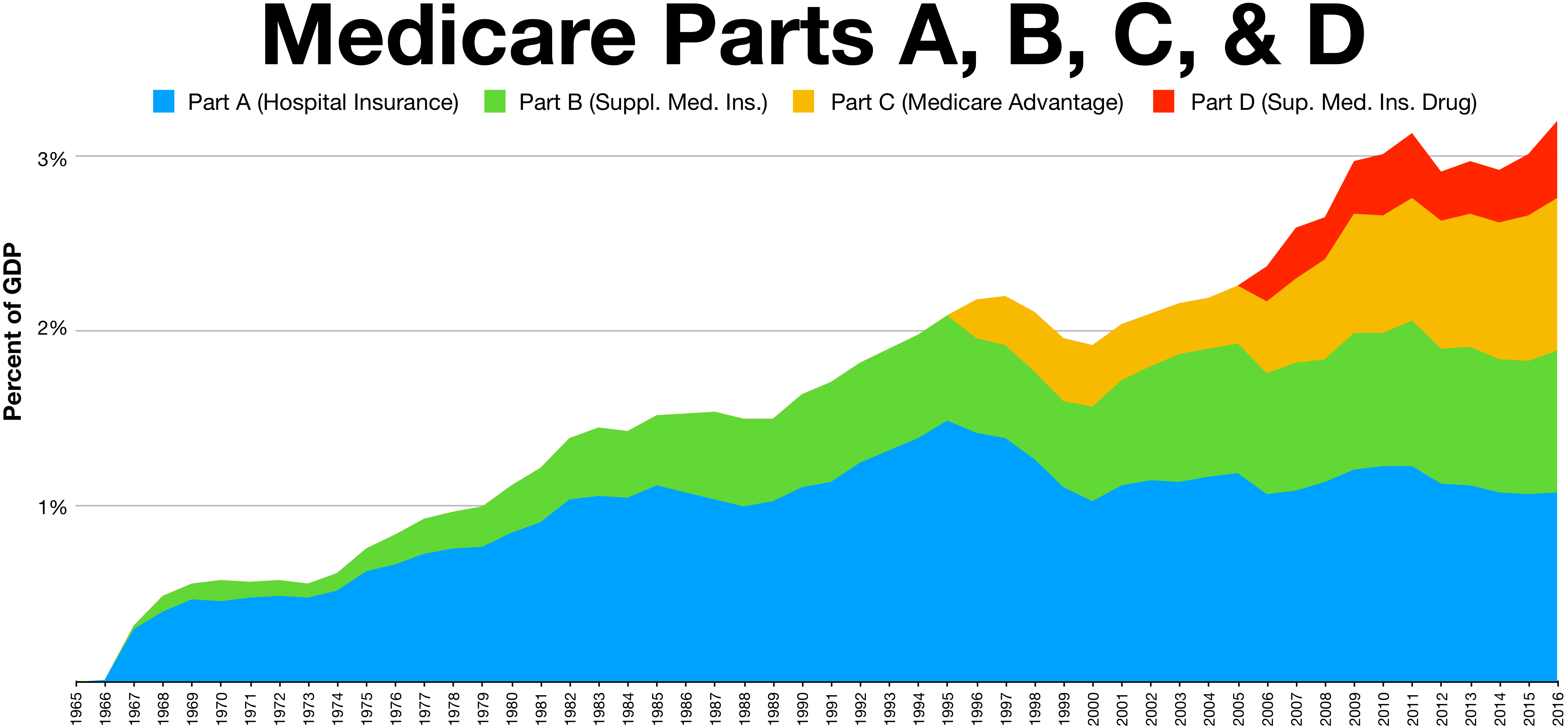

Medicare is a federal health insurance program in the United States for people age 65 or older and younger people with disabilities, including those with End Stage Renal Disease Program, end stage renal disease and amyotrophic lateral sclerosis (ALS or Lou Gehrig's disease). It started in 1965 under the Social Security Administration and is now administered by the Centers for Medicare and Medicaid Services (CMS). Medicare is divided into four parts: A, B, C and D. Part A covers hospital, skilled nursing, and hospice services. Part B covers outpatient services. Part D covers self-administered prescription drugs. Part C is an alternative that allows patients to choose private plans with different benefit structures that provide the same services as Parts A and B, usually with additional benefits. In 2022, Medicare provided health insurance for 65.0 million individuals—more than 57 million people aged 65 and older and about 8 million younger people. According to annual Medicare ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Regressive Tax

A regressive tax is a tax imposed in such a manner that the tax rate decreases as the amount subject to taxation increases. "Regressive" describes a distribution effect on income or expenditure, referring to the way the rate progresses from high to low, so that the average tax rate exceeds the marginal tax rate.Hyman, David M. (1990) ''Public Finance: A Contemporary Application of Theory to Policy'', 3rd, Dryden Press: Chicago, ILJames, Simon (1998) ''A Dictionary of Taxation'', Edgar Elgar Publishing Limited: Northampton, MA The regressivity of a particular tax can also factor the propensity of the taxpayers to engage in the taxed activity relative to their resources (the demographics of the tax base). In other words, if the activity being taxed is more likely to be carried out by the poor and less likely to be carried out by the rich, the tax may be considered regressive. To measure the effect, the income elasticity of the good being taxed as well as the income effect on cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Code

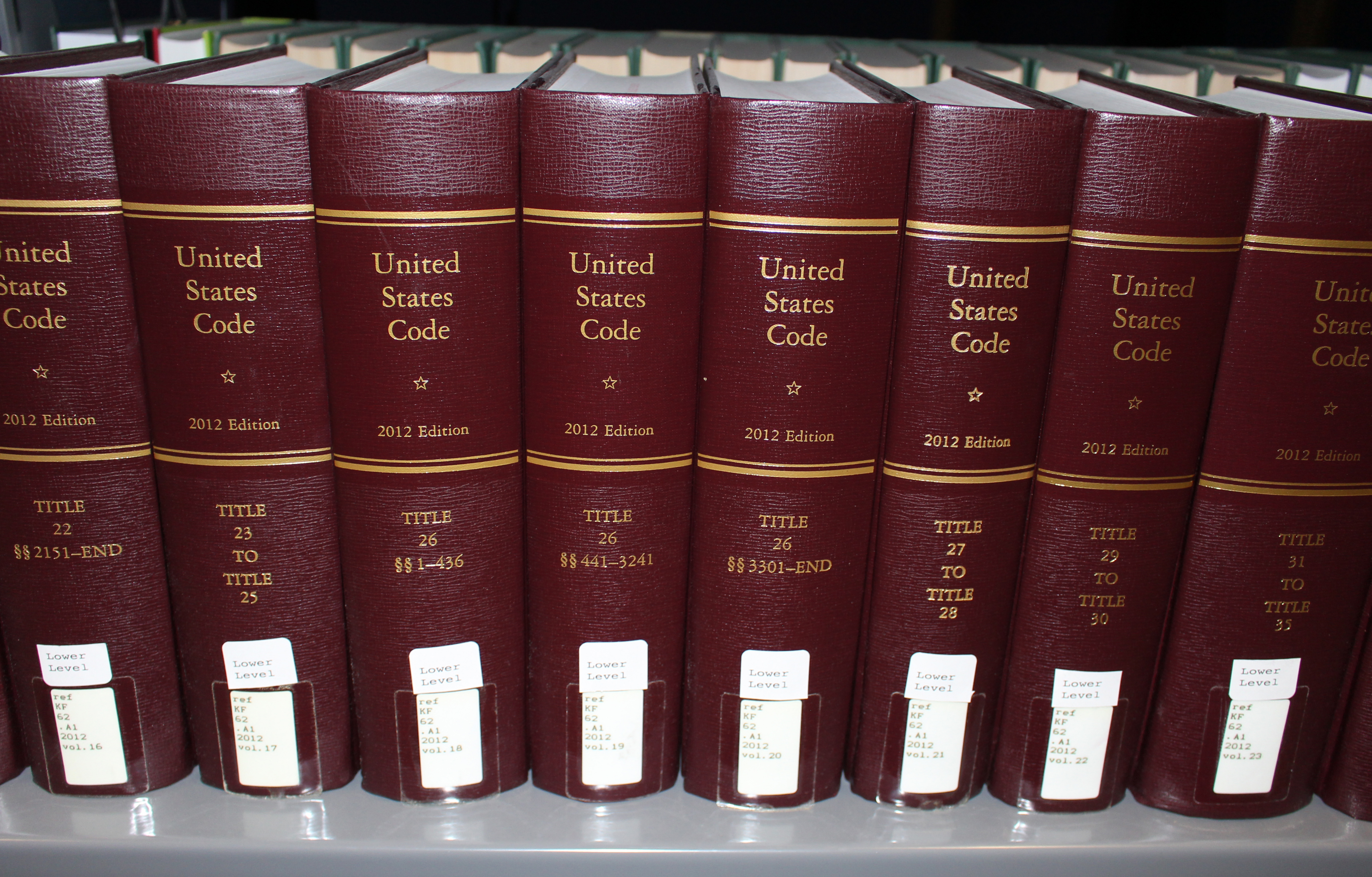

The United States Code (formally The Code of Laws of the United States of America) is the official Codification (law), codification of the general and permanent Law of the United States#Federal law, federal statutes of the United States. It contains 53 titles, which are organized into numbered sections. The U.S. Code is published by the United States House of Representatives, U.S. House of Representatives' Office of the Law Revision Counsel. New editions are published every six years, with cumulative supplements issued each year.About United States Code . Gpo.gov. Retrieved on 2013-07-19. The official version of these laws appears in the ''United States Statutes at Large'', a chronological, uncodified compilation. Codification Process The official text of an Act of Cong ...[...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Self-employed People

Self-employment is the state of working for oneself rather than an employer. Tax authorities will generally view a person as self-employed if the person chooses to be recognised as such or if the person is generating income for which a tax return needs to be filed. In the real world, the critical issue for tax authorities is not whether a person is engaged in business activity (called ''trading'' even when referring to the provision of a service) but whether the activity is profitable and therefore potentially taxable. In other words, the trading is likely to be ignored if there is no profit, so occasional and hobby- or enthusiast-based economic activity is generally ignored by tax authorities. Self-employed people are usually classified as a sole proprietor (or sole trader), independent contractor, or as a member of a partnership. Self-employed people generally find their own work rather than being provided with work by an employer and instead earn income from a profession, a trad ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Withholding

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, renting, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common. Typically, the withheld tax is treated as a pay ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Refund

A tax refund is a payment to the taxpayer due because the taxpayer has paid more taxes than owed. United States According to the Internal Revenue Service, 77% of tax returns filed in 2004 resulted in a refund check, with the average refund check being $2,100. In 2011, the average tax refund was $2,913. For the 2017 tax year the average refund was $2,035 and for 2018 it was 8% less at $1,865, reflecting the changes brought by the most sweeping changes to the tax code in 30 years. The latest data from the Internal Revenue Service (IRS) agency shows that the total amount refunded to taxpayers by IRS through 2023 will be approximately $198.9 billion, which is $23.5 billion less than in 2022. That equates to an average refund of $2,878 — or $297 less per person than last tax season. Taxpayers may choose to have their refund directly deposited into their bank account, have a check mailed to them, or have their refund applied to the following year's income tax. As of 2006, tax f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Effective Payroll Tax Rate For Different Income Percentiles (2010)

Effectiveness or effectivity is the capability of producing a desired result or the ability to produce desired output. When something is deemed effective, it means it has an intended or expected outcome, or produces a deep, vivid impression. Etymology The origin of the word ''effective'' stems from the Latin word , which means "creative, productive, or effective". It surfaced in Middle English between 1300 and 1400 AD. Usage Science and technology Mathematics and logic In mathematics and logic, ''effective'' is used to describe metalogical methods that fit the criteria of an effective procedure. In group theory, a group element acts ''effectively'' (or ''faithfully'') on a point, if that point is not fixed by the action. Physics In physics, an effective theory is, similar to a phenomenological theory, a framework intended to explain certain (observed) effects without the claim that the theory correctly models the underlying (unobserved) processes. In heat t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Partnership

A partnership is an agreement where parties agree to cooperate to advance their mutual interests. The partners in a partnership may be individuals, businesses, interest-based organizations, schools, governments or combinations. Organizations may partner to increase the likelihood of each achieving their mission and to amplify their reach. A partnership may result in issuing and holding equity or may be only governed by a contract. History Partnerships have a long history; they were already in use in medieval times in Europe and in the Middle East. According to a 2006 article, the first partnership was implemented in 1383 by Francesco di Marco Datini, a merchant of Prato and Florence. The Covoni company (1336–40) and the Del Buono-Bencivenni company (1336–40) have also been referred to as early partnerships, but they were not formal partnerships. In Europe, the partnerships contributed to the Commercial Revolution which started in the 13th century. In the 15th century ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |