|

FAS 133

Launched prior to the millennium, (and subsequently amended) FAS 133 ''Accounting for Derivative Instruments and Hedging Activities'' provided an "integrated accounting framework for derivative instruments and hedging activities." FAS 133 Overview Statements of Financial Accounting Standards No. 133, ''Accounting for Derivative Instruments and Hedging Activities'', commonly known as FAS 133, is an accounting standard issued in June 1998 by the Financial Accounting Standards Board (FASB) that requires companies to measure all assets and liabilities on their balance sheet at “fair value”. This standard was created in response to significant hedging losses involving derivatives years ago and the attempt to control and manage corporate hedging as risk management not earnings management. All derivatives within the scope of FAS133 must be recorded at fair value as an asset or liability. Hedge accounting may be applied if there is hedge documentation and gains and losses in the v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Derivative (finance)

In finance, a derivative is a contract between a buyer and a seller. The derivative can take various forms, depending on the transaction, but every derivative has the following four elements: # an item (the "underlier") that can or must be bought or sold, # a future act which must occur (such as a sale or purchase of the underlier), # a price at which the future transaction must take place, and # a future date by which the act (such as a purchase or sale) must take place. A derivative's value depends on the performance of the underlier, which can be a commodity (for example, corn or oil), a financial instrument (e.g. a stock or a bond), price index, a price index, a currency, or an interest rate. Derivatives can be used to insure against price movements (Hedge (finance)#Etymology, hedging), increase exposure to price movements for speculation, or get access to otherwise hard-to-trade assets or markets. Most derivatives are price guarantees. But some are based on an event or p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Generally Accepted Accounting Principles

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC), and is the default accounting standard used by companies based in the United States. The Financial Accounting Standards Board (FASB) publishes and maintains the Accounting Standards Codification (ASC), which is the single source of authoritative nongovernmental U.S. GAAP. The FASB published U.S. GAAP in Extensible Business Reporting Language (XBRL) beginning in 2008. Sources The FASB Accounting Standards Codification is the source of authoritative GAAP recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the SEC under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants. In addition to the SEC's rules and interpretive releases, the SEC staff issues Staff Accounting Bulletins that represent practices followed by the staff in administering SEC disclosure r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge Accounting

Hedge accounting is an accountancy practice, the aim of which is to provide an offset to the mark-to-market movement of the derivative in the profit and loss account. Types There are two types of hedge recognized. For a fair value hedge, the offset is achieved either by marking-to-market an asset or a liability which offsets the P&L movement of the derivative. For a "cash flow hedge", some of the derivative volatility is placed into a separate component of the entity's equity called the cash flow hedge reserve. Where a hedge relationship is effective (meets the 80%–125% rule), most of the mark-to-market derivative volatility will be offset in the profit and loss account. Hedge accounting entails much compliance - involving documenting the hedge relationship and both prospectively and retrospectively proving that the hedge relationship is effective. Necessity All entities are exposed to some form of market risk. For example, gold mines are exposed to the price of gol ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Exchange Hedge

A foreign exchange hedge (also called a FOREX hedge) is a method used by companies to eliminate or "hedge" their foreign exchange risk resulting from transactions in foreign currencies (see foreign exchange derivative). This is done using either the cash flow hedge or the fair value method. The accounting rules for this are addressed by both the International Financial Reporting Standards (IFRS) and by the US Generally Accepted Accounting Principles (US GAAP) as well as other national accounting standards. A foreign exchange hedge transfers the foreign exchange risk from the trading or investing company to a business that carries the risk, such as a bank. There is a cost to the company for setting up a hedge. By setting up a hedge, the company also forgoes any profit if the movement in the exchange rate would be favourable to it. Foreign exchange risk When companies conduct business across borders, they must deal in foreign currencies. Companies must exchange foreign currencies ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

IAS 39

IAS 39: Financial Instruments: Recognition and Measurement was an international accounting standard which outlined the requirements for the recognition and measurement of financial assets, financial liabilities, and some contracts to buy or sell non-financial items. It was released by the International Accounting Standards Board (IASB) in 2003, and was replaced in 2014 by IFRS 9, which became effective in 2018. It was adopted by the European Union in 2004. In 2005, the EU also introduced the fair value and hedging provision of the amended version of IAS 39. The EU version was changed at the end of 2008 in response to the 2008 financial crisis. The comparative accounting measures in the United States are FAS 133 and FAS 157. The Financial Accounting Standards Board (FASB) released a 'FASB Staff Position' statement in October 2008, in response to the 2008 financial crisis The 2008 financial crisis, also known as the global financial crisis (GFC), was a major worldwide f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FASB

The Financial Accounting Standards Board (FASB) is a private standard-setting body whose primary purpose is to establish and improve Generally Accepted Accounting Principles (GAAP) within the United States in the public's interest. The Securities and Exchange Commission (SEC) designated the FASB as the organization responsible for setting accounting standards for public companies in the U.S. The FASB replaced the American Institute of Certified Public Accountants' (AICPA) Accounting Principles Board (APB) on July 1, 1973. The FASB is run by the nonprofit Financial Accounting Foundation. FASB accounting standards are accepted as authoritative by many organizations, including state Boards of Accountancy and the American Institute of CPAs (AICPA). Structure The FASB is based in Norwalk, Connecticut, and is led by seven full-time Board members,Spiceland, David; Sepe, James; Nelson, Mark; & Tomassini, Lawrence (2009). ''Intermediate Accounting'' (5th Edition). McGraw-Hill/Irwi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lehman Brothers

Lehman Brothers Inc. ( ) was an American global financial services firm founded in 1850. Before filing for bankruptcy in 2008, Lehman was the fourth-largest investment bank in the United States (behind Goldman Sachs, Morgan Stanley, and Merrill Lynch), with about 25,000 employees worldwide. It was doing business in investment banking, equity, fixed-income and derivatives sales and trading (especially U.S. Treasury securities), research, investment management, private equity, and private banking. Lehman was operational for 158 years from its founding in 1850 until 2008. On September 15, 2008, Lehman Brothers filed for Chapter 11 bankruptcy protection following the exodus of most of its clients, drastic declines in its stock price, and the devaluation of assets by credit rating agencies. The collapse was largely due to Lehman's involvement in the subprime mortgage crisis and its exposure to less liquid assets. Lehman's bankruptcy filing is the largest in US history, having ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

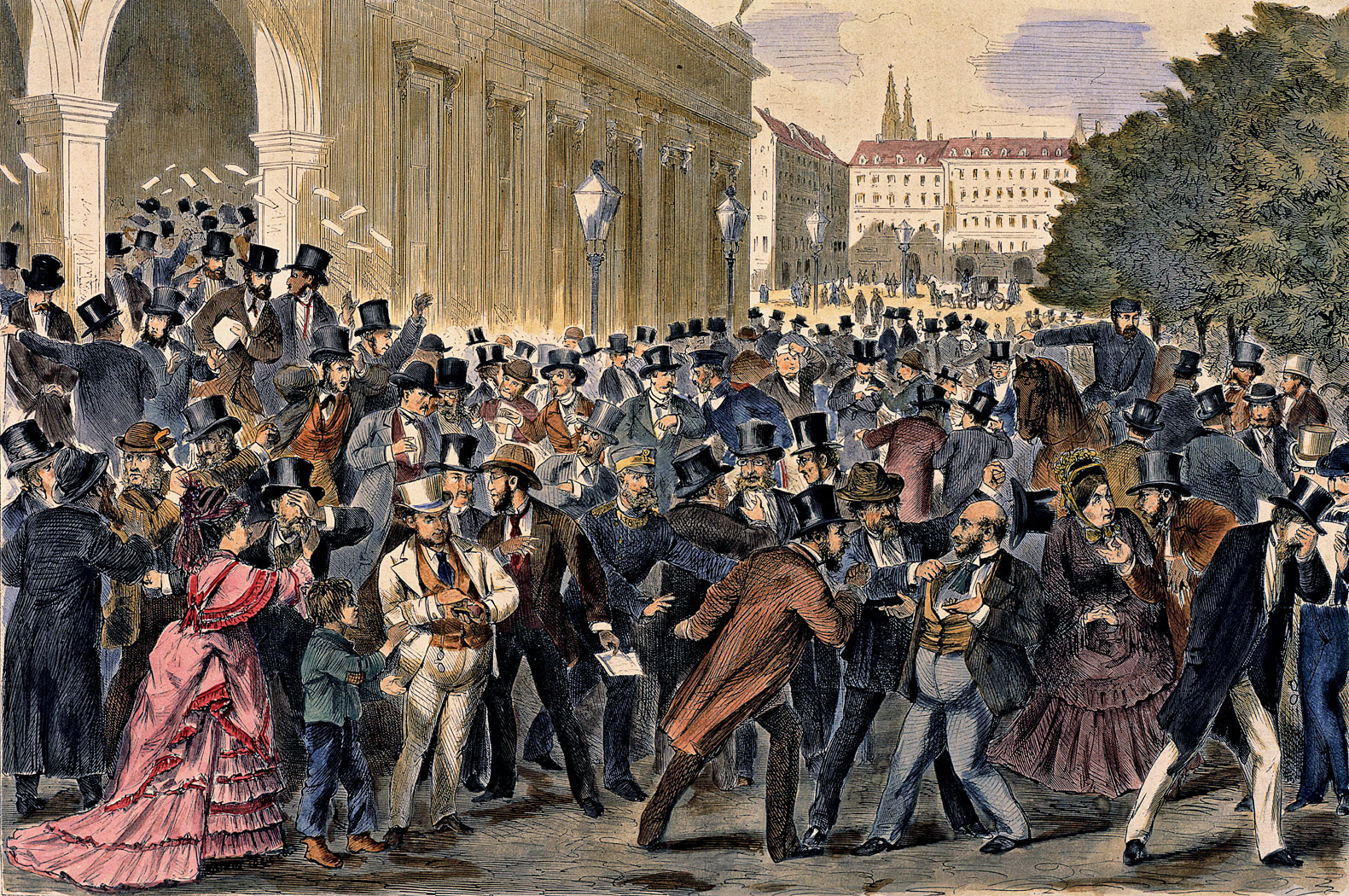

Financial Crisis

A financial crisis is any of a broad variety of situations in which some financial assets suddenly lose a large part of their nominal value. In the 19th and early 20th centuries, many financial crises were associated with Bank run#Systemic banking crises, banking panics, and many recessions coincided with these panics. Other situations that are often called financial crises include stock market crashes and the bursting of other financial Economic bubble, bubbles, currency crisis, currency crises, and sovereign defaults. Financial crises directly result in a loss of paper wealth but do not necessarily result in significant changes in the real economy (for example, the crisis resulting from the famous tulip mania bubble in the 17th century). Many economists have offered theories about how financial crises develop and how they could be prevented. There is little consensus and financial crises continue to occur from time to time. It is apparent however that a consistent feature of bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge (finance)

A hedge is an investment Position (finance), position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance policy, insurance, forward contracts, swap (finance), swaps, option (finance), options, gambles, many types of Over-the-counter (finance), over-the-counter and Derivative (finance), derivative products, and futures contracts. Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of Energy derivative, energy, precious metals, foreign currency, and interest rate fluctuations. Etymology Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

NYMEX

The New York Mercantile Exchange (NYMEX) is a commodity futures exchange owned and operated by CME Group of Chicago. NYMEX is located at One North End Avenue in Brookfield Place in the Battery Park City section of Manhattan, New York City. The company's two principal divisions are the New York Mercantile Exchange and Commodity Exchange, Inc (COMEX), once separately owned exchanges. NYMEX traces its history to 1882 and for most of its history, as was common of exchanges, it was owned by the members who traded there. Later, NYMEX Holdings, Inc., the former parent company of the New York Mercantile Exchange and COMEX, went public and became listed on the New York Stock Exchange on November 17, 2006, under the ticker symbol NMX. On March 17, 2008, Chicago based CME Group signed a definitive agreement to acquire NYMEX Holdings, Inc. for $11.2 billion in cash and stock and the takeover was completed in August 2008. Both NYMEX and COMEX now operate as designated contract markets ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge (finance)

A hedge is an investment Position (finance), position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance policy, insurance, forward contracts, swap (finance), swaps, option (finance), options, gambles, many types of Over-the-counter (finance), over-the-counter and Derivative (finance), derivative products, and futures contracts. Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of Energy derivative, energy, precious metals, foreign currency, and interest rate fluctuations. Etymology Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |