|

Energy Taxation Directive

The Energy Taxation Directive or ETD (2003/96/EC) is a European directive, which establishes the framework conditions of the European Union for the taxation of electricity, motor and aviation fuels and most heating fuels. The directive is part of European Union energy law; its core component is the setting of minimum tax rates for all Member States. Purpose and scope The directive is intended to ensure the functionality of the EU internal energy market and to avoid distortions of competition through different tax systems. In addition, it should also contribute to a low-carbon, energy-efficient economy, that is, to exert a steering effect with the aim of protecting the environment and the climate. For this purpose, it sets EU-wide minimum tax amounts for electricity and for fuels when they are used as motor fuel, aviation fuel or heating fuel. The minimum tax amounts vary according to the type of fuel (petrol, kerosene, gas oil, liquid and natural gas) and their use. When used ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Council

The European Council (informally EUCO) is a collegiate body that defines the overall political direction and priorities of the European Union. It is composed of the heads of state or government of the EU member states, the President of the European Council, and the President of the European Commission. The High Representative of the Union for Foreign Affairs and Security Policy also takes part in its meetings. Established as an informal summit in 1975, the European Council was formalised as an institution in 2009 upon the commencement of the Treaty of Lisbon. Its current president is Charles Michel, former Prime Minister of Belgium. Scope While the European Council has no legislative power, it is a strategic (and crisis-solving) body that provides the union with general political directions and priorities, and acts as a collective presidency. The European Commission remains the sole initiator of legislation, but the European Council is able to provide an impetus to guid ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

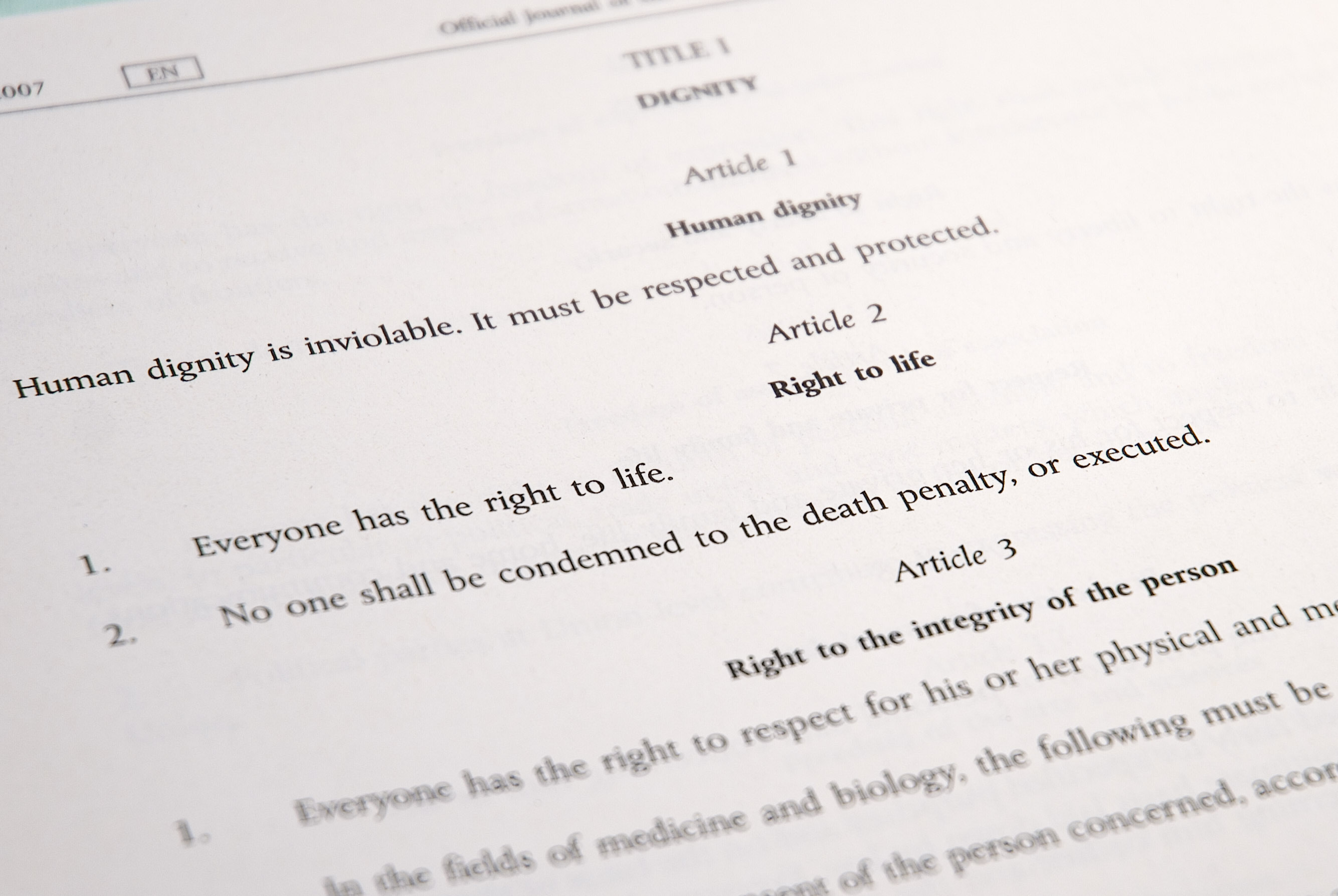

Charter Of Fundamental Rights Of The European Union

The Charter of Fundamental Rights of the European Union (CFR) enshrines certain political, social, and economic rights for European Union (EU) citizens and residents into EU law. It was drafted by the European Convention and solemnly proclaimed on 7 December 2000 by the European Parliament, the Council of Ministers and the European Commission. However, its then legal status was uncertain and it did not have full legal effect until the entry into force of the Treaty of Lisbon on 1 December 2009. The Charter forms part of the area of freedom, security and justice (AFSJ) policy domain of the EU. It applies to all the bodies of the European Union and the Euratom which must act and legislate in accordance with its provisions, as the EU's courts will invalidate any EU legislation or ruling assessed as non-compliant with the Charter. The EU member states are also bound by the Charter when engaged in implementation of the European Union law. However, Poland has been granted a partia ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2003 In Law

3 (three) is a number, numeral and digit. It is the natural number following 2 and preceding 4, and is the smallest odd prime number and the only prime preceding a square number. It has religious or cultural significance in many societies. Evolution of the Arabic digit The use of three lines to denote the number 3 occurred in many writing systems, including some (like Roman and Chinese numerals) that are still in use. That was also the original representation of 3 in the Brahmic (Indian) numerical notation, its earliest forms aligned vertically. However, during the Gupta Empire the sign was modified by the addition of a curve on each line. The Nāgarī script rotated the lines clockwise, so they appeared horizontally, and ended each line with a short downward stroke on the right. In cursive script, the three strokes were eventually connected to form a glyph resembling a with an additional stroke at the bottom: ३. The Indian digits spread to the Caliphate in the 9th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of European Union Directives

The following is a thematic list of European Union directives: For a date based list, see the :European Union directives by number Numbering From 1 January 1992 to 31 December 2014, numbers assigned by the General Secretariat of the Council followed adoption, for instance: Directive 2010/75/EU. Since 2015, acts have been numbered following the pattern (domain) YYYY/N, for instance "Regulation (EU) 2016/1627" with * domain being "EU" for the European Union, "Euratom" for the European Atomic Energy Community, "EU, Euratom" for the European Union and the European Atomic Energy Community, "CFSP" for the common foreign and security policy * year being the 4 digit year * the sequential number. Some older directives had an ordinal number in their name, for instance: "First Council Directive 73/239/EEC". Accounting, auditing, and management control *Seventh Directive: Consolidated accounts of companies with limited liability (Directive 83/349/EEC of 29/6/83). *Eighth Directive: Q ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kerosene Tax

The kerosene tax (German: ''Kerosinsteuer'', French: ''taxe kérosène''; Dutch: ''kerosinetaks'') is an ecotax on the kerosene-based jet fuel in commercial aviation, which can be levied within and by the European Union. The legal basis for it is the Energy Taxation Directive (2003/96/EG) of 27 October 2003, which proves the member states with the option of introducing a tax on turbine fuel for commercial domestic flights and flights between member states. However, as of 2023, commercial kerosene consumption is currently tax exempt under the legislation of all member states of the European Union. Importance of kerosene Jet engines using kerosene fuel rapidly developed after 1950. Wide-body aircraft and almost all helicopters fly with a turbine drive, all turbines are operated with kerosene of different specifications. The majority of modern passenger and freight air traffic as well as military flights take place in this way. Small planes, meaning almost all model planes, mot ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

German National Action Plan On Energy Efficiency

The German National Action Plan on Energy Efficiency (NAPE) (german: Nationale Aktionsplan Energieeffizienz) is the National Energy Efficiency Action Plan (NEEAP) for Germany. (Available in German too). The plan was commissioned under EU Energy Efficiency Directive 2012/27/EU of the European Union and released on 3 December 2014. Under the plan, the German government offers an average increase of 2.1%/year in macroeconomic energy productivity from 2008 to 2020. The exact reduction in primary energy use is therefore dependent on the rate of economic growth. The NAPE is part of the Climate Action Programme2020, also approved on 3December 2014. Targets The German government target under the National Action Plan on Energy Efficiency is specified in terms of energy productivity relative to gross domestic product (GDP). Under the plan, the German government offers an average annual increase of 2.1% in macroeconomic energy productivity from 2008 to 2020. Assuming an annu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EU Energy Efficiency Directive 2012

The Energy Efficiency Directive 2012/27/EU (abbreviated EED) is a European Union directive which mandates energy efficiency improvements within the European Union. It was approved on 25 October 2012 and entered into force on 4 December 2012. The directive introduces legally binding measures to encourage efforts to use energy more efficiently in all stages and sectors of the supply chain. It establishes a common framework for the promotion of energy efficiency within the EU in order to meet its energy efficiency headline target of 20% by 2020. It also paves the way for further improvements thereafter. The directive provides for the establishment of indicative national energy efficiency targets for 2020. Member states were to have submitted their National Energy Efficiency Action Plans (NEEAP) by 30 April 2014, outlining the measures they have implemented to improve energy efficiency and their expected and/or achieved energy savings. In addition, member states are r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

EU Renewable Energy Directive 2009/28/EC

The Renewable Energy Directive 20182018/2001 is a Directive in EU law that requires 32 percent of the energy consumed within the European Union to be renewable by 2030. This target is pooled among the member states. Background Before the 2009 version of the Directive, EU leaders had already reached agreement in March 2007 that, in principle, 20% of the bloc's final energy consumption should be produced from renewable energy sources by 2020 as part of its drive to cut carbon dioxide emissions. This policy later became part of the EU2020 Energy Strategy dated 10 November 2010. The key objectives of the strategy are to reduce carbon dioxide emissions by 20%, to increase the share of renewable energy to 20%, and to achieve energy savings of 20% or more. The targets are mutually dependent. The draft report on the directive was published by the European Commission in January 2008. Claude Turmes served as rapporteur on the draft. Members states were obliged to notify the European C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Energy Efficiency In Europe (study)

The Energy efficiency in Europe study is part of the Odyssee project. It aims to monitor energy efficiency progress and -reduction for the EU-28 countries and Norway, understand the energy demand trends for European countries, compare the countries in their relative energy efficiency performance, as well as to benchmark values, measuring the contribution of innovative energy efficiency and renewables technologies to the Lisbon targets to make Europe more competitive and analyse and evaluate the performance of energy efficiency policies in the different EU Member States and at EU level. The ODYSSEE MURE is a program coordinated by ADEME and supported under the Intelligent Energy Europe Programme of the European Commission. Energy efficiency is at the heart of the EU's Europe 2020 Strategy for smart, sustainable and inclusive growth and of the transition to a resource efficient economy. According to EU Commission the EU needs to act now (2011) to get on track to achieve its tar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aviation Taxation And Subsidies

Aviation taxation and subsidies includes taxes and subsidies related to aviation. Taxation is one of several methods to mitigate the environmental impact of aviation. Types of taxes * Airport improvement fee, paid by passengers to the airport or government * Air passenger taxes, paid by passengers to the government for environmental reasons; may be variable by distance and includes domestic flights ** Departure tax, paid by passengers leaving the country to the government (sometimes also applies outside of aviation) * Jet fuel tax, paid by airline companies to the government for the jet fuel (kerosene) they burn * Landing fee, paid by airline companies to the airports they land on * Solidarity tax on airplane tickets (Chirac Tax), paid by passengers to Unitaid, a global health initiative against HIV/AIDS, malaria and tuberculosis Fuel taxes According to the Amsterdam-based international environmental organisation Friends of the Earth (2005), aviation does not pay tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Green Deal

The European Green Deal, approved 2020, is a set of policy initiatives by the European Commission with the overarching aim of making the European Union (EU) climate neutral in 2050. An impact assessed plan will also be presented to increase the EU's greenhouse gas emission reductions target for 2030 to at least 50% and towards 55% compared with 1990 levels. The plan is to review each existing law on its climate merits, and also introduce new legislation on the circular economy, building renovation, biodiversity, farming and innovation. The president of the European Commission, Ursula von der Leyen, stated that the European Green Deal would be Europe's "man on the moon moment". Von der Leyen appointed Frans Timmermans as Executive Vice President of the European Commission for the European Green Deal. On 13 December 2019, the European Council decided to press ahead with the plan, with an opt-out for Poland. On 15 January 2020, the European Parliament voted to support the deal as we ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amendment

An amendment is a formal or official change made to a law, contract, constitution, or other legal document. It is based on the verb to amend, which means to change for better. Amendments can add, remove, or update parts of these agreements. They are often used when it is better to change the document than to write a new one. Only the legislative branch is involved in the amendment process. Contracts Contracts are often amended when the market changes. For example, a contract to deliver something to a customer once a month can be amended if the customer wants it delivered once a week. Usually Contracts also are categorized for their promotion in a nation, such as the Treaty of Versailles. Law Legislation In parliamentary procedure, a motion is a proposal to do something. The wording of such a proposal can be changed with a motion to amend. Amendments can remove words, add words, or change words in motions. All main motions and some secondary motions can be amended. An ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |