|

Extreme Risk

Extreme risks are risks of very bad outcomes or "high consequence", but of low probability. They include the risks of terrorist attack, biosecurity risks such as the invasion of pests, and extreme natural disasters such as major earthquakes. Introduction The estimation of the probability of extreme events is difficult because of the lack of data: they are events that have not yet happened or have happened only very rarely, so relevant data are scarce. Thus standard statistical methods are generally inapplicable. Extreme value theory If there is some relevant data, the probability of events at or beyond the range of the data may be estimated by the statistical methods of extreme value theory, developed for such purposes as predicting 100-year floods from a limited range of data of past floods. In such cases a mathematical function may be fitted to the data and extrapolated beyond the range of the data to estimate the probability of extreme events. The results need to be treated ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Probability

Probability is the branch of mathematics concerning numerical descriptions of how likely an Event (probability theory), event is to occur, or how likely it is that a proposition is true. The probability of an event is a number between 0 and 1, where, roughly speaking, 0 indicates impossibility of the event and 1 indicates certainty."Kendall's Advanced Theory of Statistics, Volume 1: Distribution Theory", Alan Stuart and Keith Ord, 6th Ed, (2009), .William Feller, ''An Introduction to Probability Theory and Its Applications'', (Vol 1), 3rd Ed, (1968), Wiley, . The higher the probability of an event, the more likely it is that the event will occur. A simple example is the tossing of a fair (unbiased) coin. Since the coin is fair, the two outcomes ("heads" and "tails") are both equally probable; the probability of "heads" equals the probability of "tails"; and since no other outcomes are possible, the probability of either "heads" or "tails" is 1/2 (which could also be written ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Global Catastrophic Risk

A global catastrophic risk or a doomsday scenario is a hypothetical future event that could damage human well-being on a global scale, even endangering or destroying modern civilization. An event that could cause human extinction or permanently and drastically curtail humanity's potential is known as an "existential risk." Over the last two decades, a number of academic and non-profit organizations have been established to research global catastrophic and existential risks, formulate potential mitigation measures and either advocate for or implement these measures. Definition and classification Defining global catastrophic risks The term global catastrophic risk "lacks a sharp definition", and generally refers (loosely) to a risk that could inflict "serious damage to human well-being on a global scale". Humanity has suffered large catastrophes before. Some of these have caused serious damage but were only local in scope—e.g. the Black Death may have resulted in the de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Invasive Species

An invasive species otherwise known as an alien is an introduced organism that becomes overpopulated and harms its new environment. Although most introduced species are neutral or beneficial with respect to other species, invasive species adversely affect habitats and bioregions, causing ecological, environmental, and/or economic damage. The term can also be used for native species that become harmful to their native environment after human alterations to its food webfor example the purple sea urchin (''Strongylocentrotus purpuratus'') which has decimated kelp forests along the northern California coast due to overharvesting of its natural predator, the California sea otter (''Enhydra lutris''). Since the 20th century, invasive species have become a serious economic, social, and environmental threat. Invasion of long-established ecosystems by organisms is a natural phenomenon, but human-facilitated introductions have greatly increased the rate, scale, and geographic range of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cognitive Bias

A cognitive bias is a systematic pattern of deviation from norm or rationality in judgment. Individuals create their own "subjective reality" from their perception of the input. An individual's construction of reality, not the objective input, may dictate their behavior in the world. Thus, cognitive biases may sometimes lead to perceptual distortion, inaccurate judgment, illogical interpretation, or what is broadly called irrationality. Although it may seem like such misperceptions would be aberrations, biases can help humans find commonalities and shortcuts to assist in the navigation of common situations in life. Some cognitive biases are presumably adaptive. Cognitive biases may lead to more effective actions in a given context. Furthermore, allowing cognitive biases enables faster decisions which can be desirable when timeliness is more valuable than accuracy, as illustrated in heuristics. Other cognitive biases are a "by-product" of human processing limitations, resulting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Federal Reserve System

The Federal Reserve System (often shortened to the Federal Reserve, or simply the Fed) is the central banking system of the United States of America. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics (particularly the panic of 1907) led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System. U.S. Congress, Congress established three key objectives for monetary policy in the Federal Reserve Act: maximizing employment, stabilizing prices, and moderating long-term interest rates. The first two objectives are sometimes referred to as the Federal Reserve's dual mandate. Its duties have expanded over the years, and currently also include supervising and bank regulation, regulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Regulation

Bank regulation is a form of government regulation which subjects banks to certain requirements, restrictions and guidelines, designed to create market transparency between banking institutions and the individuals and corporations with whom they conduct business, among other things. As regulation focusing on key factors in the financial markets, it forms one of the three components of financial law, the other two being case law and self-regulating market practices. Given the interconnectedness of the banking industry and the reliance that the national (and global) economy hold on banks, it is important for regulatory agencies to maintain control over the standardized practices of these institutions. Another relevant example for the interconnectedness is that the law of financial industries or financial law focuses on the financial (banking), capital, and insurance markets. Supporters of such regulation often base their arguments on the "too big to fail" notion. This holds that ma ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

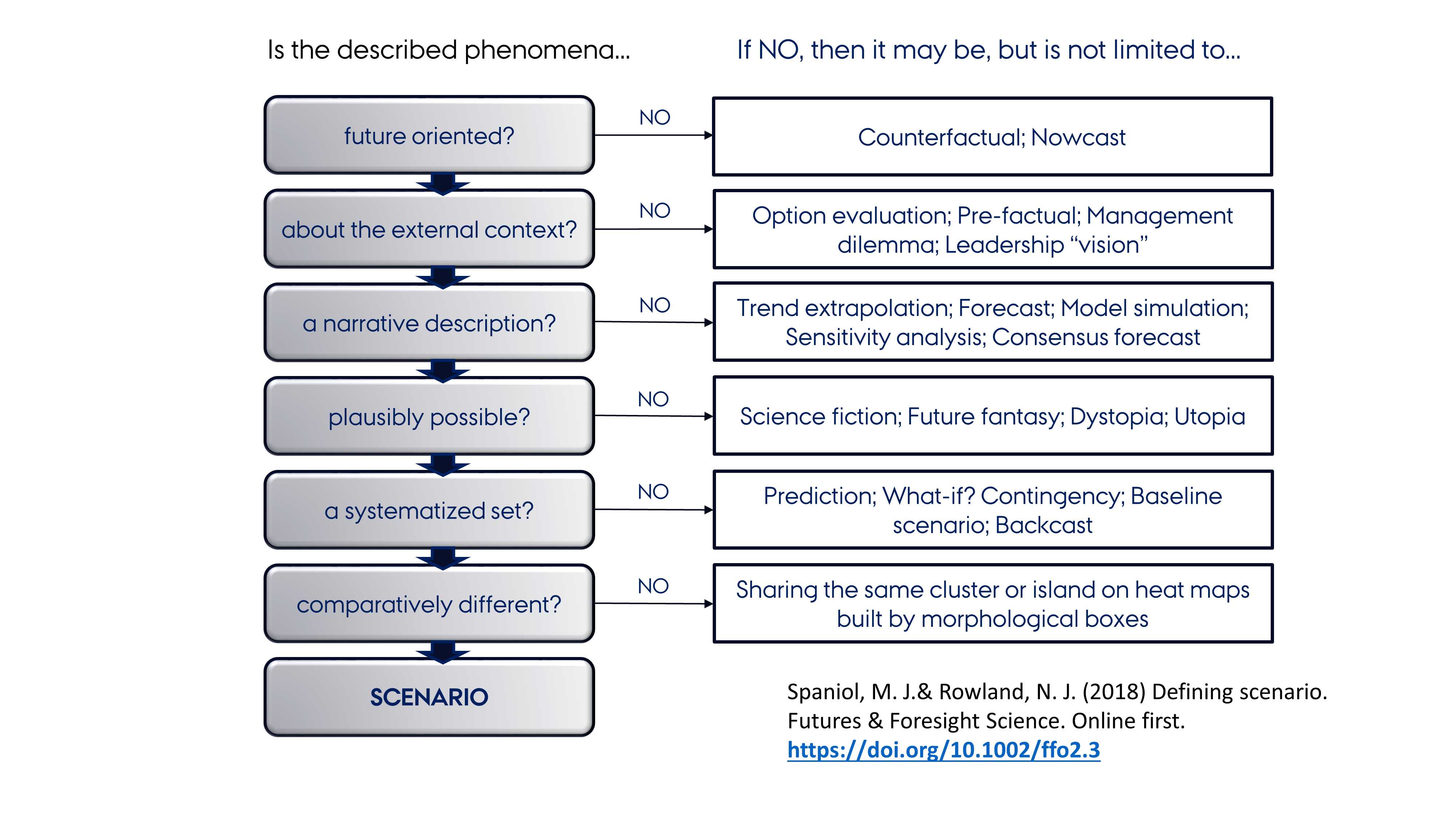

Scenario Analysis

Scenario planning, scenario thinking, scenario analysis, scenario prediction and the scenario method all describe a strategic planning method that some organizations use to make flexible long-term plans. It is in large part an adaptation and generalization of classic methods used by military intelligence. In the most common application of the method, analysts generate simulation games for policy makers. The method combines known facts, such as demographics, geography and mineral reserves, with military, political, and industrial information, and key driving forces identified by considering social, technical, economic, environmental, and political ("STEEP") trends. In business applications, the emphasis on understanding the behavior of opponents has been reduced while more attention is now paid to changes in the natural environment. At Royal Dutch Shell for example, scenario planning has been described as changing mindsets about the exogenous part of the world prior to formulating ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Basel II

Basel II is the second of the Basel Accords, which are recommendations on banking laws and regulations issued by the Basel Committee on Banking Supervision. It is now extended and partially superseded by Basel III. The Basel II Accord was published in June 2004. It was a new framework for international banking standards, superseding the Basel I framework, to determine the minimum capital that banks should hold to guard against the financial and operational risks. The regulations aimed to ensure that the more significant the risk a bank is exposed to, the greater the amount of capital the bank needs to hold to safeguard its solvency and overall economic stability. Basel II attempted to accomplish this by establishing risk and capital management requirements to ensure that a bank has adequate capital for the risk the bank exposes itself to through its lending, investment and trading activities. One focus was to maintain sufficient consistency of regulations so to limit competitive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bank Fraud

Bank fraud is the use of potentially illegal means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently posing as a bank or other financial institution. In many instances, bank fraud is a criminal offence. While the specific elements of particular banking fraud laws vary depending on jurisdictions, the term bank fraud applies to actions that employ a scheme or artifice, as opposed to bank robbery or theft. For this reason, bank fraud is sometimes considered a white-collar crime. Types of bank fraud Accounting fraud In order to hide serious financial problems, some businesses have been known to use fraudulent bookkeeping to overstate sales and income, inflate the worth of the company's assets, or state a profit when the company is operating at a loss. These tampered records are then used to seek investment in the company's bond or security issues or to make fraudulent loan applications in a final ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Risk

Market risk is the risk of losses in positions arising from movements in market variables like prices and volatility. There is no unique classification as each classification may refer to different aspects of market risk. Nevertheless, the most commonly used types of market risk are: * ''Equity risk'', the risk that stock or stock indices (e.g. Euro Stoxx 50, etc.) prices or their implied volatility will change. * ''Interest rate risk'', the risk that interest rates (e.g. Libor, Euribor, etc.) or their implied volatility will change. * ''Currency risk'', the risk that foreign exchange rates (e.g. EUR/USD, EUR/GBP, etc.) or their implied volatility will change. * ''Commodity risk'', the risk that commodity prices (e.g. corn, crude oil) or their implied volatility will change. * '' Margining risk'' results from uncertain future cash outflows due to margin calls covering adverse value changes of a given position. * ''Shape risk'' * '' Holding period risk'' * ''Basis risk'' The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Terrorist

Terrorism, in its broadest sense, is the use of criminal violence to provoke a state of terror or fear, mostly with the intention to achieve political or religious aims. The term is used in this regard primarily to refer to intentional violence during peacetime or in the context of war against non-combatants (mostly civilians and neutral military personnel). The terms "terrorist" and "terrorism" originated during the French Revolution of the late 18th century but became widely used internationally and gained worldwide attention in the 1970s during the Troubles in Northern Ireland, the Basque conflict, and the Israeli–Palestinian conflict. The increased use of suicide attacks from the 1980s onwards was typified by the 2001 September 11 attacks in the United States. There are various different definitions of terrorism, with no universal agreement about it. Terrorism is a charged term. It is often used with the connotation of something that is "morally wrong". Governments a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |