|

Exchangeable Bond

Exchangeable bond (or XB) is a type of hybrid security consisting of a straight bond and an embedded option to exchange the bond for the stock of a company other than the issuer (usually a subsidiary or company in which the issuer owns a stake) at some future date and under prescribed conditions. An exchangeable bond is different from a convertible bond In finance, a convertible bond, convertible note, or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in .... A convertible bond gives the holder the option to convert bond into shares of the issuer. The pricing of an exchangeable bond is similar to that of convertible bond, splitting it in straight debt part and an embedded option part and valuing the two separately. Pricing Price of exchangeable bond = price of straight bond + price of option to exchange * Price of an exchangeable bon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hybrid Security

Hybrid securities are a broad group of securities that combine the characteristics of the two broader groups of securities, debt and equity. Hybrid securities pay a predictable (either fixed or floating) rate of return or dividend until a certain date, at which point the holder has a number of options, including converting the securities into the underlying share. Therefore, unlike with a share of stock (equity), the holder enjoys a predetermined (rather than residual) cash flow, and, unlike with a fixed interest security (debt), the holder enjoys an option to convert the security to the underlying equity. Other common examples include convertible and converting preference shares. A hybrid security is structured differently than fixed-interest securities. While the price of some securities behaves more like that of fixed-interest securities, others behave more like the underlying shares into which they may convert. Examples *A convertible bond is a bond (''i.e.'' a loan t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bond (finance)

In finance, a bond is a type of Security (finance), security under which the issuer (debtor) owes the holder (creditor) a debt, and is obliged – depending on the terms – to provide cash flow to the creditor (e.g. repay the principal (i.e. amount borrowed) of the bond at the Maturity (finance), maturity date and interest (called the coupon (bond), coupon) over a specified amount of time.) The timing and the amount of cash flow provided varies, depending on the economic value that is emphasized upon, thus giving rise to different types of bonds. The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Thus, a bond is a form of loan or IOU. Bonds provide the borrower with external funds to finance long-term investments or, in the case of government bonds, to finance current expenditure. Bonds and Share capital, stocks are both Security (finance), securities, but the major difference between the two is that (capital) stockholders h ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Embedded Option

An embedded option is a component of a financial bond or other security, which provides the bondholder or the issuer the right to take some action against the other party. There are several types of options that can be embedded into a bond; common types of bonds with embedded options include callable bond, puttable bond, convertible bond, extendible bond, exchangeable bond, and capped floating rate note. A bond may have several options embedded if they are not mutually exclusive. Securities other than bonds that may have embedded options include senior equity, convertible preferred stock and exchangeable preferred stock. See Convertible security. The valuation of these securities couples bond- or equity-valuation, as appropriate, with option pricing. For bonds here, there are two main approaches, as follows. [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

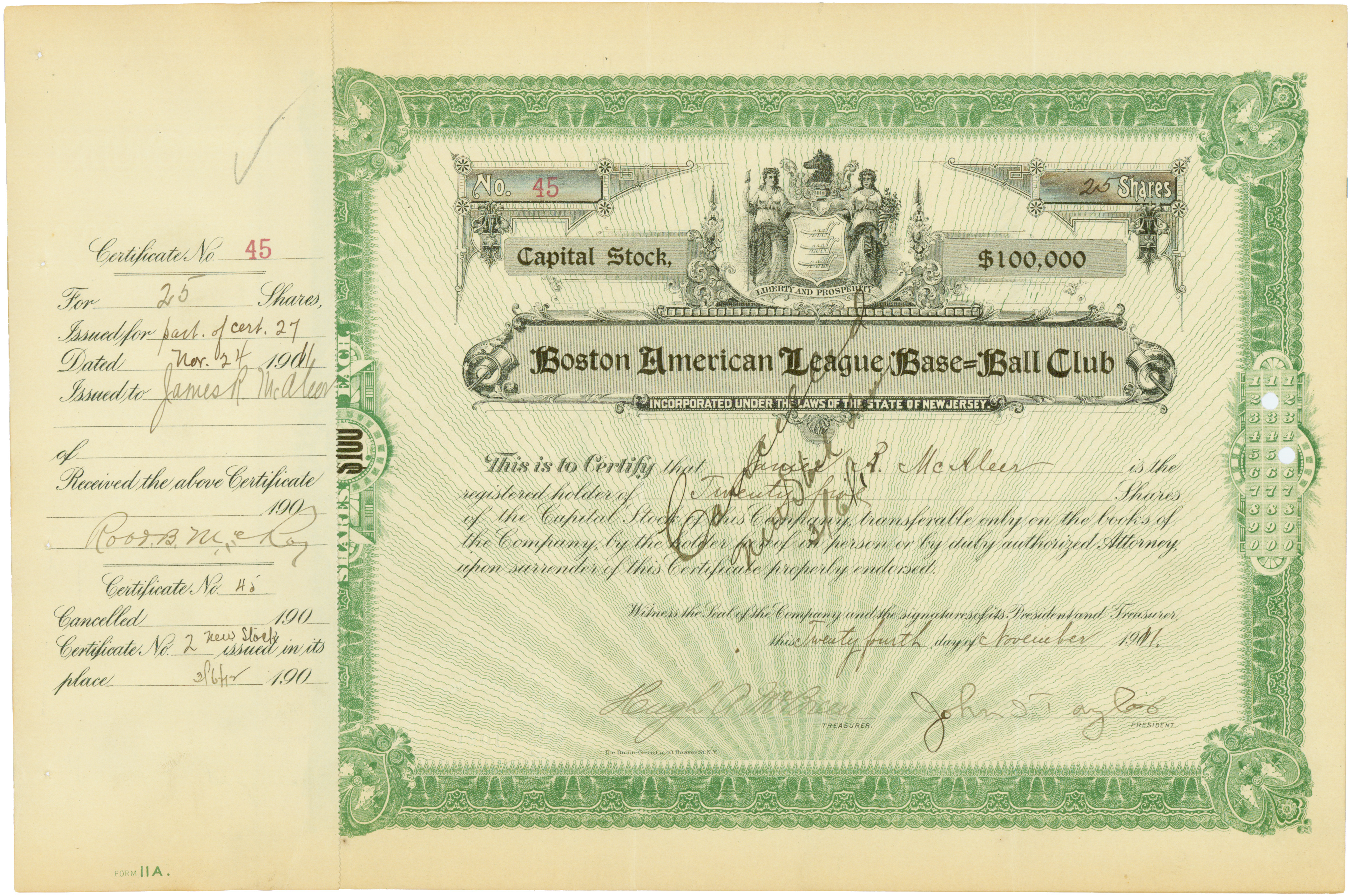

Share Capital

A corporation's share capital, commonly referred to as capital stock in the United States, is the portion of a corporation's equity that has been derived by the issue of shares in the corporation to a shareholder, usually for cash. ''Share capital'' may also denote the number and types of shares that compose a corporation's share structure. Definition In accounting, the share capital of a corporation is the nominal value of issued shares (that is, the sum of their par values, sometimes indicated on share certificates). If the allocation price of shares is greater than the par value, as in a rights issue, the shares are said to be sold at a premium (variously called share premium, additional paid-in capital or paid-in capital in excess of par). This equation shows the constituents that make up a company's real share capital: : \sum\text \times \text This is differentiated from share capital in the accounting sense, as it presents nominal share capital and does not take t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subsidiary

A subsidiary, subsidiary company, or daughter company is a company (law), company completely or partially owned or controlled by another company, called the parent company or holding company, which has legal and financial control over the subsidiary company. Unlike regional branches or divisions, subsidiaries are considered to be distinct entities from their parent companies; they are required to follow the laws of where they are incorporated, and they maintain their own executive leadership. Two or more subsidiaries primarily controlled by same entity/group are considered to be sister companies of each other. Subsidiaries are a common feature of modern business, and most multinational corporations organize their operations via the creation and purchase of subsidiary companies. Examples of holding companies are Berkshire Hathaway, Jefferies Financial Group, The Walt Disney Company, Warner Bros. Discovery, and Citigroup, which have subsidiaries involved in many different Industry (e ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Convertible Bond

In finance, a convertible bond, convertible note, or convertible debt (or a convertible debenture if it has a maturity of greater than 10 years) is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value. It is a hybrid security with debt- and equity-like features. It originated in the mid-19th century, and was used by early speculators such as Jacob Little and Daniel Drew to counter market cornering. Convertible bonds are also considered debt security because the companies agree to give fixed or floating interest rate as they do in common bonds for the funds of investor. To compensate for having additional value through the option to convert the bond to stock, a convertible bond typically has a coupon rate lower than that of similar, non-convertible debt. The investor receives the potential upside of conversion into equity while protecting downside with cash flow from the coupon payments a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Income Analysis

Fixed income analysis is the process of determining the value of a debt security based on an assessment of its risk profile, which can include interest rate risk, risk of the issuer failing to repay the debt, market supply and demand for the security, call provisions and macroeconomic considerations affecting its value in the future. Based on such an analysis, a fixed income analyst tries to reach a conclusion as to whether to buy, sell, hold, hedge or avoid the particular security. Fixed income products are generally bonds: debt instruments requiring the issuer (i.e. the debtor or borrower) to repay the lender the amount borrowed (principal) plus interest over a specified period of time (coupon payments) until maturity. They are issued by government treasuries, government agencies, companies or international organizations. Calculating Value To determine the value of a fixed income security, the analyst must estimate the expected cash flows from the investment and the approp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Debt

Debt is an obligation that requires one party, the debtor, to pay money Loan, borrowed or otherwise withheld from another party, the creditor. Debt may be owed by a sovereign state or country, local government, company, or an individual. Commercial debt is generally subject to contractual terms regarding the amount and timing of repayments of #Principal, principal and interest. Loans, bond (finance), bonds, notes, and Mortgage loan, mortgages are all types of debt. In financial accounting, debt is a type of financial transaction, as distinct from equity (finance), equity. The term can also be used metaphorically to cover morality, moral obligations and other interactions not based on a monetary value. For example, in Western cultures, a person who has been helped by a second person is sometimes said to owe a "debt of gratitude" to the second person. Etymology The English term "debt" was first used in the late 13th century and comes by way of Old French from the Latin verb ' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Commercial Bonds

Commercial may refer to: * (adjective for) commerce, a system of voluntary exchange of products and services ** (adjective for) trade, the trading of something of economic value such as goods, services, information or money * a dose of advertising conveyed through media (such as radio or television) ** Radio advertisement ** Television advertisement * Two functional constituencies in elections for the Legislative Council of Hong Kong: **Commercial (First) **Commercial (Second) * ''Commercial'' (album), a 2009 album by Los Amigos Invisibles * Commercial broadcasting * Commercial style or early Chicago school, an American architectural style * Commercial Drive, Vancouver, a road in Vancouver, British Columbia, Canada * Commercial Township, New Jersey, in Cumberland County, New Jersey See also * * Comercial (other), Spanish and Portuguese word for the same thing * Commercialism Commercialism is the application of both manufacturing and consumption towards personal usag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |