|

Exchange For ETF

In finance, an exchange for ETF (EFETF) transaction is one in which ETF units are exchanged for futures contracts which have the same underlying index; this is usually any of the broad based equity indices in North America, Europe, and Asia for which there is a liquid future available. Typical indices are S&P, FTSE, DAX, CAC 40 The CAC 40 (french: CAC quarante ) (''Cotation Assistée en Continu'') is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the E .... It is similar to an exchange for physical (EFP) in which the constituent basket of stocks is exchanged for a futures contract. Usually traded via a broker who will cross the futures on exchange, this is a way for ETF market makers to manage their inventories in ETF positions which they have hedged with futures References Futures markets Derivatives (finance) {{finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange-traded Fund

An exchange-traded fund (ETF) is a type of investment fund and exchange-traded product, i.e. they are traded on stock exchanges. ETFs are similar in many ways to mutual funds, except that ETFs are bought and sold from other owners throughout the day on stock exchanges whereas mutual funds are bought and sold from the issuer based on their price at day's end. An ETF holds assets such as stocks, bonds, currencies, futures contracts, and/or commodities such as gold bars, and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, although deviations can occasionally occur. Most ETFs are index funds: that is, they hold the same securities in the same proportions as a certain stock market index or bond market index. The most popular ETFs in the U.S. replicate the S&P 500, the total market index, the NASDAQ-100 index, the price of gold, the "growth" stocks in the Russell 1000 Index, or the index of the largest technology companies. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Contracts

In finance, a futures contract (sometimes called a futures) is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the ''forward price''. The specified time in the future when delivery and payment occur is known as the ''delivery date''. Because it derives its value from the value of the underlying asset, a futures contract is a derivative. Contracts are traded at futures exchanges, which act as a marketplace between buyers and sellers. The buyer of a contract is said to be the long position holder and the selling party is said to be the short position holder. As both parties risk their counter-party reneging if the price goes against them, the contract may involve both parties lodging as security a margin of the value of the contract with a m ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Standard & Poor's

S&P Global Ratings (previously Standard & Poor's and informally known as S&P) is an American credit rating agency (CRA) and a division of S&P Global that publishes financial research and analysis on stocks, bonds, and commodities. S&P is considered the largest of the Big Three credit-rating agencies, which also include Moody's Investors Service and Fitch Ratings. Its head office is located on 55 Water Street in Lower Manhattan, New York City. History The company traces its history back to 1860, with the publication by Henry Varnum Poor of ''History of Railroads and Canals in the United States''. This book compiled comprehensive information about the financial and operational state of U.S. railroad companies. In 1868, Henry Varnum Poor established H.V. and H.W. Poor Co. with his son, Henry William Poor, and published two annually updated hardback guidebooks, ''Poor's Manual of the Railroads of the United States'' and ''Poor's Directory of Railway Officials''. In 1906, Lu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

FTSE 100 Index

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie" , is a share index of the 100 companies listed on the London Stock Exchange with (in principle) the highest market capitalisation. The index is maintained by the FTSE Group, a subsidiary of the London Stock Exchange Group. Overview The index is maintained by the FTSE Group, now a wholly owned subsidiary of the London Stock Exchange, which originated as a joint venture between the ''Financial Times'' and the London Stock Exchange. It is calculated in real time and published every second when the market is open. The FTSE 100 Index was launched on 3 January 1984. The market capitalisation weighted FTSE 100 index replaced the price-weighted FT30 Index as the performance benchmark for most investors. The FTSE 100 broadly consists of the largest 100 qualifying UK companies by full market value. The total market value of a company is calculated by multiply ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CAC 40

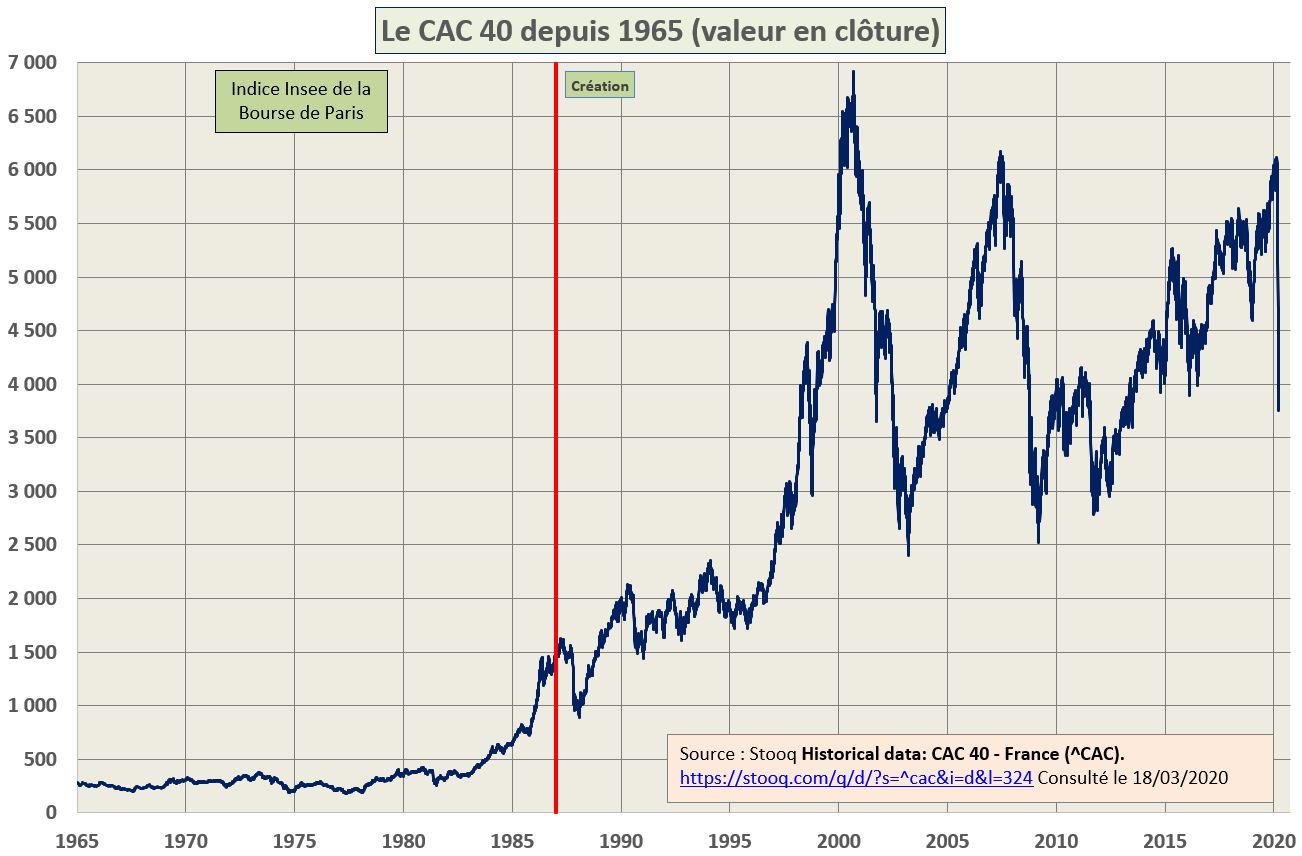

The CAC 40 (french: CAC quarante ) (''Cotation Assistée en Continu'') is a benchmark French stock market index. The index represents a capitalization-weighted measure of the 40 most significant stocks among the 100 largest market caps on the Euronext Paris (formerly the Paris Bourse). It is a price return index. It is one of the main national indices of the pan-European stock exchange group Euronext alongside Euronext Amsterdam's AEX, Euronext Brussels' BEL20, Euronext Dublin's ISEQ 20, Euronext Lisbon's PSI-20 and the Oslo Bors OBX Index. History The CAC 40 takes its name from the Paris Bourse's early automation system Cotation Assistée en Continu (''Continuous Assisted Quotation''). Its base value of 1,000 was set on 31 December 1987, equivalent to a market capitalisation of 370,437,433,957.70 French francs. On 1 December 2003, the index's weighting system switched from being dependent on total market capitalisation to free float market cap only, in line with other leading ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Exchange Of Futures For Physicals

In finance, an exchange of futures for physicals (EFP) is a transaction between two parties in which a futures contract on a commodity In economics, a commodity is an economic good, usually a resource, that has full or substantial fungibility: that is, the market treats instances of the good as equivalent or nearly so with no regard to who produced them. The price of a comm ... is exchanged for the actual physical good. This transaction involves a privately negotiated exchange of a futures position for a corresponding position in the underlying physical. An EFP is similar to an EFS, except that it involves a physical contract rather than a cash swap contract. An EFP gives the market participants the ability to manage risk. References Futures markets Derivatives (finance) {{finance-stub ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hedge (finance)

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts. Public futures markets were established in the 19th century to allow transparent, standardized, and efficient hedging of agricultural commodity prices; they have since expanded to include futures contracts for hedging the values of energy, precious metals, foreign currency, and interest rate fluctuations. Etymology Hedging is the practice of taking a position in one market to offset and balance against the risk adopted by assuming a position in a contrary or opposing market or investment. The word hedge is from Old English ''hecg'', originally any fence, living or artificial. The first known use of the word ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Futures Markets

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)