|

Equity Premium Puzzle

The equity premium puzzle refers to the inability of an important class of economic models to explain the average equity risk premium (ERP) provided by a diversified portfolio of U.S. equities over that of U.S. Treasury Bills, which has been observed for more than 100 years. There is significant disparity between returns produced by stocks compared to returns produced by government treasury bills. The equity premium puzzle addresses the difficulty in understanding and explaining this disparity. This disparity is calculated using the equity risk premium: The equity risk premium is equal to the difference between equity returns and returns from government bonds. It is equal to around 5% to 8% in the United States. The risk premium represents the compensation awarded to the equity holder for taking on a higher risk by investing in equities rather than government bonds. However, the 5% to 8% premium is considered to be an implausibly high difference and the equity premium puzzle ref ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Premium

A risk premium is a measure of excess return that is required by an individual to compensate being subjected to an increased level of risk. It is used widely in finance and economics, the general definition being the expected risky return less the risk-free return, as demonstrated by the formula below. Risk \ premium = E(r) - r_f Where E(r) is the risky expected rate of return and r_f is the risk-free return. The inputs for each of these variables and the ultimate interpretation of the risk premium value differs depending on the application as explained in the following sections. Regardless of the application, the market premium can be volatile as both comprising variables can be impacted independent of each other by both cyclical and abrupt changes. This means that the market premium is dynamic in nature and ever-changing. Additionally, a general observation regardless of application is that the risk premium is larger during economic downturns and during periods of increased ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Intertemporal Consumption

Economic theories of intertemporal consumption seek to explain people's preferences in relation to consumption and saving over the course of their lives. The earliest work on the subject was by Irving Fisher and Roy Harrod, who described 'hump saving', hypothesizing that savings would be highest in the middle years of a person's life as they saved for retirement. In the 1950s, more well-defined models were built on discounted utility theory and approached the question of inter-temporal consumption as a lifetime income optimization problem. Solving this problem mathematically, assuming that individuals are rational and have access to complete markets, Modigliani & Brumberg (1954), Albert Ando, and Milton Friedman (1957) developed what became known as the life-cycle model. See for details. The life-cycle model of consumption suggests that consumption is based on average lifetime income instead of income at any given age. First, young people borrow to consume more than their ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Market Bubble

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. Bubbles occur not only in real-world markets, with their inherent uncertainty and noise, but also in highly predictable experimental markets. In the laboratory, uncertainty is eliminated and calculating the expected returns should be a simple mathematical exercise, because participants are endowed with assets that are defined to have a finite lifespan and a known probability distribution of dividends . Other theoretical explanations of stock market bubbles have suggested that they are rational, intrinsic, and contagious. History Historically, early stock market bubbles and crashes have their roots in financial activities of the 17th-century Dutch Republic, the birthpl ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Black Swan Theory

The black swan theory or theory of black swan events is a metaphor that describes an event that comes as a surprise, has a major effect, and is often inappropriately rationalized after the fact with the benefit of hindsight. The term is based on an ancient saying that presumed black swans did not exist a saying that became reinterpreted to teach a different lesson after they were discovered in Australia. The theory was developed by Nassim Nicholas Taleb, starting in 2001, to explain: # The disproportionate role of high-profile, hard-to-predict, and rare events that are beyond the realm of normal expectations in history, science, finance, and technology. # The non-computability of the probability of consequential rare events using scientific methods (owing to the very nature of small probabilities). # The psychological biases that blind people, both individually and collectively, to uncertainty and a rare event's massive role in historical affairs. Taleb's "black swan theory" ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Survivorship Bias

Survivorship bias or survival bias is the logical error of concentrating on entities that passed a selection process while overlooking those that did not. This can lead to incorrect conclusions because of incomplete data. Survivorship bias is a form of selection bias that can lead to overly optimistic beliefs because multiple failures are overlooked, such as when companies that no longer exist are excluded from analyses of financial performance. It can also lead to the false belief that the successes in a group have some special property, rather than just coincidence as in correlation "proves" causality. Another kind of survivorship bias would involve thinking that an incident was not all that dangerous because the only people who were involved in the incident who can speak about it are those who survived it. Even if one knew that some people are dead, they would not have their voice to add to the conversation, leading to bias in the conversation. As a general experimental ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Selection Bias

Selection bias is the bias introduced by the selection of individuals, groups, or data for analysis in such a way that proper randomization is not achieved, thereby failing to ensure that the sample obtained is representative of the population intended to be analyzed. It is sometimes referred to as the selection effect. The phrase "selection bias" most often refers to the distortion of a statistical analysis, resulting from the method of collecting samples. If the selection bias is not taken into account, then some conclusions of the study may be false. Types Sampling bias Sampling bias is systematic error due to a non- random sample of a population, causing some members of the population to be less likely to be included than others, resulting in a biased sample, defined as a statistical sample of a population (or non-human factors) in which all participants are not equally balanced or objectively represented. It is mostly classified as a subtype of selection bias, sometimes sp ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

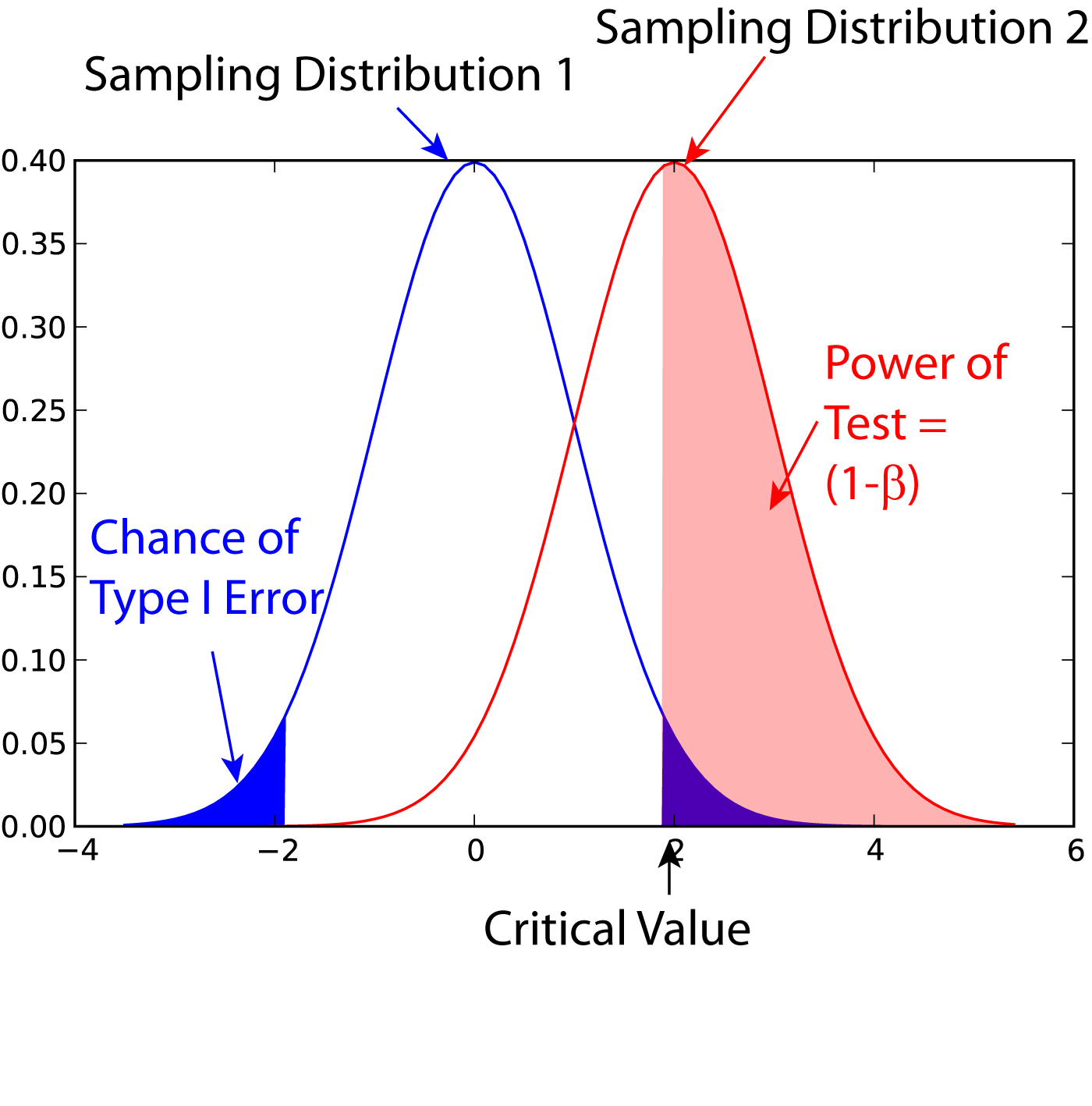

Statistical Power

In statistics, the power of a binary hypothesis test is the probability that the test correctly rejects the null hypothesis (H_0) when a specific alternative hypothesis (H_1) is true. It is commonly denoted by 1-\beta, and represents the chances of a true positive detection conditional on the actual existence of an effect to detect. Statistical power ranges from 0 to 1, and as the power of a test increases, the probability \beta of making a type II error by wrongly failing to reject the null hypothesis decreases. Notation This article uses the following notation: * ''β'' = probability of a Type II error, known as a "false negative" * 1 − ''β'' = probability of a "true positive", i.e., correctly rejecting the null hypothesis. "1 − ''β''" is also known as the power of the test. * ''α'' = probability of a Type I error, known as a "false positive" * 1 − ''α'' = probability of a "true negative", i.e., correctly not rejecting the null hypothesis Description For a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

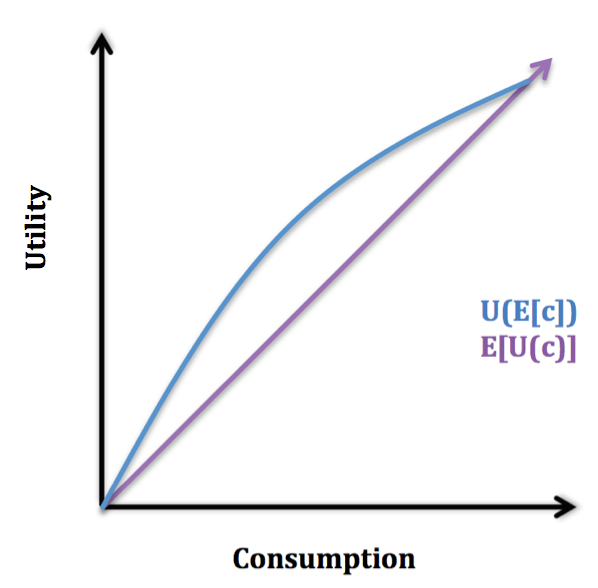

Consumption Smoothing

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life. Since income tends to be hump-shaped across an individual's life, economic theory suggests that individuals should on average have low or negative savings rate at early stages in their life, high in middle age, and negative during retirement. Although many popular books on personal finance advocate that individuals should at all stages of their life set aside money in savings, economist James Choi states that this deviates from the advice of economists. Expected utility model The graph below illustrates the expected utility model, in which U(c) is increasing in and co ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Transaction Cost

In economics and related disciplines, a transaction cost is a cost in making any economic trade when participating in a market. Oliver E. Williamson defines transaction costs as the costs of running an economic system of companies, and unlike production costs, decision-makers determine strategies of companies by measuring transaction costs and production costs. Transaction costs are the total costs of making a transaction, including the cost of planning, deciding, changing plans, resolving disputes, and after-sales. Therefore, the transaction cost is one of the most significant factors in business operation and management. Oliver E. Williamson's ''Transaction Cost Economics'' popularized the concept of transaction costs. Douglass C. North argues that institutions, understood as the set of rules in a society, are key in the determination of transaction costs. In this sense, institutions that facilitate low transaction costs, boost economic growth.North, Douglass C. 1992. “Tran ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Moral Hazard

In economics, a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk. For example, when a corporation is insured, it may take on higher risk knowing that its insurance will pay the associated costs. A moral hazard may occur where the actions of the risk-taking party change to the detriment of the cost-bearing party after a financial transaction has taken place. Moral hazard can occur under a type of information asymmetry where the risk-taking party to a transaction knows more about its intentions than the party paying the consequences of the risk and has a tendency or incentive to take on too much risk from the perspective of the party with less information. One example is a principal–agent problem, where one party, called an agent, acts on behalf of another party, called the principal. If the agent has more information about his or her actions or intentions than the princi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Adverse Selection

In economics, insurance, and risk management, adverse selection is a market situation where buyers and sellers have different information. The result is that participants with key information might participate selectively in trades at the expense of other parties who do not have the same information. In an ideal world, buyers should pay a price which reflects their willingness to pay and the value to them of the product or service, and sellers should sell at a price which reflects the quality of their goods and services. For example, a poor quality product should be inexpensive and a high quality product should have a high price. However, when one party holds information that the other party does not have, they have the opportunity to damage the other party by maximising self-utility, concealing relevant information, and perhaps even lying. Taking advantage of undisclosed information in an economic contract or trade of possession is known as adverse selection. This opportunity ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Failure

In neoclassical economics, market failure is a situation in which the allocation of goods and services by a free market is not Pareto efficient, often leading to a net loss of economic value. Market failures can be viewed as scenarios where individuals' pursuit of pure self-interest leads to results that are not efficient – that can be improved upon from the societal point of view. Paul Krugman and Robin Wells (2006). ''Economics'', New York, Worth Publishers. The first known use of the term by economists was in 1958,Francis M. Bator (1958). "The Anatomy of Market Failure," ''Quarterly Journal of Economics'', 72(3) pp351–379(press +). but the concept has been traced back to the Victorian philosopher Henry Sidgwick.Steven G. Medema (2007). "The Hesitant Hand: Mill, Sidgwick, and the Evolution of the Theory of Market Failure," ''History of Political Economy'', 39(3), p. 331��358. 200Online Working Paper. Market failures are often associated with public goods, time-incon ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |