|

Efficient Market

The efficient-market hypothesis (EMH) is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to "beat the market" consistently on a risk-adjusted basis since market prices should only react to new information. Because the EMH is formulated in terms of risk adjustment, it only makes testable predictions when coupled with a particular model of risk. As a result, research in financial economics since at least the 1990s has focused on market anomalies, that is, deviations from specific models of risk. The idea that financial market returns are difficult to predict goes back to Bachelier, Mandelbrot, and Samuelson, but is closely associated with Eugene Fama, in part due to his influential 1970 review of the theoretical and empirical research. The EMH provides the basic logic for modern risk-based theories of asset prices, and frameworks such as consumption-based asset pricing and int ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ball Brown Martineau V2

A ball is a round object (usually spherical, but can sometimes be ovoid) with several uses. It is used in ball games, where the play of the game follows the state of the ball as it is hit, kicked or thrown by players. Balls can also be used for simpler activities, such as catch or juggling. Balls made from hard-wearing materials are used in engineering applications to provide very low friction bearings, known as ball bearings. Black-powder weapons use stone and metal balls as projectiles. Although many types of balls are today made from rubber, this form was unknown outside the Americas until after the voyages of Columbus. The Spanish were the first Europeans to see the bouncing rubber balls (although solid and not inflated) which were employed most notably in the Mesoamerican ballgame. Balls used in various sports in other parts of the world prior to Columbus were made from other materials such as animal bladders or skins, stuffed with various materials. As balls are one ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jules Regnault

Jules Augustin Frédéric Regnault (; 1 February 1834, Béthencourt – 9 December 1894, Paris) was a French stock broker's assistant who first suggested a modern theory of stock price changes i''Calcul des Chances et Philosophie de la Bourse''(1863), using a random walk model. A key conclusion appears on Page 50: "''l'écart des cours est en raison directe de la racine carrée des temps''", in English: "the deviation of prices is directly proportional to the square root of time". He is also one of the first authors who tried to create a "stock exchange science" based on statistical and probabilistic analysis. His hypotheses were used by Louis Bachelier. Biography During the first years of his life, Jules Regnault lived in the département du Nord (France) where his father worked. When his father died on January 16, 1846, in Paris, his family moved to Brussels, where Odilon, Jules’ brother, became a writer and a student at the Université Libre de Bruxelles in advanced mat ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Overconfidence

Confidence is a state of being clear-headed either that a hypothesis or prediction is correct or that a chosen course of action is the best or most effective. Confidence comes from a Latin word 'fidere' which means "to trust"; therefore, having self-confidence is having trust in one's self. Arrogance or hubris, in comparison, is the state of having unmerited confidence—believing something or someone is correct or capable when evidence or reasons for this belief are lacking. Overconfidence or presumptuousness is excessive belief in someone (or something) succeeding, without any regard for failure. Confidence can be a self-fulfilling prophecy as those without it may fail or not try because they lack it and those with it may succeed because they have it rather than because of an innate ability. The concept of self-confidence is commonly defined as self-assurance in one's personal judgment, ability, power, etc. One's self-confidence increases as a result of experiences of havin ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cognitive Bias

A cognitive bias is a systematic pattern of deviation from norm or rationality in judgment. Individuals create their own "subjective reality" from their perception of the input. An individual's construction of reality, not the objective input, may dictate their behavior in the world. Thus, cognitive biases may sometimes lead to perceptual distortion, inaccurate judgment, illogical interpretation, or what is broadly called irrationality. Although it may seem like such misperceptions would be aberrations, biases can help humans find commonalities and shortcuts to assist in the navigation of common situations in life. Some cognitive biases are presumably adaptive. Cognitive biases may lead to more effective actions in a given context. Furthermore, allowing cognitive biases enables faster decisions which can be desirable when timeliness is more valuable than accuracy, as illustrated in heuristics. Other cognitive biases are a "by-product" of human processing limitations, resulting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Behavioral Finance

Behavioral economics studies the effects of psychological, cognitive, emotional, cultural and social factors on the decisions of individuals or institutions, such as how those decisions vary from those implied by classical economic theory. Behavioral economics is primarily concerned with the bounds of rationality of economic agents. Behavioral models typically integrate insights from psychology, neuroscience and microeconomic theory. The study of behavioral economics includes how market decisions are made and the mechanisms that drive public opinion. The concepts used in behavioral economics today can be traced back to 18th-century economists, such as Adam Smith, who deliberated how the economic behavior of individuals could be influenced by their desires. The status of behavioral economics as a subfield of economics is a fairly recent development; the breakthroughs that laid the foundation for it were published through the last three decades of the 20th century. Behavior ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

George Soros

George Soros ( name written in eastern order), (born György Schwartz, August 12, 1930) is a Hungarian-American businessman and philanthropist. , he had a net worth of US$8.6 billion, Note that this site is updated daily. having donated more than $32 billion to the Open Society Foundations, of which $15 billion has already been distributed, representing 64% of his original fortune. ''Forbes'' called him the "most generous giver" (in terms of percentage of net worth). Born in Budapest to a non-observant Jewish family, Soros survived the Nazi occupation of Hungary and moved to the United Kingdom in 1947. He studied at the London School of Economics and was awarded a BSc in philosophy in 1951, and then a Master of Science degree, also in philosophy, in 1954. Soros began his business career by taking various jobs at merchant banks in the United Kingdom and then the United States, before starting his first hedge fund, Double Eagle, in 1969. Profits from his first fund furnis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Warren Buffett

Warren Edward Buffett ( ; born August 30, 1930) is an American business magnate, investor, and philanthropist. He is currently the chairman and CEO of Berkshire Hathaway. He is one of the most successful investors in the world and has a net worth of over $100 billion as of November 2022, making him the world's sixth-wealthiest person. Buffett was born in Omaha, Nebraska. He developed an interest in business and investing in his youth, eventually entering the Wharton School of the University of Pennsylvania in 1947 before transferring to and graduating from the University of Nebraska at 19. He went on to graduate from Columbia Business School, where he molded his investment philosophy around the concept of value investing pioneered by Benjamin Graham. He attended New York Institute of Finance to focus his economics background and soon after began various business partnerships, including one with Graham. He created Buffett Partnership, Ltd in 1956 and his firm eventually acqui ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Market Efficiency

There are several concepts of efficiency for a financial market. The most widely discussed is informational or price efficiency, which is a measure of how quickly and completely the price of a single asset reflects available information about the asset's value. Other concepts include functional/operational efficiency, which is inversely related to the costs that investors bear for making transactions, and allocative efficiency, which is a measure of how far a market channels funds from ultimate lenders to ultimate borrowers in such a way that the funds are used in the most productive manner. Market efficiency types Three common types of market efficiency are allocative, operational and informational. However, other kinds of market efficiency are also recognised. James Tobin identified four efficiency types that could be present in a financial market: 1. Information arbitrage efficiency Asset prices fully reflect all of the privately available information (the least demanding r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

The Use Of Knowledge In Society

"The Use of Knowledge in Society" is a scholarly article written by economist Friedrich Hayek, first published in the September 1945 issue of ''The American Economic Review''. Written (along with ''The Meaning of Competition'') as a rebuttal to fellow economist Oskar R. Lange and his endorsement of a planned economy, it was included among the twelve essays in Hayek's 1948 compendium '' Individualism and Economic Order''. The article is considered one of the most important in the field of modern economics. Argument Hayek's article argues against the establishment of a Central Pricing Board (advocated by Lange) by highlighting the dynamic and organic nature of market price-fluctuations, and the benefits of this phenomenon. He asserts that a centrally planned economy could never match the efficiency of the open market because what is known by a single agent is only a small fraction of the sum total of knowledge held by all members of society. A decentralized economy thus compleme ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Friedrich Hayek

Friedrich August von Hayek ( , ; 8 May 189923 March 1992), often referred to by his initials F. A. Hayek, was an Austrian–British economist, legal theorist and philosopher who is best known for his defense of classical liberalism. Hayek shared the 1974 Nobel Memorial Prize in Economic Sciences with Gunnar Myrdal for their work on money and economic fluctuations, and the interdependence of economic, social and institutional phenomena. His account of how changing prices communicate information that helps individuals coordinate their plans is widely regarded as an important achievement in economics, leading to his prize. Hayek served in World War I during his teenage years and said that this experience in the war and his desire to help avoid the mistakes that had led to the war drew him into economics. At the University of Vienna, he studied economics, eventually receiving his doctoral degrees in law in 1921 and in political science in 1923. He subsequently lived and work ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Andrey Kolmogorov

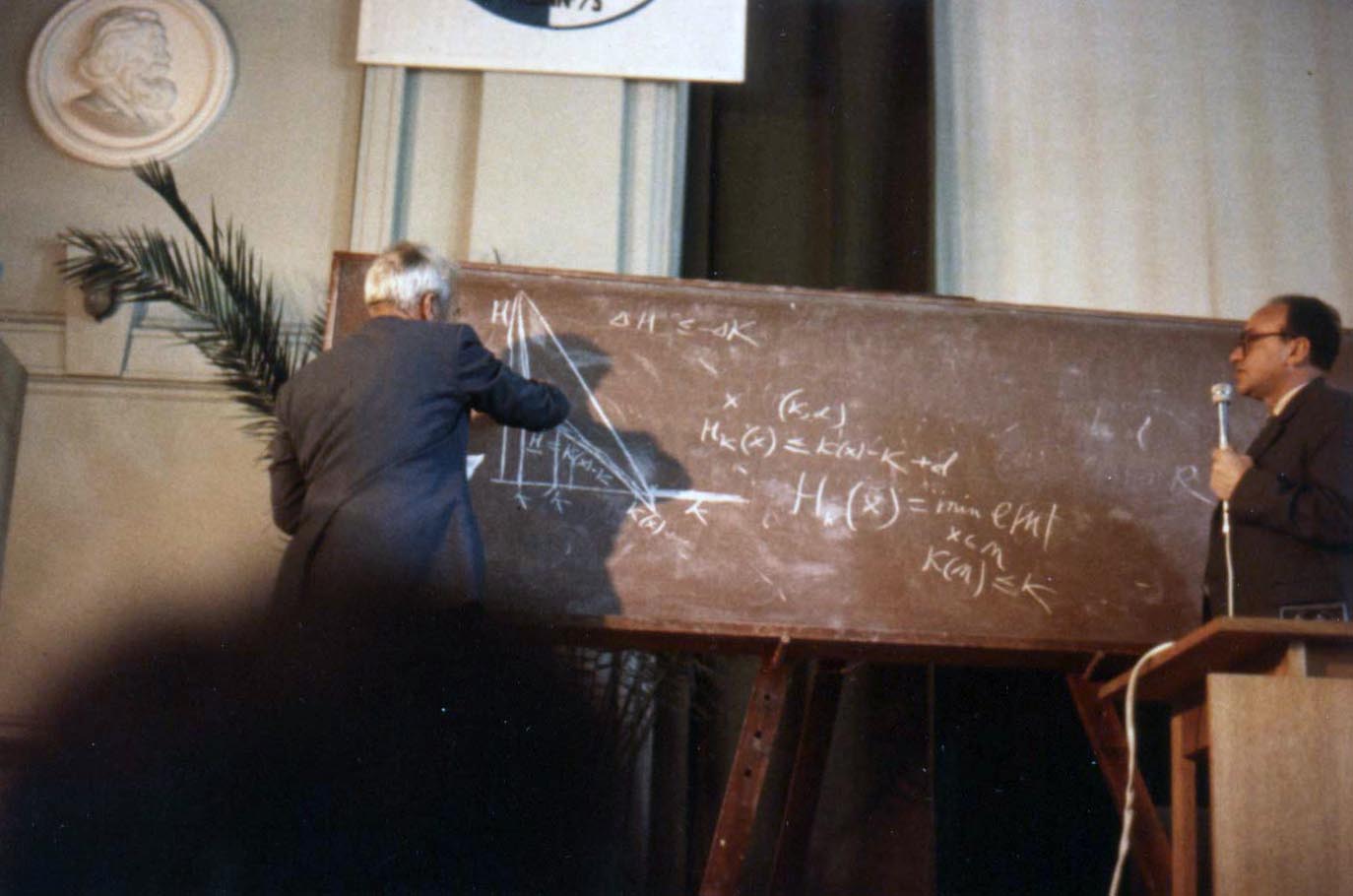

Andrey Nikolaevich Kolmogorov ( rus, Андре́й Никола́евич Колмого́ров, p=ɐnˈdrʲej nʲɪkɐˈlajɪvʲɪtɕ kəlmɐˈɡorəf, a=Ru-Andrey Nikolaevich Kolmogorov.ogg, 25 April 1903 – 20 October 1987) was a Soviet mathematician who contributed to the mathematics of probability theory, topology, intuitionistic logic, turbulence, classical mechanics, algorithmic information theory and computational complexity. Biography Early life Andrey Kolmogorov was born in Tambov, about 500 kilometers south-southeast of Moscow, in 1903. His unmarried mother, Maria Y. Kolmogorova, died giving birth to him. Andrey was raised by two of his aunts in Tunoshna (near Yaroslavl) at the estate of his grandfather, a well-to-do nobleman. Little is known about Andrey's father. He was supposedly named Nikolai Matveevich Kataev and had been an agronomist. Kataev had been exiled from St. Petersburg to the Yaroslavl province after his participation in the revolutionary movem ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

_in_1950.jpg)