|

Economic And Social Stabilization Fund

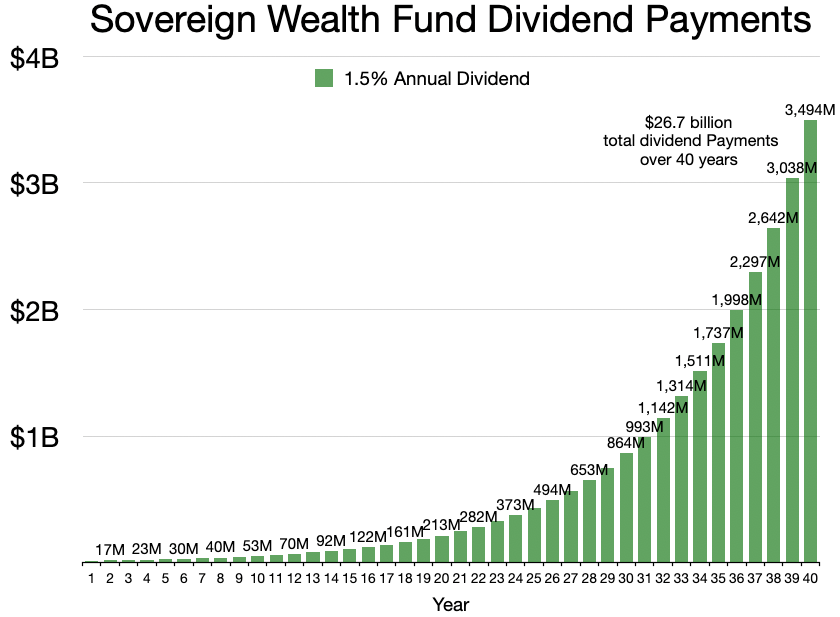

The Economic and Social Stabilization Fund (ESSF) is a state-owned fund in Chile aimed at stabilizing the finances of the Central Government in face of potential "abrupt changes in the economic cycle and extraordinary events". It was created in 2007 by the merger of the former Copper Stabilization Fund (Spanish: ''Fondo de Compensación para los ingresos del Cobre'') and of the stabilization resources created by Decreto Ley N° 3.653 of 1981. The fund is also used yearly to amortize part of the public debt and to add to the Pension Reserve Fund. The fund is subject to the Fiscal Responsibility Law. The Copper Stabilization Fund was created in 1987 basing it on the incomes of the state-owned copper mining company Codelco. This allowed for more precise annual government budget planning given that copper prices can exhibit strong fluctuations. See also *Copper mining in Chile *Sovereign wealth fund A sovereign wealth fund (SWF), or sovereign investment fund, is a state-owned ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economic Cycle

Business cycles are intervals of general Economic expansion, expansion followed by recession in economic performance. The changes in economic activity that characterize business cycles have important implications for the welfare of the general population, government institutions, and private sector firms. There are many definitions of a business cycle. The simplest defines recessions as two consecutive quarters of negative GDP growth. More satisfactory classifications are provided by, first including more economic indicators and second by looking for more data patterns than the two quarter definition. In the United States, the National Bureau of Economic Research oversees a Business Cycle Dating Committee that defines a recession as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." Business cycles are usually thought of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Copper Mining In Chile

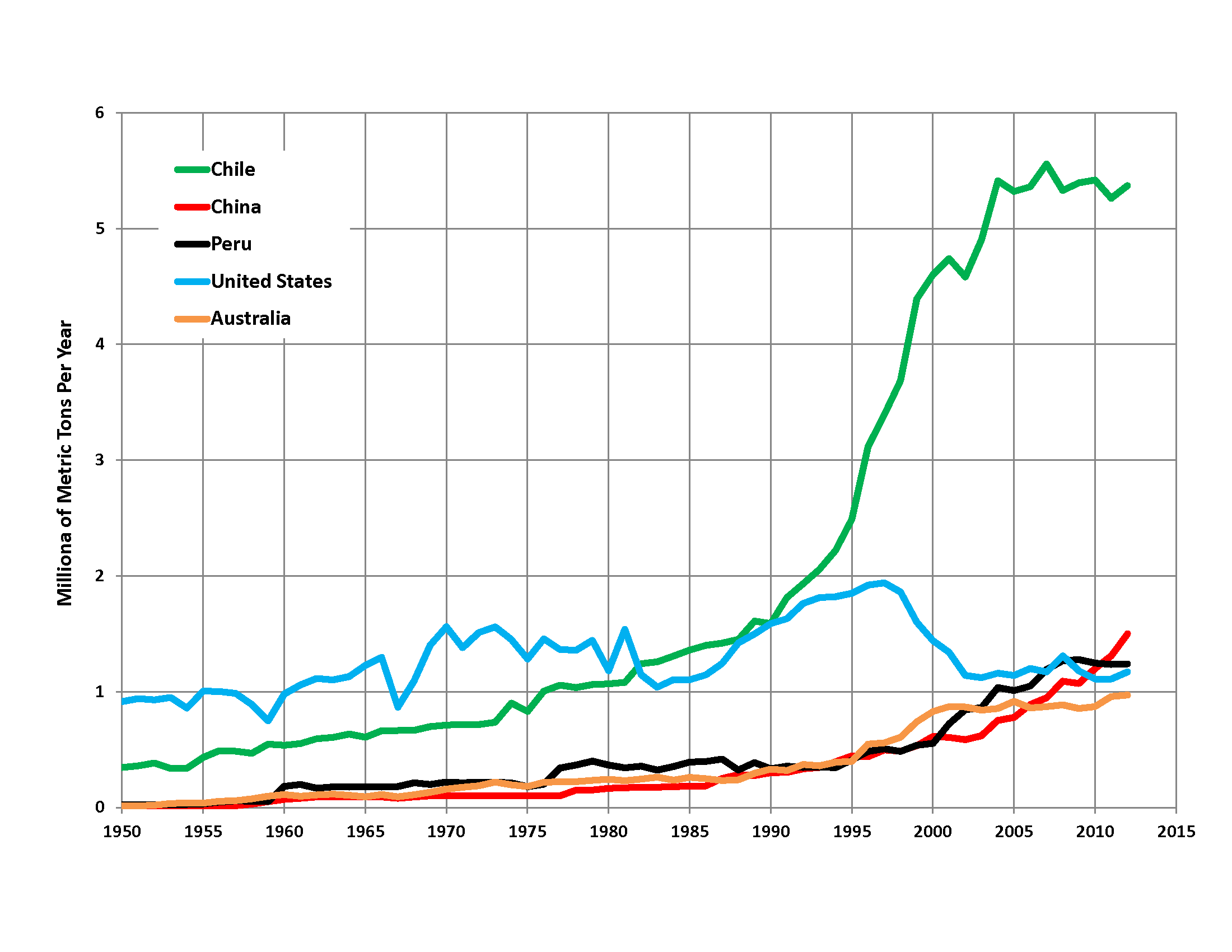

Chile is the world's largest producer of copper and has been so uninterruptedly since 1983. This activity provides a substantial part of the Chilean state's revenue: slightly less than 6% in 2020, with state-owned copper company Codelco alone generating 2.6% of state revenue. Mining of copper in Chile is done chiefly on giant low-grade porphyry copper deposits which are primarily mined by the following companies; Codelco, BHP, Antofagasta Minerals, Anglo American plc, Anglo American and Glencore. Together these companies stood for 83.6% of the copper output in Chile in 2019 and many copper mining companies are joint ventures involving one at least one of these. Medium-scale mining in Chile, which focuses mainly on copper, produced about 4.5% of the copper mined in the country from 2017 to 2021. Copper is also the main product of small-scale mining in Chile, with about 95% of small-scale miners working in copper mining. One estimate puts the number of active copper mines in Chile ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sovereign Wealth Funds

A sovereign wealth fund (SWF), or sovereign investment fund, is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity funds or hedge funds. Sovereign wealth funds invest globally. Most SWFs are funded by revenues from commodity exports or from foreign exchange reserves held by the central bank. Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation's banking system; this type of fund is usually of major economic and fiscal importance. Other sovereign wealth funds are simply the state savings that are invested by various entities for investment return, and that may not have a significant role in fiscal management. The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and International Monetary Fund ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2007 In Economic History

7 (seven) is the natural number following 6 and preceding 8. It is the only prime number preceding a cube (algebra), cube. As an early prime number in the series of positive integers, the number seven has symbolic associations in religion, mythology, superstition and philosophy. The seven classical planets resulted in seven being the number of days in a week. 7 is often considered lucky in Western culture and is often seen as highly symbolic. Evolution of the Arabic digit For early Brahmi numerals, 7 was written more or less in one stroke as a curve that looks like an uppercase vertically inverted (ᒉ). The western Arab peoples' main contribution was to make the longer line diagonal rather than straight, though they showed some tendencies to making the digit more rectilinear. The eastern Arab peoples developed the digit from a form that looked something like 6 to one that looked like an uppercase V. Both modern Arab forms influenced the European form, a two-stroke form cons ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |