|

Economic Expectations

In economics, "rational expectations" are model-consistent expectations, in that agents inside the model are assumed to "know the model" and on average take the model's predictions as valid. Rational expectations ensure internal consistency in models involving uncertainty. To obtain consistency within a model, the predictions of future values of economically relevant variables from the model are assumed to be the same as that of the decision-makers in the model, given their information set, the nature of the random processes involved, and model structure. The rational expectations assumption is used especially in many contemporary macroeconomic models. Since most macroeconomic models today study decisions under uncertainty and over many periods, the expectations of individuals, firms, and government institutions about future economic conditions are an essential part of the model. To assume rational expectations is to assume that agents' expectations may be wrong, but are corre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Economics

Economics () is the social science that studies the Production (economics), production, distribution (economics), distribution, and Consumption (economics), consumption of goods and services. Economics focuses on the behaviour and interactions of Agent (economics), economic agents and how economy, economies work. Microeconomics analyzes what's viewed as basic elements in the economy, including individual agents and market (economics), markets, their interactions, and the outcomes of interactions. Individual agents may include, for example, households, firms, buyers, and sellers. Macroeconomics analyzes the economy as a system where production, consumption, saving, and investment interact, and factors affecting it: employment of the resources of labour, capital, and land, currency inflation, economic growth, and public policies that have impact on glossary of economics, these elements. Other broad distinctions within economics include those between positive economics, desc ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Thomas Sargent

Thomas John Sargent (born July 19, 1943) is an American economist and the W.R. Berkley Professor of Economics and Business at New York University. He specializes in the fields of macroeconomics, monetary economics, and time series econometrics. As of 2020, he ranks as the 29th most cited economist in the world. He was awarded the Nobel Memorial Prize in Economics in 2011 together with Christopher A. Sims for their "empirical research on cause and effect in the macroeconomy". Education Sargent graduated from Monrovia High School. He earned his B.A. from the University of California, Berkeley in 1964, being the University Medalist as Most Distinguished Scholar in Class of 1964, and his PhD from Harvard in 1968, under supervision of John R. Meyer. Sargent's classmates at Harvard included Christopher A. Sims. After serving in the U.S. Army as a first lieutenant and captain, he moved on to teaching.URL:https://www.stern.nyu.edu/faculty/bio/thomas-sargent He held teaching positions ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption (economics)

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many other social sciences. Different schools of economists define consumption differently. According to mainstream economists, only the final purchase of newly produced goods and services by individuals for immediate use constitutes consumption, while other types of expenditure — in particular, fixed investment, intermediate consumption, and government spending — are placed in separate categories (see consumer choice). Other economists define consumption much more broadly, as the aggregate of all economic activity that does not entail the design, production and marketing of goods and services (e.g. the selection, adoption, use, disposal and recycling of goods and services). Economists are particularly interested in the relationship betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Money Demand

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1 (directly spendable holdings), or for money in the broader sense of M2 or M3. Money in the sense of M1 is dominated as a store of value (even a temporary one) by interest-bearing assets. However, M1 is necessary to carry out transactions; in other words, it provides liquidity. This creates a trade-off between the liquidity advantage of holding money for near-future expenditure and the interest advantage of temporarily holding other assets. The demand for M1 is a result of this trade-off regarding the form in which a person's funds to be spent should be held. In macroeconomics motivations for holding one's wealth in the form of M1 can roughly be divided into the transaction motive and the precautionary motive. The demand for those parts of the broader mone ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Null Hypothesis

In scientific research, the null hypothesis (often denoted ''H''0) is the claim that no difference or relationship exists between two sets of data or variables being analyzed. The null hypothesis is that any experimentally observed difference is due to chance alone, and an underlying causative relationship does not exist, hence the term "null". In addition to the null hypothesis, an alternative hypothesis is also developed, which claims that a relationship does exist between two variables. Basic definitions The ''null hypothesis'' and the ''alternative hypothesis'' are types of conjectures used in statistical tests, which are formal methods of reaching conclusions or making decisions on the basis of data. The hypotheses are conjectures about a statistical model of the population, which are based on a sample of the population. The tests are core elements of statistical inference, heavily used in the interpretation of scientific experimental data, to separate scientific claims fr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Errors And Residuals In Statistics

In statistics and optimization, errors and residuals are two closely related and easily confused measures of the deviation of an observed value of an element of a statistical sample from its "true value" (not necessarily observable). The error of an observation is the deviation of the observed value from the true value of a quantity of interest (for example, a population mean). The residual is the difference between the observed value and the ''estimated'' value of the quantity of interest (for example, a sample mean). The distinction is most important in regression analysis, where the concepts are sometimes called the regression errors and regression residuals and where they lead to the concept of studentized residuals. In econometrics, "errors" are also called disturbances. Introduction Suppose there is a series of observations from a univariate distribution and we want to estimate the mean of that distribution (the so-called location model). In this case, the errors are th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Parameter Estimate

In statistics, an estimator is a rule for calculating an estimate of a given quantity based on observed data: thus the rule (the estimator), the quantity of interest (the estimand) and its result (the estimate) are distinguished. For example, the sample mean is a commonly used estimator of the population mean. There are point and interval estimators. The point estimators yield single-valued results. This is in contrast to an interval estimator, where the result would be a range of plausible values. "Single value" does not necessarily mean "single number", but includes vector valued or function valued estimators. '' Estimation theory'' is concerned with the properties of estimators; that is, with defining properties that can be used to compare different estimators (different rules for creating estimates) for the same quantity, based on the same data. Such properties can be used to determine the best rules to use under given circumstances. However, in robust statistics, statisti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflation Rate

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

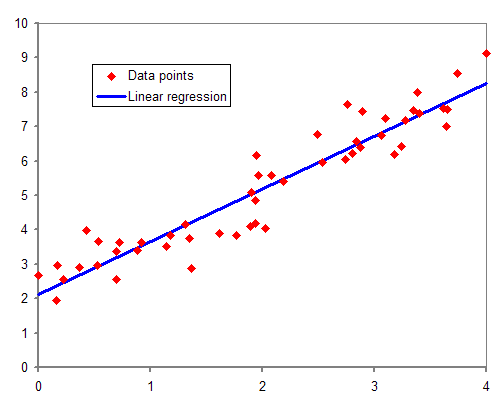

Regression Analysis

In statistical modeling, regression analysis is a set of statistical processes for estimating the relationships between a dependent variable (often called the 'outcome' or 'response' variable, or a 'label' in machine learning parlance) and one or more independent variables (often called 'predictors', 'covariates', 'explanatory variables' or 'features'). The most common form of regression analysis is linear regression, in which one finds the line (or a more complex linear combination) that most closely fits the data according to a specific mathematical criterion. For example, the method of ordinary least squares computes the unique line (or hyperplane) that minimizes the sum of squared differences between the true data and that line (or hyperplane). For specific mathematical reasons (see linear regression), this allows the researcher to estimate the conditional expectation (or population average value) of the dependent variable when the independent variables take on a given ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Inflationary Expectations

In economics, inflation is an increase in the general price level of goods and services in an economy. When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of inflation is deflation, a sustained decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose. The employment cost index is also used for wages in the United States. Most economists agree that high levels of inflation as well as hyperinflation—which have severely disruptive effects on the real economy—are caused by persistent excessive growth in the money supply. Views on low to moderate rates of inflation are more varied. Low or moderate inflation may be attri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Journal Of Economic Perspectives

The ''Journal of Economic Perspectives'' (JEP) is an economic journal published by the American Economic Association. The journal was established in 1987. It is very broad in its scope. According to its editors its purpose is: #to synthesize and integrate lessons learned from active lines of economic research; #to provide economic analysis of public policy issues; to encourage cross-fertilization of ideas among the fields of thinking; #to offer readers an accessible source for state-of-the-art economic thinking; #to suggest directions for future research; #to provide insights and readings for classroom use; #and to address issues relating to the economics profession.'' Its current editor is Heidi Williams, and its managing editor A managing editor (ME) is a senior member of a publication's management team. Typically, the managing editor reports directly to the editor-in-chief and oversees all aspects of the publication. United States In the United States, a managing edit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Lucas Critique

The Lucas critique, named for American economist Robert Lucas's work on macroeconomic policymaking, argues that it is naive to try to predict the effects of a change in economic policy entirely on the basis of relationships observed in historical data, especially highly aggregated historical data. More formally, it states that the decision rules of Keynesian models—such as the consumption function—cannot be considered as structural in the sense of being invariant with respect to changes in government policy variables. The Lucas critique is significant in the history of economic thought as a representative of the paradigm shift that occurred in macroeconomic theory in the 1970s towards attempts at establishing micro-foundations. Thesis The basic idea pre-dates Lucas's contribution—related ideas are expressed as Campbell's law and Goodhart's law—but in a 1976 paper, Lucas drove to the point that this simple notion invalidated policy advice based on conclusions draw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |