|

Deutsche Bank

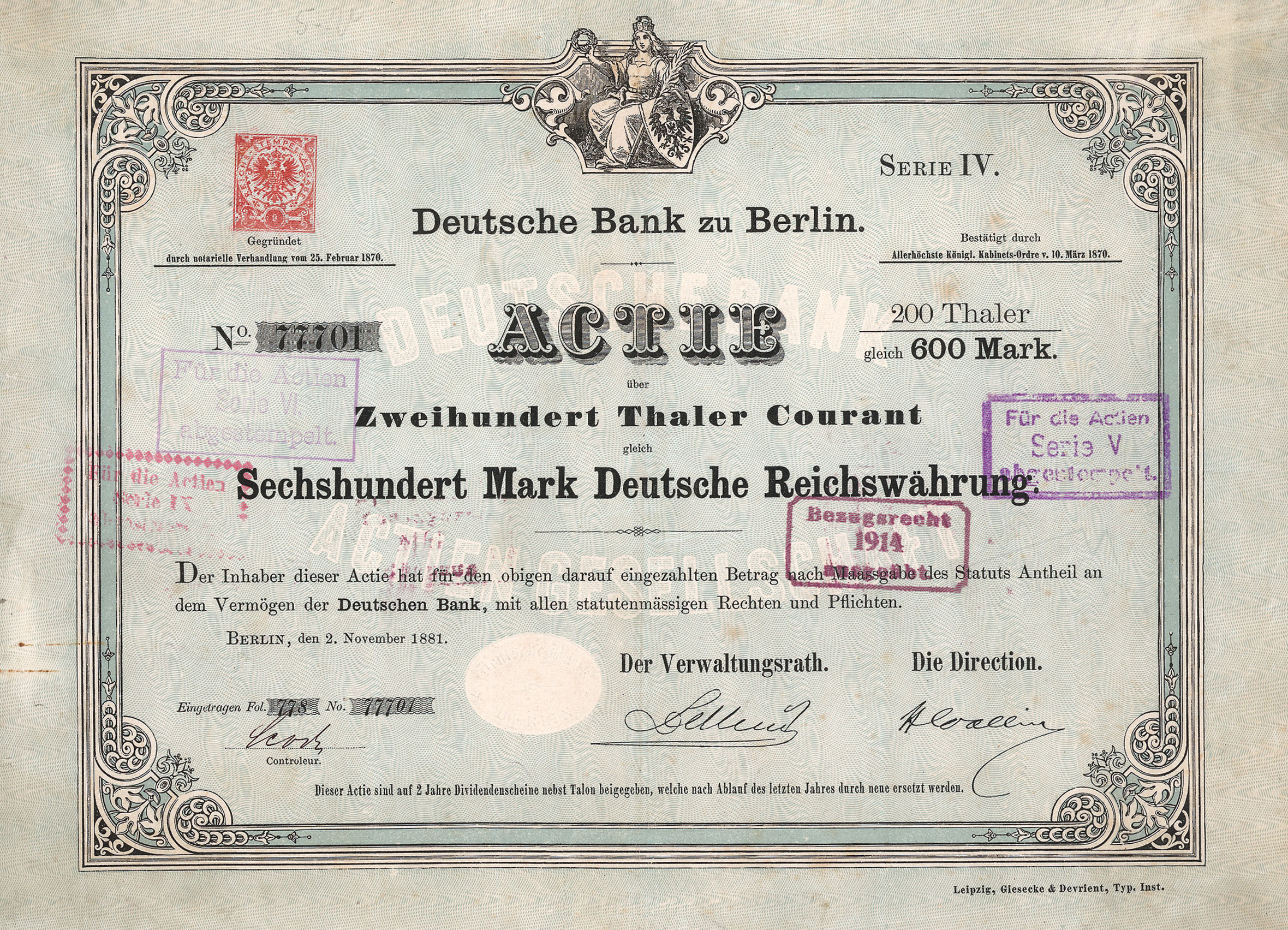

Deutsche Bank AG (), sometimes referred to simply as Deutsche, or internally as DB, is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. Deutsche Bank was founded in 1870 in Berlin. From 1929 to 1937, following its merger with Disconto-Gesellschaft, it was known as ''Deutsche Bank und Disconto-Gesellschaft'' or DeDi-Bank. Other transformative acquisitions have included those of Mendelssohn & Co. in 1938, Morgan Grenfell in 1990, Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. It is a component of the DAX stock market index and is often referred to as the largest German banking institution, with Deutsche Bank holding the majority stake in DWS Group for combined assets of 2.2 trillion euros, rivaling even Sparkassen-Finanzgru ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Bank Twin Towers

The Deutsche Bank Twin Towers, also known as Deutsche Bank Headquarters (German: ''Zwillingstürme der Deutschen Bank'' or ''Hauptverwaltung Deutsche Bank AG''), is a twin tower skyscraper complex in the Westend-Süd district of Frankfurt, Germany. Both towers rise to and serve as headquarters for Deutsche Bank, the largest bank in Germany. Location The Deutsche Bank Twin Towers are prominently located at the borders of the city districts of Westend-Süd, the Bahnhofsviertel and the Innenstadt, near a series of baroque-era-fortifications-gone-parks (''Wallanlagen'') and the Opernplatz. This area forms Frankfurts central business district called Bankenviertel. The twin towers are part of a chain of high-rise buildings at Mainzer Landstraße which stretches from the Opernplatz in the east to the Platz der Republik in the west. The towers have direct access to an underground S-Bahn station ( Taunusanlage). The largest man-shaped monolith of the world, created by the Sw ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Services

Financial services are the Service (economics), economic services provided by the finance industry, which encompasses a broad range of businesses that manage money, including credit unions, banks, credit-card companies, insurance companies, accountancy companies, consumer finance, consumer-finance companies, brokerage firm, stock brokerages, investment management, investment funds, individual asset managers, and some government-sponsored enterprises. History The term "financial services" became more prevalent in the United States partly as a result of the Gramm-Leach-Bliley Act, GrammLeachBliley Act of the late 1990s, which enabled different types of companies operating in the U.S. financial services industry at that time to merge. Companies usually have two distinct approaches to this new type of business. One approach would be a bank that simply buys an insurance company or an investment bank, keeps the original brands of the acquired firm, and adds the Takeover, acquisit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Stability Board

The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. It was established after the G20 London summit in April 2009 as a successor to the Financial Stability Forum (FSF). The Board includes all G20 major economies, FSF members, and the European Commission. Hosted and funded by the Bank for International Settlements, the board is based in Basel, Switzerland, and is established as a not-for-profit association under Swiss law. The FSB represented the G20 leaders' first major international institutional innovation. U.S. Treasury Secretary Tim Geithner has described it as "in effect, a fourth pillar" of the architecture of global economic governance. The FSB has been assigned a number of important tasks, working alongside the International Monetary Fund, World Bank, and the World Trade Organization. Unlike most multilateral financial institutions, the FSB lacks a legal form and any formal power, given ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Systemically Important Financial Institution

A systemically important financial institution (SIFI) is a bank, insurance company, or other financial institution whose failure might trigger a financial crisis. They are colloquially referred to as "too big to fail". As the financial crisis of 2007–2008 unfolded, the international community moved to protect the global financial system through preventing the failure of SIFIs, or, if one does fail, limiting the adverse effects of its failure. In November 2011, the Financial Stability Board (FSB) published a list of global systemically important financial institutions (G-SIFIs). Also in November 2010, the Basel Committee on Banking Supervision (BCBS) introduced new guidance (known as Basel III) that also specifically target SIFIs. The main focus of the Basel III guidance is to increase bank capital requirements and to introduce capital surcharges for G-SIFIs. However, some economists warned in 2012 that the tighter Basel III capital regulation, which is primarily based on risk ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sparkassen-Finanzgruppe

The ''Sparkassen-Finanzgruppe'' ("Savings Banks Financial Group") is a network of public banks that together form the largest financial services group in Germany and in all of Europe. Its name refers to local government-controlled savings banks that are known in German as , plural . Its activity is overwhelmingly located in Germany. History The first savings banks in Germany were founded in the 18th century in its major trading cities. One of the first institutions with the business model of modern savings banks was the ''Ersparungscasse der Hamburgischen Allgemeinen Versorgungsanstalt'' in Hamburg in 1778. Founders were rich merchants, clerks and academics. They intended to develop solutions for people with low income to save small sums of money and to support business start-ups. In 1801 the first savings bank with a municipal guarantor was founded in Göttingen to fight poverty. In 1838, Prussia adopted the first savings banks legislation (), which subsequently served as a mode ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

DWS Group

The DWS Group (Formerly: Deutsche Asset Management) commonly referred to as SDWS, is a German asset management company. It previously operated as part of Deutsche Bank until 2018 where it became a separate entity through an initial public offering on the Frankfurt Stock Exchange. It is currently headquartered in Frankfurt, Germany and is a constituent member of the SDAX index. History DWS was founded in Hamburg in 1956 as "Deutsche Gesellschaft für Wertpapiersparen mbH" (German Enterprise for Securities Savings), the name was later shortened to DWS, "Die Wertpapier Spezialisten" (The Fund Specialists). Originally, the activities involved products and investment services that were initially offered to investors in Germany and throughout Europe. Activities under the DWS Investments brand were later expanded to include separate line-ups of products and investments services for investors in the USA, Asia and other regions. Originally Deutsche Bank held 30% of DWS while the rest was ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Banks In Germany

Central banks *Deutsche Bundesbank, Frankfurt *European Central Bank, Frankfurt Local banks *BayernLB, Munich *Bremer Bank (German bank), Bremer Bank, Bremen *Commerzbank, Frankfurt *Consorsbank, Nuremberg *DAB BNP Paribas, Munich *DekaBank (Germany), Frankfurt *Deutsche Bank, Frankfurt *Deutsche Pfandbriefbank, Garching bei München (next to Munich) *DZ Bank, Frankfurt *GLS Bank, Bochum *HSH Nordbank, Hamburg Commercial Bank (formerly HSH Nordbank), Hamburg *KfW, Frankfurt *Landesbank Baden-Württemberg, Stuttgart *Landesbank Berlin, Landesbank Berlin Holding, Berlin *Landesbank Hessen-Thüringen, Frankfurt *Rentenbank, Landwirtschaftliche Rentenbank *National-Bank AG, Essen *Fidor Bank, FIDOR bank AG *N26 (bank), N26, Berlin *Nord/LB, Hanover *NRW.BANK , NRW.Bank, Düsseldorf *Portigon Financial Services, Düsseldorf *solarisBank, Berlin *Wirecard, Wirecard Bank Co-operative banks see: German Cooperative Financial Group Sparkassen see: Sparkassen-Finanzgruppe Investmen ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Postbank

Postbank is the retail banking division of Deutsche Bank, which was formed from the demerger of the postal savings division of Deutsche Bundespost in 1990. Since May 2018, it operates as a brand of Deutsche Bank's retail arm. It serves 13 million customers in around 1,000 branches and 700 advisory centers. History The ''Postscheckdienst'' was introduced in 1909 by the German Reich establishing accounts for payment transactions by mail and linking postal and banking services in German states. In 1990, following the German Postal Services Restructuring Act (''Poststrukturgesetz'') of 1989, the German Postal Service (Deutsche Bundespost) was divided into three companies, Deutsche Post, Deutsche Telekom and Postbank. Later that year, Deutsche Post Postbank of the former East Germany was merged with Postbank. From 1990 to 1997, Günter Schneider was chairman of the board. The first board of Postbank consisted of Günter Schneider, Rudolf Bauer and Bernhard Zurhorst. On 1 January 19 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bankers Trust

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corporation in 2003. History In 1903 a group of New York national banks formed trust company Bankers Trust to provide trust services to customers of state and national banks throughout the country on the premise that it would not lure commercial bank customers away. In addition to offering the usual trust and commercial banking functions, it also acted as a "bankers' bank" by holding the reserves of other banks and trust companies and loaning them money when they needed additional reserves due to unexpected withdrawals. Bankers Trust Company was incorporated on March 24, 1903, with an initial capital of $1.5 million. Despite technically having numerous stockholders, the voting power was held by three associates of J.P. Morgan. Thus, it was wi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Morgan, Grenfell & Company

Morgan, Grenfell & Co. was a leading London-based investment bank regarded as one of the oldest and once most influential British merchant banks. It had its origins in a merchant banking business commenced by George Peabody. Junius Spencer Morgan became a partner in 1854. After Peabody retired the business was styled J. S. Morgan & Co. In 1910, it was reconstituted as Morgan Grenfell & Co. in recognition of the senior London-based partner, Edward Grenfell, although J. P. Morgan & Co. still held a controlling interest. In the 1930s, it became a commercial bank and the Morgan family relinquished their controlling interest in the business. After a period of retrenchment, it expanded under the management of second Viscount Harcourt in the 1960s. The link with J. P. Morgan & Co. ended completely in the 1980s. The business also became embroiled in the Guinness share-trading fraud at that time. In 1990, Morgan Grenfell was acquired in an agreed deal by its minority shareholder, Deu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mendelssohn & Co

Mendelssohn & Co. was a private bank based in Berlin, Prussia. One of the leading banks in the 19th and early 20th centuries, it was Aryanized by the Nazis because the owners were Jewish. History The bank was established in 1795 by Joseph Mendelssohn in Berlin. In 1804, his younger brother Abraham Mendelssohn Bartholdy joined the company. In 1815, they moved into their new headquarters at Jägerstraße 51, thereby laying the foundations of Berlin's financial district. Mendelssohn & Co. remained in that building until its divestiture in 1939. Mendelssohn quickly rose to prominence among European banks. Starting in the 1850s, they acted as Royal bankers for the Russian Tsar, and from the 1870s dominating the Central European financial market for Russian sovereign bonds and railway bonds. Only the outbreak of World War I in 1914 and the Lenin putsch in 1917 put an end to these close contacts. The Mendelssohn family through the descendants of the founding brothers continued to run th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Disconto-Gesellschaft

The Disconto-Gesellschaft (full name: Direktion der Disconto-Gesellschaft), with headquarters in Berlin, was founded in 1851. It was, until its 1929 merger into Deutsche Bank, one of the largest German banking organizations. History It was founded in 1851 as a “credit partnership,” and in 1856 was changed into a limited liability, joint-stock company under the name of “Direktion der Disconto-Gesellschaft,” with a capital of 30,000,000 marks. Its founder was David Hansemann, later Prussian Minister of Finance. Since 1857 also his son Adolph von Hansemann worked in the bank of his father. Its purpose and earliest activities were in the fostering of current account business and the underwriting of German state and local loans and railway shares. In 1890, a branch was opened in London, from which time dated the institution's activities in overseas matters. In 1901, on the liquidation of the house of M. A. Rothschild & Sons of Frankfurt am Main, a branch was established in t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |