|

Dynamic Efficiency

In economics, dynamic efficiency is a situation where it is impossible to make one generation better off without making any other generation worse off. It is closely related to the notion of "golden rule of saving". Are modern economies dynamically efficient? Abel, Mankiw, Summers, and Zeckhauser (1989) develop a criterion for addressing dynamic efficiency and apply this model to the United States and other OECD countries, suggesting that these countries are indeed dynamically efficient. In the Solow growth model An economy in the Solow growth model is dynamically inefficient if the savings rate exceeds the Golden Rule savings rate. If the savings rate is greater than the Golden Rule savings rate, a decrease in savings rate will increase consumption per effective unit of labor. A savings rate higher than the Golden Rule savings rate implies that an economy could be better off today and tomorrow by saving less. In other models The Ramsey-Cass-Koopmans model does not have dy ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Solow Growth Model

Solow is a surname. Notable people with the surname include: * Alan Solow, an American lawyer and Jewish leader * Herbert Solow (journalist) (1903–1964), an American journalist * Herbert Franklin Solow (1931–2020), an American producer, director, studio executive, talent agent, and writer * Jeffrey Solow (born 1949), an American cello virtuoso * Jennifer Solow, an American novelist * Robert Solow (born 1924), an American economist, winner of the Nobel Prize in Economics * Sheldon Solow, an American real estate mogul and billionaire See also * Solow (horse), a Thoroughbred racehorse * The Solow Building The Solow Building, also known as 9 West 57th Street, is a skyscraper in the Midtown Manhattan neighborhood of New York City. Completed in 1974 and designed by Gordon Bunshaft of Skidmore, Owings & Merrill, it is west of Fifth Avenue between 5 ..., a Manhattan skyscraper {{surname Slavic-language surnames Jewish surnames ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

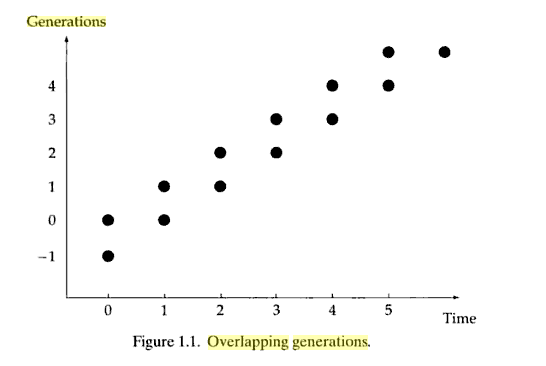

Overlapping Generations Model

The overlapping generations (OLG) model is one of the dominating frameworks of analysis in the study of macroeconomic dynamics and economic growth. In contrast, to the Ramsey–Cass–Koopmans neoclassical growth model in which individuals are infinitely-lived, in the OLG model individuals live a finite length of time, long enough to overlap with at least one period of another agent's life. The OLG model is the natural framework for the study of: (a) the life-cycle behavior (investment in human capital, work and saving for retirement), (b) the implications of the allocation of resources across the generations, such as Social Security, on the income per capita in the long-run, (c) the determinants of economic growth in the course of human history, and (d) the factors that triggered the fertility transition. History The construction of the OLG model was inspired by Irving Fisher's monograph ''The Theory of Interest''.: It was first formulated in 1947, in the context of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Theory Of Fructification

In economics, the theory of fructification is a theory of the interest rate which was proposed by French economist and finance minister Anne Robert Jacques Turgot. The term ''theory of fructification'' is due to Eugen von Böhm-Bawerk who considered Turgot as the first economist who tried to develop a scientific explanation of the interest rate. According to Turgot, a capitalist can either lend his money, or employ it in the purchase of a plot of land. Because fruitful land yields an annual rent forever, its price is given by the formula of a perpetual annuity: If ''A'' denotes the land's annual rent and ''r'' denotes the interest rate, the land price is simply ''A''/''r''. From this formula, Turgot concluded that "the lower the interest rate, the more valuable is the land." Specifically, if the interest rate approached zero, the land price would become infinite. Because land prices must be finite, it follows that the interest rate is strictly positive. Turgot argued also that the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stefan Homburg

Stefan Homburg (born March 10, 1961) is a German professor of economics. He was the director of the Institute of Public Finance at the University of Hannover, Lower Saxony, Germany until 2021. Outside academia he is best known for his controversial statements regarding the COVID-19 pandemic. Homburg studied economics, philosophy, and mathematics at the Cologne University, where he graduated with a degree in economics in 1985, followed by a doctoral degree in 1987. Subsequently, he was Professor of Economics at University of Bonn and University of Magdeburg, before he moved to Hannover. Homburg's research focuses on macroeconomics and public finance. He has co-authored a textbook in macroeconomics. Other publications address topics in monetary policy, social security, tax law, and business taxation. Homburg served as a member of several policy committees, including the Advisory Council at the Federal Ministry of Finance, the Federal Constitutional Commission (''Bundesstaatskommis ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)