|

Double Taxation

Double taxation is the levying of tax by two or more jurisdictions on the same income (in the case of income taxes), asset (in the case of capital taxes), or financial transaction (in the case of sales taxes). Double liability may be mitigated in a number of ways, for example, a jurisdiction may: * exempt foreign-source income from tax, * exempt foreign-source income from tax if tax had been paid on it in another jurisdiction, or above some benchmark to exclude tax haven jurisdictions, or * fully tax the foreign-source income but give a credit for taxes paid on the income in the foreign jurisdiction. Jurisdictions may enter into tax treaties with other countries, which set out rules to avoid double taxation. These treaties often include arrangements for exchange of information to prevent tax evasion such as when a person claims tax exemption in one country on the basis of non-residence in that country, but then does not declare it as foreign income in the other country; or who ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax

An income tax is a tax imposed on individuals or entities (taxpayers) in respect of the income or profits earned by them (commonly called taxable income). Income tax generally is computed as the product of a tax rate times the taxable income. Taxation rates may vary by type or characteristics of the taxpayer and the type of income. The tax rate may increase as taxable income increases (referred to as graduated or progressive tax rates). The tax imposed on companies is usually known as corporate tax and is commonly levied at a flat rate. Individual income is often taxed at progressive rates where the tax rate applied to each additional unit of income increases (e.g., the first $10,000 of income taxed at 0%, the next $10,000 taxed at 1%, etc.). Most jurisdictions exempt local charitable organizations from tax. Income from investments may be taxed at different (generally lower) rates than other types of income. Credits of various sorts may be allowed that reduce tax. Some jurisdicti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Tax

A corporate tax, also called corporation tax or company tax, is a direct tax imposed on the income or capital of corporations or analogous legal entities. Many countries impose such taxes at the national level, and a similar tax may be imposed at state or local levels. The taxes may also be referred to as income tax or capital tax. A country's corporate tax may apply to: * corporations incorporated in the country, * corporations doing business in the country on income from that country, * foreign corporations who have a permanent establishment in the country, or * corporations deemed to be resident for tax purposes in the country. Company income subject to tax is often determined much like taxable income for individual taxpayers. Generally, the tax is imposed on net profits. In some jurisdictions, rules for taxing companies may differ significantly from rules for taxing individuals. Certain corporate acts or types of entities may be exempt from tax. The incidence of corporate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Resident

The criteria for residence for tax purposes vary considerably from jurisdiction to jurisdiction, and "residence" can be different for other, non-tax purposes. For individuals, physical presence in a jurisdiction is the main test. Some jurisdictions also determine residency of an individual by reference to a variety of other factors, such as the ownership of a home or availability of accommodation, family, and financial interests. For companies, some jurisdictions determine the residence of a corporation based on its place of incorporation. Other jurisdictions determine the residence of a corporation by reference to its place of management. Some jurisdictions use both a place-of-incorporation test and a place-of-management test. Domicile is, in common law jurisdictions, a different legal concept to residence, though the place of residence and the place of domicile would typically be the same. The criteria for residence in double taxation treaties may be different from those of do ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cyprus

Cyprus ; tr, Kıbrıs (), officially the Republic of Cyprus,, , lit: Republic of Cyprus is an island country located south of the Anatolian Peninsula in the eastern Mediterranean Sea. Its continental position is disputed; while it is geographically in Western Asia, its cultural ties and geopolitics are overwhelmingly Southern European. Cyprus is the third-largest and third-most populous island in the Mediterranean. It is located north of Egypt, east of Greece, south of Turkey, and west of Lebanon and Syria. Its capital and largest city is Nicosia. The northeast portion of the island is ''de facto'' governed by the self-declared Turkish Republic of Northern Cyprus, which was established after the 1974 invasion and which is recognised as a country only by Turkey. The earliest known human activity on the island dates to around the 10th millennium BC. Archaeological remains include the well-preserved ruins from the Hellenistic period such as Salamis and Kourion, and Cypr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Svenskt Näringsliv

The Confederation of Swedish Enterprise or Swedish Enterprise ( sv, Svenskt Näringsliv) is a major employers' organization for private sector and business sector companies in Sweden. It has 49 member associations representing 60,000 member companies with more than 1.6 million employees. History The current organisation is the result of a merger between the Swedish Employers Association ( sv, Svenska Arbetsgivareföreningen, abbreviated SAF) and the Swedish National Federation of Industry ( sv, Sveriges Industriförbund) that was completed in March 2001. Policy Like its predecessors, the organisation is actively lobbying for pro-business interests. Tax cuts, especially the abolition of property and inheritance taxes, is a main priority. The organisation also promotes letting private enterprises take over the production of a larger part of services today mainly performed by the Swedish public sector, such as education and health services. The Confederation of Swedish Enterprise f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Business Europe

The Confederation of European Business, shortened BusinessEurope, is a lobby group representing enterprises of all sizes in the European Union (EU) and seven non-EU European countries. Members of the confederation are 40 national industry and employers' organizations. The current president of the confederation is Fredrik Persson, while the Director General is Markus J. Beyrer. Based in Brussels, the confederation is officially recognised as a social partner at European level, is involved in a range of economic and social decisions and cooperates with a number of stakeholders and business partners. It promotes the interests of corporate citizens to ensure that public policy supports the European economy. It is generally considered the strongest interest organisation in Brussels and represents 20 million companies through its member trade associations in 35 European countries. History In 2014, Unilever terminated its membership in BusinessEurope's Advisory and Support Group because ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Information Exchange Agreements

Tax information exchange agreements (TIEA) provide for the exchange of information on request relating to a specific criminal or civil tax investigation or civil tax matters under investigation. A model TIEA was developed by the OECD Global Forum Working Group on Effective Exchange of Information. This exchange of information ''on request'' was supplemented by an ''automatic'' process on 29 October 2014. The automatic process is to be based on a Common Reporting Standard. Purposes Typically, a TIEA contains the following provisions: * It provides for exchange of information that is "foreseeably relevant" to the administration and enforcement of domestic tax laws on the Contracting Parties. * The information provided under TIEA is protected by confidentiality obligations. Disclosure can be made to courts or judicial forums only for the purpose of determination of the taxation matter in question. * Information requested may relate to a person who is not a resident of a Contracting Pa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been described as a '' sui generis'' political entity (without precedent or comparison) combining the characteristics of both a federation and a confederation. Containing 5.8per cent of the world population in 2020, the EU generated a nominal gross domestic product (GDP) of around trillion in 2021, constituting approximately 18per cent of global nominal GDP. Additionally, all EU states but Bulgaria have a very high Human Development Index according to the United Nations Development Programme. Its cornerstone, the Customs Union, paved the way to establishing an internal single market based on standardised legal framework and legislation that applies in all member states in those matters, and only those matters, where the states have agreed to act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Avoidance

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of tax that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes. Tax avoidance should not be confused with tax evasion, which is illegal. Forms of tax avoidance that use legal tax laws in ways not necessarily intended by the government are often criticized in the court of public opinion and by journalists. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefiting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Foreign Tax Credit

A foreign tax credit (FTC) is generally offered by income tax systems that tax residents on worldwide income, to mitigate the potential for double taxation. The credit may also be granted in those systems taxing residents on income that may have been taxed in another jurisdiction. The credit generally applies only to taxes of a nature similar to the tax being reduced by the credit (taxes based on income) and is often limited to the amount of tax attributable to foreign source income. The limitation may be computed by country, class of income, overall, and/or another manner. Most income tax systems therefore contain rules defining source of income (domestic, foreign, or by country) and timing of recognition of income, deductions, and taxes, as well as rules for associating deductions with income. For systems that separately tax business entities and their members, a deemed paid credit may be offered to entities receiving income (such as dividends) from other entities, with respect to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Withholding Tax

Tax withholding, also known as tax retention, Pay-as-You-Go, Pay-as-You-Earn, Tax deduction at source or a ''Prélèvement à la source'', is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common. Typical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Wayne State University

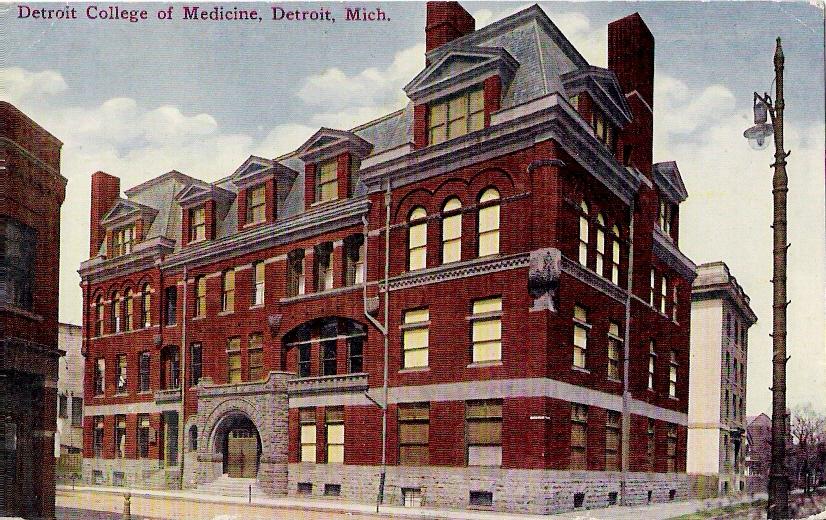

Wayne State University (WSU) is a public research university in Detroit, Michigan. It is Michigan's third-largest university. Founded in 1868, Wayne State consists of 13 schools and colleges offering approximately 350 programs to nearly 25,000 graduate and undergraduate students. Wayne State University, along with the University of Michigan and Michigan State University, compose the University Research Corridor of Michigan. Wayne State is classified among "R1: Doctoral Universities – Very high research activity". Wayne State's main campus comprises 203 acres linking more than 100 education and research buildings. It also has four satellite campuses in Macomb, Wayne and Jackson counties. The Wayne State Warriors compete in the NCAA Division II Great Lakes Intercollegiate Athletic Conference (GLIAC). History The Wayne State University was established in 1868 as the Detroit Medical College by five returning Civil War veterans. The college charter from 1868 was signed by f ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_1950_-_2010.gif)