|

Dollar Auction

The dollar auction is a non-zero sum sequential game explored by economist Martin Shubik to illustrate a paradox brought about by traditional rational choice theory in which players are compelled to make an ultimately irrational decision based completely on a sequence of apparently rational choices made throughout the game. Shubik: 1971. Page 109 Play The setup involves an auctioneer who volunteers to auction off a dollar bill with the following rule: the bill goes to the winner; however, the second-highest bidder also loses the amount that they bid, making them the biggest loser in the auction. The winner can get a dollar for a mere 5 cents (the minimum bid), but only if no one else enters into the bidding war. However, entering the auction with a low bid may result in a problematic outcome. For instance, a player might begin by bidding 5 cents, hoping to make a 95-cent profit. They can be outbid by another player bidding 10 cents, as a 90-cent profit is still desirable. Similar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

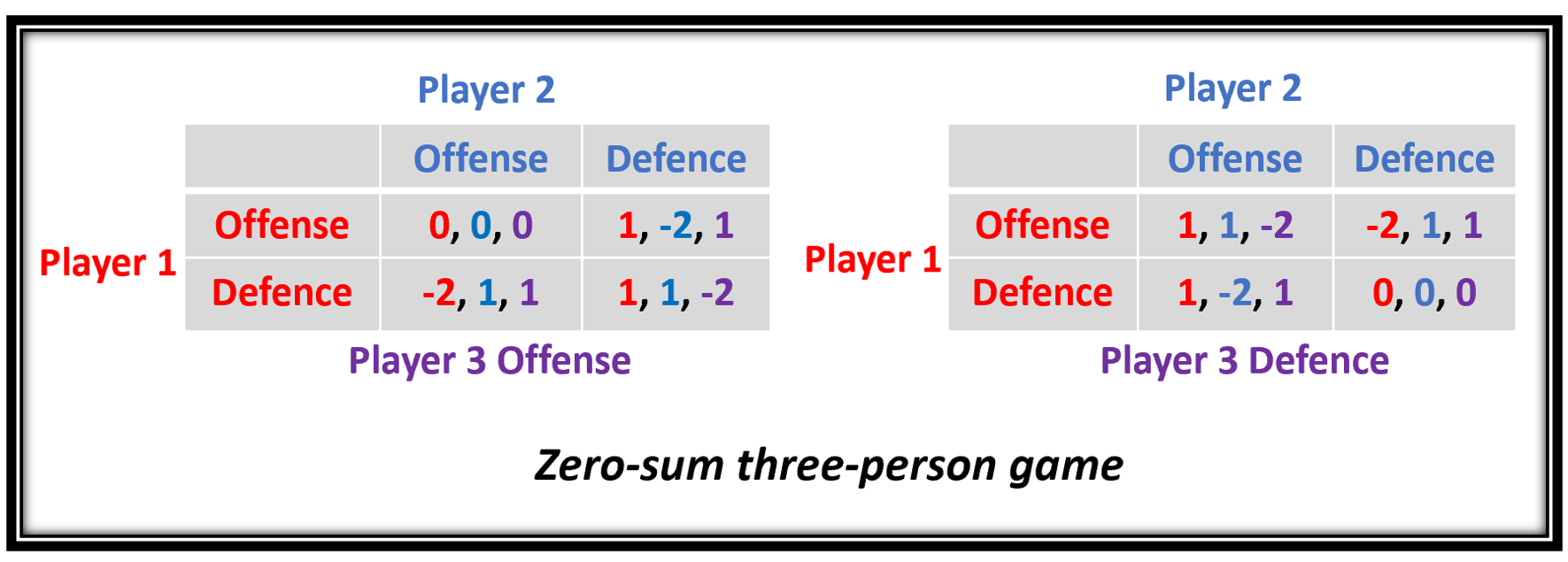

Zero Sum

Zero-sum game is a mathematical representation in game theory and economic theory of a situation which involves two sides, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, therefore the net improvement in benefit of the game is zero. If the total gains of the participants are added up, and the total losses are subtracted, they will sum to zero. Thus, cutting a cake, where taking a more significant piece reduces the amount of cake available for others as much as it increases the amount available for that taker, is a zero-sum game if all participants value each unit of cake equally. Other examples of zero-sum games in daily life include games like poker, chess, and bridge where one person gains and another person loses, which results in a zero-net benefit for every player. In the markets and financial instruments, futures contracts and options are zero-sum games as well. In c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

War Of Attrition (game)

In game theory, the ''war of attrition'' is a dynamic timing game in which players choose a time to stop, and fundamentally trade off the strategic gains from outlasting other players and the real costs expended with the passage of time. Its precise opposite is the ''pre-emption game'', in which players elect a time to stop, and fundamentally trade off the strategic costs from outlasting other players and the real gains occasioned by the passage of time. The model was originally formulated by John Maynard Smith; a mixed evolutionarily stable strategy (ESS) was determined by Bishop & Cannings. An example is a second price ''all-pay'' auction, in which the prize goes to the player with the highest bid and each player pays the loser's low bid (making it an all-pay sealed-bid second-price auction). Examining the game To see how a war of attrition works, consider the all pay auction: Assume that each player makes a bid on an item, and the one who bids the highest wins a resource of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Paradoxes In Economics

A paradox is a logically self-contradictory statement or a statement that runs contrary to one's expectation. It is a statement that, despite apparently valid reasoning from true premises, leads to a seemingly self-contradictory or a logically unacceptable conclusion. A paradox usually involves contradictory-yet-interrelated elements that exist simultaneously and persist over time. They result in "persistent contradiction between interdependent elements" leading to a lasting "unity of opposites". In logic, many paradoxes exist that are known to be invalid arguments, yet are nevertheless valuable in promoting critical thinking, while other paradoxes have revealed errors in definitions that were assumed to be rigorous, and have caused axioms of mathematics and logic to be re-examined. One example is Russell's paradox, which questions whether a "list of all lists that do not contain themselves" would include itself, and showed that attempts to found set theory on the identification ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tragedy Of The Commons

Tragedy (from the grc-gre, τραγῳδία, ''tragōidia'', ''tragōidia'') is a genre of drama based on human suffering and, mainly, the terrible or sorrowful events that befall a main character. Traditionally, the intention of tragedy is to invoke an accompanying catharsis, or a "pain hatawakens pleasure", for the audience. While many cultures have developed forms that provoke this paradoxical response, the term ''tragedy'' often refers to a specific tradition of drama that has played a unique and important role historically in the self-definition of Western civilization. That tradition has been multiple and discontinuous, yet the term has often been used to invoke a powerful effect of cultural identity and historical continuity—"the Greeks and the Elizabethans, in one cultural form; Hellenes and Christians, in a common activity," as Raymond Williams puts it. From its origins in the theatre of ancient Greece 2500 years ago, from which there survives only a fraction ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Escalation Of Commitment

Escalation of commitment is a human behavior pattern in which an individual or group facing increasingly negative outcomes from a decision, action, or investment nevertheless continue the behavior instead of altering course. The actor maintains behaviors that are irrational, but align with previous decisions and actions. Economists and behavioral scientists use a related term, ''sunk-cost fallacy'', to describe the justification of increased investment of money or effort in a decision, based on the cumulative prior investment ("sunk cost") despite new evidence suggesting that the future cost of continuing the behavior outweighs the expected benefit. In sociology, ''irrational escalation of commitment'' or ''commitment bias'' describe similar behaviors. The phenomenon and the sentiment underlying them are reflected in such proverbial images as "Throwing good money after bad", or "In for a penny, in for a pound", or "It's never the wrong time to make the right decision", or "I ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bidding Fee Auction

A bidding fee auction, also called a penny auction, is a type of all-pay auction in which all participants must pay a non-refundable fee to place each small incremental bid. The auction is extended each time a new bid is placed, typically by 10 to 20 seconds. Once time expires without a new bid being placed, the last bidder wins the auction and pays the amount of that bid. The auctioneer profits from both the fees charged to place bids and the payment for the winning bid; these combined revenues frequently total more than the value of the item being sold. Empirical evidence suggests that revenues from these auctions exceeds theoretical predictions for rational agents. This has been credited to the sunk cost fallacy. Such auctions are typically held over the Internet, rather than in person. How it works Participants pay a fee to purchase bids. Each of the bids increases the price of the item by a small amount, such as one penny (0.01 USD, 1¢, or 0.01 GBP, 1p; hence the name of the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

All-pay Auction

In economics and game theory, an all-pay auction is an auction in which every bidder must pay regardless of whether they win the prize, which is awarded to the highest bidder as in a conventional auction. As shown by Riley and Samuelson (1981), equilibrium bidding in an all pay auction with private information is revenue equivalent to bidding in a sealed high bid or open ascending price auction. In the simplest version, there is complete information. The Nash equilibrium is such that each bidder plays a mixed strategy and expected pay-offs are zero.Jehiel P, Moldovanu B (2006) Allocative and informational externalities in auctions and related mechanisms. In: Blundell R, Newey WK, Persson T (eds) Advances in Economics and Econometrics: Volume 1: Theory and Applications, Ninth World Congress, vol 1, Cambridge University Press, chap 3 The seller's expected revenue is equal to the value of the prize. However, some economic experiments and studies have shown that over-bidding is common. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Binomial Distribution

In probability theory and statistics, the binomial distribution with parameters ''n'' and ''p'' is the discrete probability distribution of the number of successes in a sequence of ''n'' independent experiments, each asking a yes–no question, and each with its own Boolean-valued outcome: ''success'' (with probability ''p'') or ''failure'' (with probability q=1-p). A single success/failure experiment is also called a Bernoulli trial or Bernoulli experiment, and a sequence of outcomes is called a Bernoulli process; for a single trial, i.e., ''n'' = 1, the binomial distribution is a Bernoulli distribution. The binomial distribution is the basis for the popular binomial test of statistical significance. The binomial distribution is frequently used to model the number of successes in a sample of size ''n'' drawn with replacement from a population of size ''N''. If the sampling is carried out without replacement, the draws are not independent and so the resulting ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sunk Cost

In economics and business decision-making, a sunk cost (also known as retrospective cost) is a cost that has already been incurred and cannot be recovered. Sunk costs are contrasted with '' prospective costs'', which are future costs that may be avoided if action is taken. In other words, a sunk cost is a sum paid in the past that is no longer relevant to decisions about the future. Even though economists argue that sunk costs are no longer relevant to future rational decision-making, people in everyday life often take previous expenditures in situations, such as repairing a car or house, into their future decisions regarding those properties. Bygones principle According to classical economics and standard microeconomic theory, only prospective (future) costs are relevant to a rational decision. At any moment in time, the best thing to do depends only on ''current'' alternatives. The only things that matter are the ''future'' consequences. Past mistakes are irrelevant. Any cos ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bidding Fee Auction

A bidding fee auction, also called a penny auction, is a type of all-pay auction in which all participants must pay a non-refundable fee to place each small incremental bid. The auction is extended each time a new bid is placed, typically by 10 to 20 seconds. Once time expires without a new bid being placed, the last bidder wins the auction and pays the amount of that bid. The auctioneer profits from both the fees charged to place bids and the payment for the winning bid; these combined revenues frequently total more than the value of the item being sold. Empirical evidence suggests that revenues from these auctions exceeds theoretical predictions for rational agents. This has been credited to the sunk cost fallacy. Such auctions are typically held over the Internet, rather than in person. How it works Participants pay a fee to purchase bids. Each of the bids increases the price of the item by a small amount, such as one penny (0.01 USD, 1¢, or 0.01 GBP, 1p; hence the name of the a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sequential Game

In game theory, a sequential game is a game where one player chooses their action before the others choose theirs. The other players must have information on the first player's choice so that the difference in time has no strategic effect. Sequential games are governed by the time axis and represented in the form of decision trees. Sequential games with perfect information can be analysed mathematically using combinatorial game theory. Decision trees are the extensive form of dynamic games that provide information on the possible ways that a given game can be played. They show the sequence in which players act and the number of times that they can each make a decision. Decision trees also provide information on what each player knows or does not know at the point in time they decide on an action to take. Payoffs for each player are given at the decision nodes of the tree. Extensive form representations were introduced by Neumann and further developed by Kuhn in the earliest yea ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

_last_flight.jpg)