|

Direct Holding System

The Direct Registration System (DRS) or direct holding system is a traditional system of securities clearance, settlement and ownership in which owners of securities have a direct relationship with the issuer. As implemented in the past, investors would either be recorded on the issuer's register or they would be in physical possession of bearer securities certificates. Advantages Directly registering a stock precludes it from being borrowed by short sellers. Additionally, it acts as an artificial source of 'illiquidity' for investors who wish to precommit to a long term position, as shares held in a DHS take longer to sell, and are often batched at market prices (ie sellers have little control over their exit price). This of course is also a disadvantage for many investors, who prefer the convenience and liquidity of a traditional broker. Historic disadvantages Within this system, transfers of securities had to be settled through the physical delivery of paper certificates an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Security (finance)

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and Fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants. Securities may be represented by a certificate or, more typically, they may be "non-certificated", that is in electronic ( dematerialized) or "book entry only" form. Certificates may be ''bearer'', meaning they entitle the holder to rights under the security merely by holding the security, or ''registered'', meaning they entitle the holder to rights only if they appear on a secur ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Naked Shorts

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf. Short selling is used to take advantage of perceived arbitrage opportunities or to anticipate a price fall, but exposes the seller to the risk of a price rise. The oldest documented example of a naked short in securities trading appears to be a 1609 maneuver against the Dutch East India Company by the Dutch trader Isaac Le Maire. Critics have advocated for stricter regulations against naked short selling. In 2005 in the United States, "Regulation SHO" was enacted, requiring that brok ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dematerialization (securities)

In finance and financial law, dematerialization refers to the substitution of paper-form securities by book-entry securities. This is a form of indirect holding system where an intermediary, such as a broker or central securities depository, or the issuer itself (e.g., French system) holds a record of the ownership of shares usually in electronic format. The dematerialization of securities such as stocks has been a major trend since the late 1960s, with the result that by 2010 the majority of global securities were held in dematerialized form. History Although the phenomenon is ancient, since book-entry systems for recording securities have been noted from civilisations as early as Assyria in 2000 BC, it gained new prominence with the advent of computer technology in the late 20th century. Even during the period when paper certificates were popular, book-entry systems continued since many small firms could not afford printing secured paper-form securities. These book-entry sec ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Uniform Commercial Code

The Uniform Commercial Code (UCC), first published in 1952, is one of a number of Uniform Acts that have been established as law with the goal of harmonizing the laws of sales and other commercial transactions across the United States through UCC adoption by all 50 states, the District of Columbia, and the Territories of the United States. While largely successful at achieving this ambitious goal, some U.S. jurisdictions (e.g., Louisiana and Puerto Rico) have not adopted all of the articles contained in the UCC, while other U.S. jurisdictions (e.g., American Samoa) have not adopted any articles in the UCC. Also, adoption of the UCC often varies from one U.S. jurisdiction to another. Sometimes this variation is due to alternative language found in the official UCC itself. At other times, adoption of revisions to the official UCC contributes to further variation. Additionally, some jurisdictions deviate from the official UCC by tailoring the language to meet their unique needs and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States

The United States of America (U.S.A. or USA), commonly known as the United States (U.S. or US) or America, is a country primarily located in North America. It consists of 50 states, a federal district, five major unincorporated territories, nine Minor Outlying Islands, and 326 Indian reservations. The United States is also in free association with three Pacific Island sovereign states: the Federated States of Micronesia, the Marshall Islands, and the Republic of Palau. It is the world's third-largest country by both land and total area. It shares land borders with Canada to its north and with Mexico to its south and has maritime borders with the Bahamas, Cuba, Russia, and other nations. With a population of over 333 million, it is the most populous country in the Americas and the third most populous in the world. The national capital of the United States is Washington, D.C. and its most populous city and principal financial center is New York City. Paleo-Americ ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hague Securities Convention

The Convention on the law applicable to certain rights in respect of securities held with an intermediary, or Hague Securities Convention is an international multilateralism, multilateral treaty intended to remove, globally, legal uncertainties for cross-border security (finance), securities transactions. The Convention was drafted under the auspices of the Hague Conference on Private International Law, which as resulted in several Conflict of Laws conventions. Switzerland, Mauritius and the United States have ratified the convention, which entered into force on 1 April 2017. The European Commission recommended in July 2006 that its member states sign the Convention, but this recommendation was later withdrawn. The need for the Convention The Convention is largely a response to the move in recent times in most nations from a purely direct holding system to a mixed direct and indirect holding system. The reforms, though largely beneficial, have created an alarming level of un ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Transfer Agent

A stock transfer agent, transfer agent, share registry or transfer agency is an entity, usually a third party firm unrelated to security transactions, that manages the change in ownership of company stock or investment fund shares, maintains a register of ownership and acts as paying agent for the payment of dividends and other distributions to investors. The name derives from the impartial intermediary role a transfer agent plays in validating and registering the purchase of new ownership shares and, in the case of a transfer of ownership, cancelling the name and certificate of shareholders who sell shares and substituting the new owner's name on the official master shareholder register. Transfer agent or stock transfer agent is the term used in the United States and Canada. Share registry is used in the United Kingdom, Australia and New Zealand. Transfer secretary is used in South Africa. A company may act as its own transfer agent or engage a third-party company to perform ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

MOASS

In January 2021, a short squeeze of the stock of the American video game retailer GameStop () and other securities took place, causing major financial consequences for certain hedge funds and large losses for short sellers. Approximately 140 percent of GameStop's public float had been sold short, and the rush to buy shares to cover those positions as the price rose caused it to rise even further. The short squeeze was initially and primarily triggered by users of the subreddit r/wallstreetbets, an Internet forum on the social news website Reddit, although a number of hedge funds also participated. At its height, on January 28, the short squeeze caused the retailer's stock price to reach a pre-market value of over US$500 per share ($125 split-adjusted), nearly 30 times the $17.25 valuation at the beginning of the month. The price of many other heavily shorted securities and cryptocurrencies also increased. On January 28, some brokerages, particularly app-based brokerage servi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Free Float

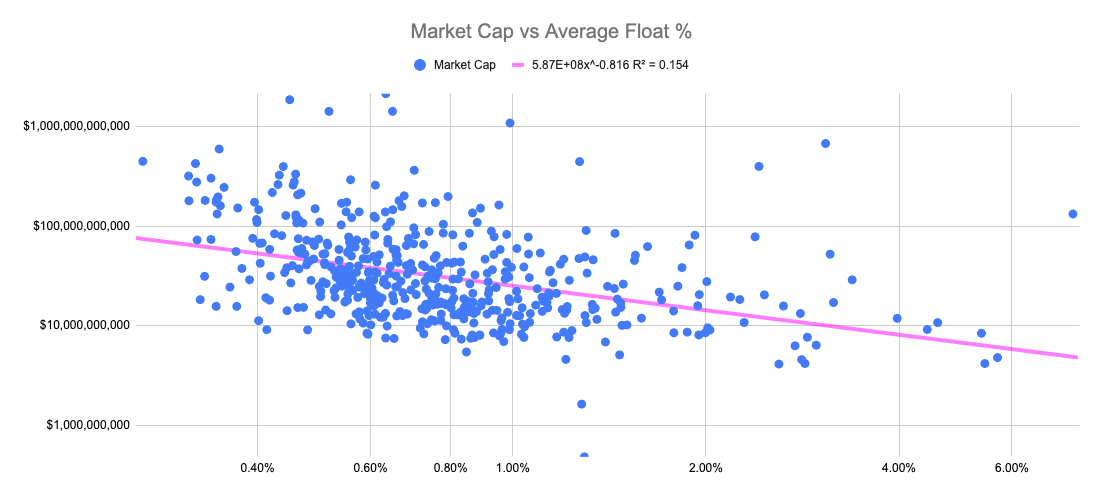

In the context of stock markets, the public float or free float represents the portion of shares of a corporation that are in the hands of public investors as opposed to locked-in shares held by promoters, company officers, controlling-interest investors, or governments. This number is sometimes seen as a better way of calculating market capitalization, because it provides a more accurate reflection (than entire market capitalization) of what public investors consider the company to be worth. In this context, the ''float'' may refer to all the shares outstanding that can be publicly traded. Calculating public float The float is calculated by subtracting the locked-in shares from outstanding shares. For example, a company may have 10 million outstanding shares, with 3 million of them in a locked-in position; this company's float would be 7 million (multiplied by the share price). Stocks with smaller floats tend to be more volatile than those with larger floats. In general, the la ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Meme Stock

A meme stock is a stock that gains popularity among retail investors through social media. The popularity of meme stocks is generally based on internet memes shared among traders, on platforms such as Reddit's r/wallstreetbets. Investors in such stocks are often young and inexperienced investors. As a result of their popularity, meme stocks often trade at prices that are above their estimated value on the basis of fundamental analysis, and are known for being extremely speculative and volatile. History Interest in meme stocks started in 2020, in what the U.S. Securities and Exchange Commission has called a "meme stock phenomenon". The stock of American video game retailer GameStop has been one of the most popular meme stocks, with mass purchases of the stock leading to the GameStop short squeeze in early 2021. The stock of entertainment company AMC is also cited as a prominent example. Other examples include the stocks of Bed, Bath & Beyond, National Beverage, and Koss. The disti ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock Certificate

In corporate law, a stock certificate (also known as certificate of stock or share certificate) is a legal document that certifies the legal interest (a bundle of several legal rights) of ownership of a specific number of shares (or, under Article 8 of the Uniform Commercial Code, a securities entitlement or pro rata share of a fungible bulk) or stock in a corporation. History A stock certificate is a legal document that certifies the legal interest (a bundle of several legal rights) of ownership of a specific number of shares (or, under Article 8 of the Uniform Commercial Code, a securities entitlement or pro rata share of a fungible bulk) or stock in a corporation. The first such instruments were used in the Netherlands by 1606, and in the United States by the year 1800. Historically, certificates may have been required to evidence entitlement to dividends, with a receipt for the payment being endorsed on the back; and the original certificate may have been required to be ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

GameStop Short Squeeze

In January 2021, a short squeeze of the stock of the American video game retailer GameStop () and other securities took place, causing major financial consequences for certain hedge funds and large losses for short sellers. Approximately 140 percent of GameStop's public float had been sold short, and the rush to buy shares to cover those positions as the price rose caused it to rise even further. The short squeeze was initially and primarily triggered by users of the subreddit r/wallstreetbets, an Internet forum on the social news website Reddit, although a number of hedge funds also participated. At its height, on January 28, the short squeeze caused the retailer's stock price to reach a pre-market value of over US$500 per share ($125 split-adjusted), nearly 30 times the $17.25 valuation at the beginning of the month. The price of many other heavily shorted securities and cryptocurrencies also increased. On January 28, some brokerages, particularly app-based brokerage servi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)

.jpg)