|

Deflationary Spiral

In economics, deflation is a decrease in the general price level of goods and services. Deflation occurs when the inflation rate falls below 0% (a negative inflation rate). Inflation reduces the value of currency over time, but sudden deflation increases it. This allows more goods and services to be bought than before with the same amount of currency. Deflation is distinct from disinflation, a slow-down in the inflation rate, i.e. when inflation declines to a lower rate but is still positive. Economists generally believe that a sudden deflationary shock is a problem in a modern economy because it increases the real value of debt, especially if the deflation is unexpected. Deflation may also aggravate recessions and lead to a deflationary spiral. Some economists argue that prolonged deflationary periods are related to the underlying of technological progress in an economy, because as productivity increases ( TFP), the cost of goods decreases. Deflation usually happens when s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

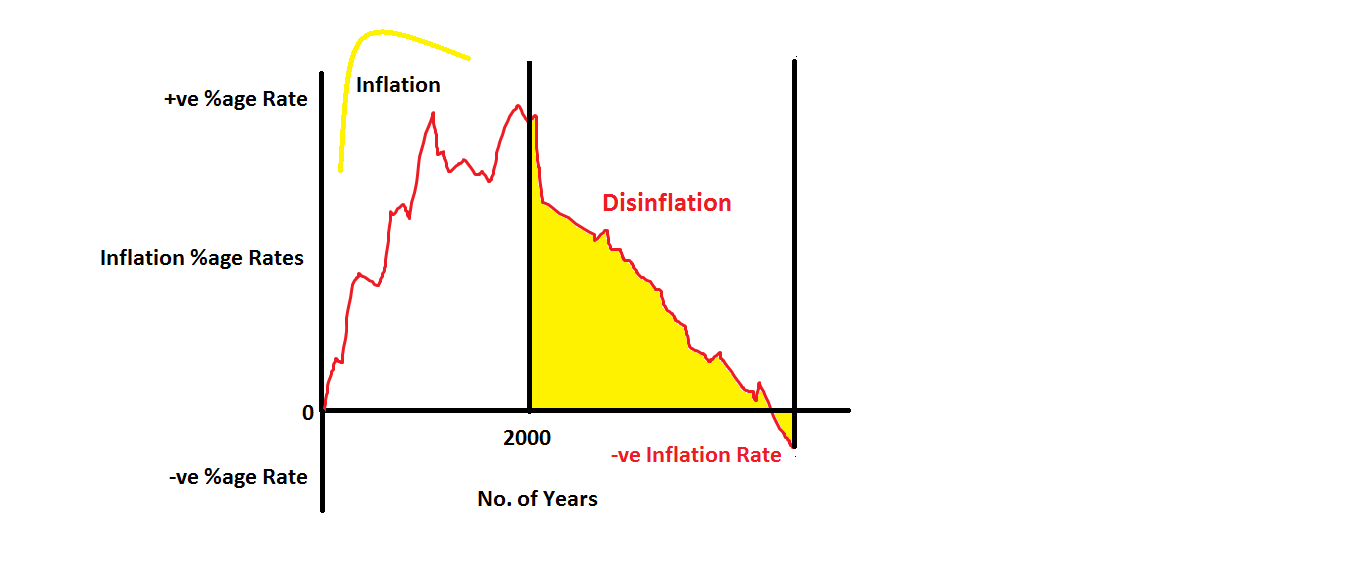

Disinflation

Disinflation is a decrease in the rate of inflation – a slowdown in the rate of increase of the general price level of goods and services in a nation's gross domestic product over time. It is the opposite of reflation. If the inflation rate is not very high to start with, disinflation can lead to deflation – decreases in the general price level of goods and services. For example if the annual inflation rate one month is 5% and it is 4% the following month, prices disinflated by 1% but are still increasing at a 4% annual rate. If the current rate is 1% and it is the -2% the following month, prices disinflated by 3% and are decreasing at a 2% annual rate. Causes, characteristics, and an example There is widespread consensus among economists that inflation is caused by increases in the supply of money available for use in a nation's economy. Inflation can also occur when the economy 'overheats' because of excess aggregate demand (this is called demand-pull inflation). ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, individuals, economic and social groups, etc. The rivalry can be over attainment of any exclusive goal, including recognition: Competition occurs in nature, between living organisms which co-exist in the same environment. Animals compete over water supplies, food, mates, and other biological resources. Humans usually compete for food and mates, though when these needs are met deep rivalries often arise over the pursuit of wealth, power, prestige, and fame when in a static, repetitive, or unchanging environment. Competition is a major tenet of market economies and business, often associated with business competition as companies are in competition with at least one other firm over the same group of customers. Competition inside a compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Productivity Improving Technologies (historical)

The productivity-improving technologies are the technological innovations that have historically increased productivity. Productivity is often measured as the ratio of (aggregate) output to (aggregate) input in the production of goods and services. Productivity is increased by lowering the amount of labor, Capital (economics), capital, energy or materials that go into producing any given amount of economic goods and services. Increases in productivity are largely responsible for the increase in per capita Standard of living, living standards. History Productivity-improving technologies date back to antiquity, with rather slow progress until the late Middle Ages. Important examples of early to medieval European technology include the water wheel, the horse collar, the spinning wheel, the three-field system (after 1500 the four-field system—see crop rotation) and the blast furnace. All of these technologies had been in use in China, some for centuries, before being introduced ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Competition

Competition is a rivalry where two or more parties strive for a common goal which cannot be shared: where one's gain is the other's loss (an example of which is a zero-sum game). Competition can arise between entities such as organisms, individuals, economic and social groups, etc. The rivalry can be over attainment of any exclusive goal, including recognition: Competition occurs in nature, between living organisms which co-exist in the same environment. Animals compete over water supplies, food, mates, and other biological resources. Humans usually compete for food and mates, though when these needs are met deep rivalries often arise over the pursuit of wealth, power, prestige, and fame when in a static, repetitive, or unchanging environment. Competition is a major tenet of market economies and business, often associated with business competition as companies are in competition with at least one other firm over the same group of customers. Competition inside a compan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Efficiency

Efficiency is the often measurable ability to avoid wasting materials, energy, efforts, money, and time in doing something or in producing a desired result. In a more general sense, it is the ability to do things well, successfully, and without waste. In more mathematical or scientific terms, it signifies the level of performance that uses the least amount of inputs to achieve the highest amount of output. It often specifically comprises the capability of a specific application of effort to produce a specific outcome with a minimum amount or quantity of waste, expense, or unnecessary effort. Efficiency refers to very different inputs and outputs in different fields and industries. In 2019, the European Commission said: "Resource efficiency means using the Earth's limited resources in a sustainable manner while minimising impacts on the environment. It allows us to create more with less and to deliver greater value with less input." Writer Deborah Stone notes that efficiency is " ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Purchasing Power

Purchasing power is the amount of goods and services that can be purchased with a unit of currency. For example, if one had taken one unit of currency to a store in the 1950s, it would have been possible to buy a greater number of items than would be the case today, indicating that the currency had a greater purchasing power in the 1950s. If one's monetary income stays the same, but the price level increases, the purchasing power of that income falls. Inflation does not ''always'' imply falling purchasing power of one's money income since the latter may rise faster than the price level. A higher real income means a higher purchasing power since real income refers to the income adjusted for inflation. Traditionally, the purchasing power of money depended heavily upon the local value of gold and silver, but was also made subject to the availability and demand of certain goods on the market. Most modern fiat currencies, like US dollars, are traded against each other and commodity mo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carry (investment)

The carry of an asset is the return obtained from holding it (if positive), or the cost of holding it (if negative) (see also Cost of carry). For instance, commodities are usually negative carry assets, as they incur storage costs or may suffer from depreciation. (Imagine corn or wheat sitting in a silo somewhere, not being sold or eaten.) But in some circumstances, appropriately hedged commodities can be positive carry assets if the forward/futures market is willing to pay sufficient premium for future delivery. This can also refer to a trade with more than one leg, where you earn the spread between borrowing a low carry asset and lending a high carry one; such as gold during financial crisis, due to its safe haven quality. Carry trades are not usually arbitrages: pure arbitrages make money no matter what; carry trades make money ''only if nothing changes'' against the carry's favor. Interest rates carry trade / Maturity transformation For instance, the traditional revenue ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autarky

Autarky is the characteristic of self-sufficiency, usually applied to societies, communities, states, and their economic systems. Autarky as an ideal or method has been embraced by a wide range of political ideologies and movements, especially left-wing ideologies like African socialism, mutualism, war communism, communalism, swadeshi, syndicalism (especially anarcho-syndicalism), and left-wing populism, generally in an effort to build alternative economic structures or to control resources against structures a particular movement views as hostile. Conservative, centrist and nationalist movements have also adopted autarky in an attempt to preserve part of an existing social order or to develop a particular industry. Proponents of autarky have argued for national self-sufficiency to reduce foreign economic, political and cultural influences, as well as to promote international peace. Economists are generally supportive of free trade. There is a broad consensus among eco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Liquidity Trap

A liquidity trap is a situation, described in Keynesian economics, in which, "after the rate of interest has fallen to a certain level, liquidity preference may become virtually absolute in the sense that almost everyone prefers holding cash rather than holding a debt (financial instrument) which yields so low a rate of interest." Keynes, John Maynard (1936) '' The General Theory of Employment, Interest and Money'', United Kingdom: Palgrave Macmillan, 2007 edition, A liquidity trap is caused when people hoard cash because they expect an adverse event such as deflation, insufficient aggregate demand, or war. Among the characteristics of a liquidity trap are interest rates that are close to zero and changes in the money supply that fail to translate into changes in the price level. Krugman, Paul R. (1998)"It's baack: Japan's Slump and the Return of the Liquidity Trap," Brookings Papers on Economic Activity Origin and definition of the term John Maynard Keynes, in his 1936 '' ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Risk Aversion

In economics and finance, risk aversion is the tendency of people to prefer outcomes with low uncertainty to those outcomes with high uncertainty, even if the average outcome of the latter is equal to or higher in monetary value than the more certain outcome. Risk aversion explains the inclination to agree to a situation with a more predictable, but possibly lower payoff, rather than another situation with a highly unpredictable, but possibly higher payoff. For example, a risk-averse investor might choose to put their money into a bank account with a low but guaranteed interest rate, rather than into a stock that may have high expected returns, but also involves a chance of losing value. Example A person is given the choice between two scenarios: one with a guaranteed payoff, and one with a risky payoff with same average value. In the former scenario, the person receives $50. In the uncertain scenario, a coin is flipped to decide whether the person receives $100 or nothing. The ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

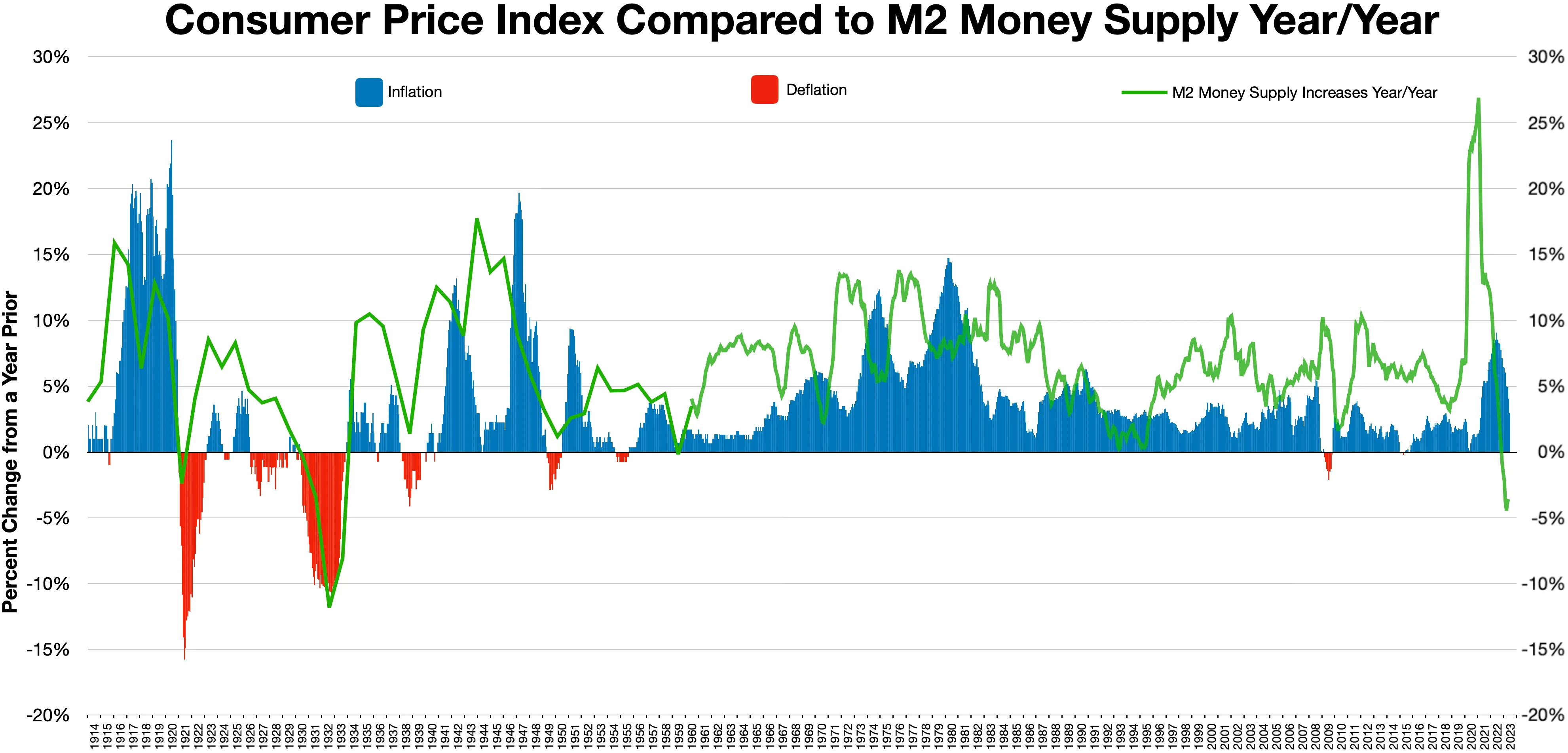

Money Supply

In macroeconomics, the money supply (or money stock) refers to the total volume of currency held by the public at a particular point in time. There are several ways to define "money", but standard measures usually include Circulation (currency), currency in circulation (i.e. physical cash) and demand deposits (depositors' easily accessed assets on the books of financial institutions). The central bank of a country may use a definition of what constitutes legal tender for its purposes. Money supply data is recorded and published, usually by a government agency or the central bank of the country. Public sector, Public and private sector analysts monitor changes in the money supply because of the belief that such changes affect the price levels of Security (finance), securities, inflation, the exchange rates, and the business cycle. The relationship between money and prices has historically been associated with the quantity theory of money. There is some empirical evidence of a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

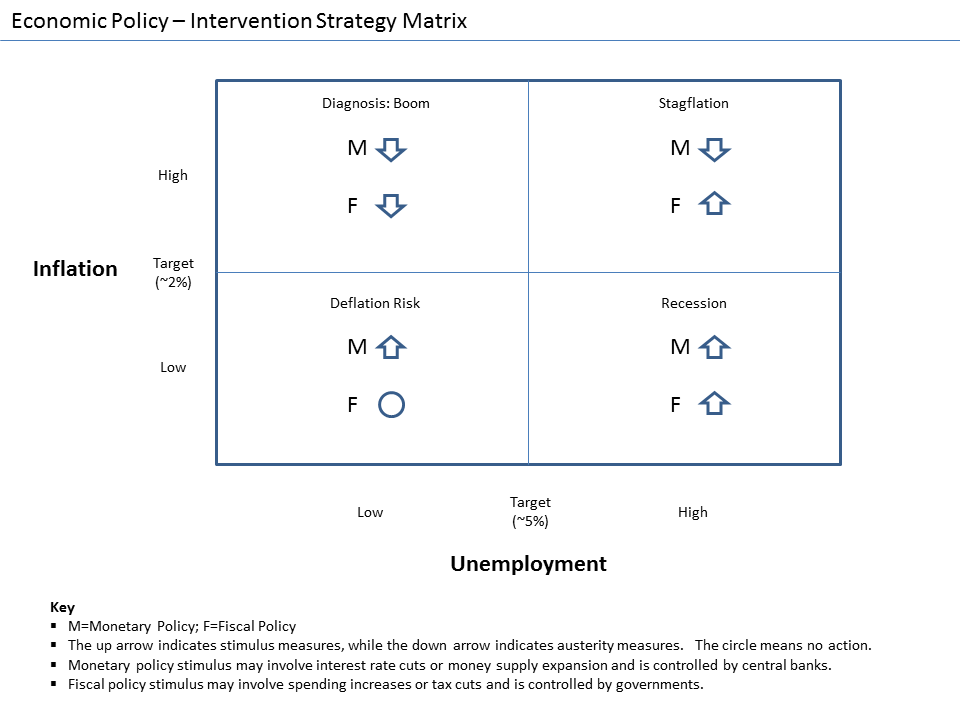

Stimulus (economic)

In economics, stimulus refers to attempts to use monetary policy or fiscal policy (or stabilization policy in general) to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easing. A stimulus is sometimes colloquially referred to as "priming the pump" or "pump priming". Concept During a recession, production and employment are far below their sustainable potential due to lack of demand. It is hoped that increasing demand will stimulate growth and that any adverse side effects from stimulus will be mild. Fiscal stimulus refers to increasing government consumption or transfers or lowering taxes, increasing the rate of growth of public debt. Supporters of Keynesian economics assume the stimulus will cause sufficient economic growth to fill that gap partially or completely via the multiplier effect. Monetary stimulus refers to lowering interest rates, quantitative easing, or other ways of increasing the amount ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |