|

Deficit Reduction

Deficit reduction can refer to any method of reducing a government budget deficit (including reduced government spending and/or increased government revenue). See also *Deficit (other) *Deficit Reduction Act (other) *Deficit reduction in the United States *United States Congress Joint Select Committee on Deficit Reduction The Joint Select Committee on Deficit Reduction,Budget Control Act of 2011, , Title IV colloquially referred to as the Supercommittee, was a joint select committee of the United States Congress, created by the Budget Control Act of 2011 on August ... {{Fin-theory-stub Deficit spending Government spending Tax ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Congress Joint Select Committee On Deficit Reduction

The Joint Select Committee on Deficit Reduction,Budget Control Act of 2011, , Title IV colloquially referred to as the Supercommittee, was a joint select committee of the United States Congress, created by the Budget Control Act of 2011 on August 2, 2011. This act was intended to prevent the sovereign default that could have resulted from the 2011 United States debt-ceiling crisis. The objective of the committee was to develop a deficit reduction plan over 10 years in addition to the $917 billion of cuts and initial debt limit increase of $900 billion in the Budget Control Act of 2011 that avoided a U.S. sovereign default. The committee recommendation was to have been subject to a simple vote by the full legislative bodies without amendment; this extraordinary provision was included to limit partisan gridlock. The goal outlined in the Budget Control Act of 2011 was to cut at least $1.5 trillion over the coming 10 years (avoiding much larger "sequestration" across-the-board cu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Budget Deficit

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a ''government budget surplus'', and a negative balance is a ''government budget deficit''. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government (from national to local) and takes into account public social security obligations. The government budget balance can be broken down into the ''primary balance'' and interest payments on accumulated government debt; the two together give the budget balance. Furthermore, the budget balance can be broken down into the ''structural balance'' (also known as ''cyclically-adjusted balance'') and the cyclical component: the structural budget balance attempts to adjust for the impact of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government Gross fixed capital formation, gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Government spending can be financed by government borrowing, taxes, custom duties, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Revenue

Government revenue or national revenue is money received by a government from taxes and non-tax sources to enable it to undertake public expenditure. Government revenue as well as government spending are components of the government budget and important tools of the government's fiscal policy. The collection of revenue is the most basic task of a government, as revenue is necessary for the operation of government, provision of the common good (through the social contract in order to fulfill the public interest) and enforcement of its laws; this necessity of revenue was a major factor in the development of the modern bureaucratic state. Government revenue is distinct from government debt and money creation, which both serve as temporary measures of increasing a government's money supply without increasing its revenue. Sources There are a variety of sources from which government can derive revenue. The most common sources of government revenue have varied in different places an ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deficit (other)

A deficit is the amount by which a sum falls short of some reference amount. Economics * Balance of payments deficit, when the balance of payments is negative * Government budget deficit * Deficit spending, the amount by which spending exceeds revenue * Primary deficit, the pure deficit derived after deducting the interest payments * Structural and cyclical deficit, parts of the public sector deficit * Income deficit, the difference between family income and the poverty threshold * Trade deficit, when the value of imports exceed the value of exports fiscal deficit of that year= total borrowing by government Psychology * Attention deficit hyperactivity disorder, a developmental disorder * Cognitive deficit, any characteristic that acts as a barrier to cognitive performance Other * Defect (geometry), angular deficit * ''Déficit'', a 2007 Mexican film by Gael García Bernal See also * Government debt, the accumulated amount of deficits; "debt" and "deficit" are sometimes con ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deficit Reduction Act (other)

{{disambiguation ...

The Deficit Reduction Act may refer to various pieces of United States legislation, including: * Deficit Reduction Act of 1984 * Gramm-Rudman-Hollings Deficit Reduction Act of 1985 * Omnibus Budget Reconciliation Act of 1993 * Deficit Reduction Act of 2005 See also * Deficit (other) A deficit is the amount by which a sum falls short of some reference amount. Economics * Balance of payments deficit, when the balance of payments is negative * Government budget deficit * Deficit spending, the amount by which spending exceeds r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deficit Reduction In The United States

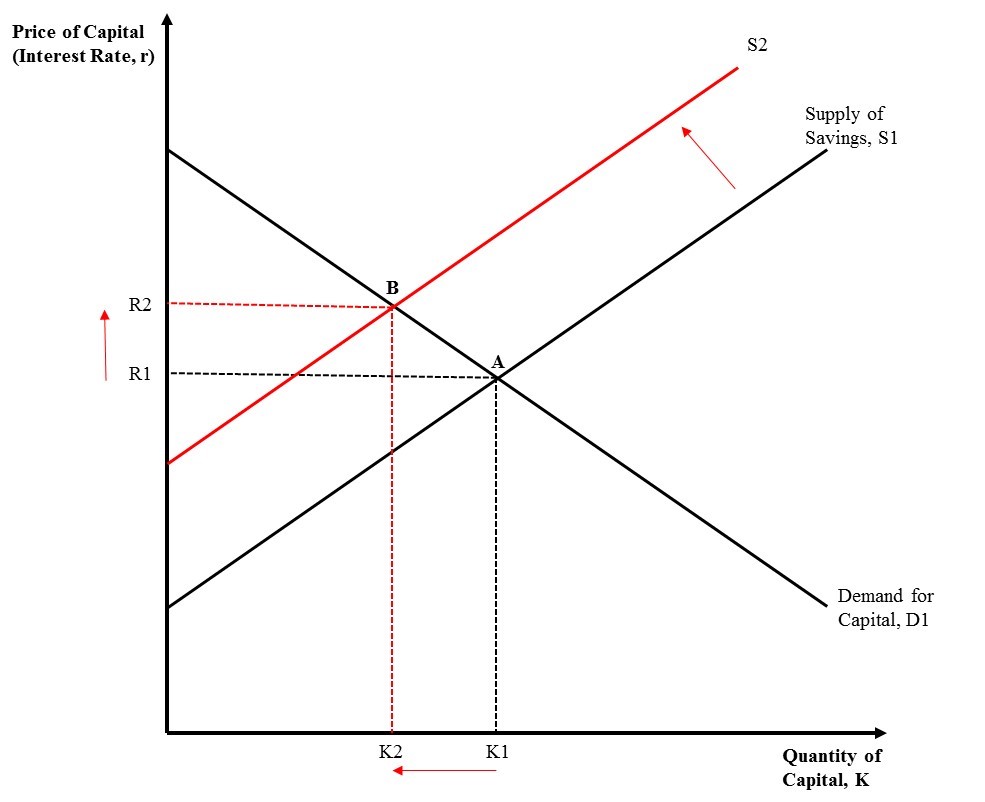

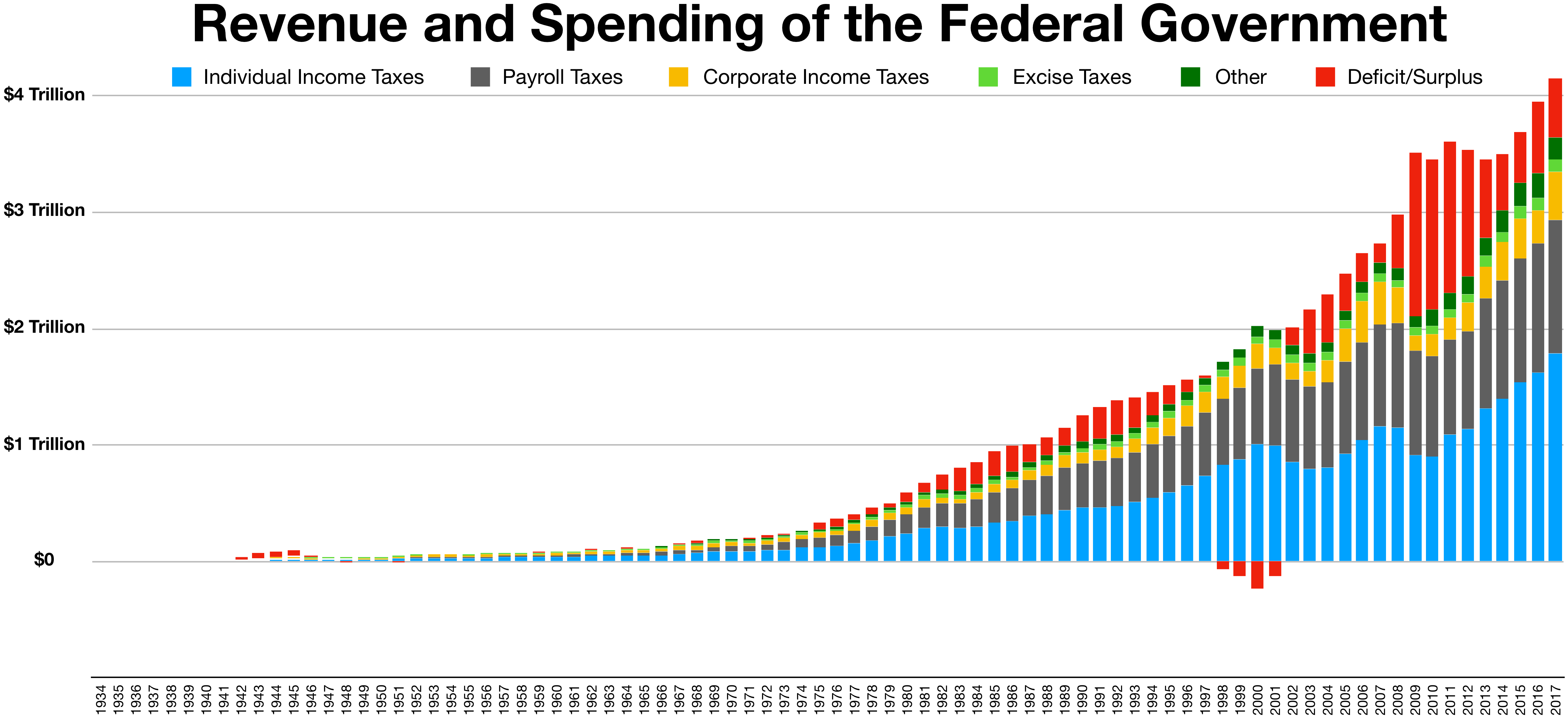

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the Federal budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt. CBO reported in July 2014 that the continuation of present tax and spending policies for the long-run (into the 2030s) results in a budget trajectory that causes debt to grow faster than GDP, which is "unsustainable." Further, CBO reported that high levels of debt relative to GDP may pose significant risks to economic growth and the ability of lawmakers to respond to crises. These risks can be addressed by higher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deficit Spending

Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below. Controversy Government deficit spending is a central point of controversy in economics, with prominent economists holding differing views. The mainstream economics position is that deficit spending is desirable and necessary as part of countercyclical fiscal policy, but that there should not be a structural deficit (i.e., permanent deficit): The government should run deficits during recessions to compensate for the shortfall in aggregate demand, but should run surpluses in boom ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Spending

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment (government Gross fixed capital formation, gross capital formation). These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product. Government spending can be financed by government borrowing, taxes, custom duties, the sale or lease of natural resources, and various fees like national park entry fees or licensing fees. When Governments choose to borrow money, they have to gov ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |