|

Dead Cat Bounce (comedy Band)

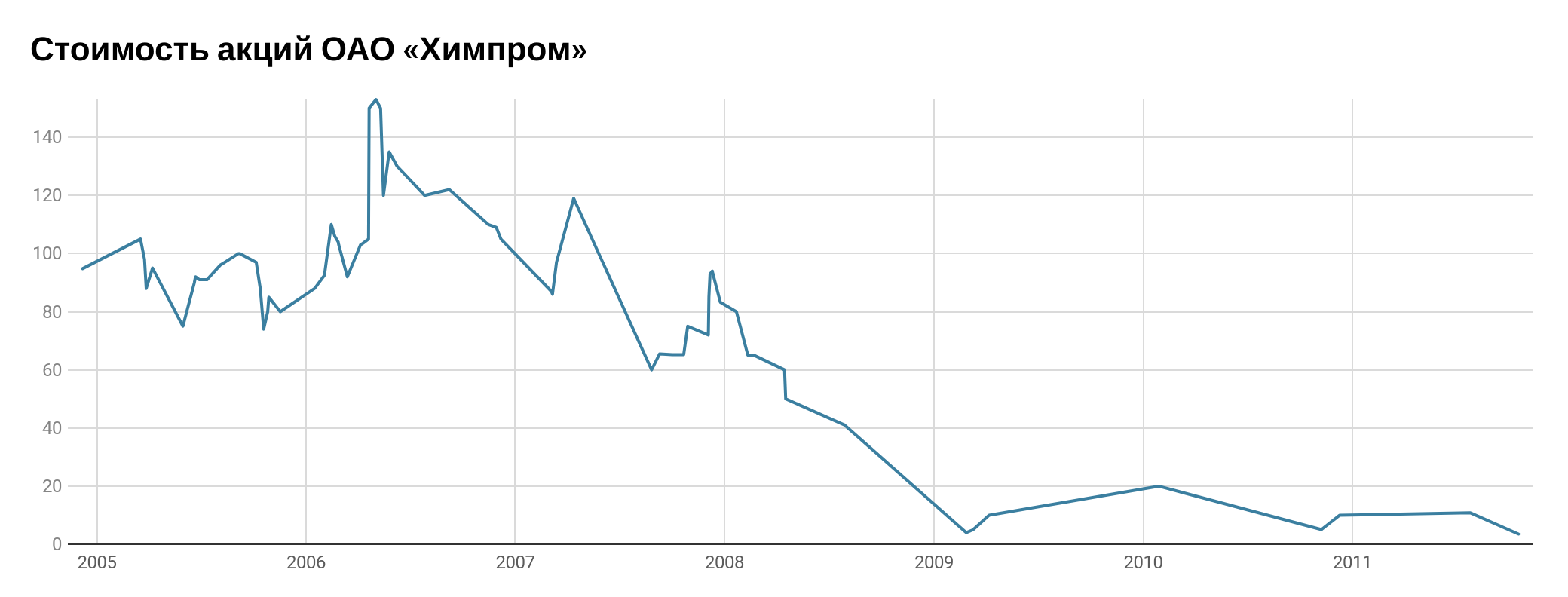

In finance, a dead cat bounce is a small, brief recovery in the price of a declining stock. Derived from the idea that "even a dead cat will bounce if it falls from a great height", the phrase, which originated on Wall Street, is also popularly applied to any case where a subject experiences a brief resurgence during or following a severe decline. This may also be known as a "sucker rally". History The earliest citation of the phrase in the news media dates to December 1985 when the Singaporean and Malaysian stock markets bounced back after a hard fall during the recession of that year. Journalists Chris Sherwell and Wong Sulong of the '' Financial Times'' were quoted as saying the market rise was "what we call a dead cat bounce". Both the Singaporean and Malaysian economies continued to fall after the quote, although both economies recovered in the following years. The phrase was used again the following year about falling oil prices. In the San Jose Mercury News, Raymond F. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Finance

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability asse ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bear Market

A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-frames. Traders attempt to identify market trends using technical analysis, a framework which characterizes market trends as predictable price tendencies within the market when price reaches support and resistance levels, varying over time. A market trend can only be determined in hindsight, since at any time prices in the future are not known. Market terminology The terms "bull market" and "bear market" describe upward and downward market trends, respectively, and can be used to describe either the market as a whole or specific sectors and securities. The terms come from London's Exchange Alley in the early 18th century, where traders who engaged in naked short selling were called "bear-skin jobbers" because they sold a bear's skin (the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Metaphors Referring To Cats

A metaphor is a figure of speech that, for rhetorical effect, directly refers to one thing by mentioning another. It may provide (or obscure) clarity or identify hidden similarities between two different ideas. Metaphors are often compared with other types of figurative language, such as antithesis, hyperbole, metonymy, and simile. One of the most commonly cited examples of a metaphor in English literature comes from the "All the world's a stage" monologue from ''As You Like It'': All the world's a stage, And all the men and women merely players; They have their exits and their entrances And one man in his time plays many parts, His Acts being seven ages. At first, the infant... :—William Shakespeare, ''As You Like It'', 2/7 This quotation expresses a metaphor because the world is not literally a stage, and most humans are not literally actors and actresses playing roles. By asserting that the world is a stage, Shakespeare uses points of comparison between the world and a s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Markets

A financial market is a market in which people trade financial securities and derivatives at low transaction costs. Some of the securities include stocks and bonds, raw materials and precious metals, which are known in the financial markets as commodities. The term "market" is sometimes used for what are more strictly ''exchanges'', organizations that facilitate the trade in financial securities, e.g., a stock exchange or commodity exchange. This may be a physical location (such as the New York Stock Exchange (NYSE), London Stock Exchange (LSE), JSE Limited (JSE), Bombay Stock Exchange (BSE) or an electronic system such as NASDAQ. Much trading of stocks takes place on an exchange; still, corporate actions (merger, spinoff) are outside an exchange, while any two companies or people, for whatever reason, may agree to sell the stock from the one to the other without using an exchange. Trading of currencies and bonds is largely on a bilateral basis, although some bonds trade o ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dead Cat Strategy

The dead cat strategy, also known as deadcatting, is the political strategy of deliberately making a shocking announcement to divert media attention away from problems or failures in other areas. The present name for the strategy has been associated with British former prime minister Boris Johnson's political strategist Lynton Crosby. Origin While he was mayor of London, Boris Johnson wrote a column for the 3 March 2013 edition of ''The Telegraph'' in which he described the "dead cat" as a piece of Australian political strategy about what to do in a situation in which the argument is being lost and "the facts are overwhelmingly against you". Johnson employed the Australian Lynton Crosby as his campaign manager during the 2008 File:2008 Events Collage.png, From left, clockwise: Lehman Brothers went bankrupt following the Subprime mortgage crisis; Cyclone Nargis killed more than 138,000 in Myanmar; A scene from the opening ceremony of the 2008 Summer Olympics in Beijing; ... and ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Double-dip Recession

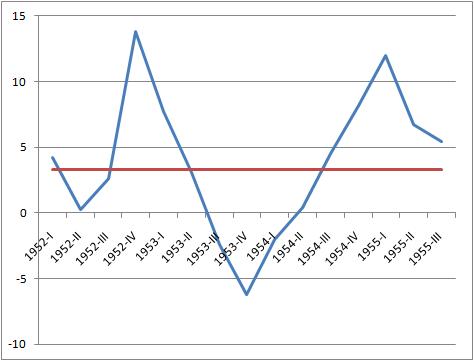

Recession shapes or recovery shapes are used by economists to describe different types of recessions and their subsequent recoveries. There is no specific academic theory or classification system for recession shapes; rather the terminology is used as an informal shorthand to characterize recessions and their recoveries. The most commonly used terms are V-shaped (with variations of square-root shaped, and Nike-swoosh shaped), U-shaped, W-shaped (also known as a double-dip recession), and L-shaped recessions, with the COVID-19 pandemic leading to the K-shaped recession (also known as a two-stage recession). The names derive from the shape the economic data – particularly GDP – takes during the recession and recovery. V-shaped In a V-shaped recession, the economy suffers a sharp but brief period of economic decline with a clearly defined trough, followed by a strong recovery. V-shapes are the normal shape for a recession, as the strength of the economic recovery is typical ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Market Trend

A market trend is a perceived tendency of financial markets to move in a particular direction over time. Analysts classify these trends as ''secular'' for long time-frames, ''primary'' for medium time-frames, and ''secondary'' for short time-frames. Traders attempt to identify market trends using technical analysis, a framework which characterizes market trends as predictable price tendencies within the market when price reaches support and resistance levels, varying over time. A market trend can only be determined in hindsight, since at any time prices in the future are not known. Market terminology The terms "bull market" and "bear market" describe upward and downward market trends, respectively, and can be used to describe either the market as a whole or specific sectors and securities. The terms come from London's Exchange Alley in the early 18th century, where traders who engaged in naked short selling were called "bear-skin jobbers" because they sold a bear's skin (the s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Don't Fight The Tape

Trend following or trend trading is a trading strategy according to which one should buy an asset when its price trend goes up, and sell when its trend goes down, expecting price movements to continue. There are a number of different techniques, calculations and time-frames that may be used to determine the general direction of the market to generate a trade signal, including the current market price calculation, moving averages and channel breakouts. Traders who employ this strategy do not aim to forecast or predict specific price levels; they simply jump on the trend and ride it. Due to the different techniques and time frames employed by trend followers to identify trends, trend followers as a group are not always strongly correlated to one another. Trend following is used by commodity trading advisors (CTAs) as the predominant strategy of technical traders. Research done by Galen Burghardt has shown that between 2000-2009 there was a very high correlation (.97) between tren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Technical Analysis

In finance, technical analysis is an analysis methodology for analysing and forecasting the direction of prices through the study of past market data, primarily price and volume. Behavioral economics and quantitative analysis use many of the same tools of technical analysis, which, being an aspect of active management, stands in contradiction to much of modern portfolio theory. The efficacy of both technical and fundamental analysis is disputed by the efficient-market hypothesis, which states that stock market prices are essentially unpredictable, and research on whether technical analysis offers any benefit has produced mixed results. History The principles of technical analysis are derived from hundreds of years of financial market data. Some aspects of technical analysis began to appear in Amsterdam-based merchant Joseph de la Vega's accounts of the Dutch financial markets in the 17th century. In Asia, technical analysis is said to be a method developed by Homma Munehisa duri ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

COVID-19

Coronavirus disease 2019 (COVID-19) is a contagious disease caused by a virus, the severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). The first known case was COVID-19 pandemic in Hubei, identified in Wuhan, China, in December 2019. The disease quickly spread worldwide, resulting in the COVID-19 pandemic. The symptoms of COVID‑19 are variable but often include fever, cough, headache, fatigue, breathing difficulties, Anosmia, loss of smell, and Ageusia, loss of taste. Symptoms may begin one to fourteen days incubation period, after exposure to the virus. At least a third of people who are infected Asymptomatic, do not develop noticeable symptoms. Of those who develop symptoms noticeable enough to be classified as patients, most (81%) develop mild to moderate symptoms (up to mild pneumonia), while 14% develop severe symptoms (dyspnea, Hypoxia (medical), hypoxia, or more than 50% lung involvement on imaging), and 5% develop critical symptoms (respiratory failure ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rent LatinAmerica 02

Rent may refer to: Economics *Renting, an agreement where a payment is made for the temporary use of a good, service or property *Economic rent, any payment in excess of the cost of production *Rent-seeking, attempting to increase one's share of existing wealth without creating wealth *Rentboy or rent boy, a male prostitute Entertainment * ''Rent'' (musical), a stage musical by Jonathan Larson ** ''Rent'' (film), a 2005 movie version of the musical **'' Rent: Filmed Live on Broadway'', 2008 film of the final Broadway performance of the musical *Rent (MUD), a game mechanic in some MUDs * ''Rent'' (song), a 1987 pop music hit from the Pet Shop Boys *Gross rentals, also known as distributor rentals, the distributor's share of a film's theatrical revenue at the box office See also *Rental (other) *Rentier (other) Rentier may refer to: * Rentier capitalism, economic practices of gaining profit by monopolizing access to property * Rentier state, a state which derives ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Stock

In finance, stock (also capital stock) consists of all the shares by which ownership of a corporation or company is divided.Longman Business English Dictionary: "stock - ''especially AmE'' one of the shares into which ownership of a company is divided, or these shares considered together" "When a company issues shares or stocks ''especially AmE'', it makes them available for people to buy for the first time." (Especially in American English, the word "stocks" is also used to refer to shares.) A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets (after discharge of all senior claims such as secured and unsecured debt), or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |