|

Crédito

The Crédito was a local currency started on 1 May 1995 in Bernal, province of Buenos Aires, Argentina, on a garage sale, which was the first of many neighbourhood barter markets (''mercados de trueque'') that emerged in Argentina during the economic crisis. The operator of this currency was the ''Red Global de Clubes de Trueque Multirecíproco'' (RGT), literally "Global Network of Multi-Reciprocal Exchange Clubs" or more simply the "Global Exchange Network" (GEN). The currency started as a Local Exchange Trading Systems (LETS) system but was soon replaced by a number of printed currencies and, after further experimentation with a LETS called ''nodine'' (from ''no dinero'', "not money"), finally became the ''Crédito'', a printed currency again. The RGT was organized as a chaordic network of barter clubs, which had a clientele from a well-educated middle class that had fallen into unemployment during the Argentine recession of the late 1990s. The clubs of the RGT had no cent ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

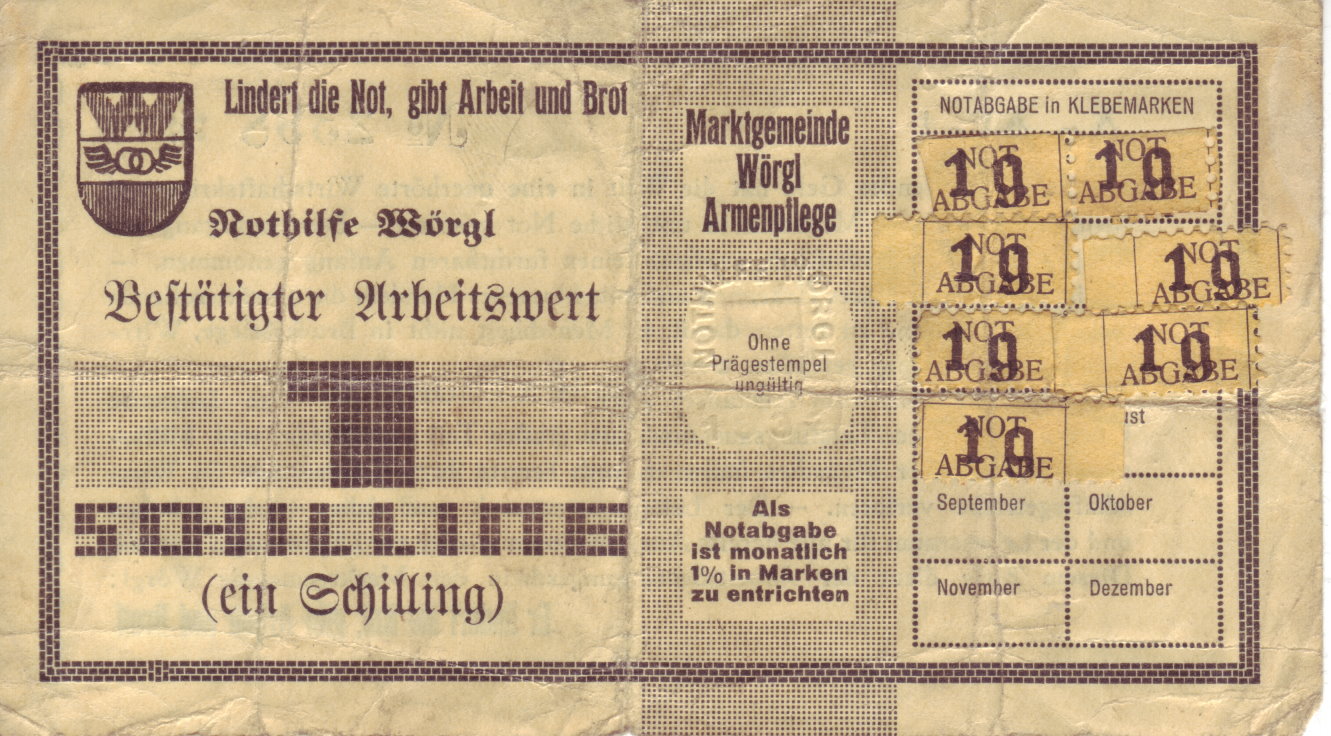

Local Currency

In economics, a local currency is a currency that can be spent in a particular geographical locality at participating organisations. A regional currency is a form of local currency encompassing a larger geographical area, while a community currency might be local or be used for exchange within an online community. A local currency acts as a complementary currency to a national currency, rather than replacing it, and aims to encourage spending within a local community, especially with locally owned businesses. Such currencies may not be backed by a national government nor be legal tender. About 300 complementary currencies, including local currencies, are listed in the Complementary Currency Resource Center worldwide database. Terminology Some definitions: * Complementary currency - is used as a complement to a national currency, as a medium of exchange, which is usually not legal tender. * Community currency - a complementary currency used by a group with a common bond, such as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

LECOP

The LECOP was a bond issued by Argentine national government. ''LECOP'' (sometimes written as a common word, ''Lecop''), stands for Letra de Cancelación de Obligaciones Provinciales ("Letter of Cancellation of Provincial Obligations"). These bonds were circulated at a substantial discount from their face value, so anybody accepting was bound to experience devaluation (or inflation). While LECOPs were intended as a means to replace legal currency (Argentine pesos) at a time when cash was scarce, there were occasions in which LECOPs were not accepted as valid means of payment — most notably, most taxes could only be paid in pesos, or only partly paid in LECOPs. Public utility companies generally restricted the percentage acceptable to a 70-30 ratio, sometimes further limiting LECOP usage to 15% of the total bill. Other complementary currencies A complementary currency is a currency or medium of exchange that is not necessarily a national currency, but that is thought of as ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Patacón (bond)

The Patacón (officially called ''Letra de Tesorería para Cancelación de Obligaciones de la Provincia de Buenos Aires'') was a Bond (finance), bond issued by the government of the Provinces of Argentina, province of Buenos Aires Province, Buenos Aires, Argentina, during 2001. The ''patacones'' were used to pay government bills, including state employees' salaries during a period when the Argentine economic crisis, economic crisis caused regular currency (Argentine pesos) to be scarce. ''Patacones'' then circulated in the economy in much the same way as pesos. First issued during the peso/U.S. dollar convertibility regime, just like other complementary currency Patacones could be attractive due to a revenue scheduled for payment in 2003 in pesos (practically equivalent to dollars). When the convertibility was abandoned amid fears of hyperinflation, the attractiveness of this revenue practically disappeared. The basis for the acceptability of complementary currency shifted to ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

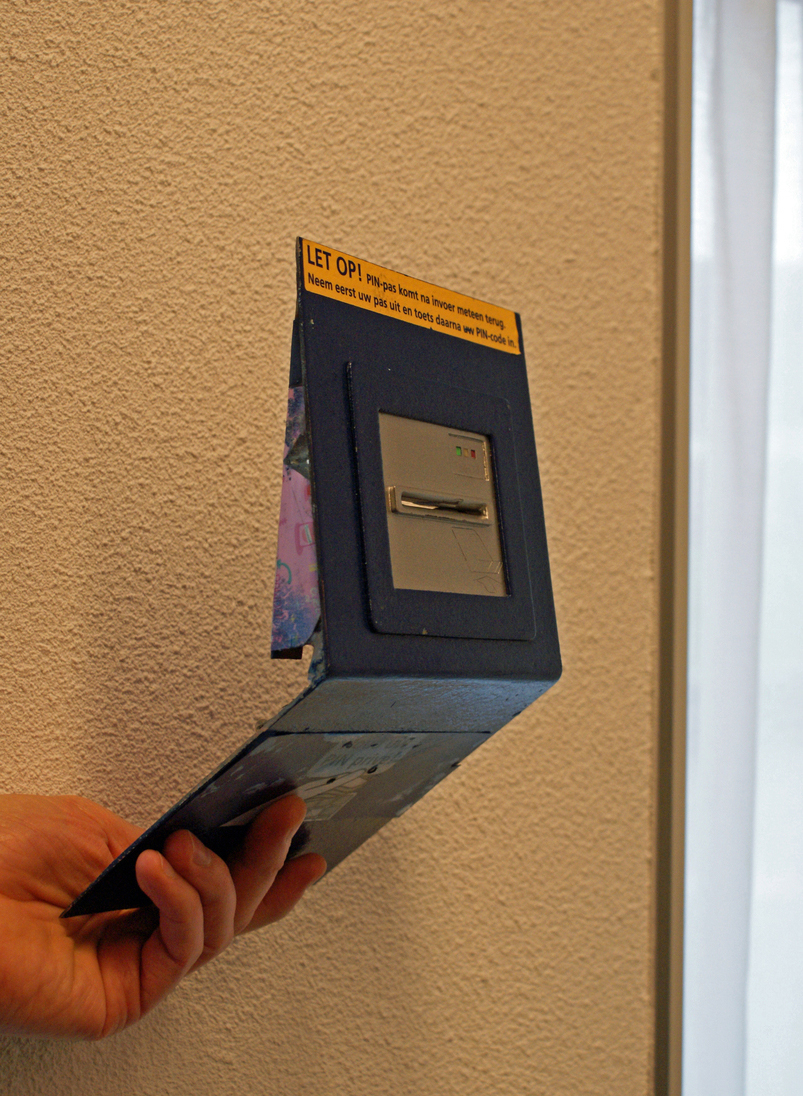

Fraud

In law, fraud is intentional deception to secure unfair or unlawful gain, or to deprive a victim of a legal right. Fraud can violate civil law (e.g., a fraud victim may sue the fraud perpetrator to avoid the fraud or recover monetary compensation) or criminal law (e.g., a fraud perpetrator may be prosecuted and imprisoned by governmental authorities), or it may cause no loss of money, property, or legal right but still be an element of another civil or criminal wrong. The purpose of fraud may be monetary gain or other benefits, for example by obtaining a passport, travel document, or driver's license, or mortgage fraud, where the perpetrator may attempt to qualify for a mortgage by way of false statements. Internal fraud, also known as "insider fraud", is fraud committed or attempted by someone within an organisation such as an employee. A hoax is a distinct concept that involves deliberate deception without the intention of gain or of materially damaging or depriving a vi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Argentine Argentino

The golden Argentino was the only official golden coins made by the argentine Casa de Moneda from 1881 to 1896, according to law N° 1130, sanctioned in 1881 during Julio Argentino Roca's presidency. Gold currency The Argentino was an Argentine currency equal to 5 pesos oro sellado. The argentino coin was issued in 1881 and 1884 and it weighs 4.0322 grams. The argentino coin was issued from 1881 to 1896 and it weighs 8.0645 grams. Both were made of gold 0.900. Planned currency The Argentino was a complementary currency in Argentina announced by then-president Adolfo Rodríguez Saá on December 26, 2001 during the Argentine economic crisis. It would have circulated alongside the peso and the dollar. He resigned on December 30, 2001 and this plan was never implemented. The currency was to replace the Patacón, the LECOP The LECOP was a bond issued by Argentine national government. ''LECOP'' (sometimes written as a common word, ''Lecop''), stands for Letra de Cancelación de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Complementary Currency

A complementary currency is a currency or medium of exchange that is not necessarily a national currency, but that is thought of as supplementing or complementing national currencies. Complementary currencies are usually not legal tender and their use is based on agreement between the parties exchanging the currency. According to Jérôme Blanc of Laboratoire d'Économie de la Firme et des Institutions, complementary currencies aim to protect, stimulate or orientate the economy. They may also be used to advance particular social, environmental, or political goals. When speaking about complementary currencies, a number of overlapping and often interchangeable terms are in use: local or community currencies are complementary currencies used within a locality or other form of community (such as business-based or online communities); regional currencies are similar to local currencies, but are used within a larger geographical region; and sectoral currencies are complementary curren ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Hyperinflation

In economics, hyperinflation is a very high and typically accelerating inflation. It quickly erodes the real value of the local currency, as the prices of all goods increase. This causes people to minimize their holdings in that currency as they usually switch to more stable foreign currencies. When measured in stable foreign currencies, prices typically remain stable. Unlike low inflation, where the process of rising prices is protracted and not generally noticeable except by studying past market prices, hyperinflation sees a rapid and continuing increase in nominal prices, the nominal cost of goods, and in the supply of currency. Typically, however, the general price level rises even more rapidly than the money supply as people try ridding themselves of the devaluing currency as quickly as possible. As this happens, the real stock of money (i.e., the amount of circulating money divided by the price level) decreases considerably.Bernholz, Peter 2003, chapter 5.3 Almost all ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Harvard University

Harvard University is a private Ivy League research university in Cambridge, Massachusetts. Founded in 1636 as Harvard College and named for its first benefactor, the Puritan clergyman John Harvard, it is the oldest institution of higher learning in the United States and one of the most prestigious and highly ranked universities in the world. The university is composed of ten academic faculties plus Harvard Radcliffe Institute. The Faculty of Arts and Sciences offers study in a wide range of undergraduate and graduate academic disciplines, and other faculties offer only graduate degrees, including professional degrees. Harvard has three main campuses: the Cambridge campus centered on Harvard Yard; an adjoining campus immediately across Charles River in the Allston neighborhood of Boston; and the medical campus in Boston's Longwood Medical Area. Harvard's endowment is valued at $50.9 billion, making it the wealthiest academic institution in the world. Endowment inco ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

United States Dollar

The United States dollar ( symbol: $; code: USD; also abbreviated US$ or U.S. Dollar, to distinguish it from other dollar-denominated currencies; referred to as the dollar, U.S. dollar, American dollar, or colloquially buck) is the official currency of the United States and several other countries. The Coinage Act of 1792 introduced the U.S. dollar at par with the Spanish silver dollar, divided it into 100 cents, and authorized the minting of coins denominated in dollars and cents. U.S. banknotes are issued in the form of Federal Reserve Notes, popularly called greenbacks due to their predominantly green color. The monetary policy of the United States is conducted by the Federal Reserve System, which acts as the nation's central bank. The U.S. dollar was originally defined under a bimetallic standard of (0.7735 troy ounces) fine silver or, from 1837, fine gold, or $20.67 per troy ounce. The Gold Standard Act of 1900 linked the dollar solely to gold. From 1934, it ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Fixed Exchange Rate

A fixed exchange rate, often called a pegged exchange rate, is a type of exchange rate regime in which a currency's value is fixed or pegged by a monetary authority against the value of another currency, a basket of other currencies, or another measure of value, such as gold. There are benefits and risks to using a fixed exchange rate system. A fixed exchange rate is typically used to stabilize the exchange rate of a currency by directly fixing its value in a predetermined ratio to a different, more stable, or more internationally prevalent currency (or currencies) to which the currency is pegged. In doing so, the exchange rate between the currency and its peg does not change based on market conditions, unlike in a floating (flexible) exchange regime. This makes trade and investments between the two currency areas easier and more predictable and is especially useful for small economies that borrow primarily in foreign currency and in which external trade forms a large part of the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Argentine Peso

The peso (established as the ''peso convertible'') is the currency of Argentina, identified by the symbol $ preceding the amount in the same way as many countries using peso or dollar currencies. It is subdivided into 100 '' centavos''. Its ISO 4217 code is ARS. The Argentine currency has experienced severe inflation, with periods of hyperinflation, since the mid-20th century, with periodic change of the currency to a new version at a rate ranging from 100:1 to 10,000:1. The peso introduced in 1992 was worth 10,000,000,000,000 (ten trillion) of the pesos in use until 1970. Since the early 21st century, the Argentine peso has experienced a substantial rate of devaluation, reaching over 51% year-on-year inflation rate in 2021. The official exchange rate for the United States dollar commenced at 1:1 at the peso's introduction in 1992; it then hovered around 3:1 from 2002 to 2008, before climbing from 6:1 to 10:1 between 2009 and 2015. In July 2022, the value exchange rate with the U ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Recession

In economics, a recession is a business cycle contraction when there is a general decline in economic activity. Recessions generally occur when there is a widespread drop in spending (an adverse demand shock). This may be triggered by various events, such as a financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale Anthropogenic hazard, anthropogenic or natural disaster (e.g. a pandemic). In the United States, a recession is defined as "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales." The European Union has adopted a similar definition. In the United Kingdom, a recession is defined as negative economic growth for two consecutive quarters. Governments usually respond to recessions by adopting expansionary macroeconomic policies, such as monetary policy, incr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |