|

Credito Italiano

Credito Italiano also known as just Credit, was an Italian bank, now part of UniCredit. It was merged with Unicredito in 1998, forming Unicredito Italiano (now UniCredit). Circa 1999 to 2002 UniCredit created a new subsidiary of the same name to run the retail network of Credito Italiano. On 1 July 2002 the subsidiary received the assets of sister banks to become UniCredit Banca. History Founded on 28 April 1870 in Genoa as Banca di Genova, it took part in the establishment of the Bank of Italy ( it, Banca d'Italia) and opened the first trans-Atlantic banking business with Buenos Aires (1872). Local shareholders were local nobility ( Pallavicino and Balbi), bankers (Quartara, Polleri) and merchants (Lagorio, Dodero, Bacigalupo), creating an initial capital of 3 million Italian lira. It acquired "Banca Vonwiller" of Milan. In the 1890s, the international financial crisis led to refinancing by German and Swiss banks and name change to "Credito Italiano" (1895) With a paid-in ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

UniCredit Banca

UniCredit Banca S.p.A. was the retail banking division of UniCredit Group. On 1 July 2002, Rolo Banca, Banca CRT, Cariverona Banca, Cassamarca, Cassa di Risparmio di Trento e Rovereto and Cassa di Risparmio di Trieste were merged into Credito Italiano S.p.A. (a new subsidiary of UniCredit incorporated in December 1999), with Credito Italiano was renamed into UniCredit Banca S.p.A.. On 1 January 2003 UniCredit Private Banking and UniCredit Banca d'Impresa were spin off from UniCredit Banca After UniCredit acquired Capitalia Group in an all-share deal in 2007, UniCredit Group gained the brand Banca di Roma and Banco di Sicilia. UniCredit Banca exchanged branches with the two sister companies (as well as absorbing Bipop Carire), making UniCredit Banca was specialized in the northern Italy. 3 branches of former UniCredit Banca were sold to fellow Italian bank Banca Carige Banca Carige S.p.A., historically known as Cassa di Risparmio di Genova e Imperia (Ca.Ri.Ge.) is an Itali ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cassa Di Risparmio Di Verona, Vicenza, Belluno E Ancona

Cassa di Risparmio di Verona, Vicenza, Belluno e Ancona known as Cariverona in short, was an Italian savings bank headquartered in Verona. In 1991, due to , the bank was split into two organizations, Cassa di Risparmio di Verona, Vicenza, Belluno e Ancona S.p.A. (trading as Cariverona Banca) and Fondazione Cassa di Risparmio di Verona, Vicenza, Belluno e Ancona. They joined Unicredito banking group as founding subsidiary and shareholder respectively. The banking foundation was a minority shareholder of the successor of the banking group UniCredit. Predecessor Monte di Pietà di Verona Monte di Pietà di Verona is a mount of piety ( it, monte di pietà) founded in 1490, by the Franciscan Michele da Acqui in the Republic of Venice, 28 years after the first recorded mount of Italy was founded in Perugia, by other Franciscans, Bernardine of Feltre and Michele Carcano, in the Papal States. The mount was later known as Monte di Credito su Pegno di Verona since 1930s. Despite as the fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cassa Di Risparmio Di Torino

Banca Cassa di Risparmio di Torino S.p.A. known as Banca CRT, or Caritorino, was an Italian savings bank based in Turin, Piedmont. In 1997, the bank joined Unicredito banking group, as well as in 1998 followed the group to merge with Credito Italiano to form UniCredito Italiano (now known as UniCredit). In 2002, Banca CRT was absorbed into the parent company. The former owner of Banca CRT, Fondazione Cassa di Risparmio di Torino (Fondazione CRT), as of 31 December 2013, still owned 2.506% voting rights of UniCredit, as 7th largest shareholder. On 31 December 1999, Fondazione CRT was the second largest shareholder of UniCredit with 14.228% of the total ordinary shares (704,943,077 of 4,954,465,306). History Cassa di Risparmio di Torino was founded in 1827 with a philanthropic ideals, at that time still in the Kingdom of Sardinia. Before 1950s, the bank already acquired the local banks in Casale Monferrato, Pinerolo and Ivrea. In 1991, due to , the daily banking operation, char ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Rolo Banca

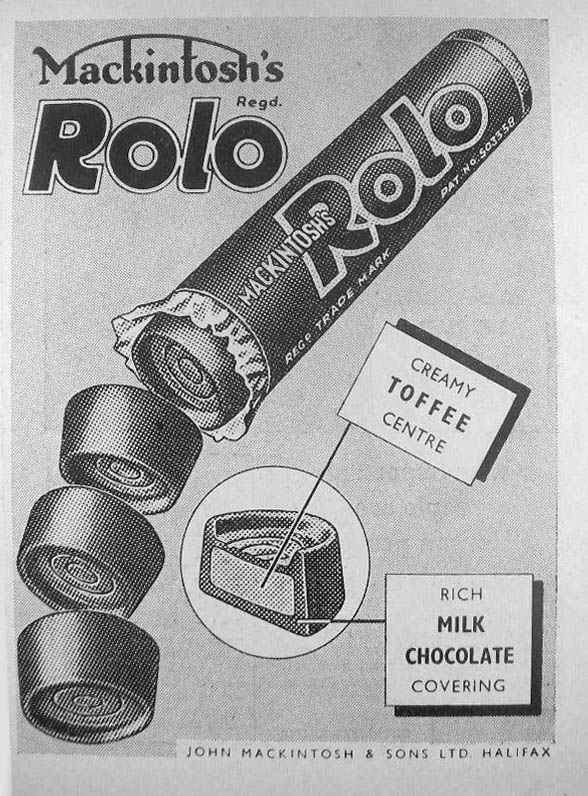

Rolo (pronounced /ˈrəʊləʊ/), referring to the roll-styled chocolates, is a brand of truncated cone-shaped or conical frustum-shaped chocolates with a caramel inside. First manufactured in Norwich, Norfolk in the United Kingdom by Mackintosh's in 1937 (followed by Rowntree's after the takeover in 1969), they are made by Nestlé (except in the United States, where production has been licensed to The Hershey Company). A long-running British advertising slogan for the brand was "Do you love anyone enough to give them your last Rolo?" A YouGov poll saw Rolo ranked the eleventh most popular and seventeenth most famous confectionery in the UK. History The Rolo product was developed in England by Mackintosh's, (later Rowntree-Mackintosh), simply a combination of caramel and a chocolate coating. Rolo was launched in the United Kingdom in 1937. In 1956, the New England Confectionery Company acquired a licence to produce Rolos in the US. In 1969, the license for US Manufacturing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Popolare Di Rieti , a Philippine outrigger canoe

{{dab, geodis ...

Banca may refer to: Places * Bangka Island, an island lying east of Sumatra, part of Indonesia * Banca, Pyrénées-Atlantiques, a commune of the Pyrénées-Atlantiques ''département'', France * Banca, Tasmania, a locality in Tasmania, Australia * Banca, Vaslui, a commune in Vaslui County, Romania * Banca, a village in Dealu Morii Commune, Bacău County, Romania Other * Banca or Bangka (boat) Bangka are various native watercraft of the Philippines. It originally referred to small double-outrigger dugout canoes used in rivers and shallow coastal waters, but since the 18th century, it has expanded to include larger lashed-lug ships, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Carimonte Banca

Carimonte Banca was an Italian bank based in Bologna, Emilia–Romagna region. The bank was formed on 12 July 1991 (gazetted on 21 August) by the merger of Banca del Monte di Bologna e Ravenna and Cassa di Risparmio di Modena. On 31 December 1995 was merged with Credito Romagnolo (a subsidiary of Credito Italiano) to form Rolo Banca. In 1995 the bank also acquired a minority interests in Banca Popolare di Rieti. History The predecessor of the bank could be traced back to Mount of Piety of Bologna, found 1473, which was merged with Mount of Piety of Ravenna (found 1492) to form Banca del Monte di Bologna e Ravenna in 1966. In 1991 Carimonte Banca was formed by the merger of the Banca Monte and Cassa di Risparmio di Modena (found 1846). The holding company of the bank was Carimonte Holding, a joint venture of Fondazione Carimodena and Fondazione del Monte di Bologna e Ravenna in 50–50 voting rights and 60–40 share capitals. Sponsorship The bank was a sponsor of Modena Vo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Popolare Del Molise

Banca Popolare del Molise was an Italian bank based in Campobasso, Molise. The bank was one of the "big three" banks in the Molise region in 1994 (in terms of deposit and lending market), as well as ranked the 181st by client deposits in the whole Italy. The bank was absorbed by Rolo Banca, a subsidiary of Credito Italiano in June 1998. The successor of the parent company of the bank (Credito Italiano), and its main competitor (Banca di Roma): UniCredit (Credito Italiano) and Capitalia (Banca di Roma) respectively was merged in 2007. UniCredit Banca di Roma, had 38 branches in the Molise region in 2008, which included 19 via Pietrunto, the former headquarter of BPM. However, the site was assigned to UniCredit Banca from 2002 to 2007. History The bank had a market shares (in lending market, year missing, short term) of 19.5% in Molise region, comparing to competitors Banca di Roma (30.99%) and Banco di Napoli (14.95%) respectively, according to reports from Autorità Garante della ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credito Romagnolo

Credito Romagnolo nicknamed Rolo was an Italian bank based in Bologna, Emilia-Romagna. In 1995 it was acquired by Credito Italiano. In 1996 Credito Romagnolo Group (Credito Romagnolo Holding and Credito Romagnolo S.p.A.) were merged with Group Carimonte Banca to form Rolo Banca. History Banca Piccolo Credito Romagnolo was found in 1896. In 1987 the bank acquired Banca Venturi, a bank based in Apulia. In 1992–94 the bank absorbed Banca del Friuli, a bank based in Friuli – Venezia Giulia region. In 1991 Credito Romagnolo had a market share of 11.9% in lending in Emilia-Romagna, while Banca del Friuli had a market share of 8.5% in Friuli – Venezia Giulia. In 1994 the bank acquired Banca Popolare del Molise. The bank also owned Banca Agricola Commerciale (San Marino) at that time. In 1994 the bank proposed a merger plan to the shareholders of Casse Emiliano Romagnole (CAER), which all shares of CAER would be offer for new shares of Credito Romagnolo. However, it was rejected. C ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Cattolica Di Molfetta

Banca Cattolica S.p.A. was an Italian cooperative bank based in Molfetta, Apulia region, southern Italy. The former parent company of the bank (until 1998), Cattolica Popolare survived as a cooperative society. History Banca Cattolica Popolare was founded in 1902. In 1994 Banca Cattolica Popolare Società cooperativa a responsabilità limitata spin off its banking activities to form a subsidiary Banca Cattolica S.p.A., which Credito Italiano acquired 35% shares. The bank (S.p.A.) was later acquired by Banca Antoniana Popolare Veneta (Antonveneta) in the 1998, for 80%. As at 31 December 2000, Antonveneta owned 86.836% of the bank's share capital; The bank had a shareholders' equity of 115.113 billion Billion is a word for a large number, and it has two distinct definitions: *1,000,000,000, i.e. one thousand million, or (ten to the ninth power), as defined on the short scale. This is its only current meaning in English. * 1,000,000,000,000, i. ... lire (about €59 million ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Banca Popolare Di Spoleto , a Philippine outrigger canoe

{{dab, geodis ...

Banca may refer to: Places * Bangka Island, an island lying east of Sumatra, part of Indonesia * Banca, Pyrénées-Atlantiques, a commune of the Pyrénées-Atlantiques ''département'', France * Banca, Tasmania, a locality in Tasmania, Australia * Banca, Vaslui, a commune in Vaslui County, Romania * Banca, a village in Dealu Morii Commune, Bacău County, Romania Other * Banca or Bangka (boat) Bangka are various native watercraft of the Philippines. It originally referred to small double-outrigger dugout canoes used in rivers and shallow coastal waters, but since the 18th century, it has expanded to include larger lashed-lug ships, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Mediobanca

Mediobanca is an Italian investment bank founded in 1946 at the initiative of Raffaele Mattioli (at that time CEO of Banca Commerciale Italiana, the largest commercial bank in Italy which promoted its incorporation together with Credito Italiano) and Enrico Cuccia to facilitate the post-World War II reconstruction of Italian industry. Cuccia led Mediobanca from 1946 to 1982. Today, it is an international banking group with offices in Milan, Frankfurt, London, Madrid, Luxembourg, New York and Paris. History Mediobanca was set up to provide medium-term financing for manufacturers and establish a direct relationship between the banking sector and the investment needs of the reorganization of industry after the devastation caused by World War II. The Banking Act of 1936 established a clear separation between short term and medium-to-long term financing and the major banks had opted for specializing in short-term loans and there was the institution that would deal with financing fo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |