|

Cov-lite

Cov-lite (or "covenant light") is financial jargon for loan agreements that do not contain the usual protective covenants for the benefit of the lending party. Although traditionally banks have insisted on a wide range of covenants that allow them to intervene if the financial position of the borrower or the value of underlying assets deteriorates, around 2006 the increasing strength of private equity firms and the decreasing opportunities for traditional corporate loans made by banks fueled something of a "race to the bottom", with syndicates of banks competing with each other to offer ever less invasive terms to borrowers in relation to leveraged buy-outs. In the wake of the Financial crisis of 2007–08 growth in the use of cov-lite loans stalled, but more recently they have increased in popularity again. Cov-lite lending is seen as riskier because it removes the early warning signs lenders would otherwise receive through traditional covenants. Against this, it has been coun ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Debt Bubble

The corporate debt bubble is the large increase in corporate bonds, excluding that of financial institutions, following the financial crisis of 2007–08. Global corporate debt rose from 84% of gross world product in 2009 to 92% in 2019, or about $72 trillion. In the world's eight largest economies—the United States, China, Japan, the United Kingdom, France, Spain, Italy, and Germany—total corporate debt was about $51 trillion in 2019, compared to $34 trillion in 2009. Excluding debt held by financial institutions—which trade debt as mortgages, student loans, and other instruments—the debt owed by non-financial companies in early March 2020 was $13 trillion worldwide, of which about $9.6 trillion was in the U.S. The corporate bond market historically centered in the United States. The U.S. Federal Reserve noted in November 2019 that leveraged loans, corporate bonds made to companies with poor credit histories or large amounts of existing debt, were the fastest growing ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Private Equity

In the field of finance, the term private equity (PE) refers to investment funds, usually limited partnerships (LP), which buy and restructure financially weak companies that produce goods and provide services. A private-equity fund is both a type of ownership of assets ( financial equity) and is a class of assets (debt securities and equity securities), which function as modes of financial management for operating private companies that are not publicly traded in a stock exchange. Private-equity capital is invested into a target company either by an investment management company (private equity firm), or by a venture capital fund, or by an angel investor; each category of investor has specific financial goals, management preferences, and investment strategies for profiting from their investments. Each category of investor provides working capital to the target company to finance the expansion of the company with the development of new products and services, the restructuring ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leveraged Buy-out

A leveraged buyout (LBO) is one company's acquisition of another company using a significant amount of borrowed money (leverage) to meet the cost of acquisition. The assets of the company being acquired are often used as collateral for the loans, along with the assets of the acquiring company. The use of debt, which normally has a lower cost of capital than equity, serves to reduce the overall cost of financing the acquisition. The cost of debt is lower because interest payments often reduce corporate income tax liability, whereas dividend payments normally do not. This reduced cost of financing allows greater gains to accrue to the equity, and, as a result, the debt serves as a lever to increase the returns to the equity. The term LBO is usually employed when a financial sponsor acquires a company. However, many corporate transactions are partially funded by bank debt, thus effectively also representing an LBO. LBOs can have many different forms such as management buyout (MBO) ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loan Agreement

A loan agreement is a contract between a borrower and a lender which regulates the mutual promises made by each party. There are many types of loan agreements, including "facilities agreements," "revolvers," " term loans," "working capital loans." Loan agreements are documented via a compilation of the various mutual promises made by the involved parties. Prior to entering into a commercial loan agreement, the "borrower" first makes representations about his affairs surrounding his character, creditworthiness, cashflow, and any collateral that he may have available to pledge as security for a loan. These representations are taken into consideration and the lender then determines under what conditions (terms), if any, they are prepared to advance money. Loan agreements, like any contract, reflect an "offer," the "acceptance of the offer," "consideration," and can only involve situations that are "legal" (a term loan agreement involving heroin drug sales is not "legal"). Loan agre ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Jargon

Jargon is the specialized terminology associated with a particular field or area of activity. Jargon is normally employed in a particular Context (language use), communicative context and may not be well understood outside that context. The context is usually a particular occupation (that is, a certain trade, profession, vernacular or academic field), but any ingroups and outgroups, ingroup can have jargon. The main trait that distinguishes jargon from the rest of a language is special vocabulary—including some words specific to it and often different word sense, senses or meanings of words, that outgroups would tend to take in another sense—therefore misunderstanding that communication attempt. Jargon is sometimes understood as a form of technical slang and then distinguished from the official terminology used in a particular field of activity. The terms ''jargon'', ''slang,'' and ''argot'' are not consistently differentiated in the literature; different authors interpret the ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Anthony Bolton

Anthony Bolton (born 7 March 1950) is a former investment fund manager and successful investor in the United Kingdom. He managed the Fidelity Special Situations fund from December 1979 to December 2007, and then managed Fidelity China Special Situations PLC, a London Stock Exchange listed investment trust, until his retirement in April 2014. He is also a musician and a composer. Education and career Educated at Stowe School and Trinity College, Cambridge, Bolton left with a degree in engineering and business studies. He pursued a career in the city where, age 29, he was recruited by Fidelity as one of their first London based investment managers. He is now President of Investments at Fidelity International Limited and manager of Fidelity China Special Situations PLC. Bolton began managing Special Situations (a UK equity OEIC) when he joined Fidelity in 1979 and continued until 2007. He managed other funds alongside Special Situations during this time. From November 1 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Loans

In finance, a loan is the lending of money by one or more individuals, organizations, or other entities to other individuals, organizations, etc. The recipient (i.e., the borrower) incurs a debt and is usually liable to pay interest on that debt until it is repaid as well as to repay the principal amount borrowed. The document evidencing the debt (e.g., a promissory note) will normally specify, among other things, the principal amount of money borrowed, the interest rate the lender is charging, and the date of repayment. A loan entails the reallocation of the subject asset(s) for a period of time, between the lender and the borrower. The interest provides an incentive for the lender to engage in the loan. In a legal loan, each of these obligations and restrictions is enforced by contract, which can also place the borrower under additional restrictions known as loan covenants. Although this article focuses on monetary loans, in practice, any material object might be lent. Act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Corporate Bonds

A corporate bond is a bond issued by a corporation in order to raise financing for a variety of reasons such as to ongoing operations, M&A, or to expand business. The term is usually applied to longer-term debt instruments, with maturity of at least one year. Corporate debt instruments with maturity shorter than one year are referred to as commercial paper. Definition The term "corporate bond" is not strictly defined. Sometimes, the term is used to include all bonds except those issued by governments in their own currencies. In this case governments issuing in other currencies (such as the country of Mexico issuing in US dollars) will be included. The term sometimes also encompasses bonds issued by supranational organizations (such as European Bank for Reconstruction and Development). Strictly speaking, however, it only applies to those issued by corporations. The bonds of local authorities (municipal bonds) are not included. Trading Corporate bonds trade in decentralize ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Crunch

A credit crunch (also known as a credit squeeze, credit tightening or credit crisis) is a sudden reduction in the general availability of loans (or credit) or a sudden tightening of the conditions required to obtain a loan from banks. A credit crunch generally involves a reduction in the availability of credit independent of a rise in official interest rates. In such situations, the relationship between credit availability and interest rates changes. Credit becomes less available at any given official interest rate, or there ceases to be a clear relationship between interest rates and credit availability (i.e. credit rationing occurs). Many times, a credit crunch is accompanied by a flight to quality by lenders and investors, as they seek less risky investments (often at the expense of small to medium size enterprises). Causes A credit crunch is often caused by a sustained period of careless and inappropriate lending which results in losses for lending institutions and investor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2007 Subprime Mortgage Financial Crisis

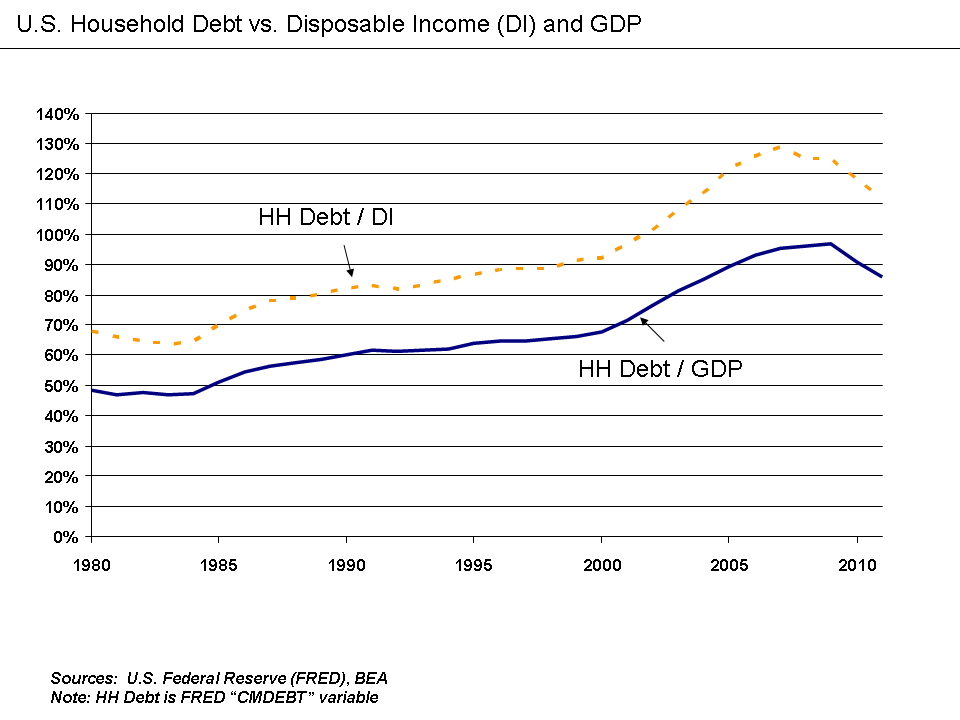

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 2007–2008 global financial crisis. It was triggered by a large decline in US home prices after the collapse of a housing bubble, leading to mortgage delinquencies, foreclosures, and the devaluation of housing-related securities. Declines in residential investment preceded the Great Recession and were followed by reductions in household spending and then business investment. Spending reductions were more significant in areas with a combination of high household debt and larger housing price declines. The housing bubble preceding the crisis was financed with mortgage-backed securities (MBSes) and collateralized debt obligations (CDOs), which initially offered higher interest rates (i.e. better returns) than government securities, along with attractive risk ratings from rating agencies. While elements of the crisis first became more visible d ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Data

First Data Corporation is a financial services company headquartered in Atlanta, Georgia, United States. The company's STAR Network provided nationwide domestic debit acceptance at more than 2 million retail POS, ATM, and Online outlets for nearly a third of all U.S. debit cards. First Data has six million merchants, the largest in the payments industry. The company handles 45% of all US credit and debit transactions, including handling prepaid gift card processing for many US brands such as Starbucks. It processes around 2,800 transactions per second and $2.2 trillion in card transactions annually, with an 80% market share in gas and groceries in 2014. First Data's SpendTrend Report is a key shopping metric for national news networks such as '' WSJ, USA Today'', ''ESPN'', ''The New York Times'', Vox Media, and ''Bloomberg''. In October 2015, First Data returned to public markets, selling 160 million shares in the New York Stock Exchange’s biggest IPO of that year. On Januar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Kohlberg Kravis Roberts

KKR & Co. Inc., also known as Kohlberg Kravis Roberts & Co., is an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds. , the firm had completed more than 650 private equity investments in portfolio companies with approximately $675 billion of total enterprise value. , assets under management ("AUM") and fee paying assets under management ("FPAUM") were $471 billion and $357 billion, respectively. The firm was founded in 1976 by Jerome Kohlberg Jr., and cousins Henry Kravis and George R. Roberts, all of whom had previously worked together at Bear Stearns, where they completed some of the earliest leveraged buyout transactions. Since its founding, KKR has completed a number of transactions, including the 1989 leveraged buyout of RJR Nabisco, which was the largest buyout in history to that point, as well as the 200 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |