|

Complex Multiplier

:''This article deals with the concept in economics. For the multiplication of complex numbers, see Complex number#Multiplication.'' The complex multiplier is the multiplier principle in Keynesian economics (formulated by John Maynard Keynes). The simplistic multiplier that is the reciprocal of the marginal propensity to save is a special case used for illustrative purposes only. The multiplier applies to any change in autonomous expenditure, in other words, an externally induced change in consumption, investment, government expenditure or net exports. Each of these operates to increase or reduce the equilibrium level of income in the economy. * any increase to an injection will be multiplied to result in a higher level of aggregate expenditure. * Any decrease in an injection will be multiplied to result in a lower level of aggregate expenditure. * Any increase in a withdrawal will be multiplied to result in a lower level of aggregate expenditure. and... *Any decrease in a with ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Complex Number

In mathematics, a complex number is an element of a number system that extends the real numbers with a specific element denoted , called the imaginary unit and satisfying the equation i^= -1; every complex number can be expressed in the form a + bi, where and are real numbers. Because no real number satisfies the above equation, was called an imaginary number by René Descartes. For the complex number a+bi, is called the , and is called the . The set of complex numbers is denoted by either of the symbols \mathbb C or . Despite the historical nomenclature "imaginary", complex numbers are regarded in the mathematical sciences as just as "real" as the real numbers and are fundamental in many aspects of the scientific description of the natural world. Complex numbers allow solutions to all polynomial equations, even those that have no solutions in real numbers. More precisely, the fundamental theorem of algebra asserts that every non-constant polynomial equation with real or ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Multiplier (economics)

In macroeconomics, a multiplier is a factor of proportionality that measures how much an endogenous variable changes in response to a change in some exogenous variable. For example, suppose variable ''x'' changes by ''k'' units, which causes another variable ''y'' to change by ''M'' × ''k'' units. Then the multiplier is ''M''. Common uses Two multipliers are commonly discussed in introductory macroeconomics. Commercial banks create money, especially under the fractional-reserve banking system used throughout the world. In this system, money is created whenever a bank gives out a new loan. This is because the loan, when drawn on and spent, mostly finishes up as a deposit back in the banking system and is counted as part of money supply. After putting aside a part of these deposits as mandated bank reserves, the balance is available for the making of further loans by the bank. This process continues multiple times, and is called the multiplier effect. The multiplier may v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Keynesian Economics

Keynesian economics ( ; sometimes Keynesianism, named after British economist John Maynard Keynes) are the various macroeconomic theories and models of how aggregate demand (total spending in the economy) strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. Instead, it is influenced by a host of factors – sometimes behaving erratically – affecting production, employment, and inflation. Keynesian economists generally argue that aggregate demand is volatile and unstable and that, consequently, a market economy often experiences inefficient macroeconomic outcomes – a recession, when demand is low, or inflation, when demand is high. Further, they argue that these economic fluctuations can be mitigated by economic policy responses coordinated between government and central bank. In particular, fiscal policy actions (taken by the government) and monetary policy actions (t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

John Maynard Keynes

John Maynard Keynes, 1st Baron Keynes, ( ; 5 June 1883 – 21 April 1946), was an English economist whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. Keynes's intellect was evident early in life; in 1902, he gained admittance to the competitive mathematics program at King's College at the University of Cambridge. During the Great Depression of the 1930s, Keynes spearheaded a revolution in economic thinking, challenging the ideas of neoclassical economics that held that free markets would, in the short to medium term, a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Marginal Propensity To Save

The marginal propensity to save (MPS) is the fraction of an increase in income that is not spent and instead used for saving. It is the slope of the line plotting saving against income. For example, if a household earns one extra dollar, and the marginal propensity to save is 0.35, then of that dollar, the household will spend 65 cents and save 35 cents. Likewise, it is the fractional decrease in saving that results from a decrease in income. The MPS plays a central role in Keynesian economics as it quantifies the saving-income relation, which is the flip side of the consumption-income relation, and according to Keynes it reflects the fundamental psychological law. The marginal propensity to save is also a key variable in determining the value of the multiplier. Calculation MPS can be calculated as the change in savings divided by the change in income. :MPS=\frac Or mathematically, the marginal propensity to save (MPS) function is expressed as the derivative of the savings ( ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Autonomous Expenditure

In developmental psychology and moral, political, and bioethical philosophy, autonomy, from , ''autonomos'', from αὐτο- ''auto-'' "self" and νόμος ''nomos'', "law", hence when combined understood to mean "one who gives oneself one's own law" is the capacity to make an informed, uncoerced decision. Autonomous organizations or institutions are independent or self-governing. Autonomy can also be defined from a human resources perspective, where it denotes a (relatively high) level of discretion granted to an employee in his or her work. In such cases, autonomy is known to generally increase job satisfaction. Self-actualized individuals are thought to operate autonomously of external expectations. In a medical context, respect for a patient's personal autonomy is considered one of many fundamental ethical principles in medicine. Sociology In the sociology of knowledge, a controversy over the boundaries of autonomy inhibited analysis of any concept beyond relative autonomy, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Consumption (economics)

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of ''future'' income. Consumption is a major concept in economics and is also studied in many other social sciences. Different schools of economists define consumption differently. According to mainstream economists, only the final purchase of newly produced goods and services by individuals for immediate use constitutes consumption, while other types of expenditure — in particular, fixed investment, intermediate consumption, and government spending — are placed in separate categories (see consumer choice). Other economists define consumption much more broadly, as the aggregate of all economic activity that does not entail the design, production and marketing of goods and services (e.g. the selection, adoption, use, disposal and recycling of goods and services). Economists are particularly interested in the relationship betwee ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Net Exports

The balance of trade, commercial balance, or net exports (sometimes symbolized as NX), is the difference between the monetary value of a nation's exports and imports over a certain time period. Sometimes a distinction is made between a balance of trade for goods versus one for services. The balance of trade measures a flow of exports and imports over a given period of time. The notion of the balance of trade does not mean that exports and imports are "in balance" with each other. If a country exports a greater value than it imports, it has a trade surplus or positive trade balance, and conversely, if a country imports a greater value than it exports, it has a trade deficit or negative trade balance. As of 2016, about 60 out of 200 countries have a trade surplus. The notion that bilateral trade deficits are bad in and of themselves is overwhelmingly rejected by trade experts and economists. Explanation The balance of trade forms part of the current account, which includes ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Static Equilibrium (economics)

In economics, economic equilibrium is a situation in which economic forces such as supply and demand are balanced and in the absence of external influences the ( equilibrium) values of economic variables will not change. For example, in the standard text perfect competition, equilibrium occurs at the point at which quantity demanded and quantity supplied are equal. Market equilibrium in this case is a condition where a market price is established through competition such that the amount of goods or services sought by buyers is equal to the amount of goods or services produced by sellers. This price is often called the competitive price or market clearing price and will tend not to change unless demand or supply changes, and quantity is called the "competitive quantity" or market clearing quantity. But the concept of ''equilibrium'' in economics also applies to imperfectly competitive markets, where it takes the form of a Nash equilibrium. Understanding economic equilibriu ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Aggregate Expenditure

In economics, aggregate expenditure (AE) is a measure of national income. Aggregate expenditure is defined as the current value of all the finished goods and services in the economy. The aggregate expenditure is thus the sum total of all the expenditures undertaken in the economy by the factors during a given time period. It is the expenditure incurred on consumer goods, planned investment and the expenditure made by the government in the economy. In an open economy scenario, aggregate expenditure also includes the difference between the exports and the imports. Aggregate expenditures is defined as AE=C+I_p+G+N_X * C = Household Consumption * I_p = Planned Investment * G = Government spending * N_X = Net exports (Exports − Imports) Aggregate expenditure provides one way to calculate the sum total of all economic activity in an economy, which is referred to as the gross domestic product of an economy. The gross domestic product is calculated through the aggregate expenditure mod ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Leakage (economics)

In economics, a leakage is a diversion of funds from some iterative process. For example, in the Keynesian depiction of the circular flow of income and expenditure, leakages are the non-consumption uses of income, including saving, taxes, and imports. In this model, leakages are equal in quantity to injections of spending from outside the flow at the equilibrium aggregate output. The model is best viewed as a circular flow between national income, output, consumption, and factor payments. Savings, taxes, and imports are "leaked" out of the main flow, reducing the money available in the rest of the economy. Imported goods are one way this may happen, transferring money earned in the country to another one. The simplest possible model of credit creation assumes all loans borrowed from banks in a fractional-reserve banking system are re-deposited to the system. This allows simple calculation of the amount of credit created. In practice, though, cash leakages occur in the form of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

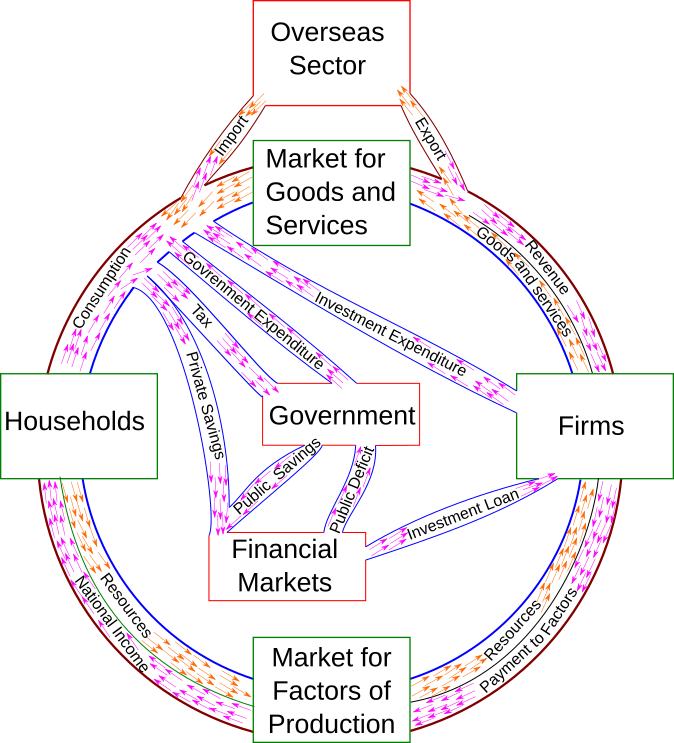

Circular Flow Of Income

The circular flow of income or circular flow is a model of the economy in which the major exchanges are represented as flows of money, goods and services, etc. between economic agents. The flows of money and goods exchanged in a closed circuit correspond in value, but run in the opposite direction. The circular flow analysis is the basis of national accounts and hence of macroeconomics. The idea of the circular flow was already present in the work of Richard Cantillon.Antoin E. Murphy. "John Law and Richard Cantillon on the circular flow of income." ''Journal of the History of Economic Thought.'' 1.1 (1993): 47-62. François Quesnay developed and visualized this concept in the so-called Tableau économique.Backhouse, Roger E., and Yann Giraud. "Circular flow diagrams." in: ''Famous Figures and Diagrams in Economics'' (2010): 221-230. Chapter 23. Important developments of Quesnay's tableau were Karl Marx's reproduction schemes in the second volume of '' Capital: Critique of Poli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |