|

Competitive Tax Plan

The Competitive Tax Plan is an approach to taxation, suggested in the United States, that would impose a 10–15% value added tax (VAT) and reduce personal and corporate income taxes. The plan was created by Michael J. Graetz, a tax law professor at Columbia Law School and a former Deputy Assistant Secretary of the Treasury for Tax Policy. Graetz states that the plan would generate enough revenue to exclude families earning less than $100,000 of annual income from having to pay income taxes or file tax returns. The Competitive Tax Plan would provide a new payroll tax offset to replace the Earned Income Tax Credit, protecting low and moderate income workers from any tax increase under the new system. Under the initial proposal, households with an annual income of more than $100,000 would be taxed at a flat 25% rate and the corporate income tax rate would be reduced to 25%. Graetz argues that reducing the corporate tax rate "would make the United States an extremely attractive ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation

A tax is a compulsory financial charge or some other type of levy imposed on a taxpayer (an individual or legal person, legal entity) by a governmental organization in order to fund government spending and various public expenditures (regional, local, or national), and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right amount of tax at the right time and securing the correct tax allowances and tax reliefs. The first known taxation took place in Ancient Egypt around 3000–2800 BC. A failure to pay in a timely manner (Tax noncompliance, non-compliance), along with evasion of or resistance to taxation, is punishable by law. Taxes consist of direct tax, direct or indirect taxes and may be paid in money or as its labor equivalent. Most countries have a tax system in place, in order to pay for public, common societal, or agreed national needs and for the functions of government. Some levy a flat tax, flat percentag ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

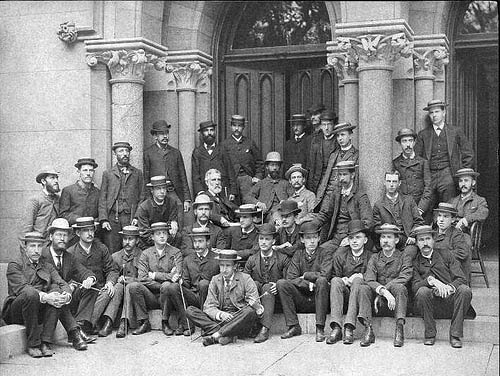

Yale Law School

Yale Law School (Yale Law or YLS) is the law school of Yale University, a Private university, private research university in New Haven, Connecticut. It was established in 1824 and has been ranked as the best law school in the United States by ''U.S. News & World Report'' every year between 1990 and 2022, when Yale made a decision to voluntarily pull out of the rankings, citing issues with the rankings' methodology. One of the most selective academic institutions in the world, the 2020–21 acceptance rate was 4%, the lowest of any law school in the United States. Its Yield (college admissions), yield rate of 87% is also consistently the highest of any law school in the United States. Yale Law alumni include many List of Yale Law School alumni, prominent figures in law and politics, including President of the United States, United States presidents Gerald Ford and Bill Clinton and former United States Secretary of State, U.S. secretary of state and presidential nominee, Hillary Cli ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Taxation In The United States

The United States, United States of America has separate Federal government of the United States, federal, U.S. state, state, and Local government in the United States, local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, Capital gains tax in the United States, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey. Taxes fall much more heavily on labor income than on capital income. Divergent taxes and subsidies for different forms of income and spending can also constitute a form of indirect taxation of some activities over others. For example, individual spending on higher education can ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Income Tax In The United States

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed (with some exceptions in the case of Federal income taxation), but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels. In the United States, the term "payroll tax" usually refers to FICA taxes that are paid to fund Social Security and Medicare, while "income tax" re ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Ben Cardin

Benjamin Louis Cardin (born October 5, 1943) is an American lawyer and politician serving as the senior United States senator from Maryland, a seat he has held since 2007. A member of the Democratic Party, he previously was the U.S. representative for from 1987 to 2007. Cardin served as a member of the Maryland House of Delegates from 1967 to 1987 and as Speaker of the Maryland House of Delegates from 1979 to 1987, the youngest person to hold the position in history. In his half-century career as an elected official, he has never lost an election. Cardin was elected as U.S. Senator to succeed Paul Sarbanes in 2006, defeating Republican Michael Steele, the Lieutenant Governor of Maryland, by a margin of 54% to 44%. He was reelected in 2012 taking 56% of the vote. He became Maryland's senior U.S. senator on January 3, 2017, upon Barbara Mikulski's retirement. Cardin won reelection to a third term in 2018, taking 65% of the vote. Early life and career Benjamin Louis Cardin was bor ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

US Senate

The United States Senate is the upper chamber of the United States Congress, with the House of Representatives being the lower chamber. Together they compose the national bicameral legislature of the United States. The composition and powers of the Senate are established by Article One of the United States Constitution. The Senate is composed of senators, each of whom represents a single state in its entirety. Each of the 50 states is equally represented by two senators who serve staggered terms of six years, for a total of 100 senators. The vice president of the United States serves as presiding officer and president of the Senate by virtue of that office, despite not being a senator, and has a vote only if the Senate is equally divided. In the vice president's absence, the president pro tempore, who is traditionally the senior member of the party holding a majority of seats, presides over the Senate. As the upper chamber of Congress, the Senate has several powers of ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Bill (proposed Law)

A bill is proposed legislation under consideration by a legislature. A bill does not become law until it is passed by the legislature as well as, in most cases, approved by the executive. Once a bill has been enacted into law, it is called an '' act of the legislature'', or a ''statute''. Bills are introduced in the legislature and are discussed, debated and voted upon. Usage The word ''bill'' is primarily used in Anglophone United Kingdom and United States, the parts of a bill are known as ''clauses'', until it has become an act of parliament, from which time the parts of the law are known as ''sections''. In Napoleonic law nations (including France, Belgium, Luxembourg, Spain and Portugal), a proposed law may be known as a "law project" (Fr. ''projet de loi''), which is a government-introduced bill, or a "law proposition" (Fr. ''proposition de loi''), a private member's bill. For example the Dutch parliamentary system does not make this terminological distinction (''wetsontwe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

European Union

The European Union (EU) is a supranational political and economic union of member states that are located primarily in Europe. The union has a total area of and an estimated total population of about 447million. The EU has often been described as a '' sui generis'' political entity (without precedent or comparison) combining the characteristics of both a federation and a confederation. Containing 5.8per cent of the world population in 2020, the EU generated a nominal gross domestic product (GDP) of around trillion in 2021, constituting approximately 18per cent of global nominal GDP. Additionally, all EU states but Bulgaria have a very high Human Development Index according to the United Nations Development Programme. Its cornerstone, the Customs Union, paved the way to establishing an internal single market based on standardised legal framework and legislation that applies in all member states in those matters, and only those matters, where the states have agreed to act ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Gross Domestic Product

Gross domestic product (GDP) is a money, monetary Measurement in economics, measure of the market value of all the final goods and services produced and sold (not resold) in a specific time period by countries. Due to its complex and subjective nature this measure is often revised before being considered a reliable indicator. List of countries by GDP (nominal) per capita, GDP (nominal) per capita does not, however, reflect differences in the cost of living and the inflation, inflation rates of the countries; therefore, using a basis of List of countries by GDP (PPP) per capita, GDP per capita at purchasing power parity (PPP) may be more useful when comparing standard of living, living standards between nations, while nominal GDP is more useful comparing national economies on the international market. Total GDP can also be broken down into the contribution of each industry or sector of the economy. The ratio of GDP to the total population of the region is the GDP per capita, p ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

OECD

The Organisation for Economic Co-operation and Development (OECD; french: Organisation de coopération et de développement économiques, ''OCDE'') is an intergovernmental organisation with 38 member countries, founded in 1961 to stimulate economic progress and world trade. It is a forum whose member countries describe themselves as committed to democracy and the market economy, providing a platform to compare policy experiences, seek answers to common problems, identify good practices, and coordinate domestic and international policies of its members. The majority of OECD members are high-income economies with a very high Human Development Index (HDI), and are regarded as developed countries. Their collective population is 1.38 billion. , the OECD member countries collectively comprised 62.2% of global nominal GDP (US$49.6 trillion) and 42.8% of global GDP ( Int$54.2 trillion) at purchasing power parity. The OECD is an official United Nations observer. In April 1948, ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

California Institute Of Technology

The California Institute of Technology (branded as Caltech or CIT)The university itself only spells its short form as "Caltech"; the institution considers other spellings such a"Cal Tech" and "CalTech" incorrect. The institute is also occasionally referred to as "CIT", most notably in its alma mater, but this is uncommon. is a private research university in Pasadena, California. Caltech is ranked among the best and most selective academic institutions in the world, and with an enrollment of approximately 2400 students (acceptance rate of only 5.7%), it is one of the world's most selective universities. The university is known for its strength in science and engineering, and is among a small group of institutes of technology in the United States which is primarily devoted to the instruction of pure and applied sciences. The institution was founded as a preparatory and vocational school by Amos G. Throop in 1891 and began attracting influential scientists such as George Ellery H ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Value Added Tax

A value-added tax (VAT), known in some countries as a goods and services tax (GST), is a type of tax that is assessed incrementally. It is levied on the price of a product or service at each stage of production, distribution, or sale to the end consumer. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services, it can reclaim the tax paid. It is similar to, and is often compared with, a sales tax. VAT is an indirect tax because the person who ultimately bears the burden of the tax is not necessarily the same person as the one who pays the tax to the tax authorities. Not all localities require VAT to be charged, and exports are often exempt. VAT is usually implemented as a destination-based tax, where the tax rate is based on the location of the consumer and applied to the sales price. The terms VAT, GST, and the more general consumption tax are sometimes used interchangeably. VAT raises about a fifth of total tax revenues bo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)