|

Citadel Securities LLC

Citadel LLC (formerly known as Citadel Investment Group, LLC) is an American multinational hedge fund and financial services company. Founded in 1990 by Kenneth C. Griffin, it has more than $50 billion in assets under management . The company has over 2,600 employees, with corporate headquarters in Miami, Florida, and offices throughout North America, Asia, and Europe. Founder, CEO and Co-CIO Kenneth C. Griffin owns approximately 85% of the firm. Citadel LLC is a separate entity from the market maker Citadel Securities, although both were founded and are owned by American financier Kenneth C. Griffin. History Kenneth Griffin started his trading career out of his dorm room at Harvard University in 1987 trading convertible bonds. As a sophomore, he traded convertible bonds and hooked a satellite dish to the roof of his dormitory. After graduating with a degree in economics, Griffin joined Chicago-based hedge fund Glenwood Partners. Citadel was started with $4.6 million in capit ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Southeast Financial Center

Southeast Financial Center is a two-acre development in Miami, Florida, United States. It consists of a tall office skyscraper and its 15-story parking garage. It was previously known as the Southeast Financial Center (1984–1992), the First Union Financial Center (1992–2003) and the Wachovia Financial Center (2003–2011). In 2011, it retook its old name of Southeast Financial Center as Wachovia merged with Wells Fargo and moved to the nearby Wells Fargo Center. When topped-off in August 1983, it was the tallest building south of New York City and east of the Mississippi River, taking away the same title from the Westin Peachtree Plaza Hotel, in Atlanta, Georgia."Southeast Financial Center is Topped Off" Ocala Star-Banner - August 12, 1983 It remained the tallest building in the southeastern U.S. until 1987, when it was surpassed by One Atlantic Center in Atlanta and the tallest in Florida until October 1, 2003, when it was surpassed by the Four Seasons Hotel and Tower, als ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Citadel Securities

Citadel Securities is an American market making firm headquartered in Miami. It is one of the largest market makers in the world, and is active in more than 50 countries. It is the largest designated market maker on the New York Stock Exchange. Citadel Securities is a separate entity from the hedge fund Citadel LLC, although both were founded and are majority owned by American financier Kenneth C. Griffin. Citadel Securities is expected to eventually move its headquarters from Chicago to Miami, having bought land there to build its new headquarters. Overview Market maker Citadel Securities was formed in 2002, and is a market maker, providing liquidity and trade execution to retail and institutional clients. Citadel Securities automation has resulted in more reliable trading at lower costs and with tighter spreads. In 2015, ''Barron's'' ranked Citadel Securities #1 in providing price improvement for investors in both S&P 500 and non-S&P shares. Citadel Securities is the l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Times

The ''Financial Times'' (''FT'') is a British daily newspaper printed in broadsheet and published digitally that focuses on business and economic current affairs. Based in London, England, the paper is owned by a Japanese holding company, Nikkei, with core editorial offices across Britain, the United States and continental Europe. In July 2015, Pearson sold the publication to Nikkei for £844 million ( US$1.32 billion) after owning it since 1957. In 2019, it reported one million paying subscriptions, three-quarters of which were digital subscriptions. The newspaper has a prominent focus on financial journalism and economic analysis over generalist reporting, drawing both criticism and acclaim. The daily sponsors an annual book award and publishes a " Person of the Year" feature. The paper was founded in January 1888 as the ''London Financial Guide'' before rebranding a month later as the ''Financial Times''. It was first circulated around metropolitan London by James Sher ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Financial Crisis Of 2007–2008

Finance is the study and discipline of money, currency and capital assets. It is related to, but not synonymous with economics, the study of production, distribution, and consumption of money, assets, goods and services (the discipline of financial economics bridges the two). Finance activities take place in financial systems at various scopes, thus the field can be roughly divided into personal, corporate, and public finance. In a financial system, assets are bought, sold, or traded as financial instruments, such as currencies, loans, bonds, shares, stocks, options, futures, etc. Assets can also be banked, invested, and insured to maximize value and minimize loss. In practice, risks are always present in any financial action and entities. A broad range of subfields within finance exist due to its wide scope. Asset, money, risk and investment management aim to maximize value and minimize volatility. Financial analysis is viability, stability, and profitability a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

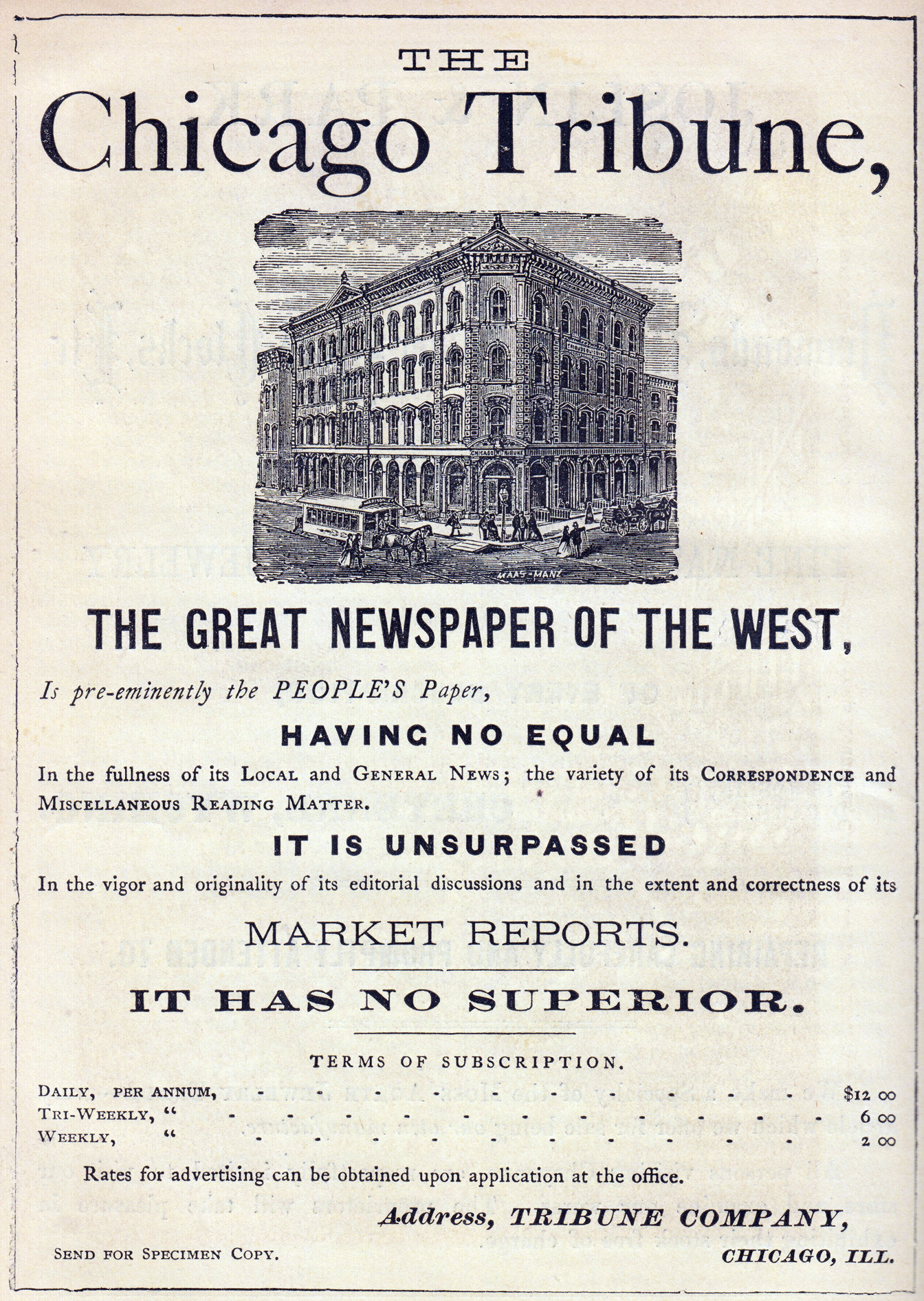

Chicago Tribune

The ''Chicago Tribune'' is a daily newspaper based in Chicago, Illinois, United States, owned by Tribune Publishing. Founded in 1847, and formerly self-styled as the "World's Greatest Newspaper" (a slogan for which WGN radio and television are named), it remains the most-read daily newspaper in the Chicago metropolitan area and the Great Lakes region. It had the sixth-highest circulation for American newspapers in 2017. In the 1850s, under Joseph Medill, the ''Chicago Tribune'' became closely associated with the Illinois politician Abraham Lincoln, and the Republican Party's progressive wing. In the 20th century under Medill's grandson, Robert R. McCormick, it achieved a reputation as a crusading paper with a decidedly more American-conservative anti- New Deal outlook, and its writing reached other markets through family and corporate relationships at the '' New York Daily News'' and the '' Washington Times-Herald.'' The 1960s saw its corporate parent owner, Tribune Company ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Board Of Directors

A board of directors (commonly referred simply as the board) is an executive committee that jointly supervises the activities of an organization, which can be either a for-profit or a nonprofit organization such as a business, nonprofit organization, or a government agency. The powers, duties, and responsibilities of a board of directors are determined by government regulations (including the jurisdiction's corporate law) and the organization's own constitution and by-laws. These authorities may specify the number of members of the board, how they are to be chosen, and how often they are to meet. In an organization with voting members, the board is accountable to, and may be subordinate to, the organization's full membership, which usually elect the members of the board. In a stock corporation, non-executive directors are elected by the shareholders, and the board has ultimate responsibility for the management of the corporation. In nations with codetermination (such a ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Common Stock

Common stock is a form of corporate equity ownership, a type of security. The terms voting share and ordinary share are also used frequently outside of the United States. They are known as equity shares or ordinary shares in the UK and other Commonwealth realms. This type of share gives the stockholder the right to share in the profits of the company, and to vote on matters of corporate policy and the composition of the members of the board of directors. The owners of common stock do not own any particular assets of the company, which belong to all the shareholders in common. A corporation may issue both ordinary and preference shares, in which case the preference shareholders have priority to receive dividends. In the event of liquidation, ordinary shareholders receive any remaining funds after bondholders, creditors (including employees), and preference shareholders are paid. When the liquidation happens through bankruptcy, the ordinary shareholders typically receive nothing. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Second Lien Loan

The vast majority of all second lien loans are senior secured obligations of the borrower. Second lien loans differ from both unsecured debt and subordinated debt. First lien secured loans In the event of a bankruptcy or liquidation, the assets used by the company as security would first be provided to the first lien secured lenders as repayment of their borrowings. To the extent that the value of the assets is sufficient to satisfy the company's obligations to the first lien secured lenders, any additional proceeds from the sale of the pledged assets would then be made available to the second lien lenders as repayment of the second lien loan. With almost no exceptions, a borrower will take a second lien loan either at the same time or after taking a traditional first lien secured loan and the secured lenders will place limitations on the borrower's ability to pledge its assets or borrow additional secured debt. The specific rights of the first lien and second lien lenders ar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Collateralized Debt Obligation

A collateralized debt obligation (CDO) is a type of structured asset-backed security (ABS). Originally developed as instruments for the corporate debt markets, after 2002 CDOs became vehicles for refinancing mortgage-backed securities (MBS).Lepke, Lins and Pi card, ''Mortgage-Backed Securities'', §5:15 (Thomson West, 2014). Like other private label securities backed by assets, a CDO can be thought of as a promise to pay investors in a prescribed sequence, based on the cash flow the CDO collects from the pool of bonds or other assets it owns. Distinctively, CDO credit risk is typically assessed based on a probability of default (PD) derived from ratings on those bonds or assets. The CDO is "sliced" into sections known as "tranches", which "catch" the cash flow of interest and principal payments in sequence based on seniority. If some loans default and the cash collected by the CDO is insufficient to pay all of its investors, those in the lowest, most "junior" tranches suffer l ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Subprime Mortgage

In finance, subprime lending (also referred to as near-prime, subpar, non-prime, and second-chance lending) is the provision of loans to people in the United States who may have difficulty maintaining the repayment schedule. Historically, subprime borrowers were defined as having FICO scores below 600, although this threshold has varied over time. These loans are characterized by higher interest rates, poor quality collateral, and less favorable terms in order to compensate for higher credit risk. Many subprime loans were packaged into mortgage-backed securities (MBS) and ultimately defaulted, contributing to the financial crisis of 2007–2008.Lemke, Lins and Picard, ''Mortgage-Backed Securities'', Chapter 3 (Thomson West, 2013 ed.). Defining subprime risk The term ''subprime'' refers to the credit quality of particular borrowers, who have weakened credit histories and a greater risk of loan default than prime borrowers. As people become economically active, records are cr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

E-Trade

E-Trade Financial Corporation (stylized as E*TRADE) is a financial services subsidiary of Morgan Stanley, which offers an electronic trading platform to trade financial assets. The company receives revenue from interest income on margin balances, commissions for order execution, payment for order flow, and management services. The company has 30 branches. History In 1982, William A. Porter and Bernard A. Newcomb founded TradePlus in Palo Alto, California, with $15,000 in capital. In 1991, Porter and Newcomb founded E-Trade Securities, Inc., with several hundred thousand dollars of startup capital from TradePlus. E-Trade offered its trading services via America Online and Compuserve. In 1994, its revenues neared $11 million, up from $850,000 in 1992. By June 30, 1996, the company had 73,000 accounts and processed 8,000 trades per day, with quarterly revenue of $15 million. On August 16, 1996, the company became a public company via an initial public offering. In 2000, t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Amaranth Advisors

Amaranth Advisors LLC was an American multi-strategy hedge fund founded by Nicholas M. Maounis and headquartered in Greenwich, Connecticut. At its peak, the firm had up to $9.2 billion in assets under management before collapsing in September 2006, after losing in excess of $6 billion on natural gas futures. Amaranth Advisors collapse is one of the biggest hedge fund collapses in history and at the time (2006) largest known trading losses. History 2000 founding The company was founded in 2000 by Nicholas M. Maounis and based in Greenwich, Connecticut. Throughout much of its history, convertible arbitrage was the firm's primary profit vehicle. Maounis had prior to founding Amaranth Advisors worked at Paloma Partners as a portfolio manager covering debt securities. The company was named after the amaranth an "immortal" flower that retains vivid color even after death. 2004–2005 Focus on energy trading During 2004-2005, the firm shifted its emphasis to energy trading by Canad ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |