|

Check Verification Service

A check verification service provides businesses or individuals with either the ability to check the validity of the actual check or draft being presented, or the ability to verify the history of the account holder, or both. There are a number of different methods that can be used to provide the service, these include checking different databases with negative or account history, checking that routing and account numbers are valid using algorithms, or contacting the bank that issued the check to get confirmation about the account status. Business Check verification services have been most common in the United States, in Europe a cheque guarantee system operated for a number of years that could be used by merchants until the usage of cheques declined to the point where it was no longer necessary. Outside the United States the decline in check usage in favour of debit cards and credit cards has meant that cheques are rarely accepted by merchants thus rendering cheque verification s ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque

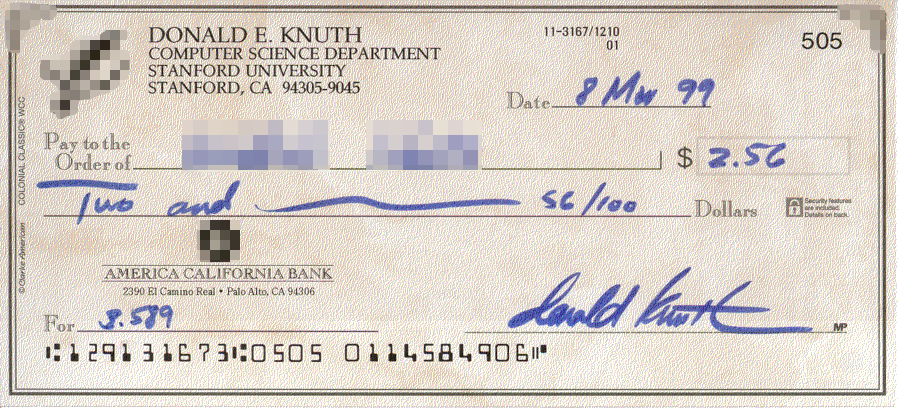

A cheque, or check (American English; see spelling differences) is a document that orders a bank (or credit union) to pay a specific amount of money from a person's account to the person in whose name the cheque has been issued. The person writing the cheque, known as the ''drawer'', has a transaction banking account (often called a current, cheque, chequing, checking, or share draft account) where the money is held. The drawer writes various details including the monetary amount, date, and a payee on the cheque, and signs it, ordering their bank, known as the ''drawee'', to pay the amount of money stated to the payee. Although forms of cheques have been in use since ancient times and at least since the 9th century, they became a highly popular non-cash method for making payments during the 20th century and usage of cheques peaked. By the second half of the 20th century, as cheque processing became automated, billions of cheques were issued annually; these volumes peaked ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Automated Clearing House

An automated clearing house (ACH) is a computer-based electronic network for processing transactions, usually domestic low value payments, between participating financial institutions. It may support both credit transfers and direct debits. The ACH system is designed to process batches of payments containing numerous transactions, and it charges fees low enough to encourage its use for low value payments. History The first automated clearing house was BACS in the United Kingdom, which started processing payments in April 1968. In the U.S. in the late 1960s, a group of banks in California sought a replacement for check payments. This led to the first automated clearing house in the US in 1972, operated by the Federal Reserve Bank of San Francisco. BACS operated from the beginning on a net settlement basis. Netting ACH transactions reduces the amount of deposits a bank must hold. Operation ACHs process large volumes of credit and debit transactions in batches. ACH credit tr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque Guarantee Card

A cheque guarantee card was an abbreviated portable letter of credit granted by a bank to a qualified depositor in the form of a plastic card that was used in conjunction with a cheque. The scheme provided retailers accepting cheques with greater security. The retailer would write the card number on the back of the cheque, which was signed in the retailer's presence, and the retailer verified the signature on the cheque against the signature on the card. The cheque could not be stopped and payment could not be refused by the bank. Each bank would set a limit on the maximum amount of an individual cheque that could be guaranteed. The guarantee only applied to cheques drawn on an account provided by the bank that issued the card, and could result in an overdraft with penalty interest on the cardholder. After the introduction of debit cards there was a rapid decline in the use of cheques and of cheque guarantee cards, and these facilities were generally phased out during the 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ACH Network

In the United States, the ACH Network is the national automated clearing house (ACH) for electronic funds transfers established in the 1960s and 1970s. It processes financial transactions for consumers, businesses, and federal, state, and local governments. ACH processes large volumes of credit and debit transactions in Batch processing, batches. Short for "Automated Clearing House", ACH credit transfers include direct deposit for payroll, Social Security and other benefit payments, tax refunds, and vendor payments. ACH direct debit transfers include consumer payments on insurance premiums, mortgage loans, and other kinds of bills. The rules and regulations that govern the ACH network are established by National Automated Clearinghouse Association (Nacha). In 2018, the network processed 23billion transactions with a total value of $51.2trillion. Credit card payments are handled by separate networks. The Federal Reserve Bank, Reserve Banks and the Electronic Payments Network (E ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

First Data

First Data Corporation is a financial services company headquartered in Atlanta, Georgia, United States. The company's STAR Network provided nationwide domestic debit acceptance at more than 2 million retail POS, ATM, and Online outlets for nearly a third of all U.S. debit cards. First Data has six million merchants, the largest in the payments industry. The company handles 45% of all US credit and debit transactions, including handling prepaid gift card processing for many US brands such as Starbucks. It processes around 2,800 transactions per second and $2.2 trillion in card transactions annually, with an 80% market share in gas and groceries in 2014. First Data's SpendTrend Report is a key shopping metric for national news networks such as '' WSJ, USA Today'', ''ESPN'', ''The New York Times'', Vox Media, and ''Bloomberg''. In October 2015, First Data returned to public markets, selling 160 million shares in the New York Stock Exchange’s biggest IPO of that year. On Januar ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Certegy

Certegy was a public corporation created in 2001 when Equifax spun off their payment services division. The corporation had two divisions of its own: check verification and credit cards. In September 2005, a merger with Fidelity Information Services, a subsidiary of Fidelity National Financial, was announced. The merger was completed in 2006. Although designed to be the surviving entity of the merger, Certegy's corporate name was changed as part of the merger agreement to Fidelity National Information Services, and the ticker symbol on the NYSE changed from CEY to FI1 Executive offices were relocated to Jacksonville, Florida, although manufacturing and operations remained in St. Petersburg, Florida. In 2004, Certegy acquired Game Financial, a cash access provider operating in several casinos in the United States, including rights to their trade name, GameCash. In 2007, it was announced that Certegy Gaming (formed after the acquisition of Game Financial) would be sold to Globa ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ABA Routing Transit Number

In the United States, an ABA routing transit number (ABA RTN) is a nine-digit code printed on the bottom of checks to identify the financial institution on which it was drawn. The American Bankers Association (ABA) developed the system in 1910 to facilitate the sorting, bundling, and delivering of paper checks to the drawer's (check writer's) bank for debit to the drawer's account. Newer electronic payment methods continue to rely on ABA RTNs to identify the paying bank or other financial institution. The Federal Reserve Bank uses ABA RTNs in processing Fedwire funds transfers. The ACH Network also uses ABA RTNs in processing direct deposits, bill payments, and other automated money transfers. Management Since 1911, the American Bankers Association has partnered with a series of registrars, currently Accuity, to manage the ABA routing number system. Accuity is the Official Routing Number Registrar and is responsible for assigning ABA RTNs and managing the ABA RTN system. Ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Credit Union

A credit union, a type of financial institution similar to a commercial bank, is a member-owned nonprofit organization, nonprofit financial cooperative. Credit unions generally provide services to members similar to retail banks, including deposit accounts, provision of Credit (finance), credit, and other financial services. In several African countries, credit unions are commonly referred to as SACCOs (Savings and Credit Co-Operative Societies). Worldwide, credit union systems vary significantly in their total assets and average institution asset size, ranging from volunteer operations with a handful of members to institutions with hundreds of thousands of members and assets worth billions of US dollars. In 2018, the number of members in credit unions worldwide was 274 million, with nearly 40 million members having been added since 2016. Leading up to the financial crisis of 2007–2008, commercial banks engaged in approximately five times more subprime lending relative t ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Driver's License

A driver's license is a legal authorization, or the official document confirming such an authorization, for a specific individual to operate one or more types of motorized vehicles—such as motorcycles, cars, trucks, or buses—on a public road. Such licenses are often plastic and the size of a credit card. In most international agreements the wording "driving permit" is used, for instance in the Vienna Convention on Road Traffic. In this article's country specific sections, the local spelling variant is used. Most American jurisdictions issue a permit with "driver license" printed on it but some use "driver's license", which is conversational American English. Canadian English uses both "driver's licence" as well as "driver licence" ( Atlantic Canada). The Australian and New Zealand English equivalent is "driver licence". In British English and in many former British colonies it is "driving licence". The laws relating to the licensing of drivers vary between jurisdic ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Cheque Guarantee

A cheque guarantee card was an abbreviated portable letter of credit granted by a bank to a qualified depositor in the form of a plastic card that was used in conjunction with a cheque. The scheme provided retailers accepting cheques with greater security. The retailer would write the card number on the back of the cheque, which was signed in the retailer's presence, and the retailer verified the signature on the cheque against the signature on the card. The cheque could not be stopped and payment could not be refused by the bank. Each bank would set a limit on the maximum amount of an individual cheque that could be guaranteed. The guarantee only applied to cheques drawn on an account provided by the bank that issued the card, and could result in an overdraft with penalty interest on the cardholder. After the introduction of debit cards there was a rapid decline in the use of cheques and of cheque guarantee cards, and these facilities were generally phased out during the 2 ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

ChexSystems

ChexSystems is a check verification service and consumer reporting agency owned by the eFunds subsidiary of Fidelity National Information Services. It provides information about the use of deposit accounts by consumers. History In 1991, the agency was owned by Deluxe Corporation, and it was part of the spin-off from Deluxe that formed eFunds in 1999. Fidelity National Information Services acquired eFunds in 2007. The number of "bank and thrift branches" served in 1991 was 59,000. Services Eighty percent of commercial banks and credit unions in the United States use ChexSystems to screen applicants for checking and savings accounts. eFunds claims that their services are used in over 9,000 banks, including over 100,000 individual bank branches in the United States. As of 1991, ChexSystems held 7.3 million names of consumers whose bank accounts had been closed "for cause". Services include verification of identity, reports on account history, and transaction monitoring. Repo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)