|

Canada Learning Bond

The Canada Learning Bond (french: Bon d'études canadien, CLB) is a grant paid by the government of Canada to assist low-income families with saving money for their children's post-secondary education. The CLB relies primarily on the National Child Benefit (NCB) program to determine which families may be eligible and the tax regulations for the Registered Education Savings Plan (RESP) to guide the eventual use of the CLB funds. As of 1 July 2005, the CLB is legislated by the '' Canada Education Savings Act''. History As part of the 2004 Canadian federal budget, the Minister of Finance Ralph Goodale introduced the Canada Learning Bond as a way to encourage low-income families to use a RESP for saving money to be used for a child's post-secondary education.Department of Finance Canada (2004, March 23). ''Learning: Cornerstone of Canada's economic and social progress''. Retrieved June 22, 2008, from http://www.fin.gc.ca/budget04/pamph/paleae.htm The maximum net benefit outlined pe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Government Of Canada

The government of Canada (french: gouvernement du Canada) is the body responsible for the federal administration of Canada. A constitutional monarchy, the Crown is the corporation sole, assuming distinct roles: the executive, as the ''Crown-in-Council''; the legislature A legislature is an assembly with the authority to make law Law is a set of rules that are created and are enforceable by social or governmental institutions to regulate behavior,Robertson, ''Crimes against humanity'', 90. with its p ..., as the ''Crown-in-Parliament''; and the courts, as the ''Crown-on-the-Bench''. Three institutions—the Privy Council ( conventionally, the Cabinet); the Parliament of Canada; and the Judiciary of Canada, judiciary, respectively—exercise the powers of the Crown. The term "Government of Canada" (french: Gouvernement du Canada, links=no) more commonly refers specifically to the executive—Minister of the Crown, ministers of the Crown (the Cabinet) and th ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

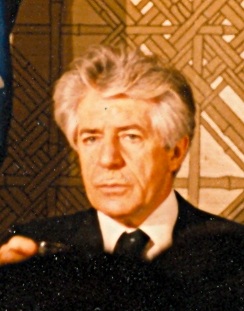

Jim Flaherty

James Michael Flaherty (December 30, 1949 – April 10, 2014) was a Canadian politician who served as the federal minister of finance from 2006 to 2014 under Conservative Prime Minister Stephen Harper. First elected to the Legislative Assembly of Ontario in 1995 under the Progressive Conservative (PC) banner, Flaherty would sit as a member of Provincial Parliament (MPP) until 2006, also serving in a number of Cabinet positions from 1997 to 2002 during Premier Mike Harris' government. He unsuccessfully ran for the PC leadership twice. Flaherty entered federal politics and ran for the Conservative Party in the 2006 election. With his party forming government, Prime Minister Harper named Flaherty as finance minister. As finance minister, Flaherty cut the goods and services tax from 7 percent to 5 percent, introduced the tax-free savings account, and combatted the 2008 financial crisis; the $55.6 billion deficit from the crisis was eliminated in 2014 as a result of major spe ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

High School

A secondary school describes an institution that provides secondary education and also usually includes the building where this takes place. Some secondary schools provide both '' lower secondary education'' (ages 11 to 14) and ''upper secondary education'' (ages 14 to 18), i.e., both levels 2 and 3 of the ISCED scale, but these can also be provided in separate schools. In the US, the secondary education system has separate middle schools and high schools. In the UK, most state schools and privately-funded schools accommodate pupils between the ages of 11–16 or 11–18; some UK private schools, i.e. public schools, admit pupils between the ages of 13 and 18. Secondary schools follow on from primary schools and prepare for vocational or tertiary education. Attendance is usually compulsory for students until age 16. The organisations, buildings, and terminology are more or less unique in each country. Levels of education In the ISCED 2011 education scale levels 2 and 3 c ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Millennium Scholarship Foundation

The Canada Millennium Scholarship Foundation was a private, independent organization created by an act of the Parliament of Canada in 1998. It received an initial endowment of $2.5 billion from the federal government to provide awards annually for ten years. The foundation distributed $325 million in the form of bursaries and scholarships each year throughout Canada in support of post-secondary education. As well, the foundation conducted research into post-secondary access, via the Millennium Research Program. Overview The Canada Millennium Scholarship Foundation was created by an Act of Parliament in 1998 by the then Liberal government under Jean Chrétien. Branded as Canada's way to marking the new millennium, the Foundation was endowed with CAD$2.5 billion and was given the mandate to 1) improve access to post-secondary education for all Canadians, especially those facing economic or social barriers, to 2) encourage a high level of student achievement and engagement in Canadi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canada Education Savings Grant

The Canada Education Savings Grant (french: Subvention canadienne pour l’épargne-études, CESG) is part of a Government of Canada program, administered through Employment and Social Development Canada, to assist with savings for Canadian children's higher education. Under the CESG program, the government will contribute an amount to a Registered Education Savings Plan (RESP) according to a formula which is dependent on the amount contributed and the income level of the family making the contributions. As of 1 July 2005, the CESG is legislated by the '' Canada Education Savings Act''. Program The grant payment is at least 20% of the total annual contributions up to $2500 per child. For lower income families, the grant may be up to 40% on the first $500, and 20% on the balance over that amount. The maximum lifetime grant limit is $7200. Upon high school graduation, the child beneficiary may use the grant money to support either full-time or part-time studies in an apprenticeship pr ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Canadian Association Of University Teachers

The Canadian Association of University Teachers (CAUT; french: Association canadienne des professeures et professeurs d'université, ACPPU) is a federation of independent associations and trade unions representing approximately 70,000 teachers, librarians, researchers, and other academic professionals and general staff at 120 universities and colleges across Canada. Principal aims The principal objectives of CAUT, as defined in its general by-law, are the following: * the defence of academic freedom, tenure, equality and human rights; * the provision of collective bargaining services for the support and assistance of member associations; * the conduct of federal lobbying and public relations for academic staff and post-secondary education; * the collection and analysis of data and the operation of a clearing house for information pertaining to the social and economic well-being of academic staff and post-secondary education; * the establishment and maintenance of international r ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

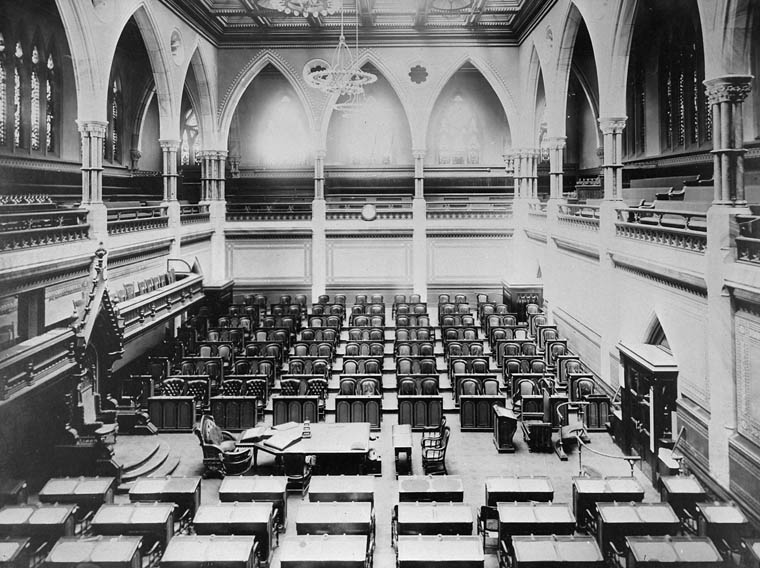

House Of Commons Of Canada

The House of Commons of Canada (french: Chambre des communes du Canada) is the lower house of the Parliament of Canada. Together with the Crown and the Senate of Canada, they comprise the bicameral legislature of Canada. The House of Commons is a democratically elected body whose members are known as members of Parliament (MPs). There have been 338 MPs since the most recent electoral district redistribution for the 2015 federal election, which saw the addition of 30 seats. Members are elected by simple plurality ("first-past-the-post" system) in each of the country's electoral districts, which are colloquially known as ''ridings''. MPs may hold office until Parliament is dissolved and serve for constitutionally limited terms of up to five years after an election. Historically, however, terms have ended before their expiry and the sitting government has typically dissolved parliament within four years of an election according to a long-standing convention. In any case, an ac ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Diane Finley

Diane Finley (born October 3, 1957) is a former Canadian politician. From 2006 through 2015, she served in the cabinet of Prime Minister Stephen Harper. Her ministerial portfolios included Minister of Human Resources and Skills Development, Minister of Public Works and Government Services, Minister Responsible for Canada Mortgage and Housing Corporation, or CMHC, and Minister of Citizenship and Immigration. She was a member of the House of Commons of Canada, representing the riding of Haldimand—Norfolk for the Conservative Party from 2004 to 2021. In August 2020, she announced that she would not be running in the 2021 Canadian federal election. She resigned from office on May 11, 2021. Personal life Diane Finley was raised in Port Dover and Charlotteville in Norfolk County, Ontario, and has a Bachelor of Arts degree and a Masters in Business Administration from the University of Western Ontario. After graduation, she became the administrator of Western's French Immersion ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Minister Of Employment, Workforce Development And Disability Inclusion

The minister of employment, workforce development and disability inclusion () is the minister of the Crown in the Canadian Cabinet who is responsible for Employment and Social Development Canada, the Government of Canada department that oversees programs such as employment insurance, the Canada pension plan, old age security, and Canada student loans. History The ministerial responsibility for employment has its origins in the October 1, 1966 cabinet reshuffle, when Jean Marchand's portfolio was renamed from Minister of Immigration and Citizenship to Minister of Manpower and Immigration, Along with this change, minister Marchand was tasked by Prime Minister Lester Pearson to draft a White paper to renew Canada's immigration policy. Pearson wanted to removed all discriminatory clauses remaining in Canada's immigration regulations, and instead facilitate the immigration of qualified workers from Asia. The following year, Canada introduced its first point system to rank potential ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

2006 Canadian Federal Budget

The Canadian federal budget for the fiscal year 2006–2007, was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on May 2, 2006. Among the most notable elements of the federal budget were its reduction of the Goods and Services Tax by one percentage point, income tax cuts for middle-income earners, and $1,200-per-child childcare payment (the "Universal Child Care Benefit") for Canadian parents. Prime Minister Stephen Harper called the bill an indication of what Canadians should expect from his Conservative minority government. Many aspects of the bill were criticized by opposition parties. The Liberal Party and New Democratic Party indicated that they would not support the budget, while the Bloc Québécois indicated that it would vote in favour of it. On June 6, 2006, the budget was introduced for a third reading in the House of Commons. Amid an apparent mix-up, no Members of Parliament rose to speak. Thus, the budget was declared passed by unan ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tertiary Education

Tertiary education, also referred to as third-level, third-stage or post-secondary education, is the educational level following the completion of secondary education. The World Bank, for example, defines tertiary education as including university, universities as well as trade schools and colleges. Higher education is taken to include undergraduate and postgraduate education, while vocational education beyond secondary education is known as ''further education'' in the United Kingdom, or included under the category of ''continuing education'' in the United States. Tertiary education generally culminates in the receipt of Academic certificate, certificates, diplomas, or academic degrees. UNESCO stated that tertiary education focuses on learning endeavors in specialized fields. It includes academic and higher vocational education. The World Bank's 2019 World Development Report on the future of work argues that given the future of work and the increasing role of technology in v ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Registered Education Savings Plan

A registered education savings plan (RESP) in Canada is an investment vehicle available to caregivers to save for their children's post-secondary education. The principal advantages of RESPs are the access they provide to the Canada Education Savings Grant (CESG) and as a method of generating tax-deferred income. Tax benefits An RESP is a tax shelter designed to benefit post-secondary students. With an RESP, contributions (comprising the investment's principal) are, or have already been, taxed at the contributor's tax rate, while the investment growth (and CESG) is taxed on withdrawal at the recipient's tax rate. An RESP recipient is typically a post-secondary student; these individuals generally pay little or no federal income tax, owing to tuition and education tax credits. Thus, with the tax-free principal contribution available for withdrawal, CESG, and nearly-tax-free interest, the student will have a good source of income to fund their post-secondary education. If the benefi ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

.jpg)