|

CumEx-Files

The CumEx-Files is an investigation by a number of European news media outlets into a tax fraud scheme discovered by them in 2017. A network of banks, stock traders, and lawyers had obtained billions from European treasuries through suspected fraud and speculation involving dividend taxes. The five hardest hit countries may have lost at least $62.9 billion. Germany is the hardest hit country, with around $36.2 billion withdrawn from the German treasury. Estimated losses for other countries include at least €17 billion for France, €4.5 billion in Italy, €1.7 billion in Denmark and €201 million for Belgium. The name "cum-ex" is derived from Latin, meaning "with without", and refers to the disappearing nature of the fraudulent dividend payments. Method The network stole several billion Euros from the treasury, through what Correctiv calls a "cum-ex" trade: The participants in the network would lend each other shares in large companies, so that to tax authorities there wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Sanjay Shah

:''See also List of people who have lived in airports'' use both this parameter and , birth_date to display the person's date of birth, date of death, and age at death) --> , death_place = , death_cause = , body_discovered = , resting_place = , resting_place_coordinates = , burial_place = , burial_coordinates = , monuments = , nationality = , other_names = , siglum = , citizenship = British , education = , alma_mater = , occupation = Trader , years_active = , era = , employer = , organization = , agent = , known_for = , notable_works = , style = , net_worth = , height = , television = , title = , term = , predecessor = , successor = , party = , movement = , opponents ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

CumEx-Files - Countries Affected By The Fraud

The CumEx-Files is an investigation by a number of European news media outlets into a tax fraud scheme discovered by them in 2017. A network of banks, stock traders, and lawyers had obtained billions from European treasuries through suspected fraud and speculation involving dividend taxes. The five hardest hit countries may have lost at least $62.9 billion. Germany is the hardest hit country, with around $36.2 billion withdrawn from the German treasury. Estimated losses for other countries include at least €17 billion for France, €4.5 billion in Italy, €1.7 billion in Denmark and €201 million for Belgium. The name "cum-ex" is derived from Latin, meaning "with without", and refers to the disappearing nature of the fraudulent dividend payments. Method The network stole several billion Euros from the treasury, through what Correctiv calls a "cum-ex" trade: The participants in the network would lend each other shares in large companies, so that to tax authorities there wo ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Evasion

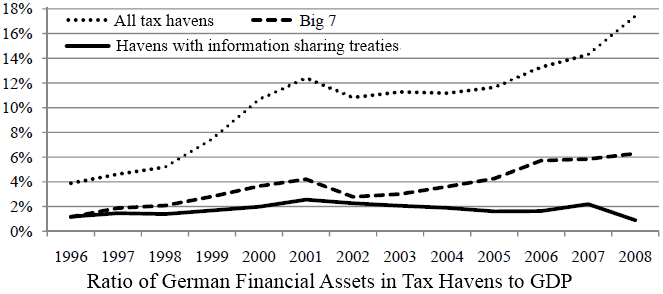

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, using bribes against authorities in countries with high corruption rates and hiding money in secret locations. Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that should be reported to the tax authorities and the actual amount reported. In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Dividend Stripping

Dividend stripping is the practice of buying shares a short period before a dividend is declared, called cum-dividend, and then selling them when they go ex-dividend, when the previous owner is entitled to the dividend. On the day the company trades ex-dividend, theoretically the share price drops by the amount of the dividend. This may be done either by an ordinary investor as an investment strategy, or by a company's owners or associates as a tax avoidance strategy. Investors For an investor, dividend stripping provides dividend income, and a capital loss when the shares fall in value (in normal circumstances) on going ex-dividend. This may be profitable if income is greater than the loss, or if the tax treatment of the two gives an advantage. Different tax circumstances of different investors is a factor. A tax advantage available to everyone would be expected to show up in the ex-dividend price fall. But an advantage available only to a limited set of investors might not. ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Tax Evasion

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, declaring less income, profits or gains than the amounts actually earned, overstating deductions, using bribes against authorities in countries with high corruption rates and hiding money in secret locations. Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that should be reported to the tax authorities and the actual amount reported. In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they de ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Correctiv

The CORRECTIV (or CORRECT!V) is a German nonprofit investigative journalism newsroom whose stated goal is "to give citizens access to information." With about 20 staff members, CORRECT!V is the only nonpartisan, nonprofit investigative center in Germany. CORRECT!V describes itself as an organization that is "one of the many answers to the media crisis." CORRECT!V releases its reports in English, German and Russian languages via its web site to media outlets throughout Europe and around the globe. History CORRECT!V was initiated in 2014 by the charitable organization "CORRECTIV – Recherchen für die Gesellschaft" ("CORRECTIV – Research for Society") based in Essen and has been supported by the Brost Foundation with a grant of €1 million per year for three years. Organization CORRECT!V is a member of the International Fact-Checking Network. Funding CORRECT!V is a nonprofit organization and exempt from taxation under German law. The funding comes entirely from charitab ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Freshfields Bruckhaus Deringer

Freshfields Bruckhaus Deringer LLP (informally Freshfields, or FBD) is an international law firm headquartered in London, and a member of the Magic Circle. The firm has 28 offices in 17 jurisdictions across Asia, Europe, the Middle East and North America. It advises national and multinational corporations, financial institutions and governments. History Freshfields Bruckhaus Deringer was created in 2000 when U.K.-based Freshfields merged with the two law firms, Germany-based Deringer Tessin Herrmann & Sedemund and Germany-and-Austria-based Bruckhaus Westrick Heller Löber. Dubbed as the oldest firm within the Magic Circle, Freshfields' origins arguably go back to around 1716, when Thomas Woodford began to practise law. Woodford was succeeded in his practice in 1730 by William Wall, who was succeeded in turn in 1743 by Samuel Dodd.Slinn 1984, p. 177. That same year, Dodd was appointed attorney to the Bank of England.Slinn, Judy (1993). ''Freshfields, 1743–1993'', London: ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

List Of Banks And Credit Unions In Canada

This is a list of banks in Canada, including chartered banks, credit unions, trusts, and other financial services companies that offer banking services and may be popularly referred to as "banks". The "Big Five" Canada's "big five" banks, and a few statistics (2013): The term "Big Six" is frequently used as well and includes the National Bank of Canada (2013 market cap of $8.9B), though its operations are primarily focused in the provinces of Quebec and New Brunswick. Banks by legal classification Banks in Canada are classified by their ownership as domestic banks, subsidiaries of foreign banks, or branches of foreign banks. For a greater explanation of the classifications, see ''Banking in Canada'' and '' Canada Bank Act''. Schedule I banks (domestic banks) Under the Canada Bank Act, Schedule I are banks that are not a subsidiary of a foreign bank, i.e., domestic banks, even if they have foreign shareholders. There are 35 domestic banks, included 2 federally regulate ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

Deutsche Bank

Deutsche Bank AG (), sometimes referred to simply as Deutsche, is a German multinational investment bank and financial services company headquartered in Frankfurt, Germany, and dual-listed on the Frankfurt Stock Exchange and the New York Stock Exchange. It was founded in 1870 and grew through multiple acquisitions, including Disconto-Gesellschaft in 1929 (as a consequence of which it was known from 1929 to 1937 as Deutsche Bank und Disconto-Gesellschaft or "DeDi-Bank"), Bankers Trust in 1998, and Deutsche Postbank in 2010. As of 2018, the bank's network spanned 58 countries with a large presence in Europe, the Americas, and Asia. As of 2021, Deutsche Bank was the 21st largest bank in the world by total assets and 93rd in the world by market capitalization. It is a component of the DAX stock market index, and often referred to as the largest German banking institution even though the Sparkassen-Finanzgruppe comes well ahead in terms of combined assets. Deutsche Bank ha ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |

HypoVereinsbank

UniCredit Bank AG, better known under its brand name HypoVereinsbank (HVB), is the fifth-largest of the German financial institutions, ranked according to its total assets, and the fourth-largest bank in Germany according to the number of its employees. Its registered office is in Munich, and it is a member of the Cash Group. Since 2005, UniCredit Bank AG has been a subsidiary of UniCredit S.p.A., an Italian financial service provider headquartered in Milan. When the transfer resolution was entered in the commercial register in 2008, the equities of the minority shareholders were transferred to the principal shareholder, UniCredit S.p.A., as part of a squeeze-out. HVB thus became a wholly owned subsidiary and has not been listed on a stock exchange since that time. Operating in Germany, HVB mainly focuses on private clients business and corporate banking, customer-related capital market activities and private banking (also known as wealth management). As a mixed mortgage ba ... [...More Info...] [...Related Items...] OR: [Wikipedia] [Google] [Baidu] |